In the cryptocurrency market, savvy investors keep an eye out for opportunities, especially during market dips. Recently, the MVRV (market-value-to-realized-value) ratio, has highlighted several cryptos as significantly undervalued.

This raises an intriguing question for seasoned and novice investors whether it is now the time to buy the dip.

The Most Undervalued Cryptos

The MVRV ratio, a comparison of an asset’s market capitalization to its realized capitalization, offers insights into whether the price of a crypto is above or below its “fair value.” It serves as a barometer for market profitability and potential tops and bottoms.

Essentially, when the market cap outweighs the realized cap, it signals that unrealized profits are high, suggesting a possible sell-off. Conversely, a lower market cap relative to the realized cap might indicate undervaluation or weak demand.

Read more: Top 10 Cheapest Cryptocurrencies to Invest in January 2024

Currently, several cryptocurrencies show noteworthy low MVRV values, indicating potential undervaluation.

Here is the list of cryptocurrencies that currently look undervalued:

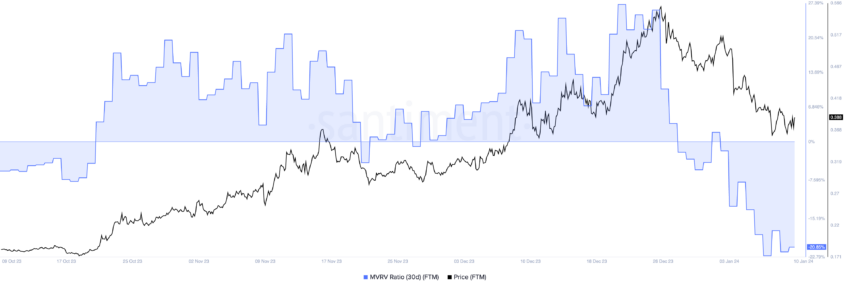

- Fantom (FTM) presents a 30-day MVRV of -22.78%.

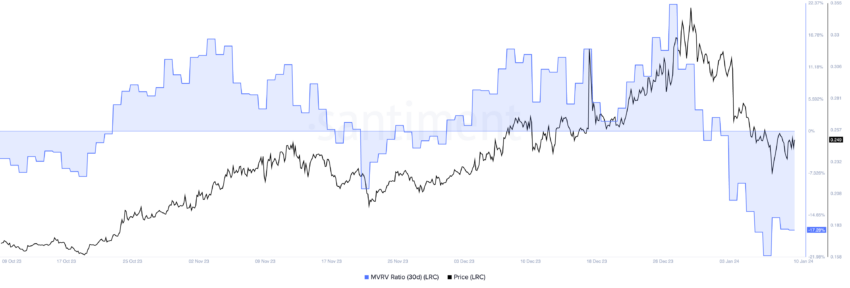

- Loopring (LRC) shows a 30-day MVRV of -18.12%.

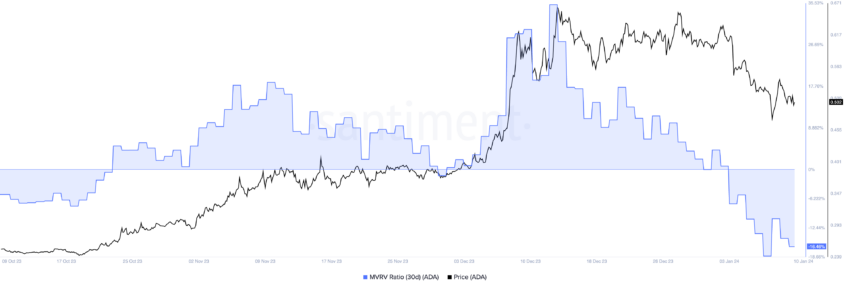

- Cardano (ADA) has its 30-day MVRV at -14.48%.

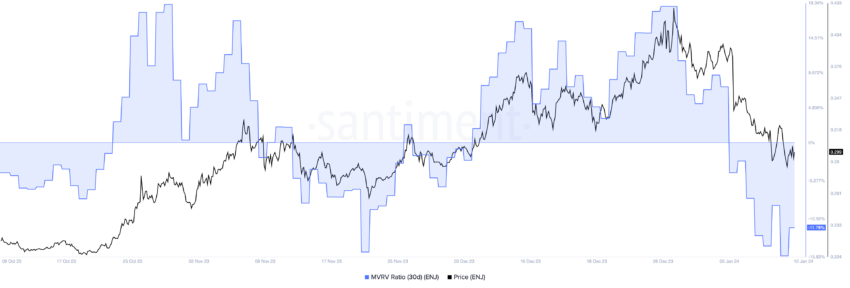

- Enjin Coin (ENJ) signals a 30-day MVRV of -13.31%.

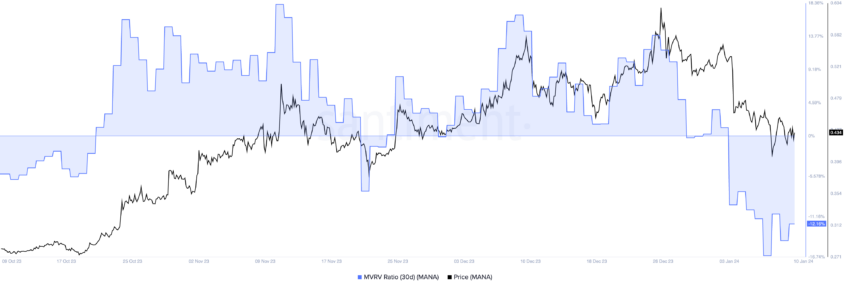

- Decentraland (MANA) trades with a 30-day MVRV at -13.21%.

These negative values suggest that a significant portion of the assets is held at or near a loss, a typical indicator of market capitulation and a sign that might attract investors looking for bargains.

Is It Time to Buy the Dip?

Investors often consider such dips as opportune moments to buy. The rationale is that buying an asset when its market value is below its realized value could lead to significant gains once the market corrects itself. However, it is crucial to note that the crypto market is known for its volatility, and what seems like an undervalued asset could further decrease in value.

While the MVRV ratio is a powerful tool, it is not the sole factor to consider. The overall market trend, global economic conditions, and specific news related to each cryptocurrency play significant roles in determining future value. For instance, technological updates, regulatory news, or changes in investor sentiment can all dramatically influence the price of these assets.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Investors should also consider the unique aspects of each cryptocurrency. Fantom, for instance, is known for its advanced blockchain technology focusing on scalability and efficiency, which might appeal to a different investor segment than Decentraland, a metaverse platform. Moreover, crypto narratives can also play a big role.

“If you want to be a good crypto investor, the main thing is you need to understand what narratives are actually being driven… It’s all about narratives. It’s all about selecting coins in the narrative. That is the difference between making money and making life-changing money in crypto. That is the only difference,” Ran Neuner, founder of Crypto Banter, explained.

For this reason, the decision to buy the dip should be based on a balanced view of market indicators, personal investment strategy, and risk tolerance.