The broader market’s bullish cues pushed many cryptocurrencies towards new heights along with the Fetch.ai (FET) price. The altcoin registered a new all-time high on Wednesday, following Bitcoin’s lead.

However, while this is a moment of celebration, some FET holders seem to be taking a different route. Could this negatively impact the altcoin?

Fetch.ai Price Is at Another Level

Fetch.ai price surged to a record high of $2.00 this week, reflecting a remarkable 200% rise over the past three weeks. Throughout this climb, FET notably established support levels at $1.05 and $1.70, indicating stability amidst its upward trajectory. This surge underscores the growing interest and confidence in the asset within the crypto market as investors react to its potential and performance.

This is also reflected in the overall bullish sentiment across the network, as investors have witnessed consistent profits since February 19. This was the day the FET price broke the previous all-time high of $0.90, and all holders noted gains.

According to the Global In/Out of the Money (GIOM) indicator, 100% of the entire circulating supply of FET is yielding gains to its investors. The last group to reach profit was a cohort holding 18,350 FET worth $36,700, bought at an average of $1.82.

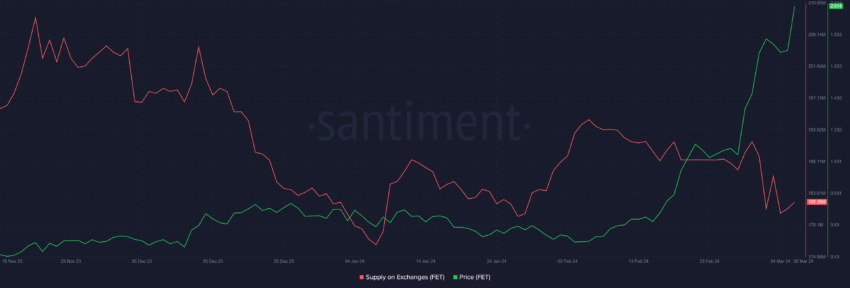

This shows investors are still accumulating FET despite the continuous rise and ascertained gains. Consequently, providing support for further price increases. The same can be observed in the declining balance of FET on exchanges. This is generally a signal of potential buying interest in the crypto asset verified by the investors’ actions, which could keep the rally going.

FET Price Prediction: Whales May Not Be on the Same Page

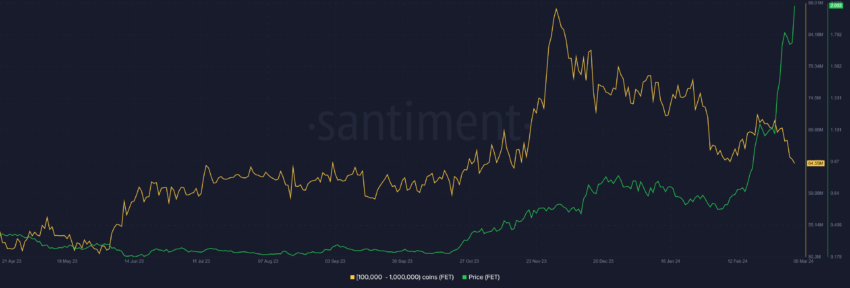

FET whale addresses have been in the process of shedding their holdings since the FET price broke the previous all-time high in mid-February. Since then, these large wallets have sold roughly 8.45 million FET worth nearly $17 million.

These addresses, which hold between 100,000 and 1 million FET, seem to be of the opposite mindset than the retail investors. Furthermore, their activity has dictated the FET price action in the past as their buying leads to an increase in price, while continued selling has caused price decreases.

Additionally, the Relative Strength Index (RSI) exhibits that FET is currently overbought, a signal of saturation of the bullish sentiment. Thus, if these whales continue selling, the FET price could decline. This would result in the altcoin potentially falling back to $1.71, invalidating the bullish thesis.