Recent network activities surrounding Chainlink (LINK) tokens have attracted attention. Market observers raised concerns about this cryptocurrency’s stability and future price direction.

The oracle network, whose native token recently printed a 22-month high, released substantial digital assets into circulation over the past day.

Chainlink Unlocks 19 Million Tokens

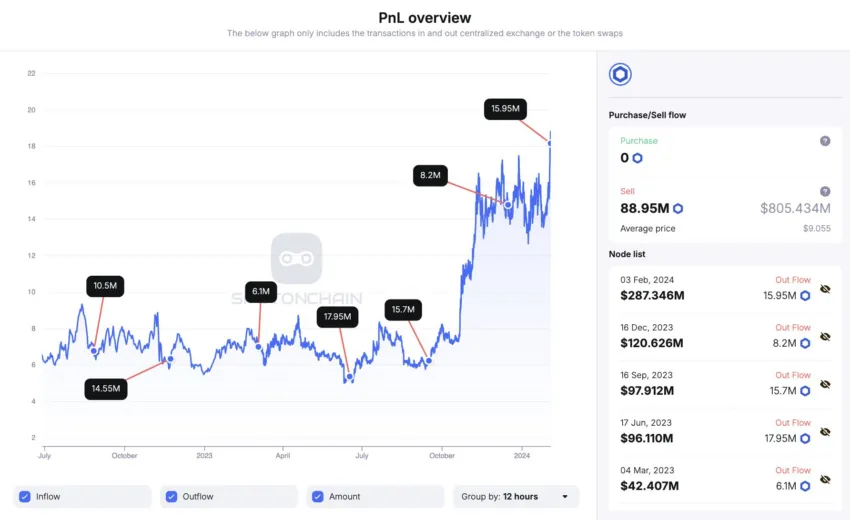

On February 3, crypto analysis firm SpotOnChain disclosed that 19 million LINK tokens, valued at $341 million, were unlocked from three of Chainlink’s non-circulating supply contracts.

Specifically, 15.95 million LINK tokens, amounting to $287 million, were transferred to Binance. Meanwhile, the remaining 3.05 million LINK, valued at $54.3 million, found their way to a multi-sig wallet, 0xD50f.

It is worth noting that these on-chain activities are not novel occurrences. SpotOnChain observed these designated wallets have consistently transferred LINK tokens to Binance since August 2022. During this period, Chainlink has unlocked 106 million LINK, moving 88.95 million LINK to Binance at an average price of $9.06, totaling $805 million.

The blockchain oracle provider still maintains a substantial reserve of 412.5 million LINK across 24 contracts, valued at $7.35 billion.

What’s Next For the Price of LINK?

BeInCrypto’s pricing data indicates that the increased LINK circulation has not significantly impacted the token’s value. In the last 24 hours, LINK has experienced a modest gain of 0.83%, reaching $18.01, continuing a positive trend that has seen it gain more than 26% during the past week.

This price movement aligns with the observations of on-chain analyst LookOnChain, who suggested that LINK’s price has generally increased after token deposits. Similarly, Ali Martinez, BeInCrypto’s Global Head of News, noted Chainlinlk may face resistance at the $20 level, where 5,330 addresses hold 8.59 million LINK.

“Chainlink appears primed for further gains! On-chain analytics reveal a significant resistance level at $20, where 5,330 addresses collectively hold approximately 8.59 million LINK,” Martinez said.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

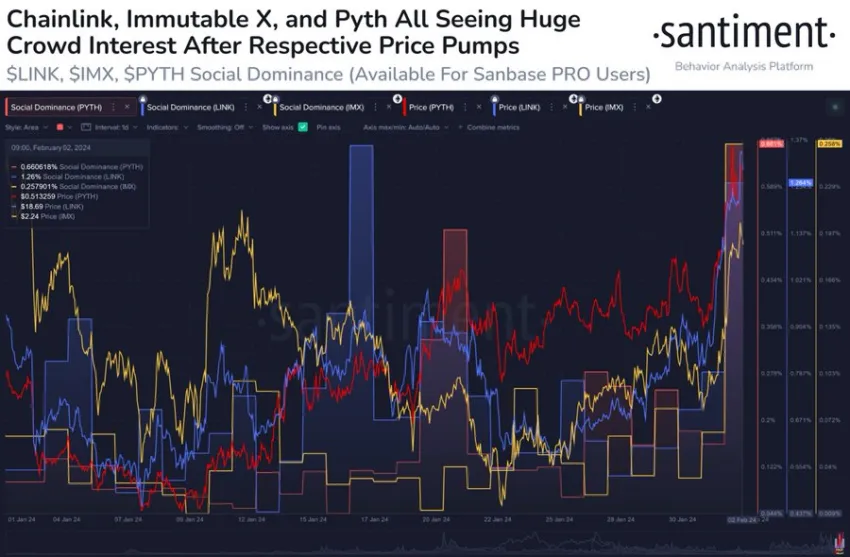

Nevertheless, Santiment, a prominent analytical firm, urged market participants to be cautious. The firm stated that speculation surrounding LINK may induce fear of missing out (FOMO), potentially attracting mainstream crowds and triggering heightened volatility in the asset.

“Chainlink (+34%), ImmutableX (+23%), and Pyth (+26%) have all enjoyed impressive market cap growth in the past week. The mainstream crowd is discussing them at high rates, meaning FOMO should lead to high volatility for these particular assets,” Santiment said.