The Polygon (MATIC) price has been observed to increase consistently for the past month, which has propelled the altcoin by over 50%.

This increase might be noting some slowdown now as the MATIC price faces a crucial barrier that could reverse the bullish momentum if breached.

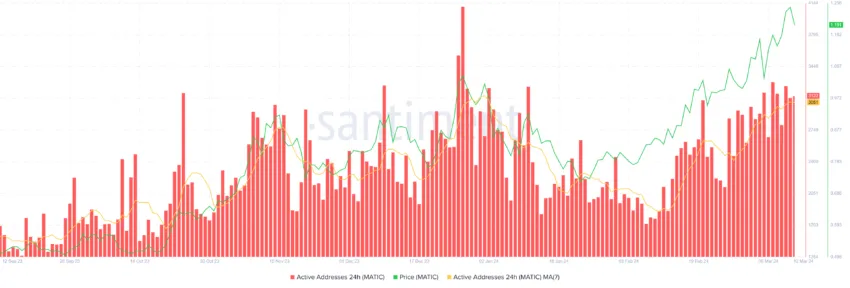

Polygon Finds Support as Active Addresses Rises

While many altcoins have managed to chart a rally by drafting off of other cryptocurrencies, MATIC has achieved the same with the help of support from its holders. These investors have been sustaining the bullish momentum by being active on the chain.

In fact, the average active addresses, i.e., those conducting transactions on the network, have shot up by 88% from 1,719 to 3,232. This is proof of increased traction in the market and investors’ confidence in the altcoin, exhibited by the high participation.

Secondly, the Polygon native token has noted a surge in buying at the hands of investors. The supply on exchange, which showcases the total MATIC on all exchanges, has dipped over the past week.

Investors have purchased nearly 59 million MATIC worth $70.2 million, indicating that the bullish sentiment will likely sustain for a while. This may help Polygon’s price navigate through the shift in momentum it might witness owing to the $1.18 resistance level.

MATIC Price Prediction: Rise Challenged

Polygon price on the 3-day chart observed a slight correction over the past 48 hours, slowing down the consistent increases. The altcoin encountered the $1.18 resistance level, which it last tested in April 2023.

By looking at the market condition and investors’ interest, as well as the aforementioned conditions, Polygon’s price looks in shape to push through $1.18 and continue the rally. Flipping this resistance into support would enable MATIC to tag $1.30 and mark a yearly high.

However, MATIC cannot be ruled immune to a breach of $1.18 this time, considering its failure to do so in April last year. Should this happen, Polygon’s price would likely drop to $1.05, registering a 10% correction.

If this support level is lost, the bullish thesis would be invalidated, and MATIC could lose the $1 support level.