Bitcoin Cash (BCH) price is making another attempt at breaching the year-to-date high, although, by the looks of it, this may not happen.

Multiple reasons are contributing to the bearish anticipation, but this could be turned around if BCH flips a crucial level into support.

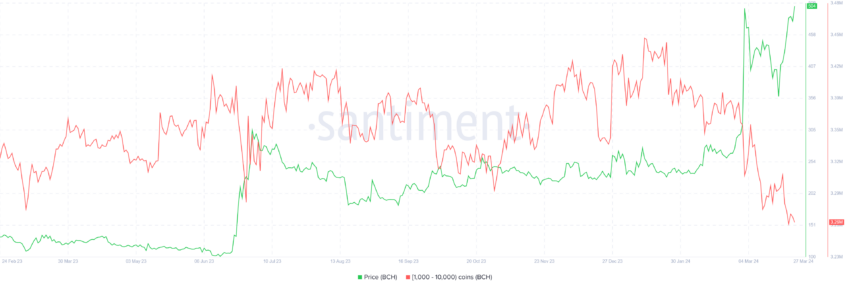

Bitcoin Cash Whales Signal Drawdown

Bitcoin Cash price will potentially bear the impact of the bearishness exhibited by the whales. These large wallet investors tend to sway the direction of the price action. Historically, their selling has induced corrections, while accumulation has resulted in rallies.

This time around, the outcome is expected to be bearish since the addresses hodling between 1,000 to 10,000 BCH have been consistently selling since March began. Nearly 50,000 BCH worth over $25 million were sold in the last week alone.

However, since the price kept going upward, the altcoin is now due for a correction.

Read More: Bitcoin Cash (BCH) Price Prediction 2024/2025/2030

As a matter of fact, even retail investors are going to sell their holdings now. The Market Value signals this to the Realized Value (MVRV) ratio. The MVRV ratio measures investors’ profit/loss.

Bitcoin Cash’s 30-day MVRV at 10% signals profit, potentially prompting selling. Historically, BCH corrections have occurred when the indicator is between 7%-17% MVRV, labeled a danger zone.

Thus, BCH is vulnerable to corrections due to selling, which could occur at any time.

BCH Price Prediction: What to Expect?

If selling begins, Bitcoin Cash price will likely fail in testing the $501 resistance as support, even if it does manage to breach it. A decline to $448 will result in BCH losing the 50-day Exponential Moving Average (EMA).

Falling through this support will result in a drop to $400 or $378, which marks the confluence of the 100-day EMA.

Read More: How To Buy Bitcoin Cash (BCH) and Everything You Need To Know

However, the altcoin could invalidate the bearish thesis if the breach and testing of $501 as support be successful. BCH would then be open to rising towards $520.