Solana (SOL) is losing the support of one of the most important groups of investors, the institutions.

This will likely result in a massive correction for SOL unless the altcoin manages to do this.

Institutions Take a Break From Solana

Solana’s price, like every other cryptocurrency, is bound to be impacted by the actions of institutional investors. These investors are the trigger factors of any bull run and just the same, they are also one of the biggest causes of a correction.

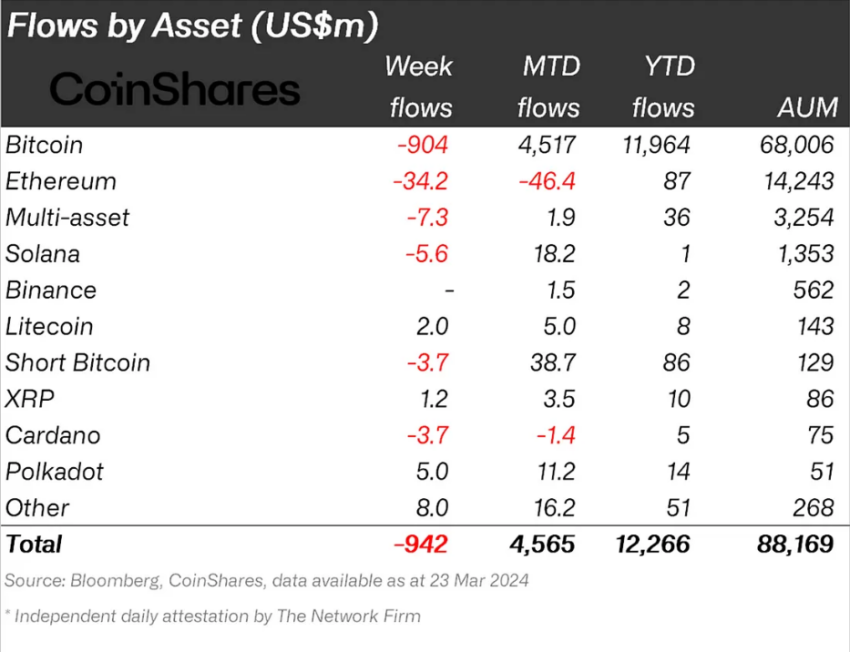

This is what is expected out of SOL going forward since the altcoin has lost a substantial amount of investment from institutions. According to CoinShares’ weekly flows report, Solana, along with Bitcoin and Ethereum, noted considerable outflows.

Nearly $5.6 million have been pulled out by these institutions in the past week, bringing the month-to-date flows to $18.2 million, down from $23.8 million. Consequently, the net flows since the beginning of the year have come down to $1 million.

This will likely trigger a decline in price, and retail investors might not be able to save Solana from this bearishness.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

The reason behind this is the lack of optimism among them, which is evidenced by the funding rate of SOL. The funding rate is a mechanism in derivatives markets ensuring a balance between long and short positions. Although the rates are positive at the moment, they have noted no growth in the last ten days.

This shows that traders are not betting on an increase in Solana price, which will minimize the bullish counter impact.

SOL Price Prediction: Another 15% Decline on the Cards?

Solana’s price is presently trading at $187, crossing the resistance level marked at $183. However, the altcoin will likely fall back soon as it will fail to breach the $201 barrier as it did earlier this month.

This will potentially result in a drawdown, bringing Solana’s price down to $160, marking a 15% decline, falling through the support level marked at $168.

Read More: 13 Best Solana (SOL) Wallets To Consider In March 2024

On the other hand, should Solana’s price break past the $200 resistance level, it would invalidate the bearish thesis. This would send SOL towards $220.