A smart Bitcoin whale booked significant profits, raising questions about the current state of the cryptocurrency market. This move also aligns with an on-chain metric, which gave a strong indication of changing sentiments.

Analysts believe whales could be moving into a risk-off environment, foreseeing a de-leveraging phase.

Is Bitcoin About to Reach a Market Top?

The Inter-Exchange Flow Pulse (IFP), a tool developed by CryptoQuant, tracks the flow of Bitcoin between spot and derivative exchanges. It serves as a barometer for market sentiment. Technically, increasing Bitcoin flow to derivative exchanges signals bull runs, and decreasing flows indicate bearish trends.

Recently, the IFP trend has taken a noteworthy turn, dipping below its 90-day average. Historically, such shifts have been precursors to bear markets, suggesting a potential downturn in Bitcoin’s price.

Read more: How To Evaluate Cryptocurrencies with On-chain & Fundamental Analysis

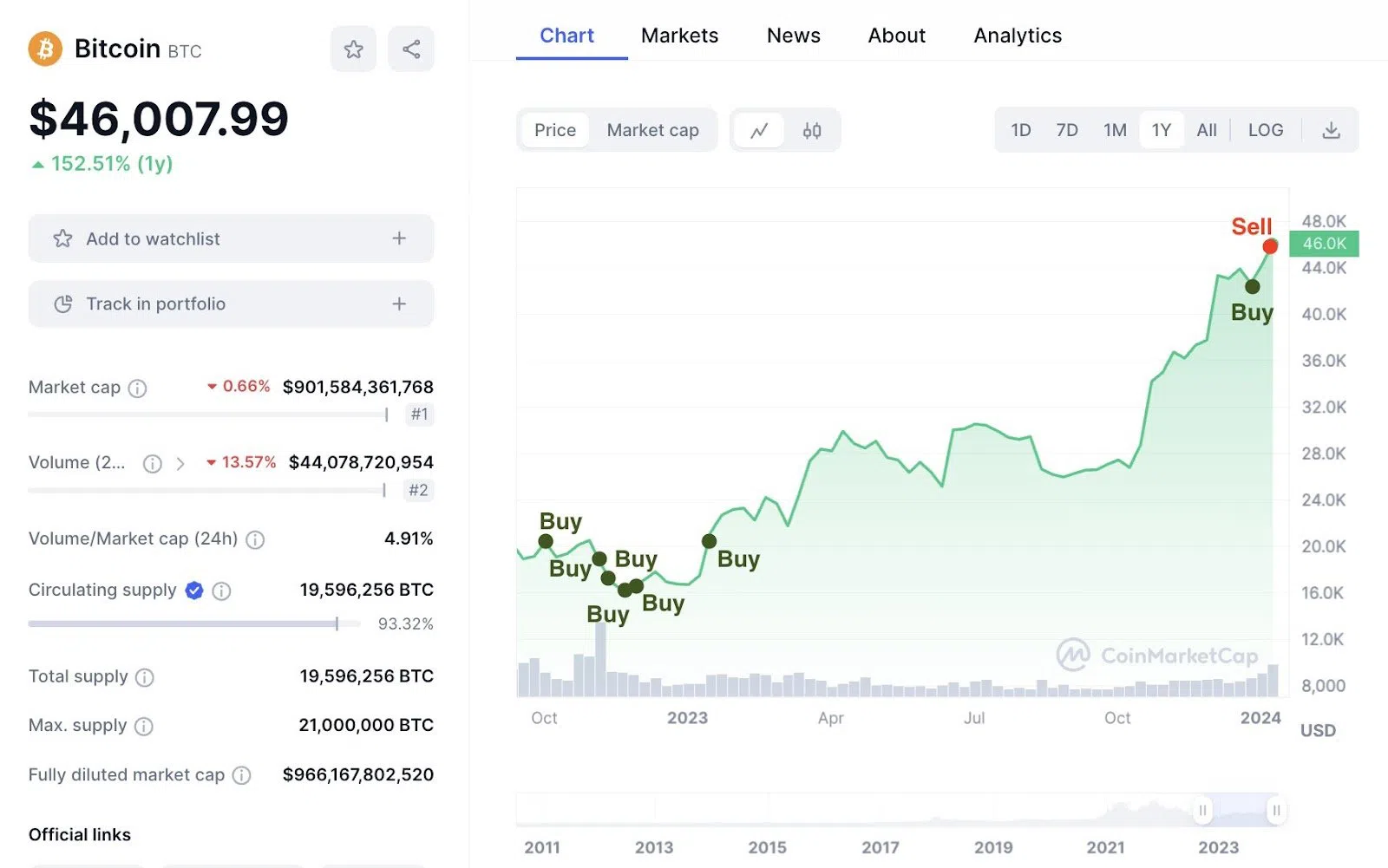

Amidst these market fluctuations, a strategic transaction by a notable Bitcoin whale has become the focal point. This whale secured a substantial profit of over $75 million, a 41.5% increase, by selling 2,742 BTC, valued at approximately $127.7 million.

The timing of this sale, which occurred shortly after the launch of spot Bitcoin ETFs, is particularly significant. Indeed, some experts believe that while spot Bitcoin ETFs are bullish from a long-term perspective, it might be a “sell the news event” for the short term.

“The approval [of spot Bitcoin ETFs] should be very bullish mid- and long-term, but for the short-term it remains to be seen. The market had (almost) fully priced in the approval (which is being partially confirmed by the lack of a super rally), and it remains to be seen if we get the typical “buy the rumor – sell the news” type of action in the short-term,” Jaime Baeza, founder of AnB Investments said.

Read more: A Comprehensive Guide on Tracking Smart Money in the Crypto Market

Still, the whale transaction is not just a standalone event but part of a broader trend observed by CryptoQuant CEO Ki Young Ju.

According to Ju, Bitcoin whales are increasingly adopting a risk-off mode, steering clear of derivative exchanges. Consequently, this behavior clearly indicates a de-leveraging phase within the cryptocurrency market.

“Bitcoin whales are shifting to risk-off mode, avoiding sending BTC to derivative exchanges. Red up. De-leveraging time,” Ju said.

The shift in whale behavior and the IFP’s recent dip have important implications for investors. It signals a time of increased vigilance and a re-evaluation of investment strategies in the face of a potential Bitcoin market top.