The Filecoin (FIL) price analysis points to a consolidation phase for Filecoin. A decline in daily active users since early February and an RSI above the overbought threshold suggests an imminent stabilization.

The price chart closely aligns EMA lines with the current price, further showing this consolidation trend. This phase indicates that Filecoin is preparing for a period of stability, setting the stage for potential future price movements.

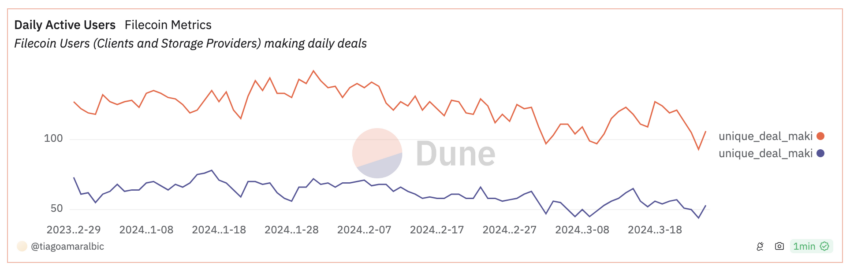

Filecoin Daily Active Users Has Been Declining

Since the beginning of February, Filecoin has been experiencing a noticeable, gradual decrease in its daily active users, signaling a subtle yet unyielding shift that carries profound implications for its overall ecosystem.

This progressive reduction in user engagement is especially alarming as it highlights an ongoing decline without the presence of notable recovery periods to counterbalance this downtrend. The fact that there haven’t been any dramatic daily drops might not seem immediately worrisome, but the steady loss of active users over time shows a concerning trend: Filecoin is slowly but surely losing its forward momentum.

Filecoin’s slow but steady user decline highlights a critical challenge: engaging and retaining users. Vital for growth, this ongoing drop in user activity is concerning for the community.

It points to Filecoin facing issues that could impact its competitiveness in the decentralized storage market. Such trends are critical for stakeholders to monitor, signaling possible obstacles in keeping Filecoin vibrant and attractive to new users.

Read More: The Economics of Decentralized Storage Protocols

RSI Remains Overbought

Filecoin’s recent RSI 7D stands at 73, experiencing a noticeable dip from a high of 83 three weeks ago. This shift is particularly significant in the context of FIL’s market behavior, suggesting a phase of consolidation after a period of vigorous trading activity. Initially soaring to an RSI of 83, FIL demonstrated a classic overbought scenario, where demand pushed its price to potentially unsustainable levels, hinting at an imminent correction or stabilization.

The Relative Strength Index (RSI) measures price momentum on a scale from 0 to 100. Readings below 30 often indicate an oversold, potentially undervalued asset, signaling a buy. Above 70, the RSI hints at an overbought, possibly overpriced asset, forecasting a likely price drop as profits are taken.

FIL’s RSI dropping to 73 suggests the buying rush is subsiding, paving the way for price stability. This RSI shift hints at FIL entering consolidation, balancing prices after the recent surge.

FIL Price Prediction: EMA Lines Are Drawing Consolidation

The 4-hour chart for Filecoin (FIL) demonstrates a moment of convergence among the Exponential Moving Averages (EMAs) and the current price line. EMA lines are trend-following indicators that give more weight to the most recent price data, aiming to reduce the lag found in traditional Simple Moving Averages (SMAs). They help traders identify the market’s direction and potential turning points.

This chart shows EMA lines converging with the current price, hinting at an imminent significant price move. EMAs huddled together signal market uncertainty as traders seek clear direction.

Read More: Filecoin (FIL) price prediction 2024/2025/2030

A ‘death cross,’ where the 20 EMA dips below the 200 EMA, may lead to a bearish slide to $7.6. On the flip side, an uptrend, possibly indicated by a ‘golden cross’ of the short-term EMA over the long-term EMA, could lift FIL to $11.