As the cryptocurrency market continues to evolve, Bitcoin remains at the forefront of investor interest. This is supported by its recent price performance, surpassing $60,000.

In a detailed analysis, trading veteran Peter Brandt has provided a compelling forecast for Bitcoin’s price trajectory. He linked its potential to the cryptocurrency’s halving events. This is a mechanism that cuts the reward for mining new blocks in half. Consequently, it reduces the supply of new BTC and often triggering a price surge.

Bitcoin Price Prediction: Is $400,000 Next?

Brandt’s methodical examination of Bitcoin’s past bull cycles in relation to its halving dates uncovers a pattern of significant growth phases that align with these events. Through an analysis that spans over a decade, Brandt highlighted the predictive power of these cycles. These suggest an optimistic future for Bitcoin’s price.

The trading expert pointed to the historical symmetry in the duration of bull trends before and after each halving. With the next halving scheduled for April 2024, Brandt’s projections suggest a bullish outlook for Bitcoin.

According to his analysis, if the post-halving price increases replicate the pattern of past cycles, Bitcoin could see its value climb to remarkable levels. Indeed, he projected targets of $150,000, $275,000, and even $400,000.

“If the pace of the bull trend after Apr 2024 is at similar pace to the bull trend since the Nov 2022 low, then the high in Oct 2025 could be around $150,000. However, the post-halving advances during previous bull cycles have been much steeper than the pre-halving advances,” Brandt said.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

Further bolstering the bullish sentiment, analysts at CryptoQuant provided BeInCrypto with a snapshot of the current market dynamics driving Bitcoin’s price. A recent surge to $64,300, the highest since November 2021, underscores the significant demand from large US investors.

This demand is mirrored in the rising holdings of large Bitcoin entities and an influx of new capital into the market, as indicated by the increasing short-term holder realized capitalization.

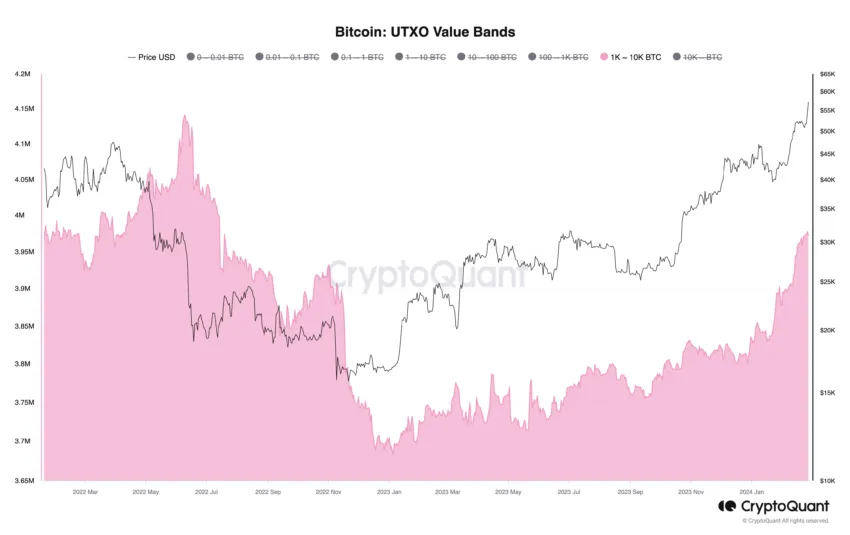

“The Bitcoin holdings of large entities has grown to the highest level since July 2022, totaling 3.975 million Bitcoin. The holdings have steadily increased from lows of 3.694 million Bitcoin in December 2022. Large entities (1,000 to 10,000 Bitcoin) expanding their holdings is correlated to higher prices as it denotes increasing Bitcoin demand for investment purposes,” analysts at CryptoQuant told BeInCrypto.

CryptoQuant’s analysis also shed light on the sustainability of the current price levels from a miner profit perspective. The analysts suggested that Bitcoin’s valuation remains reasonable, despite the recent rally.

Still, they cautioned against potential market corrections, citing indicators such as nearing extreme levels of unrealized profit margin among traders and the elevated cost of opening new long positions in the futures market.

Despite these cautionary indicators, the overarching sentiment among experts remains bullish. The confluence of historical data, current market trends, and the anticipated impact of the next halving event paints a picture of significant growth potential for Bitcoin.

This optimism has a solid foundation, as Bitcoin has demonstrated resilience and a consistent ability to reach new highs following past halvings.