The vast majority of Dogecoin addresses have returned to profitability, marking a significant positive turn for holders of the cryptocurrency.

Looking at Dogecoin’s market trends, both bullish and bearish, on-chain metrics offer intricate data extraction and analysis directly from the blockchain, offering valuable insights into the meme coin performance.

Dogecoin Price Rallies 54% from October Low: A Strong Recovery

Since reaching its lowest point on October 9, the price of Dogecoin has surged, experiencing a remarkable recovery of nearly 54%. Presently, Dogecoin faces a crucial hurdle, encountering substantial resistance at the golden ratio level, approximately $0.0815. A breakthrough beyond this resistance could propel Dogecoin to surpass its recent peak near $0.0876.

Additionally, a positive indicator for Dogecoin’s short to medium-term trajectory is the formation of a golden crossover on the daily chart. This crossover further cements the bullish trend.

Regarding technical indicators, the Moving Average Convergence Divergence (MACD) histogram has been showing increasingly bullish signs over the past few days, and the MACD lines are poised to cross in a bullish manner soon.

However, the Relative Strength Index (RSI) remains neutral, providing no definitive signals at this juncture. Should Dogecoin face a bearish rejection at the golden ratio resistance, the next significant Fibonacci support level to watch is around $0.0685.

Majority of Addresses are Now Profitable as Dogecoin Gains Momentum

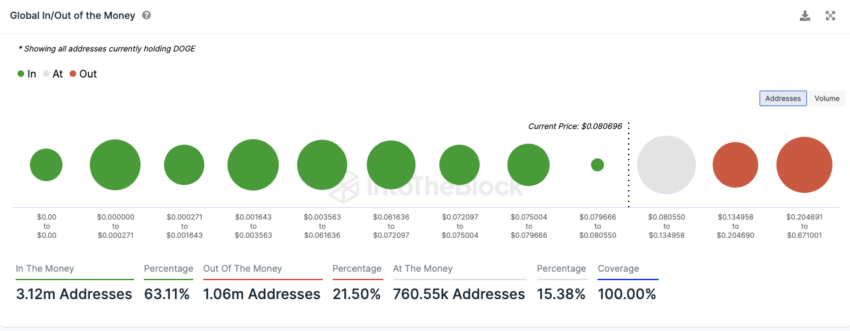

Approximately 63% of Dogecoin addresses have returned to profitability, with their investments now valued higher than their initial purchase price. Conversely, a smaller fraction, about 21.5%, of addresses still find themselves in a loss-making position, with their holdings valued lower than the cost at which they were acquired.

Additionally, a significant portion, around 15.4%, of Dogecoin addresses currently sits at the break-even point. Holders of these addresses would neither incur a loss nor realize a profit if they were to sell their DOGE at the current market price.

This situation reflects a balanced state where the market value of their holdings matches the initial investment cost.

Dogecoin Network Expands: Indications of Sustained Growth

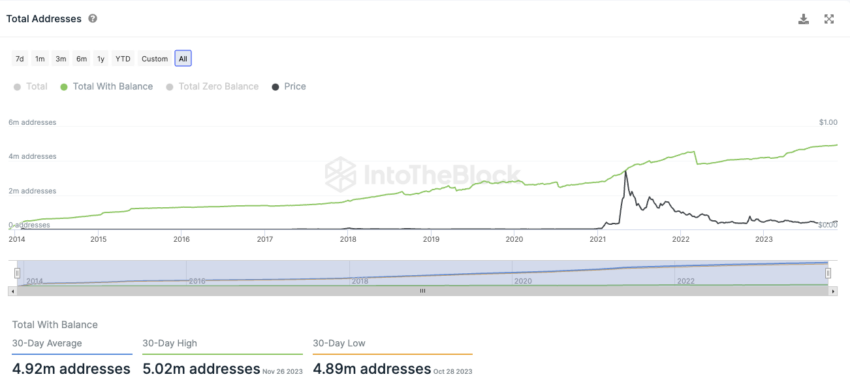

The Dogecoin network is showing a positive trajectory, as indicated by the increasing number of addresses holding DOGE. Over the past 30 days, there has been an average of approximately 4.92 million addresses with Dogecoin balances.

Recently, this figure has risen to about 5.02 million addresses, signaling a growing interest and participation in the Dogecoin ecosystem. This uptick in the number of Dogecoin holders reflects a broader engagement within the network.

Surge in Activity: Dogecoin Network Experiences Explosive Growth

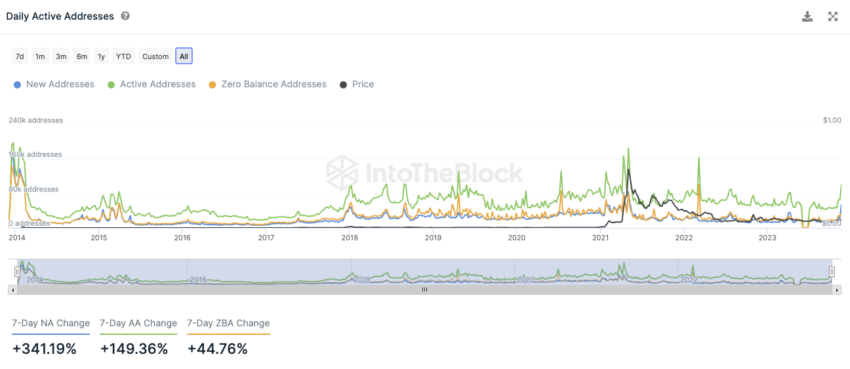

The Dogecoin network has experienced a dramatic surge in activity over the past week. The most notable increase was creating new addresses, skyrocketing by approximately 341%. This significant rise indicates a substantial influx of new participants into the Dogecoin ecosystem.

Simultaneously, there was also a substantial increase of about 150% in the number of active addresses. This metric often reflects heightened transactional activity, suggesting that existing users are more engaged in trading, transferring, or using their DOGE.

Furthermore, there has been a rise of around 45% in the number of addresses that do not hold any DOGE balances. This increase could point to various factors, such as users moving their holdings off these addresses or growth in addresses that are being used for purposes other than holding Dogecoin, like smart contracts or temporary transactional addresses.

Overwhelmingly Positive Sentiment on Telegram

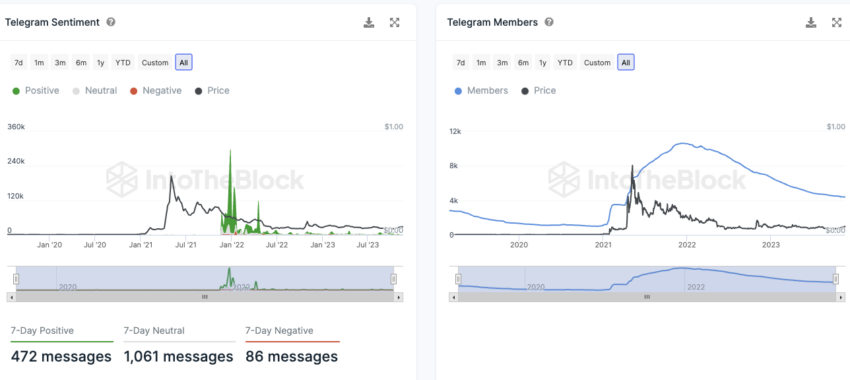

The sentiment surrounding Dogecoin on Telegram channels has been overwhelmingly positive, with the number of favorable news stories about the cryptocurrency surpassing negative ones by a substantial margin.

Specifically, there have been nearly 472 positive news reports compared to only 86 negative stories. This ratio demonstrates a strong bullish sentiment among the community and observers discussing Dogecoin on Telegram.

Despite this positive news coverage, the Dogecoin Telegram group has experienced a notable decrease in its membership since the end of 2021.

This decline in the group’s membership could be influenced by various factors. These factors could include shifts in the broader cryptocurrency market, changing interests among crypto enthusiasts, or the emergence of new platforms and communities for cryptocurrency discussions.

Retail Investors Hold Over One-Third of Dogecoin Supply

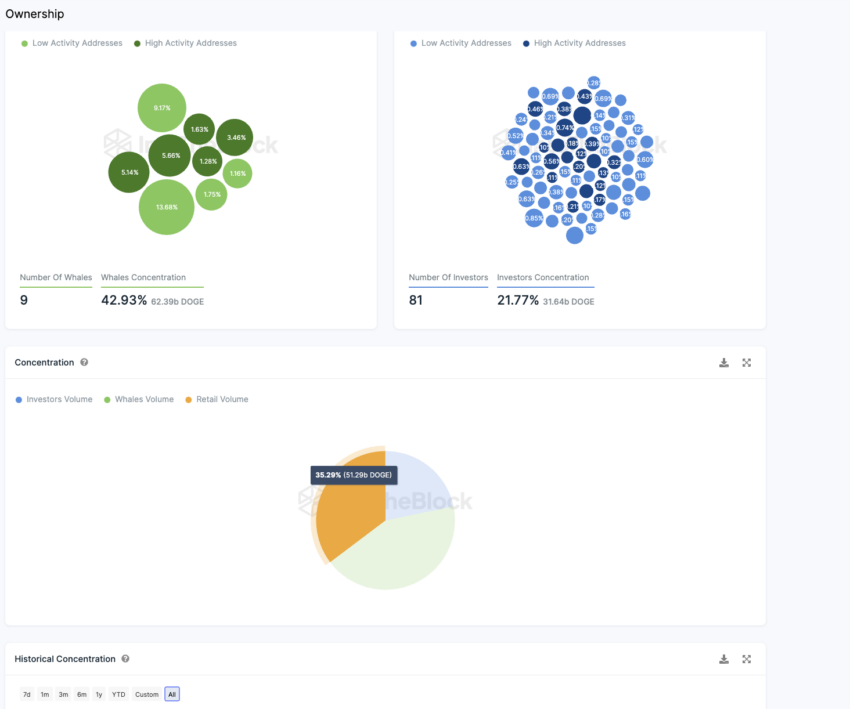

Analyzing the ownership distribution of Dogecoin reveals an increasing concentration among larger investors. In the most recent analysis, there has been a notable growth in the number of significant investors. Previously, there were about 73 major investors who collectively held around 21% of all available DOGE.

This number has now risen to 81 major investors, each owning between 0.1% and 1% of the coins. Collectively, these investors account for approximately 21.77% of the total Dogecoin token supply. This indicates a slight increase in their combined holdings.

Simultaneously, there has been a small shift in the distribution of the largest holders, often referred to as “whales.” The current count of whale addresses stands at nine, down by one from the previous tally. These whale addresses, each holding at least 1% of the total Dogecoin supply, collectively possess nearly 43% of all Dogecoin.

For smaller investors, those holding less than 0.1% of the token supply account for just over a third (35.3%) of all DOGE. Therefore, this segment represents a broad base of individual or smaller-scale holders within the Dogecoin ecosystem.