Fetch.ai (FET) price is continuing its bullish streak even though the rest of the crypto market is cooling down from the February and March rallies.

Will this lead to corrections for FET, or will the altcoin be able to note another all-time high?

Fetch.ai Could Lose Support From Its Investors

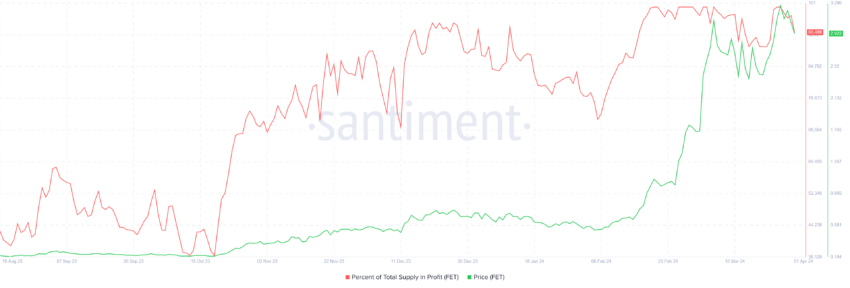

After a remarkable rise, Fetch.ai’s price is noting some drawdown until the market cools down. This was an expected decline since nearly 98% of the entire circulating supply was sitting in profits.

Whenever more than 95% of the supply witnesses profits, a market top is formed. Market top refers to the peak of a market cycle, indicating a potential reversal or correction in the near future. This was validated by the recent correction. However, since 93% of the entire supply is still in profit, it could potentially induce profit-taking.

The altcoin would bear the consequence as the price would decline following selling from investors.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

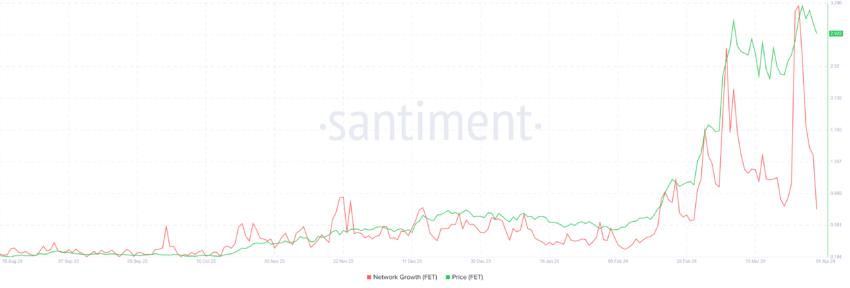

Secondly, the project is losing traction in the market, as evidenced by network growth. The network growth refers to the addition of new addresses, which, when it takes a dip, suggests investors are refraining from investing their money in the asset.

Thus, Fetch.ai price would witness some bearish momentum, resulting in a potential decline in price.

FET Price Prediction: Consolidation or Decline?

Fetch.ai’s price is close to losing the psychological support of $2.9 after having lost the 50-day Exponential Moving Average (EMA). If the aforementioned factors are weighed in, the likely outcome for FET could be a decline to $2.4, given it has been previously tested multiple times as support.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

However, if Fetch.ai’s price can sustain above the $2.9 support, it would have a shot at reigniting the bullish flame. This will result in the invalidation of the bearish thesis if the 50-day EMA is flipped into support, enabling a rise to $3 and beyond to chart a new all-time high.