Ripple (XRP) price has been in a downtrend for the better half of the month, and these bearish signals are getting stronger.

Will the altcoin end up losing crucial support since XRP long-term holders are losing conviction in the asset?

Ripple Investors Lose Conviction

The long-term holders are one of the most important cohorts that impact the XRP price. These investors tend to hold an asset for a period of more than 12 months. Thus, selling from them is considered to be a confirmed bearish signal.

Their actions are observed by the total age consumed when they move their holdings between addresses. The higher the spike, the larger the amount of tokens moved. In the case of Ripple, their movement has not been as significant as instances in the past. Nevertheless, this is a signal that these investors are losing conviction.

Historically, during such occurrences, the XRP price has witnessed corrections most of the time. The same outcome can be expected this time around as well.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

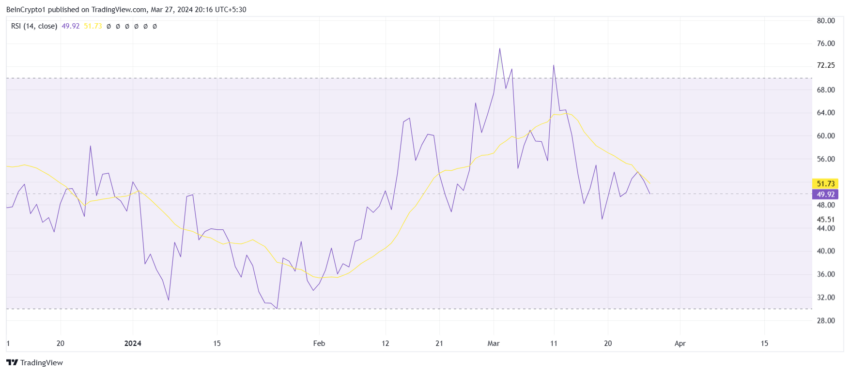

A bearish move would be confirmed once the Relative Strength Index (RSI) falls below the neutral line at 50.0. RSI is a momentum oscillator measuring the speed and change of price movements, indicating overbought and oversold conditions.

Thus, the chances of a decline would increase if the indicators fall into the bearish zone.

XRP Price Prediction: Crucial Support Lost

XRP price is presently trading above the $0.606 support level. The altcoin has already slipped below the 50-day Exponential Moving Average (EMA). If the $0.606 support is invalidated, too, the cryptocurrency will lose the 100-day EMA as support.

This will result in further decline, potentially sending Ripple to $0.555.

However, per the Average Directional Index (ADX), the bearish trend has yet to gain strength. The latter is still below the 25.0 threshold crossing, which generally suggests that the active trend is gaining strength.

Read More: Everything You Need To Know About Ripple vs SEC

So, if the XRP price sees no immediate bearishness and manages to bounce back from $0.606, it might have a shot at recovery, potentially invalidating the bearish thesis.