Render price has been declining for the past two weeks after marking an all-time high in March. But it seems like this sentiment among investors has dissipated.

With declining activity, could RNDR be on the verge of losing crucial psychological support?

Render Investors Back Down

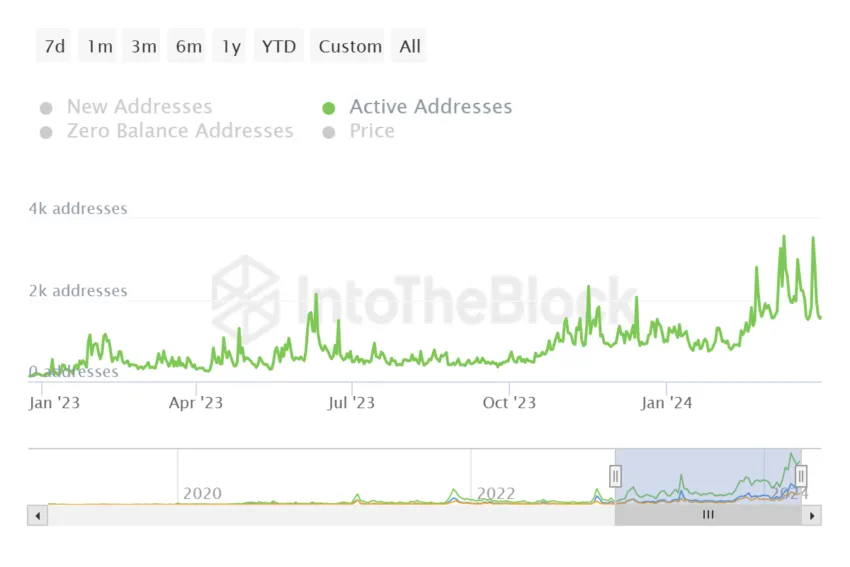

Render price is witnessing bearish cues building up not only because of the broader market cues but also because of its own investors. Active Addresses, which represent the investors participating in the network and conducting transactions, have noted a massive decline.

In the span of a week, these addresses have come from 3,530 to 1,580. This shows that with the decline in price, investors are convinced of further losses, motivating them to pull out and sit still until recovery begins.

Read More: Top 9 Web3 Projects That Are Revolutionizing the Industry

Not only this but upon breaking down the active addresses, it appears that there is still some inkling of profit-taking among RNDR holders. The distribution of active addresses by profitability shows that 77% of the investors are at the money, noting no profits or losses, and another 21% are witnessing profits.

Their presence suggests that they intend to book profits before prices fall further and they incur losses. Consequently, the Render price will face further bearishness should this selling intensify.

RNDR Price Prediction: More Downside on the Way?

Render price, if impacted by the above-mentioned bearish cues, could lose the $10 support level to slip to $8.7. If this support floor is lost, the altcoin will likely fall to $8.05 to mark a 20% correction.

Read More: 10 of the Most Common Web3 Interview Questions and Answers

On the other hand, if the psychological support of $10 remains unbroken, Render price will potentially have a shot at initiating a recovery. Should it manage to flip the 50 and 100-day Exponential Moving Average (EMA) into support, it would invalidate the bearish thesis.