The cryptocurrency market saw a significant upheaval in leveraged positions, resulting in around $315 million in liquidations within the last 48 hours. This disturbance was prompted by the recent volatility observed in Bitcoin and altcoins.

Bitcoin, the flagship cryptocurrency, endured a downturn during this period, dropping to a low of $50,670 before experiencing a modest recovery to $51,873.

Crypto Market Liquidations Hit $315 Million

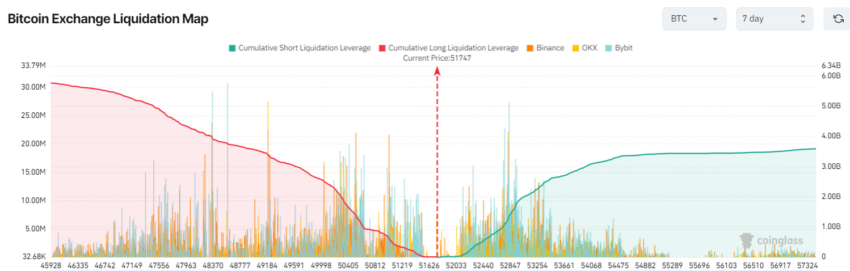

According to trading data from Coinglass, the crypto market saw a significant liquidation of $314.82 million between February 16 and the reporting time. Long-position traders incurred losses of $186.1 million, contrasting with short traders who lost $128.72 million within the same timeframe.

These liquidations coincided with the price of Bitcoin dipping into the $50,000 range and Ethereum sliding to $2,724 from over $2,800. Other major assets like Solana and Avalanche also experienced slight declines.

Binance users bore the brunt of this market turbulence. They incurred losses of $149.27 million, approximately 50% of the total liquidations in the crypto market. This is unsurprising considering Binance’s status as the largest crypto exchange by trading volume. Traders on other platforms, such as OKX, ByBit, and Huobi, also suffered notable losses.

Bitcoin Risks a Price Correction to $46,000

Ali Martinez, BeInCrypto’s Global Head of News, warned that Bitcoin could face an 8% correction if it fails to reclaim the $52,000 level quickly. He emphasized that such a dip could see BTC dropping to the $48,000 to $46,500 range, where substantial support exists.

“If Bitcoin fails to quickly reclaim the $52,000 level, it might face an 8% correction, potentially dropping to between $48,000 and $46,500. At this price range, over 1 million addresses hold more than 544,870 BTC, indicating significant support,” Martinez said.

Despite Martinez’s cautionary short-term outlook, prominent blockchain analytics firm IntoTheBlock remains bullish. The firm assigned an 85% probability that BTC will achieve a new all-time high within six months.

Read more: Bitcoin Price Prediction 2024/2025/2030

IntoTheBlock attributed this optimism to several factors, including the forthcoming halving event poised to reduce BTC’s inflation rate, anticipated Fed rate cuts, and the robust institutional interest in Bitcoin.

“Given the current momentum, the expected Fed rate cuts, and the strong institutional interest in Bitcoin, we give Bitcoin 85% odds of hitting all-time highs within the next six months,” IntoTheBlock stated.

Furthermore, the firm highlighted a significant uptick in BTC accumulation by whales. It attributed this increase to the improved ease of access for institutions to acquire Bitcoin.