Over the past weeks, the crypto market has remained relatively quiet. This has fueled concerns about whether Bitcoin and altcoins will undergo a downturn.

Nonetheless, market observers, citing stablecoin inflows and other reasons, have maintained that the possibility of a bull cycle remains high.

The Stablecoin Market Expands

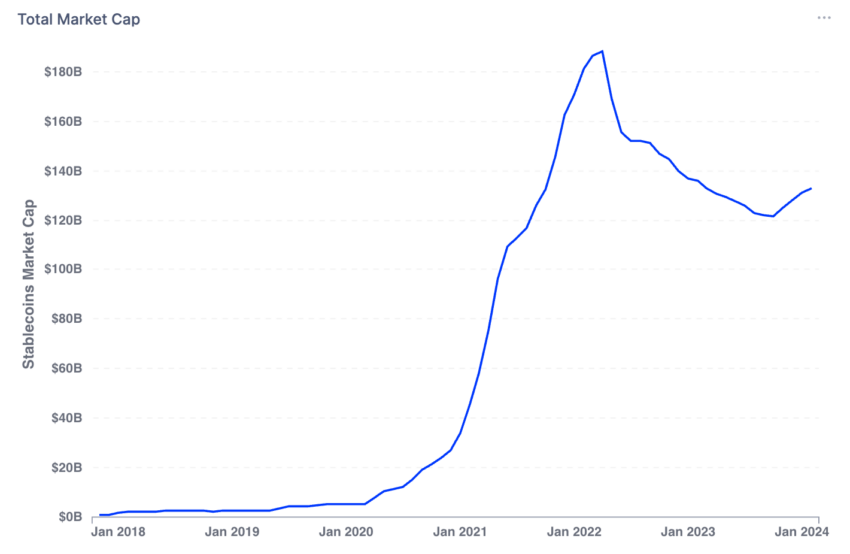

Blockchain analytics firm IntoTheBlock stated that the stablecoin market capitalization was recovering strongly. Different assets in the industry, including USDT and USDC, added more than $9 billion since October 2023. Now, the stablecoin market capitalization stands at $133 billion.

This surge reflects renewed strength in the stablecoin sector and underscores the injection of significant liquidity into the cryptocurrency industry. In addition, the uptick is a promising indicator of growing investor confidence in the potential onset of a bullish market trend.

“The stablecoin market cap is recovering strongly, adding over $9 billion since October of 2023. The sustained upward trend further reinforces the possibility of an upcoming bull market cycle,” IntoTheBlock said.

Crypto analyst Zyre gave a more nuanced explanation. According to the analyst, stablecoins are the “bridge” between conventional finance and the crypto industry. Therefore, the spike in market capitalization shows that the “bridge is expanding to accommodate more crypto enthusiasts.”

Interestingly, Tether’s USDT leads the stablecoin sector with a market capitalization reaching $96 billion. However, JP Morgan analysts expressed concerns about USDT’s dominance, highlighting significant risks to the industry. Instead, they advocate for USDC due to Circle’s regulatory compliance.

The Catalysts for Further Growth

Besides the increasing stablecoin market capitalization, industry experts believe cryptocurrencies would rally because of the impending Bitcoin halving and the recent approval of Bitcoin ETFs.

A recent study reveals increasing optimism regarding the halving’s impact on Bitcoin’s price. Nearly 84% of investors believe it will help push Bitcoin to higher heights.

“More than half of the respondents predict Bitcoin prices during the halving (around April 2024) to range between $30,000 and $60,000, while 30% believe the price would break $60,000,” Bitget revealed.

Similarly, the newly launched Bitcoin ETFs further sets the stage for potential upward momentum in the crypto market. Observers point to the early success of these ETFs as an indication of the significant impact they could have on the overall market.

“Spot Bitcoin ETFs have taken in ~$700 million in net flows this week alone. Absolutely amazing. People overestimated the short-term impact of ETFs and continue to dramatically underestimate the long-term impact,” Bitwise CIO Matt Hougan said.