Bitcoin (BTC) displays a promising uptrend, inching closer to $45,000. This surge is significantly attributed to reduced selling pressure, particularly from Bitcoin miners who have scaled back their daily sales from over 800 BTC in late 2023 to below 300 BTC in early 2024.

This shift suggests a strategic change in the miners’ approach to their holdings, with major US publicly traded Bitcoin mining firms reporting an uptick in their BTC reserves.

Bitcoin Miners Resist Selling Despite Profit Declines

Despite a notable dip in miner profitability – the steepest in over a year – selling pressure remains subdued. Data from CryptoQuant suggests that Bitcoin miners have faced considerable underpayment, yet their preference to hold onto their assets rather than sell is apparent.

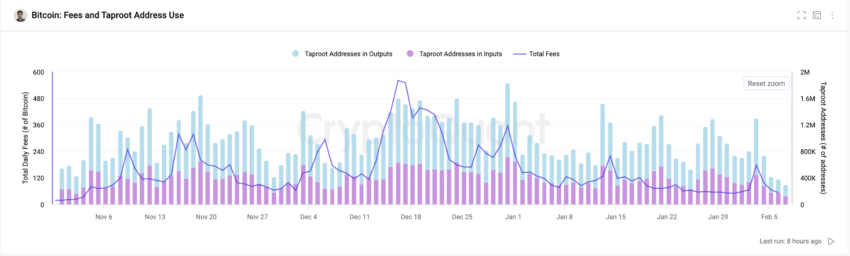

Moreover, the network has experienced a transaction downturn, going from a daily all-time high of 731,000 in late December 2023 to a three-month low of 278,000. This decrease is largely due to diminished activity in inscriptions and BRC-20 token transactions, particularly those utilizing taproot addresses, which have seen a 76% decline. Consequently, Bitcoin transaction fees have declined steeply, dropping by 90% from mid-December to early February.

“Miner selling pressure has remained low so far 2024 even after miner profitability decreased by the largest amount in at least a year. Miner have been mostly extremely underpaid so far in 2024,” CryptoQuant said.

Read more: Who Owns the Most Bitcoin in 2024?

Further bolstering Bitcoin’s uptrend is the growing interest from large-scale investors, or “whales,” actively accumulating Bitcoin. Insights from the on-chain analytics platform LookOnChain highlight significant movements, including withdrawals totaling 2,741 BTC, worth around $118 million, from Binance, just ahead of the price hike.

This easing of selling pressure and whale accumulation have collectively contributed to Bitcoin’s upward trajectory towards the $45,000 threshold. The flagship cryptocurrency is trading at approximately $44,451, marking a 3.61% increase over the past 24 hours.

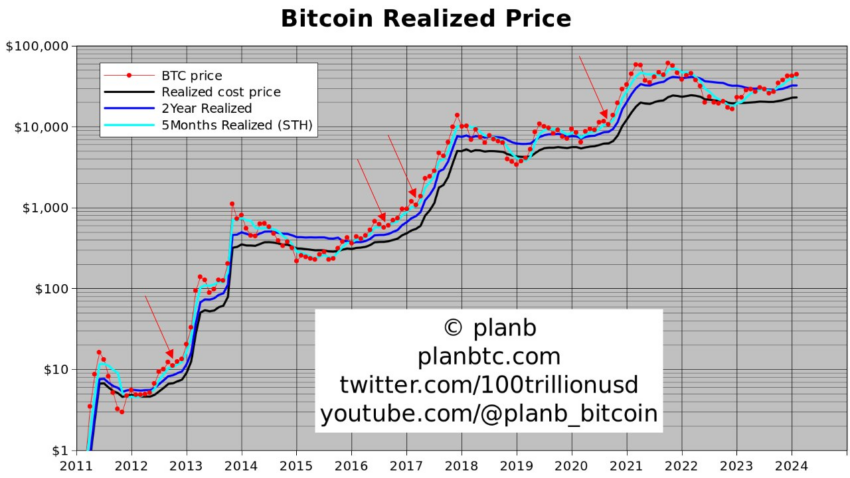

Prominent Bitcoin analyst PlanB offered an optimistic outlook, drawing attention to the increasing realized prices – a metric representing the average price at which Bitcoin has been historically traded. He posited that the current trend above these realized prices indicates a bullish momentum reminiscent of the early phases of previous bull markets.

Read more: Bitcoin Price Prediction 2024/2025/2030

PlanB speculates that Bitcoin’s price may not dip below $40,000 ever again, given its current trajectory above all realized price levels.

“All these realized prices are going up and Bitcoin is above all of them and that’s a very bullish sign. We see that at the start of every bull market… They all go up, and Bitcoin stays above… So that might mean no guarantee, again, but that might mean that Bitcoin will not go below $40,000 ever again,” PlanB said.