Celestia’s (TIA) price had a rather bearish March but this did not stop the optimistic bunch of investors from remaining hopeful of a rally.

This is evident in their behavior, which may result in a bullish April, provided their pessimism does not hinder the price action.

Celestia Price to Bounce Back?

Celestia’s price can be seen changing hands at $13.8 at the time of writing, barely recovering from $13. This, however, has not slowed the optimism that TIA investors hold as they continue to place bullish bets on the altcoin.

The Funding Rate of Celestia at the moment is positive. The funding rate is a mechanism used in perpetual futures contracts, which signals whether traders are placing long or short contracts. Positive funding rates hint at the former, while negative rates suggest the latter.

TIA’s positive rate shows that despite the correction, traders are expecting a rise in price. In part, they are right about their prediction since the Moving Average Convergence Divergence (MACD) indicator is signaling bullishness.

Read More: Best Upcoming Airdrops in 2024

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It’s composed of a MACD line and a signal line, used to identify bullish and bearish trends.

Presently, the indicator is signaling that the altcoin is at the cusp of a bullish crossover. This hints at the incoming bullish momentum, which, if sustained, would drive TIA higher.

TIA Price Prediction: What to Expect Next?

Celestia’s price recovered a part of the 28% decline noted in mid-March. Looking at the aforementioned conditions, the chances of a rally seem high, which would likely send TIA to $18.

Read More: Top 10 Aspiring Crypto Coins for 2024

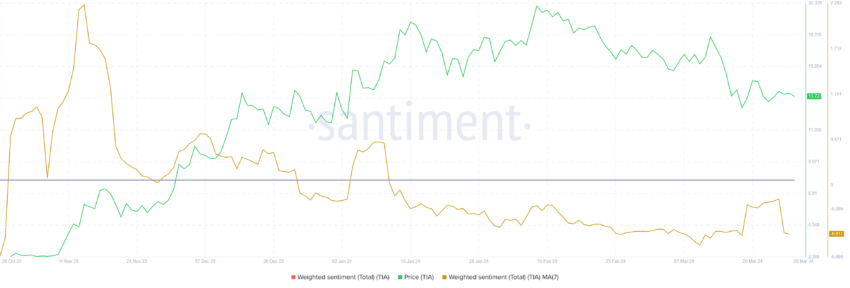

However, the retail investors are exhibiting slight pessimism at the moment. The overall sentiment they hold is negative, which might keep TIA from witnessing a substantial rally.

Should they move to protect their present gains from further losses, Celestia’s price could lose the support of $13.08 and fall to 11.5, slipping beyond which would invalidate the bullish thesis.