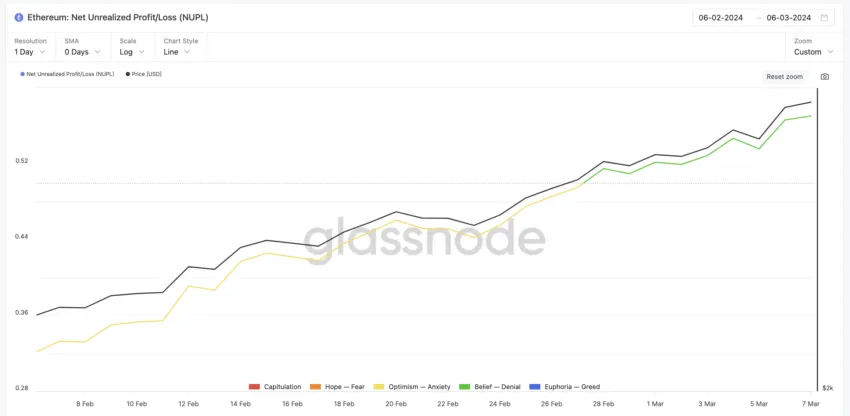

The recent shift in ETH Net Unrealized Profit/Loss (NUPL) into the ‘Belief — Denial’ zone signals a pivotal juncture. Ethereum’s current position at this delicate threshold suggests that while confidence in its long-term value remains robust, there exists a looming caution that market dynamics could pivot.

For an in-depth exploration of these factors and a strategic examination of Ethereum’s potential paths forward, delve into the complete analysis.

ETH Is the Clear Winner Among the Top 10

In an analysis focusing on the year-to-date (YTD) growth of the leading 10 cryptocurrencies, excluding stablecoins and memecoins, ETH has demonstrated a remarkable increase, surging by 67.22% this year. This growth rate has allowed it to surpass all its key competitors, including Bitcoin (BTC), Binance Coin (BNB), Solana (SOL), and Chainlink (LINK).

At the beginning of the year, ETH was valued at $2,352. Since then, it has seen a significant rise, reaching a price of $3,946 more recently. Despite this impressive growth, ETH’s current price remains 18.39% below its all-time high (ATH) of $4,849.03. However, there is a strong possibility that ETH could retest its ATH in the near future. This optimism is partly due to Bitcoin (BTC) having recently surpassed its record high.

Nonetheless, there is a chance that the cryptocurrency market may experience some degree of consolidation in the short term. This potential development could occur as investors in ETH, where currently 79% of them are in a profitable position, may decide to liquidate some of their holdings.

The motivation behind such a move could be diversifying their investments towards other cryptocurrencies with greater growth opportunities, including memecoins.

NUPL Indicator Changes Status

ETH Net Unrealized Profit/Loss (NUPL) metric recently transitioned from the ‘Optimist – Anxiety’ category to the ‘Belief – Denial’ phase. This transition signifies that the majority of holders are currently observing their holdings in a profitable light, which, in turn, solidifies their confidence and belief in ETH. This phenomenon is generally interpreted as a hallmark of a maturing bull market, characterized by investors who exhibit confidence in their investments without veering into the territory of irrational exuberance.

The Net Unrealized Profit/Loss (NUPL) metric represents the difference between Relative Unrealized Profit and Relative Unrealized Loss across all on-chain addresses. It essentially shows whether the network as a whole is currently in a state of profit or loss.

However, if NUPL moves into the ‘Euphoria – Greed’ range, it often indicates that the market is greedy, where most investors are in profit. Historically, this has often been an indicator of a market top. This could lead to a market correction as more investors decide to profit.

IOMAP Data Shows Strong Support and Resistance Levels

Ethereum (ETH) currently benefits from significant levels of strong support, identified at two key price points: $3,830 and $3,710. These levels act as crucial buffers for the cryptocurrency. However, should ETH be unable to maintain these support levels, there is a potential for the price to decline further. Specifically, it could drop to as low as $3,591. This scenario points to a notable decrease in ETH market value.

Conversely, the asset exhibits a significant level of resistance at the moment, specifically at price points of $3,949 and $4,064. Nonetheless, should it manage to penetrate through these resistance levels, there exists a potential for its value to escalate further, possibly reaching as high as $4,500.

This price point is notably close to its all-time high (ATH). The prevailing mood within the broader market could influence such an upward trajectory. Given that BTC, along with other cryptocurrencies, has been achieving new peaks recently, ETH seems poised to emerge as one of the most substantial beneficiaries in this current market cycle.

Current metrics show a possible consolidation in the short term, but overall market trends, like a possible Ethereum ETF, suggest ETH could hit $4,500 and test a new all-time high soon.