Worldcoin (WLD) could experience a period of relative stability in its pricing, with investors meticulously evaluating the market’s future trajectory. Analysis from IOMAP data reveals a robust support base, which has played a critical role in minimizing any sharp declines in value.

Although the number of holders is still growing, almost 90% of them are now at profit. This scenario could lead investors to increase selling pressure or wait for the price to increase before selling.

Worldcoin Holders Are Still Growing Slowly

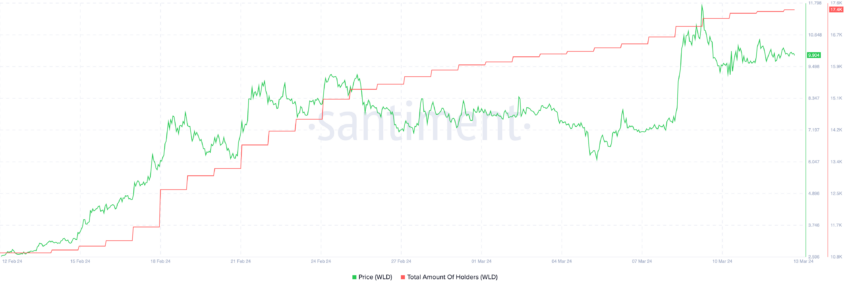

WLD has witnessed a significant uptick in its holder count, escalating from 11,006 to 17,450 between February 13 and March 13. This surge signifies a robust growth rate of 58.55% within a mere month, underscoring the increasing interest in WLD.

However, a noticeable deceleration in the rate at which the number of holders is increasing is worth noting. Specifically, from March 7 to March 13, the holder count only rose from 16,544 to 17,450, marking a more modest growth of 5.48%.

The reason for this scrutiny stems from a notable event in mid-February when the WLD price experienced a significant rally. The price leaped from $3.27 to $4.20 between February 15 and 16. Following this price surge, there was a corresponding increase in WLD holders, culminating in a vigorous bull run. During this period, the WLD price skyrocketed from $4.20 to $9.08, an impressive 116.19% growth over ten days.

Given this backdrop, the correlation between the growth of WLD holders and the asset’s price becomes apparent. Therefore, the current slowing pace in the growth of WLD holders might hint at an impending period of price stagnation. This potential correlation is crucial for investors and analysts to consider, as it could offer insights into future price movements of WLD, especially if the pattern of holder growth influencing price trends continues.

Could Profitable WLD Holders Start Selling?

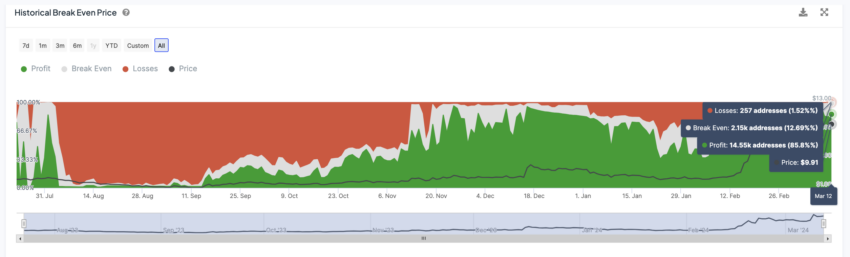

In the current pricing, an impressive more than 85%, which translates to approximately 14,500 addresses, find themselves in a profitable position with their holdings of WLD. Understanding that this scenario doesn’t automatically spell a bearish outlook for the cryptocurrency is crucial.

These investors might opt to maintain their holdings, banking on the asset’s potential to surge beyond 16% and set a new record high, amplifying their gains.

However, it’s equally essential to highlight that there was a moment when the proportion of holders in profit soared to 95%, swiftly followed by a notable 9.43% drop in value in just a 24-hour timeframe. Such a sharp correction serves as a potential warning signal for Worldcoin’s market stability.

Upon evaluating their prospects for further gains unfavorably or identifying more attractive investment avenues, a considerable segment of profitable investors might decide to offload their assets.

This collective move to liquidate could generate significant selling pressure, ultimately driving down Worldcoin’s market price. This dynamic warrants close monitoring as it could significantly influence the asset’s future price trajectory.

WLD Price Prediction: Can Worldcoin Reclaim $10.50?

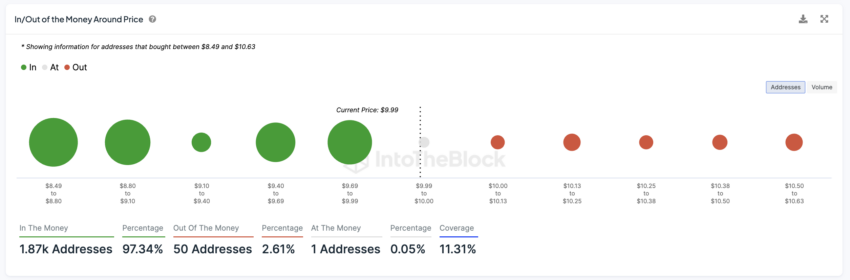

The In/Out of the Money Around Price (IOMAP) chart shows a substantial green area below the current price, indicating that most investors are ‘In the Money.’ It’s also possible to see that WLD has good support zones at $9.69 and $9.40. However, if it cannot resist these support zones, it could go down as much as $9.10, a potential 7% correction.

The IOMAP chart serves as a map of investor profitability and expectation, which segments various price points based on the average cost at which the current holders purchased the coins. It visually depicts clusters of investor positions in three categories: ‘In the Money’ (green), where investors would make a profit if they sold their coins at the current price; ‘At the Money’ (gray), where the purchase price is approximately equal to the current price; and ‘Out of the Money’ (red), indicating a hypothetical loss if sold.

If the number of holders starts growing again and WLD enters an uptrend, it could easily break the resistances ahead, achieving $10.50 or even breaking its previous all-time high of $11.71 soon.