The Dogecoin (DOGE) network has seen a notable increase in activity over the past week, coinciding with a rise in its price during the same period.

For analyzing trends in Dogecoin, including distinguishing between bullish and bearish movements, IntoTheBlock serves as a valuable resource. This crypto analytics tool aggregates and analyzes blockchain data, offering insights into various metrics such as transactions, large transactions, and holder composition, among others.

Such data can provide a deeper understanding of market sentiments and potential price movements for Dogecoin.

Dogecoin Challenges $0.0818 EMA Barrier

Dogecoin recently experienced a bullish bounce from the golden ratio support near $0.076 and has since remained above the 200-day Exponential Moving Average (EMA), indicating positive momentum. It is now encountering a key resistance level at the 50-day EMA, around $0.0818.

A breakthrough above this level could propel Dogecoin towards the 0.382 Fibonacci (Fib) level at approximately $0.0868. Overcoming this hurdle may set the stage for Dogecoin to challenge a critical Fib resistance near $0.095.

Surpassing the golden ratio resistance at $0.095 would signal a return to a bullish trend for Dogecoin in the short to medium term. Supporting this bullish outlook, the EMAs are displaying a golden crossover, and the Moving Average Convergence Divergence (MACD) lines are in a bullish crossover with the MACD histogram trending upwards, indicating bullish momentum.

Meanwhile, the Relative Strength Index (RSI) remains in neutral territory, suggesting there is room for movement in either direction.

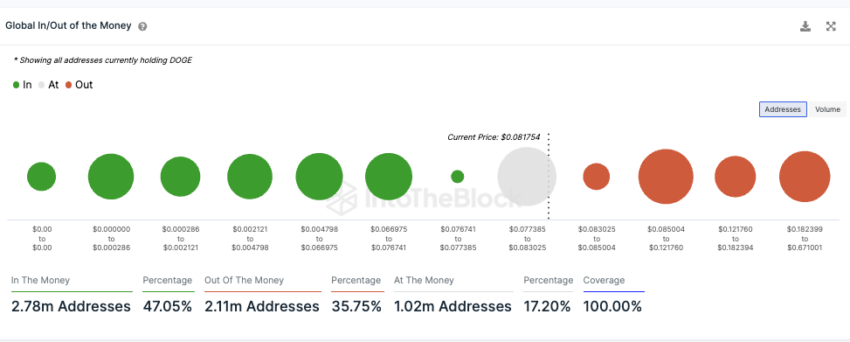

Dogecoin Addresses: Under 50% in Green

Currently, 47% of DOGE addresses are profitable, meaning they are ‘in the green’. In contrast, nearly 36% of addresses are experiencing losses, placing them ‘in the loss zone’. Additionally, approximately 17.2% of DOGE holders are at a break-even point, where selling their DOGE tokens at the current market price would result in neither a profit nor a loss.

This distribution highlights the varied investment outcomes among Dogecoin holders based on their respective entry points and the fluctuating market price of DOGE.

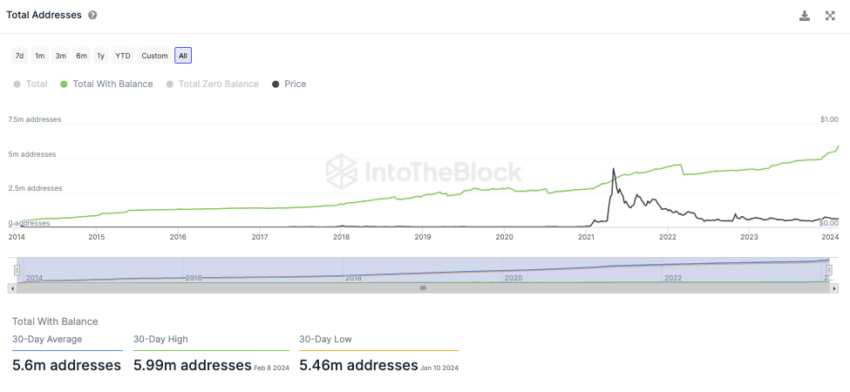

Dogecoin Network Sees Strong Upward Trend

Entering the new year, the Dogecoin network is exhibiting a positive trajectory, with the number of addresses holding DOGE reaching approximately 5.6 million.

Additionally, this growth signifies an increasing interest and participation in the Dogecoin ecosystem, reflecting its continued appeal among cryptocurrency users and investors.

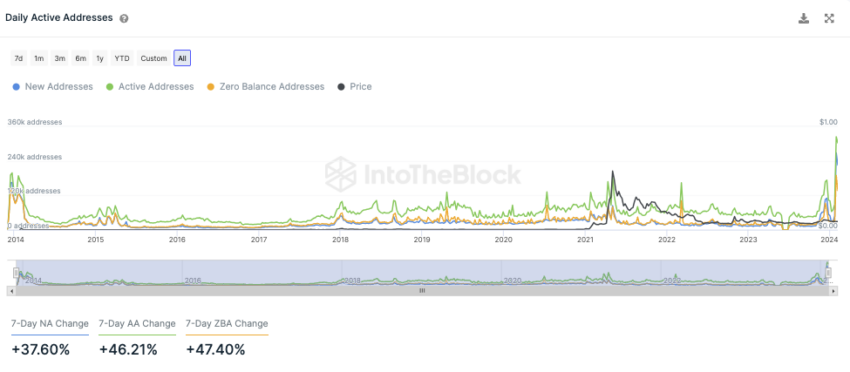

Surge in Dogecoin Network Activity Over Last 7 Days

Over the past week, Dogecoin has witnessed a significant surge in network activity. The number of active DOGE addresses has seen an impressive increase of over 46%. Additionally, there has been approximately a 38% rise in the creation of new DOGE addresses.

Concurrently, the count of addresses that no longer hold DOGE balances has also experienced a substantial increase, rising by almost 50%. These figures collectively indicate a heightened level of engagement and transactions within the Dogecoin network, pointing to growing interest and activity in the DOGE ecosystem.

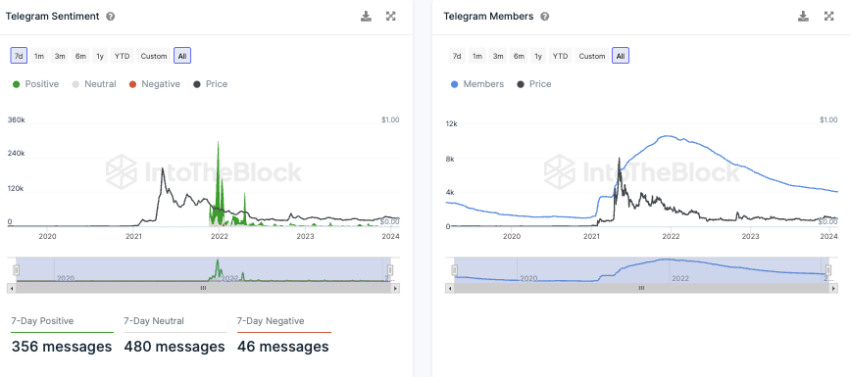

Positive Sentiment Prevails for Dogecoin on Telegram

Positive news about Dogecoin on Telegram significantly outweighs the negative, with nearly 356 positive news stories in the last seven days compared to 46 negative ones, showcasing a predominantly optimistic sentiment towards Dogecoin within the community.

Despite this favorable outlook, the Dogecoin Telegram group has experienced a notable decrease in membership over the past two years, indicating a divergence between the positive news coverage and community engagement on the platform.

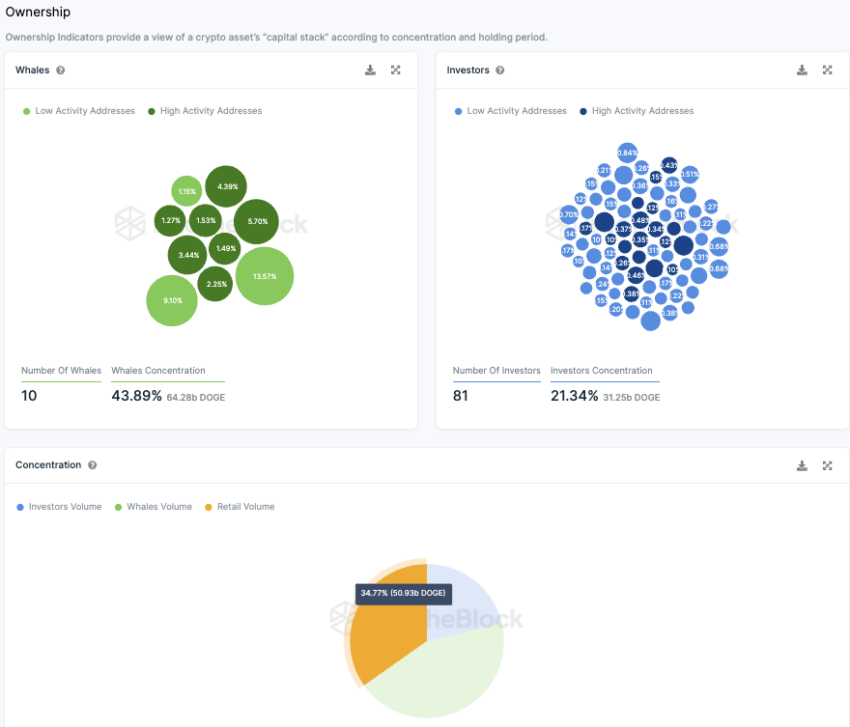

Over One-Third of Dogecoin Supply Held by Retail Investors

The ownership structure of Dogecoin reveals a significant concentration among large investors and whale addresses. Therefore, approximately 81 major investors, each holding between 0.1% and 1% of the Dogecoin tokens, collectively possess around 21.3% of the total supply.

Furthermore, there are ten whale addresses, each owning more than 1% of the total Dogecoin volume, accounting for nearly 44% of the holdings.

This leaves just over a third (34.8%) of the Dogecoin supply for retail investors, defined as addresses with less than 0.1% token ownership. This distribution highlights the substantial influence of large holders within the Dogecoin ecosystem.