Mantle (MNT) price is trading at an all-time high today after charting an impressive rally in the last 24 hours.

The rally was led by a single group of investors, but the question is whether they would be able to sustain it.

Mantle Price Soars to New Highs

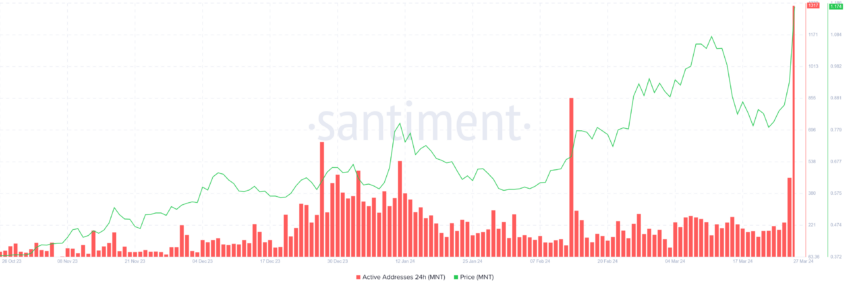

Mantle price noted a surge following the recovery trigger this week. The nearly 40% rally today resulted in the altcoin zooming past the previous all-time high (ATH) of $1.07 to hit $1.30 during the intra-day high.

The broader market cues, at the moment, are rather neutral, which means this rally was caused by a development native to cryptocurrency. Such is the case, too, since MNT shot up following massive accumulation at the hands of whales.

Addresses holding between 100,000 to 1 million MNT added more than 11 million MNT worth over $12.7 million in a single day. This cohort is known to influence the price based on historical movements and presently holds about 24.69 million MNT in its wallet.

Read More: What Is Mantle Network? A Guide to Ethereum’s Layer 2 Solution

But the whales were not alone as retail investors jumped aboard the bandwagon, too evident from the active addresses. The investors participating on the network surged by 187% in merely 24 hours, also reaching the highest since the inception of the cryptocurrency.

If this bullish momentum persists, the altcoin could sustain this rally and continue posting higher highs.

MNT Price Prediction: Another All-Time High or Back to the Previous High?

Mantle price at the time of writing could be seen changing hands at $1.17, marking the intra-day high at $1.30. If the current investor behavior and sentiment do not change, MNT could make it back to $1.30 and potentially even close the daily candlestick above it.

Read More: Top 11 DeFi Protocols To Keep an Eye on in 2024

This will allow the altcoin to continue its uptrend and post higher highs. On the other hand, if the bullish momentum subsides, Mantle’s price could fall back to the previous all-time high of $1.07 to test it as support. Losing this level would result in a drawdown to $1.0, invalidating the bullish thesis.