The Gala price growth has been one of the most impressive rallies in this bull run, with the altcoin gaining by over 90% in two days.

This indicates that many investors enjoy long-due profits, but it is not the best outcome for some.

Investors Await Gains

The recent rally, which brought the Gala price to $0.076, has been a sight for sore eyes for about 48% of all holders. These addresses bought their supply at a price lower than the trading price. However, such is not the case for the rest of the investors.

Nearly 50% of the holders are currently underwater, awaiting a rally that might be rather difficult to happen. The reason is that most of these investors bought their supply closer to the all-time high, which would require a 750% increase in price to become profitable.

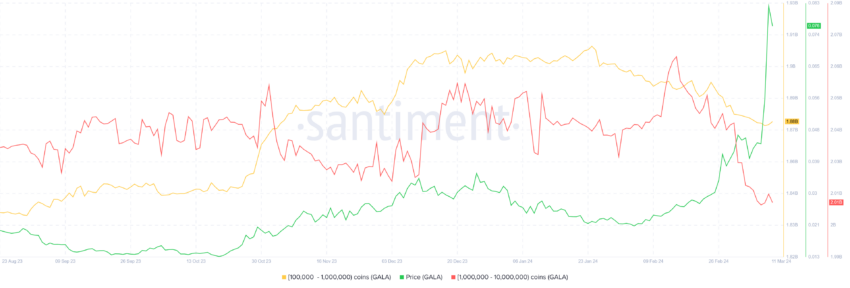

Generally, a solid rise, as noted by this cryptocurrency, initiates further growth, but that may not be the case this time. One of the most important cohorts – whales have already begun booking profits and selling a chunk of their supply.

Addresses holding between 100,000 to 10 million GALA have sold over 30 million GALA in the span of ten days. Most of this selling is concentrated around the time the Gala price began growing, thus making further rallies an absolute event of selling.

Furthermore, the profits enjoyed by the altcoin holders are the largest witnessed by them since November 2021. The Market Value to Realized Value (MVRV) ratio evaluates investors’ average profit or loss after acquiring an asset. Specifically, the 30-day MVRV reflects gains or losses from purchases the preceding month.

For Gala, the 30-day MVRV sitting at 88% signifies an 88% profit for recent investors, potentially prompting profit-taking and triggering a sell-off.

Historical patterns show that when MVRV climbs above 34%, significant corrections often occur, leading to the term “danger zone” for this area. And since Gala is far above this threshold, the probability of profit-taking is much higher.

Gala Price Prediction: Will it Fall?

The Gala price has a good chance of correcting. The signs are already visible in the form of red candlesticks, which are noted on the daily timeframe. If selling at the hands of whales continues, a drawdown to $0.06 would likely wipe a chunk of the recent gains.

However, if investors display resilience and hold off selling, expecting further increases, the Gala price might bounce off $0.072. This would provide GALA with a boost to breach the $0.0845 resistance level, allowing a potential rally to $0.10, invalidating the bearish thesis.