Chainlink (LINK) has retraced 7.6% since reaching a yearly high of $16.7 on November 11. Although prices have encountered strong support around $15, momentum seems to be building for another upward move.

The Chainlink network continues to experience significant growth, and whales appear committed to holding their LINK tokens.

Interest in LINK Remains Elevated

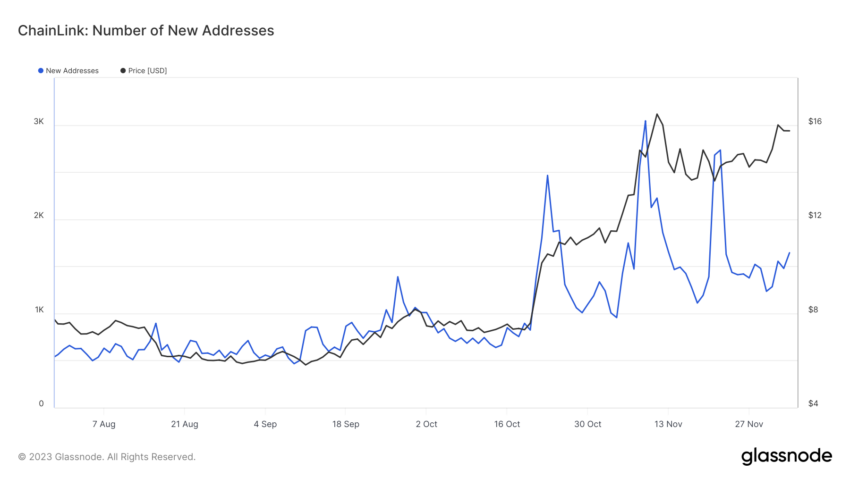

The Chainlink network is growing at an impressive rate. Since early September, the number of new and unique addresses appearing in a transaction for the first time has consistently reached higher highs and higher lows.

The count has increased from as low as 467 new addresses per day to as high as 3,044, representing a 650% increase in three months. Such a significant increase in user adoption over time indicates potential price increases.

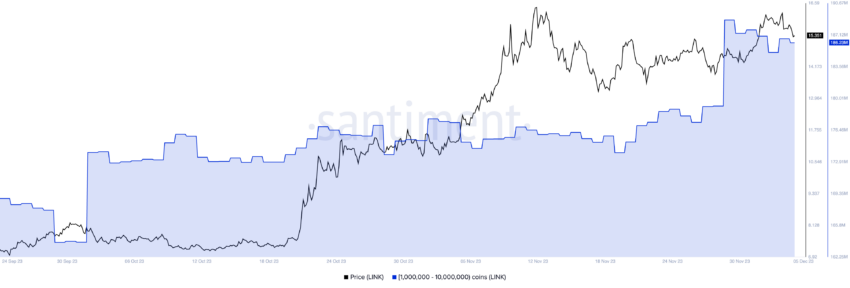

This rising demand is also evident in the holdings of crypto whales. Between November 28 and November 29, whales purchased over 9.6 million LINK, valued at around $143.3 million.

Although these major players have sold about 2.5 million LINK since then, contributing to the recent price correction, they still hold approximately 186.2 million LINK.

The growing network activity and steadfastness of the crypto whales support the impressive bull run Chainlink has enjoyed in recent months.

Chainlink Price Prediction: Strong Support, Weak Resistance

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model assists in identifying the average price at which tokens were purchased and compares it with their current price. It organizes these addresses into groups to identify significant buying zones using on-chain data, which are expected to act as support or resistance levels.

According to the IOMAP, Chainlink faces only one significant supply barrier before advancing further. This resistance wall is located between $15.8 and $16.3, where 9,140 addresses previously purchased over 11.4 million LINK. Chainlink must close a daily candlestick above this level to aim for $20.

It is important to note that a crucial demand zone currently supports Chainlink. Over 18,000 addresses have bought 40.4 million LINK between $14.4 and $14.9.

In case of increased profit-taking by whales, this support level must hold to preserve Chainlink’s bullish outlook. Failure to maintain this level could lead to a correction toward $13.2 or even $12.