Reserve Rights (RSR) price is one of the many cryptocurrencies that have charted astonishing rallies in a single day this month.

However, looking at the market and asset conditions, it seems like this rally will bear little to no impact.

Reserve Rights Price Needs More Steam

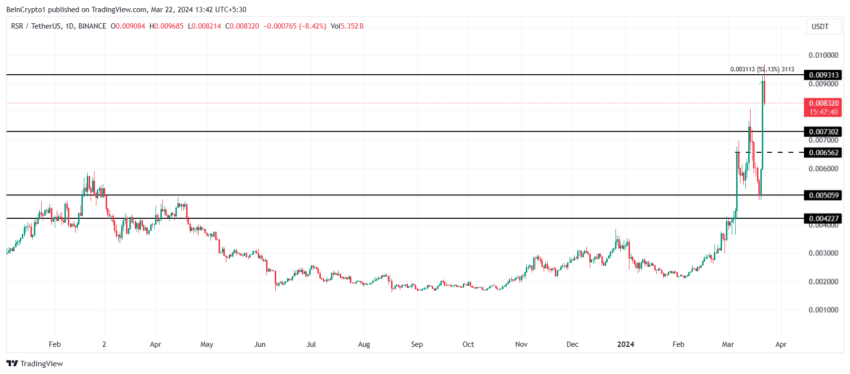

Reserve Rights price shot up by over 52% in the last 24 hours, bringing the altcoin to a 17-month high. However, cryptocurrency is still far from charting a fresh all-time high. Nevertheless, this rise did bring the low-cap crypto asset to notice.

Interestingly, despite the growth, the potential of any impact of the rally is nearly insignificant, as most of the gains will be wiped out by due corrections. The reason behind this is the fact that RSR is an overvalued asset, which means that the bullishness surrounding the token has saturated.

This is evident from the Market Value to Realized Value (MVRV) Z-Score. This indicator measures the ratio of market cap to realized value, indicating whether an asset is overvalued or undervalued relative to its historical price movements. A high positive score suggests potential overvaluation, while a low or negative score implies potential undervaluation.

In the case of RSR, MVRV Z-Score is above the 2.62 threshold. Values above this point suggest that the asset is overvalued, and historically, this has resulted in corrections in price. Reserve Right price might face a similar fate.

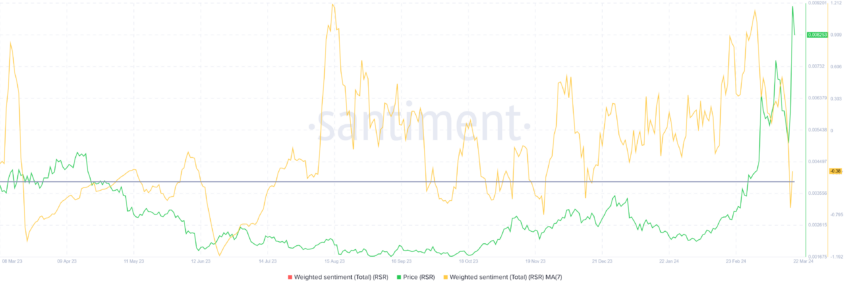

Furthermore, the cryptocurrency is losing what little backup it has from its investors. The overall sentiment, which has been positive for the past three months, dipped this week despite the rally. At the moment, investors are exhibiting pessimism, with the weighted sentiment falling to a four-month low.

This will result in a decline in price over the coming days.

RSR Price Prediction: Possible 20% Correction

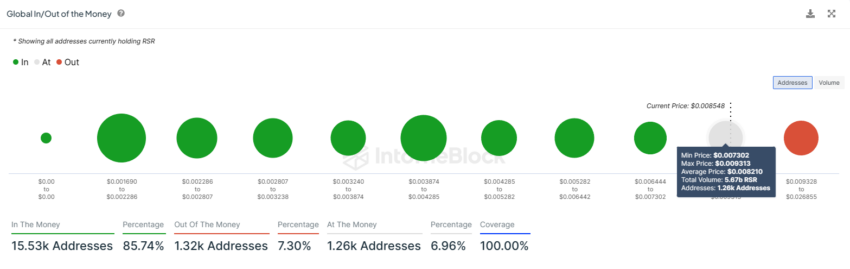

Reserve Rights price, trading at $0.008320 at the time of writing, is down by more than 8% since the beginning of the day. The altcoin is poised to fall towards the next support level, marked at $0.007302.

This price point also marks the lower limit of the range in which 5.67 billion RSR worth more than $47 million was bought by investors. Falling through this will push these 1,260 investors back into losses, bringing RSR down to $0.006500.

However, the $0.007302 is a crucial level that has been tested as both resistance and support in the past. If the Reserve Rights price manages to bounce off this level, it would be able to invalidate the bearish thesis provided it can reclaim $0.008000.