NEAR price rise left a bullish crater yesterday after skyrocketing on the daily chart. The impact was felt by the bears, who were expecting a decline.

What lies ahead of NEAR will likely only further hurt the bears, but they could be vindicated if the altcoin follows the path set historically.

Near Price Blasts Off

NEAR price at the time of writing could be seen trading at $5.64 after registering a 38% rally in the last 24 hours. While fruitful to many, the increase proved to be an unsettling event for the bears betting on the altcoin taking a dive following the three red candles from the previous days.

Over $2.23 million worth of short contracts were liquidated within a day. This marked the first incident on this scale in nearly three months. However, what lies ahead for the DeFi protocol’s native token will likely only upset the bears since all indicators signal an increase.

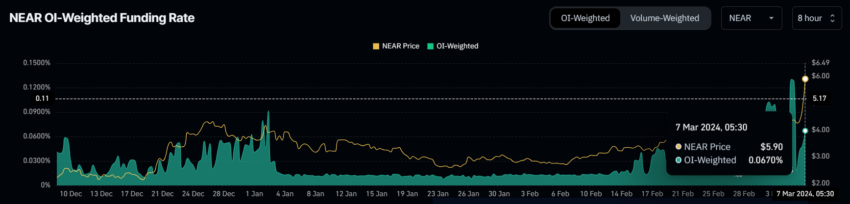

The Open Iinterest-weighted Funding Rate is presently significantly positive for NEAR at an average of 0.0670%. Funding Rates are periodic fees paid between traders holding perpetual swap positions to maintain price alignment with the underlying asset.

If the derivative price deviates from the spot price, long or short position holders pay or receive funding to balance it. As such, positive rates suggest a bullish sentiment in the market, and traders are pining for further increases.

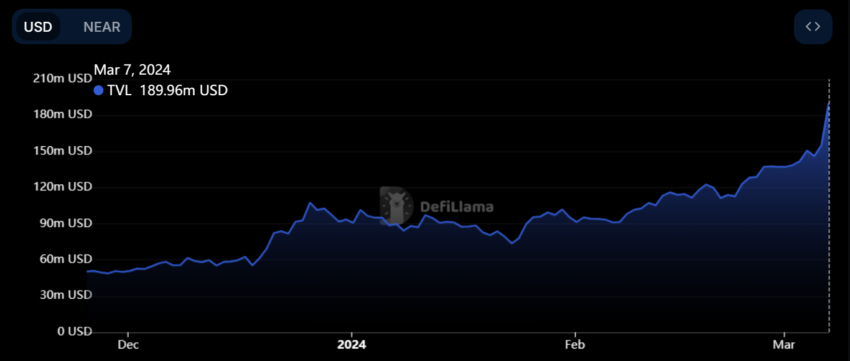

But beyond speculation, usage of the protocol is also noting a boost. Amidst the rise in price on Wednesday, the total value locked (TVL) on NEAR protocol also increased by 22.5% from $155 to $189 million within 24 hours.

This shows that the protocol’s adoption is observing growth alongside the demand, making the rally significantly more substantial.

NEAR Price Prediction: Fear of Correction Looms

Even though the NEAR price has risen, it has not cemented the increase. This is because, at the moment, NEAR is facing a barrier of $5.60. Breaching it is likely, but flipping it into support is far more crucial for it to continue its price increase.

Once that happens, NEAR will be on its way to tagging the yearly high of $6.50. Based on the aforementioned indicators, it is likely that bears will keep away for a while to prevent further losses. This would act as a catalyst for the crypto asset and push it towards the resistance level.

However, the Relative Strength Index (RSI) indicates that the asset is currently overbought. The RSI sits above 70 and looks to be declining. This is a sign of potential saturation of the bullish sentiment, which could hint at an impending correction.

The RSI is a momentum indicator traders use to evaluate whether a market is overbought or oversold and whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite. The indicator is above 50 but is decreasing, indicating bulls could be losing steam after the recent price rally.

This has been the case historically, and a similar outcome would keep NEAR’s price around the $5.60 mark. Losing this support level would invalidate the bullish thesis and send the cryptocurrency down towards the $4.85 level.