Liquid staking protocol Lido DAO is poised to hit a significant milestone of 10 million Ethereum (ETH) staked as the ecosystem experiences a surge in usage.

This growth coincides with an increased interest from validators looking to participate in ETH staking.

10 Million ETH Staked in Lido DAO

On-chain data from DeFiLlama shows that Lido DAO is on the verge of surpassing 10 million ETH staked.

Currently, the DeFi protocol holds an impressive 9.49 million ETH, representing 72% of all liquid-staked Ethereum, valued at around $21.76 billion. These numbers reflect a notable growth trajectory for the protocol during the past year, with Lido DAO’s total value locked (TVL) nearly doubling from 5 million in February 2023 to its current standing.

The collective liquid-staked Ethereum within the sector has witnessed a substantial increase as well to 13.10 million ETH, valued at $30.12 billion.

Read more: 11 Best DeFi Platforms To Earn With Lido’s Staked ETH (stETH)

Lido DAO has achieved this milestone despite Ethereum’s Shapella upgrade, which allowed stakers to withdrawal ETH. The protocol currently ranks among the top three institutions, including Coinbase and Kraken, that have withdrawn ETH from the beacon chain since the network update.

Beyond Ethereum, Lido DAO has a footprint on other blockchains. These include Solana, Moonbeam, and Moonriver, with token values of $16.96 million, $265,000, and $187,000, respectively.

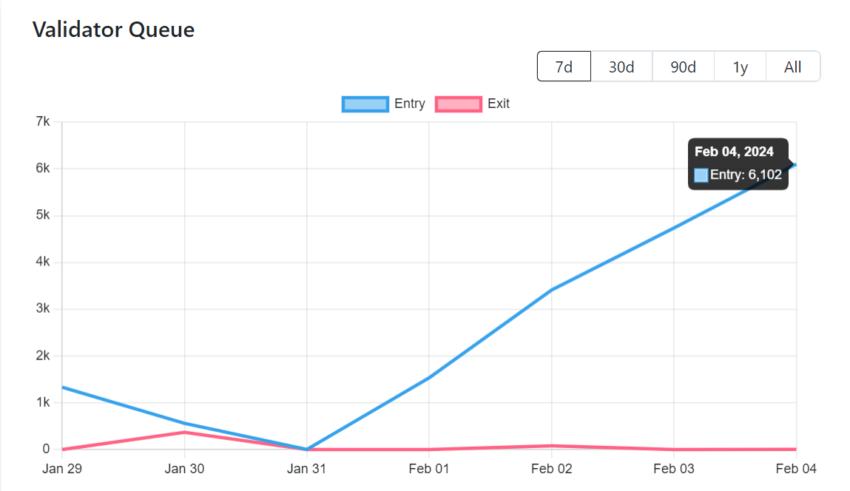

Ethereum Validators Queue Increases

Meanwhile, Ethereum’s staking ecosystem is witnessing an upswing. The number of validators queuing to stake their assets has risen to the highest levels since October 2023.

Indeed, more than 6,000 validators are in line to join the system. Subsequently surpassing the number of exits and increasing the average waiting time for validator approval to approximately two days.

Read more: Top 7 High-Yield Liquid Staking Platforms To Watch

The spike in validator entries commenced on January 31, following a significant unstaking event from the defunct Celsius Network, which resulted in over 16,700 validators exiting the system. Observers suggest the growing demand could push the number of active validators from 920,469 to over a million.