In this article, we cover:

- How Solana is currently rhyming Ethereum during the previous market cycle

- Three blockchain design choices Re7 sees as differentiators to alternatives for developer/user experience

- How Solana’s design choices are accelerating Solana’s adoption curve relative to Ethereum of 2020 through 3 lenses:

- DeFi Velocity

- Decentralised Physical Infrastructure (DePIN)

- NFT Experimentation

- Defining Solana’s DeFi opportunity and the look ahead

Introduction

The growth of Solana as an ecosystem over the past 3 years has been nothing short of exceptional. The network’s daily active address base has grown 21x from 23k to 500k, users are transacting 2x as much (~20m per day), and active developers have increased 2x to 325.

For Re7, Solana represents a promising monolithic blockchain ecosystem unifying different technical components into one unified network – a cocktail mix enabling faster and cheaper transactions than more modular alternatives, such as Ethereum.

Establishing itself as a leading Web3 ecosystem, Solana echoes the fundamental trajectory of Ethereum during the last adoption cycle, which can be seen cross-sector.

Rhyming With the Ethereum of 2020

DeFi

Exchanges were the first financial applications to achieve clear product-market-fit on Ethereum in the last cycle.

Fast forward to today and Solana’s exchange ecosystem drives the vast majority of on-chain transactional activity within DeFi.

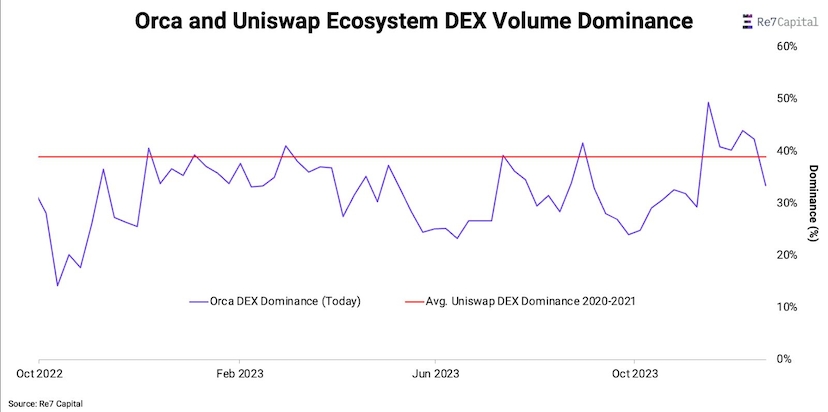

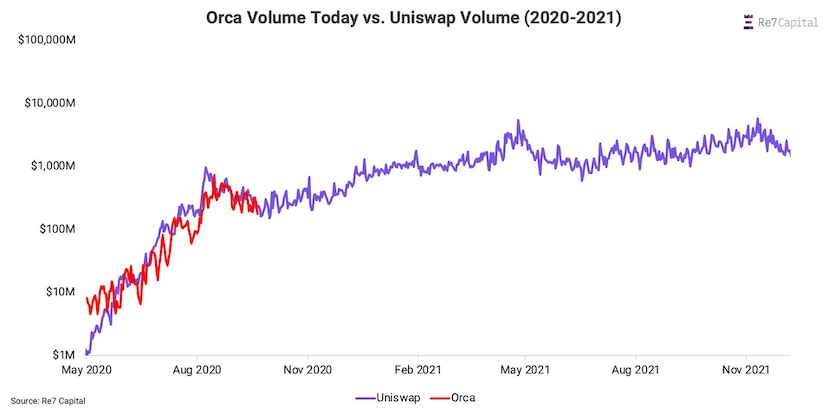

Orca, Solana’s leading AMM by DEX volume, is taking 30-40% of weekly market share, breaching $1B in weekly volume for the first time in December.

This is somewhat comparable to 2020-2021 for Ethereum – where Uniswap averaged ~39% of DEX volume dominance within this ecosystem during this period.

Mapping Orca’s current volume trends onto Ethereum appears to put the DEX at ~August 2020 when Uniswap broke and consistently sustained >$100m daily volume.

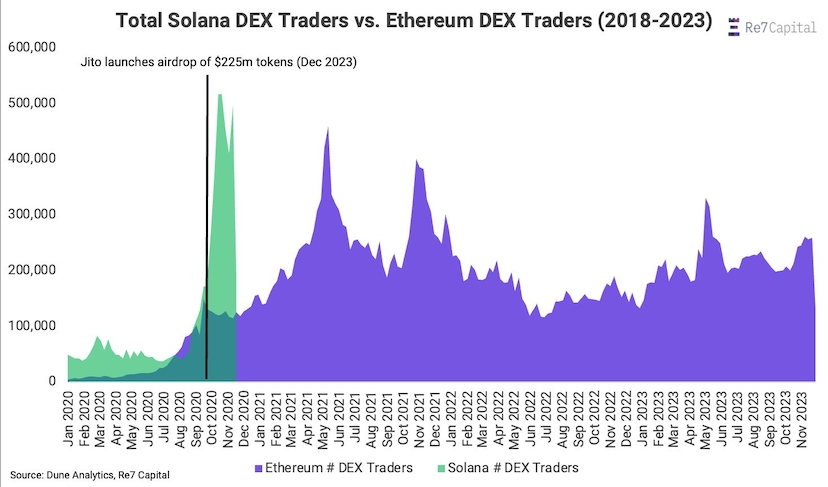

Broader dynamics for Solana’s DEX ecosystem were beginning to map onto Ethereum in 2020, including for total active DEX traders. However, in December 2023, we see Solana beginning to outpace Ethereum’s 2020 dynamic as blue chip DeFi names began to airdrop tokens (see Jito).

Future airdrops and experimentation around point systems for Solana-based applications in a relatively limited token economy have catalysed on-chain activity to a high degree as users look to be rewarded for their contributions.

In other words, Solana was trodding on Ethereum’s path before more recent innovation allowed it to take its own direction.

NFTs

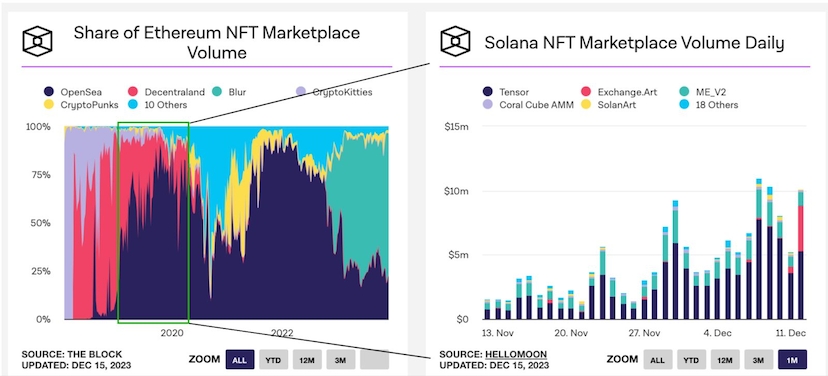

The Solana NFT ecosystem is growing rapidly, with daily trading volumes now reaching $10m.

Solana’s lower transaction costs have made it a fruitful ground for NFT experimentation and tooling. This has meant newer NFT projects have chosen Solana over Ethereum. These include marketplaces PFP-centric NFT marketplaces such as Tensor, Magic Eden and SolanArt.

Tensor currently leads the pack by volume, taking anywhere between 50-70% of daily volume – a dynamic which we see comparable to Ethereum 2019-2020, where OpenSea dominated volume market share.

This marked a time that preceded a period of volume diversification too. With Solana, we foresee a similar opportunity driven by the advent of game or ecosystem-centric NFT platforms (e.g. MOOAR).

These platforms can enable token-gated access to communities, merch stores, events, and in-game experiences through the use of novel NFT standards (xNFTs). However, unlike Ethereum, Solana’s low transaction costs make it feasible for users to interact with tokens gated content on-chain at a high rate.

And therein lies the difference.

Walking With Stride

Developers can deploy their applications to a high-performance platform without the need to consider bridging/deploying between disparate networks or variable gas fees. A tradeoff with monolithic design is developer flexibility.

As a more nascent ecosystem finding its footing with core use cases, it felt Solana was starting to rhyme with Ethereum’s structural positioning during the previous market cycle.

At the same time, we believed there would be measurable differences in how Solana has accelerated its adoption curve due to its architectural design choices.

As a monolithic blockchain, we see Solana having measurable improvements on a number of key design verticals that inform the developer and user experience:

- Throughput: consensus nodes not needing to dedicate processing power towards verifying various timestamps providing more native scalability. Solana’s 65,000 transactions-per-second limit could be increased to 1.2m by new validator clients

- Micropayments: Solana’s invariable, low transaction fees (~0.000021 avg) enabling distinct use cases that rely on ultra-small fees.

- State costs: native technologies (i.e. state compression) that dramatically reduce the costs associated with storing data on-chain.

These are just 3 key fundamental reasons Re7 has continued to invest and research within the Solana ecosystem alongside others that make differentiated tradeoffs (e.g. modularity) – Web3 will consist of competing ecosystems that run in parallel to one another.

As we’ve highlighted above, there are many aspects of Solana that rhyme with the structural timeline of Ethereum of the previous cycle.

At the same time, Solana is taking its own unique path to address some of Ethereum’s architectural limitations that may drive measurable differences today or in the future. Below, we highlight three areas in which Solana’s architectural design choices accelerated growth relative to Ethereum in 2020 and today.

Higher throughput

Certain Web3 use cases that can only be enabled with sufficiently high TPS include applications involving high-frequency trading and global digital payments. The appetite for existing businesses in these use cases to move their operations on-chain is already here.

HFT shop Jump is building a new validator client that can increase throughput from a 65k TPS peak to 1.2m+. In September 2023, Visa concluded that Solana has “attributes like high transaction throughput” that make it a suitable candidate for its stablecoin settlement pilot.

Establishing a higher transaction-per-second (TPS) allows for more on-chain transactions and volume on a per unit-of-time basis.

We can measure the rate of economic activity relative to ecosystem liquidity to model an ecosystem’s capital efficiency. One measure is DeFi velocity (defined as volume traded per dollar of TVL). The Solana DeFi ecosystem leads the entire Web3 market for this measure at 0.55.

In other words, for every dollar of liquidity in Solana DeFi, 55 cents is being transacted on a daily basis. Solana’s DeFi Velocity is 2x over Avalanche in second place. Overall, this would imply that users find more value in the tools available to them within the ecosystem.

Micropayments

The network also has a predictably low base fee of 0.000005 SOL for each transaction. This level of low-cost predictability contrasts with variable fee markets on other chains where spikes in demand to execute on-chain drive higher fee prices.

Re7 believes Solana’s low fee environment is conducive for use cases that necessitate frequent on-chain interactions by design (e.g. social platforms, IoT).

One area here is decentralised physical infrastructure (DePIN) – networks of physical infrastructure created and maintained through globally distributed efforts.

At their core, DePIN networks distribute costs and actions related to the creation and upkeep of a network among supply-side participants to drive demand-side participants. Incentives are often based around micropayments.

DePIN projects like Helium and Render migrated operations from Ethereum to Solana in 2023 due to lower transaction costs. For others, the gas costs for using the respective DePIN network are sufficiently low.

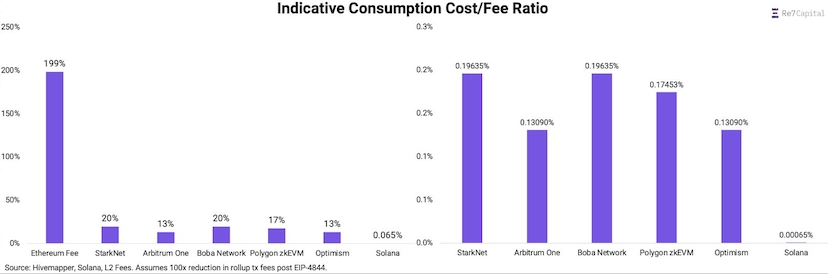

For example, the on-chain transaction fees as a ratio of the total indicative cost of consuming geospatial maps as a user on Hivemapper, is

The fee costs associated with accessing the same maps on other alternative EVM ecosystems would be prohibitively high (ranging from 24%-329% of the consumption cost today). This may still be the case after Ethereum scalability upgrades like EIP-4844 are implemented which promises to reduce rollup gas fees by 100x.

In other words, micro transaction-based use cases are more likely to proliferate on Solana today and potentially even in a cheaper rollup future for Ethereum.

NFT experimentation

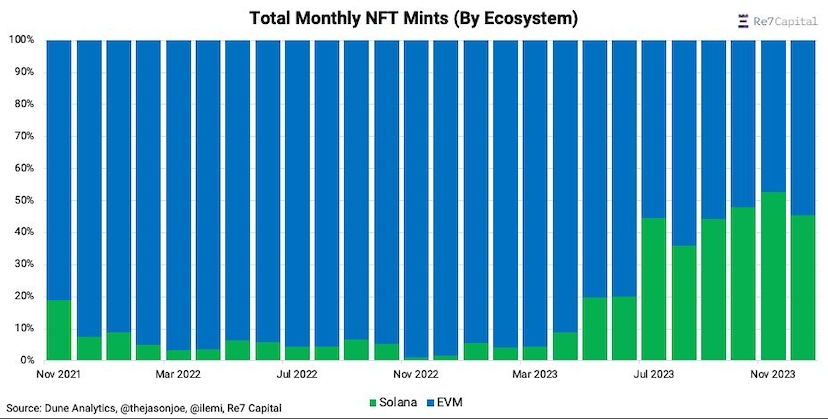

A core thesis at Re7 is that state compression paves the way for a faster rate of experimentation by creators and consumer applications that will drive a dominance of Solana NFT mints vs. more expensive ecosystems.

The ability to mint millions of low-cost NFTs will enable more use cases as the cost of distribution falls dramatically.

One example is ticketing, where event organisers issue NFTs connected to millions of tickets tied to a blockchain. These are reasons why NFTs will be at the centre of the inevitable Web2 Web3 convergence.

Since launching in March 2023, state compression has driven Solana mint dominance in the market where the ecosystem now commands >60% of total monthly NFTs vs. its peers.

Solana, as a single ecosystem, generates the same or more NFT mint volume than all of the leading EVM chains put together.

Looking Ahead: Solana’s DeFi Opportunity

One common thread tying the key design verticals together is that they collectively work towards providing a scalable on-chain financial system for both fungible and non-fungible assets.

One of the challenges that Solana faces is the need to build out established DeFi players and projects. Solana has seen rapid growth on a number of key metrics, but it lacks long-running “blue-chip” protocols and projects that bring trust and stability to the ecosystem. Similarly, the “blue-chip” protocols on Ethereum did not emerge until a cycle of testing and iteration during DeFi summer. On Solana, we should expect to see clear leaders emerge in each DeFi category as these protocols grow.

While Solana has witnessed the creation of several DeFi projects, many of them are forks or adaptations of existing protocols from other blockchains. To truly stand out and ensure the sustainability of the ecosystem, Solana needs more unique, native protocols and innovations.

These native solutions can differentiate Solana from other platforms and attract and retain users looking for something new and exciting. The experimentation that leverages the unique technical aspects of Solana for enhanced performance and reliability suggests that there are killer products waiting to be built on the network.

Solana should encourage the development of projects that leverage its high throughput and low transaction fees to create innovative DeFi solutions. This could include the creation of additional derivatives and options protocols, as well as exploring other DeFi use cases beyond trading and liquidity provision. By fostering native innovation, Solana can build a more robust and diverse ecosystem.

One key piece missing on the network is a robust stablecoin ecosystem. This is a main aspect of Ethereum DeFi, as stablecoins provide the foundation for lending, borrowing, and leveraged trading. Solana should actively work on expanding its stablecoin offerings to cater to different user needs. There is currently no major Collateralized Debt Position (CDP) protocol on Solana, which presents a significant gap in the DeFi ecosystem. Developing such a protocol could attract more users and capital to the network.

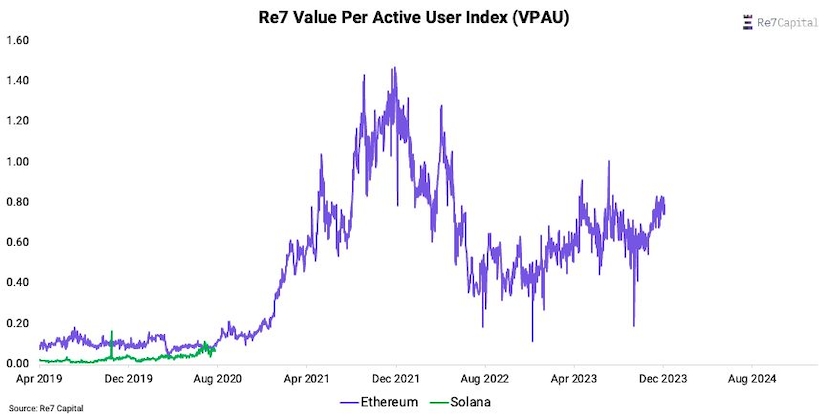

The reason why this is important is because an ecosystem’s value to a user is proportional to the active user base within that ecosystem.

In other words, when ecosystems become richer and attract users, they become more valuable for each participating user.

Re7 tracks the market value placed on each active user as an index. We can see Solana’s value per active user is at a level found for Ethereum in the summer of 2020.

For Solana, we are excited for how user value creation can be generated as the ecosystem evolves, and builds out new use cases at the application layer.

Closing Remarks

In many ways, Solana is an emergent ecosystem following Ethereum’s footsteps from the last cycle. Yet, it’s also had the benefit of learning about the current challenges modular ecosystems face today.

With this benefit, Solana is breaking the adoption curve mould, unlocking use cases, and improving on the developer/user experiences that have not been possible until now. In this way, we look to Solana as a past ecosystem of the future, and Re7 is excited for the next chapter.

About the Authors

Evgeny is the founder and managing partner at Re7 Capital. He has been active in the blockchain industry since 2015 and has over a decade of investment experience.

Lewis is a portfolio manager for Re7’s Opportunities Fund, investing thematically across key verticals. Lewis previously held PM and investment research positions at Republic, Decentral Park Capital, and ID Theory.

Launched in 2021, Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Disclaimers

The information provided in this article by Re7 Capital is intended for general informational purposes only. It should not be considered as investment advice or a recommendation to buy, sell, or hold any cryptocurrencies or related assets. Re7 or its affiliates may have investments or financial interests in the cryptocurrencies discussed in this article.

Certain content on this website may contain forward-looking statements about the potential future performance of certain cryptocurrencies or the overall market. These statements are based on current expectations and projections and involve inherent risks and uncertainties. Actual results could differ materially from those anticipated. Re7 undertakes no obligation to update or revise any such statements.

Reference to any specific cryptocurrency, exchange, service, or project on this website does not constitute an endorsement or recommendation by Re7. Any opinions expressed are solely those of the authors and do not reflect the views of Re7. Conduct your own research and due diligence before engaging in any transactions or investments.

See Re7’s full list of disclaimers here.

This article is sourced from the internet: Solana: A Past Ecosystem of the Future

Related: Will Bitcoin (BTC) Price Finally Hit $40,000 as Investors Make This $300M Move?

Bitcoin (BTC) price has rebounded above the $37,500 mark on Friday as markets recovered from the shock leadership upheaval at Binance. On-chain analysis explores how the BTC price rebound could evolve into a prolonged price rally. BTC price is back on an upward trajectory, shaking off the initial bearish reaction to the shock ouster of Binance founder Changpeng Zhao. Vital on-chain movements suggest the recent market shake-up could drive Bitcoin’s price to a new 2023 peak. Investors Have Moved BTC Worth $300 Million From Market Supply Bitcoin price wobbled to a weekly low of $35,800 as markets surrendered to a wave of fear, uncertainty, and doubt (FUD) in the wake of CZ’s exit on Wednesday. However, the pioneer cryptocurrency has since rebounded 6% to reclaim $37,800 by Thursday. Away from the…