More and more on-chain indicators suggest a critical point of cycle change in the cryptocurrency and Bitcoin (BTC) market. Selected indicators that in the past marked the beginning of a long-term bull market are starting to turn green.

BeInCrypto presents 3 on-chain signals recently presented by well-known analysts. These include the so-called on-chain value map, realized capitalization, and the threshold of long/short-term holders.

Although each indicator monitors a different Bitcoin blockchain activity, their long-term structure suggests a cyclical change. In the past, these changes have been correlated with the start of a bull market in cryptocurrencies. Interestingly, they usually occurred during periods of historical halving events.

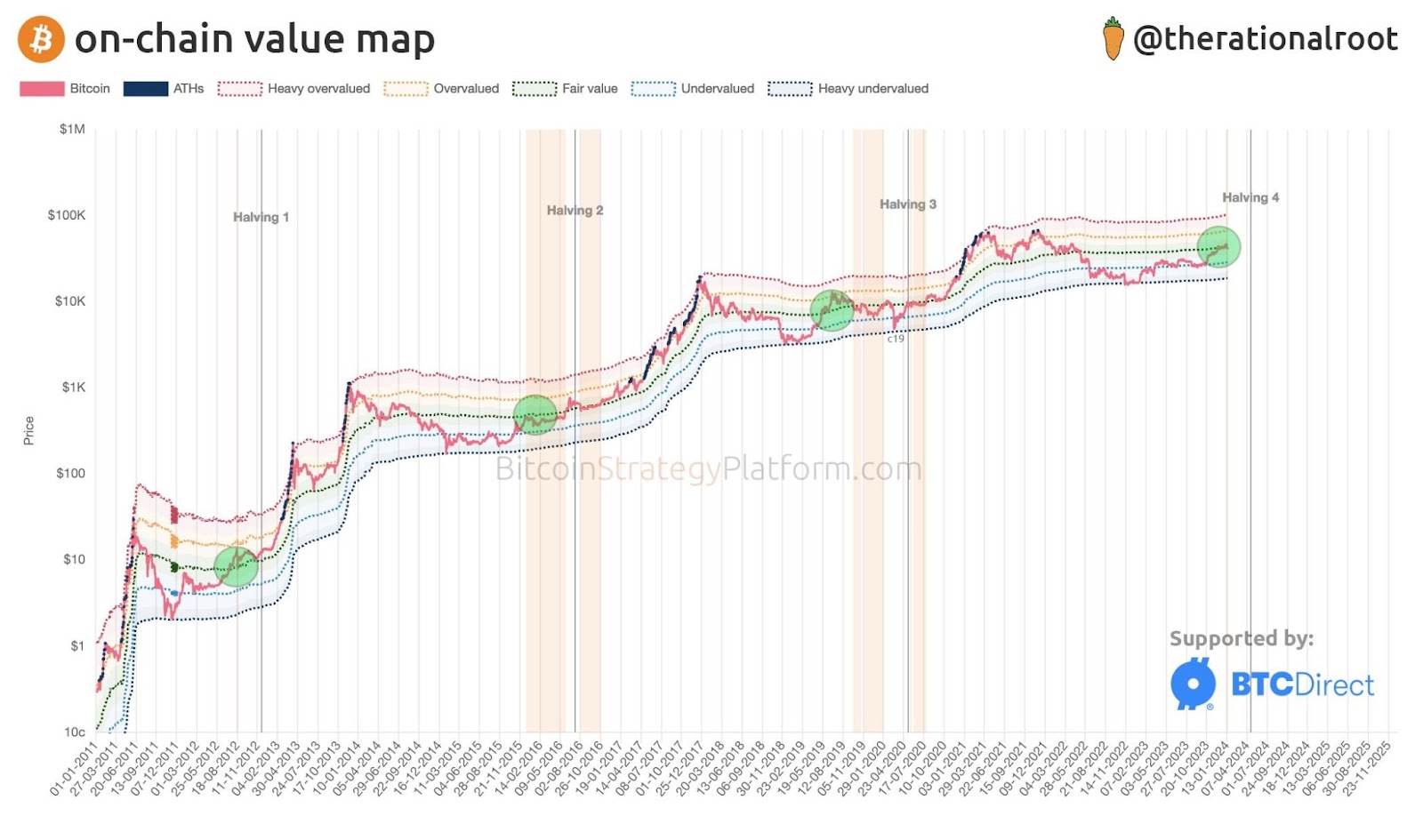

3 On-Chain Signals: Value Map

Bitcoin’s on-chain value map indicator was created by well-known analyst @therationalroot. It combines 3 other, more fundamental on-chain indicators: realized capitalization, liquid supply, and coin days destroyed.

By combining these three indicators, the analyst was able to generate a long-term range that seems useful in identifying the lows and peaks of the BTC price. This range takes the form of a 4-color band with a green median. It indicates the so-called “fair value” of Bitcoin. If the price of BTC is near this line, the valuation of the largest cryptocurrency is neither overvalued nor undervalued.

In contrast, when the BTC price deviates from “fair value” meaningfully, there is an overvaluation or undervaluation of Bitcoin. The two bands above green – yellow and red – are reached during bull markets, when BTC is overvalued. In contrast, the two bands below – light and dark blue – are associated with bear markets and undervaluation of the BTC price.

In his post on X (Twitter), the analyst emphasizes that Bitcoin has just returned to the green “fair value” area. He goes on to mention that achieving this level in the past correlated with a period of sideways trending. This one occurred around halving and signaled a phase of accumulation before a mature bull market. However, a moment later, he adds:

“Note, fair value is on the rise.”

Looking back at previous moments on the charts, when “fair value” began to increase (green circles), we see that this was definitely a bullish signal. Indeed, after this event, there was a sideways trend for several months, which naturally transitioned into an upward phase. What’s more, they appeared a few weeks before the halving.

The only exception to this is the COVID-19 crash in early 2020. This event culminated in a mini bear market, which proved to be an excellent buying opportunity before the previous bull market.

Realized Market Capitalization Also Turns Upward

The second indicator that exhibits behavior akin to the on-chain value map is Bitcoin’s realized market capitalization. This similarity is unsurprising as this indicator constitutes one of the three components of the previously mentioned index. However, it is worth noting that its long-term chart also indicates a key moment of the cycle change.

Realized market capitalization prices different parts of the supply at different prices (instead of using the current daily close). In particular, it is calculated by valuing each UTXO at the price when it was last moved. Therefore, this indicator is more precise than the bare market capitalization of BTC.

We see similarities in the chart of realized capitalization going back to the first Bitcoin cycle. All 4 bear markets to date have led to a slight decline in realized capitalization and its several-year sideways trend. Only the initiation of a new bull market always correlated with a reversal on the indicator’s chart, which began to head upward (green circles).

Moreover, multi-year sideways trends seem similar to a wide, rounded bottom (blue arrows).

Currently, the realized capitalization is heading upward again. This signals a change in the long-term trend and is a strong signal of an impending bull market. This indicator – like the on-chain value map – historically changes its direction around the halving of BTC.

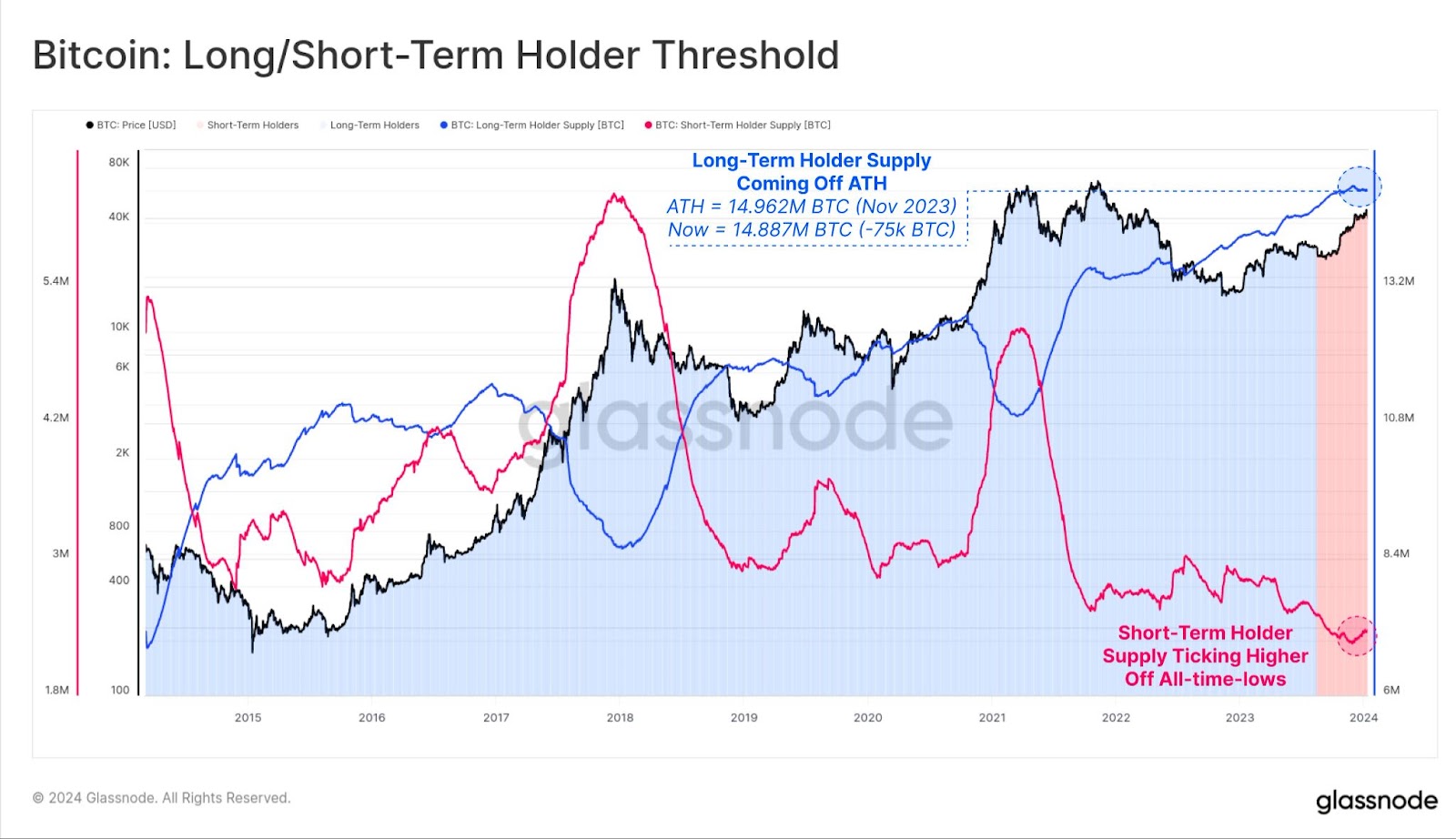

On-Chain Signals: Long-Term Holders Begin to Sell

Finally, the last on-chain signal we chose for today’s analysis was published on the official X account of data provider Glassnode. This is the so-called threshold of long/short-term holders.

The indicator’s graph shows two curves corresponding to resources held by long-term (blue) and short-term holders (red). The historical relationship between the two charts is clear. Mature bull markets are characterized by a sharp decline in the blue line and a surge in the red line. In other words, during a period of rapid increase in the BTC price, long-term holders sell their assets to short-term market participants.

However, the situation quickly changes after the peak of the Bitcoin price. Then, short-term holders panic and sell in favor of long-term investors.

Glassnode analysts point out that the current long/short-term holders threshold situation is unique. The blue line recently reached an all-time high (ATH), while the red line has just bounced off an all-time low (ATL).

This suggests that we may just be witnessing a cyclical trend change on the chart. If short-term holders start accumulating Bitcoin, this could confirm an impending bull market.

However, regardless of when this turnaround occurs, a change on the long-term chart seems to be only a matter of time. Investors with diamond hands are usually patient and do not sell at a loss.

For BeInCrypto’s latest crypto market analysis, click here.