The Chainlink (LINK) price is in a downtrend, but the trend is rather weak at the moment. This has allowed investors to put a stop to the ongoing decline.

On the other hand, the altcoin is witnessing certain bearish developments that could wipe out a chunk of the recent gains.

Chainlink Price Is Finding Support Among Holders

Chainlink’s price over the last four days has corrected by more than 14% to trade at $18.56. Despite this, the altcoin has kept itself consolidated within the $21.69 and $17.56 range, recently testing the latter as support.

Looking at the on-chain metrics performance, this consolidation seems likely to continue, given that the cryptocurrency also notes backup from LINK holders. Most of the active addresses that are actively conducting transactions on the network comprise bullish investors.

According to the Active Addresses by Profitability, we see that 7% of the active investors are at a loss. The other 57% are those that are at the money, i.e., neither in profit nor at loss, and the remaining 35% are investors that are in profit.

Since most participating addresses are not witnessing losses, they will keep from selling, preventing excessive drawdown.

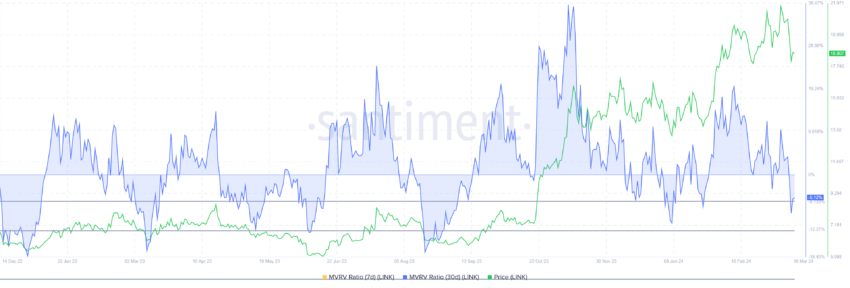

Secondly, the Market Value to Realized Value (MVRV) ratio also signals bullishness. The MVRV ratio assesses investor profit or loss. A 30-day MVRV of -5.2% for Chainlink indicates recent investors have lost money.

Furthermore, historical data shows that -5% to -12% MVRV often precedes market rallies, termed “opportunity zone” for accumulation.

Thus, LINK is optimum for accumulation at the moment and might draw investors towards it.

LINK Price Prediction: Death Cross Looms Above Investors’ Heads

Considering the aforementioned factors, Chainlink’s price might have a shot at potentially pushing back and reigniting the bullish rally. This would help LINK not only reclaim the 50-day Exponential Moving Average (EMA) but also $19 as a support level.

However, it is to be noted that the altcoin is witnessing a Death Cross on the 4-hour chart. A Death Cross occurs when the 50-day EMA crosses below the 200-day EMA, signaling a potential asset price downtrend.

If this dominates the bullishness, Chainlink’s price might fall to $17.56, losing which would invalidate the bullish thesis.