Ripple price needs to break out of the ongoing sub-bearish price action that has kept the altcoin restricted for months now.

The best shot for XRP is to validate this bullish reversal pattern, but looking at investors’ behavior, it may not happen soon.

Ripple Investors Need to Be Optimistic

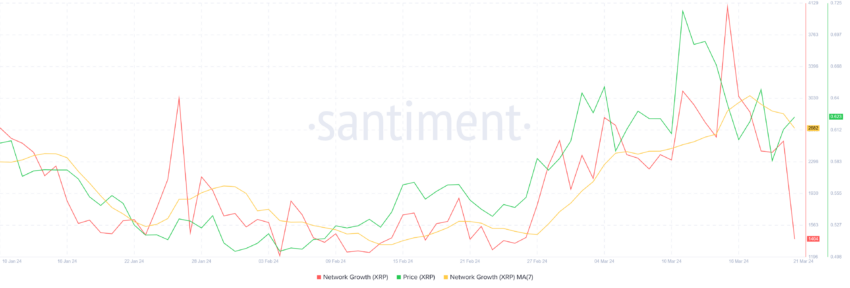

Ripple price is already bearing the brunt of the broader market bearish cues, and to make things worse, the investors are not acting bullish either. XRP holders have been slowly but surely pulling away from the asset.

This behavior is not limited to just the present investors but also potential future XRP holders. The network growth, which refers to the formation of new addresses, is observing a considerable decline. This means that Ripple is losing traction among potential investors, which tends to leave a bearish impact on the price.

In addition to this, the existing investors are not too bullish at the moment either. The addresses conducting transactions on the chain have been falling for the past few days. These active addresses hit a three-month low and do not show signs of rising back.

As participation in the network decreases, the bullish interest wanes away, too, leaving the cryptocurrency vulnerable to further decline.

XRP Price Prediction: This Bullish Reversal Pattern Will Fail

Ripple price formed a double bottom pattern over the past couple of months in terms of the weekly timeframe. This bullish reversal pattern hints at the potential increase that an asset can witness, provided it breaches the breaking point.

Given that XRP, at the time of writing, is noting consolidation on the daily chart, it would not be surprising to see this pattern fail. The altcoin will likely fail to breach through the neckline, bringing it back down toward the low of $0.50.

However, if the altcoin crosses the threshold of the breaking point, it would have a shot at recovery. The bearish thesis would be invalidated and Ripple price would be enabled to attempt a 26.31% rally, obtained by the bullish pattern.