With supply on exchanges still decreasing, the potential for a bullish scenario for FTM price persists. Currently, approximately 43% of investors are holding onto their investments despite not having achieved a profit in the hope that the market will recover and prices will increase.

For those interested in delving deeper into the nuances of FTM price dynamics, read the full analysis to understand the potential future movements better.

Fantom Supply on Exchanges Is Decreasing

Since March 1, the quantity of FTM tokens available on exchanges has notably decreased from 655 million to 643 million. This trend seems to be closely associated with a significant uptick in the value of Fantom’s price, which escalated from $0.50 to $0.82 within a span of just 12 days, marking an impressive 64% growth in value.

The decline in the available supply of FTM on exchanges signals that there is a lower quantity of tokens that can be easily traded, bought, or sold. This decrease became particularly apparent when the supply of FTM dropped by 1 million between March 10 and March 13.

A diminished supply on exchanges often leads to upward pressure on prices. This happens as buyers may be willing to pay more for tokens when they become less available. The decrease in FTM on exchanges often suggests that investors increasingly transfer their tokens to private wallets for long-term storage.

Such a strategic move is often motivated by the anticipation of further price appreciation. This investor behavior contributes to tightening the circulating supply available for immediate trading, potentially fuelling further increases in price.

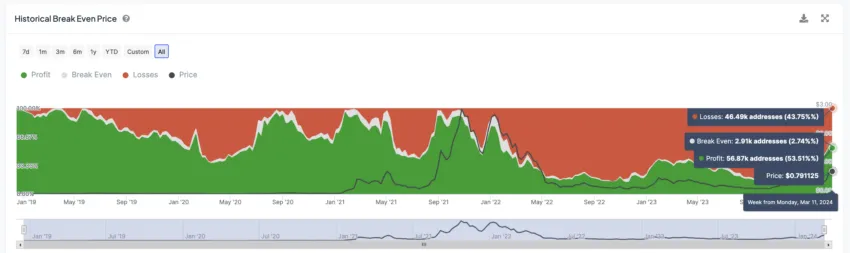

More Than 45,000 Holders Are Still at a Loss

Even with the recent rise in FTM price, around 43% of its investors have holdings valued below their initial investment. This suggests that a significant number are waiting for the token’s value to increase before they consider selling.

Their hesitance to sell could lead to a decrease in selling pressure on the market, which, in turn, may bolster the potential for an ongoing upward price movement. The anticipation of enhanced returns could be a driving force behind a continued increase in FTM value.

Historical data reveals that when around 45% of FTM holders faced losses, the token experienced remarkable surges in its price. Specifically, 165.22% and 97.16% growth rates were recorded within two to three weeks, respectively.

These patterns highlight that many investors in a loss position could be a precursor to substantial price rallies for FTM. Given that 43% of holders are presently looking to break into profitability, the likelihood of witnessing another pronounced rise in price exists, provided that the market conditions and investor sentiments remain steady.

This scenario shows the potential for future price increases as investors continue to hold their tokens in anticipation of achieving higher returns.

FTM Price Prediction: Is $0.96 Coming Soon?

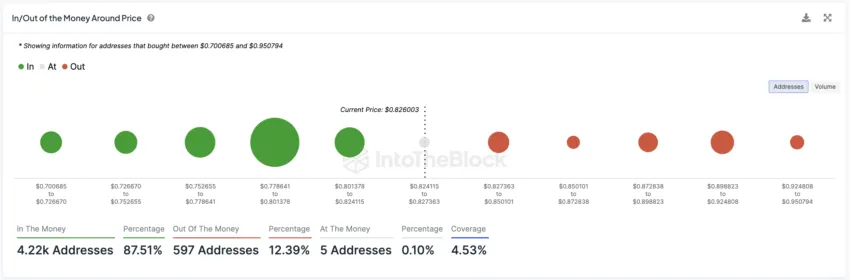

The In/Out of the Money Around Price (IOMAP) analysis for FTM indicates that most holders, precisely 87.51% or 4,220 addresses, find themselves in a favorable financial position, having acquired FTM at prices below the current $0.82 mark. This significant portion of investors holding onto profits is poised to act as a foundational support for FTM price.

Their potential reluctance to sell at a loss if the price drops below their buy-in motivates this. If prices fall, they might buy more FTM to lower their average costs or keep their holdings. Either approach could help stabilize the price.

Should the FTM price struggle to maintain the critical support level of $0.80, there’s a plausible risk of a downtrend towards $0.77 in the near future.

However, the $0.85 to $0.95 range is a tough hurdle. Investors facing losses might sell as prices hit their initial investment levels, pushing FTM’s price down. Breaking through the $0.85 barrier could kickstart a bullish trend for FTM, aiming for $0.95.

This indicates that surpassing major resistance points could fuel a continued rise if the market handles the sell-off well at these pivotal moments.