Ethena Price Gains 17%, But Selling Surges After $833 Million ENA Unlock

Ethena (ENA) has recently experienced a price uptick of 17%, following a challenging start to the year. This rise, however, comes after significant losses that started early in 2025, exacerbated by a massive token unlock event in the last 48 hours.

Despite some positive movement, ENA still faces major hurdles in securing a sustained breakout.

Ethena Faces A Bearish Event

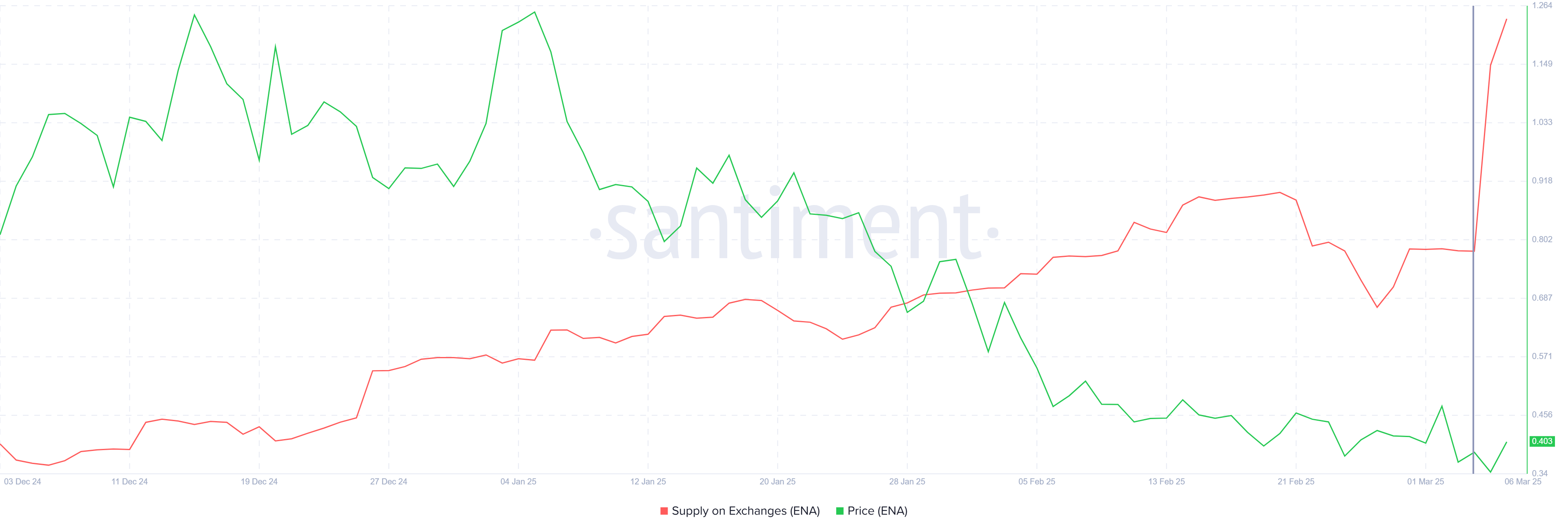

The market sentiment surrounding Ethena has been marked by increased selling activity, especially in the days leading up to the March 5 token unlock. Within a 24-hour period before the event, approximately 149 million ENA tokens, worth around $60 million, were sold.

This was in response to the expectation that the unlock, which involved $833 million worth of tokens, would flood the market, affecting the supply-demand balance and driving down prices.

Token unlock events often result in price declines, as the influx of new tokens dilutes the value of existing ones. This dynamic has spooked many investors, especially those who held large amounts of ENA, leading to a sharp rise in balances held on exchanges. Many opted to sell in an attempt to prevent further losses, further contributing to the downward pressure on the price.

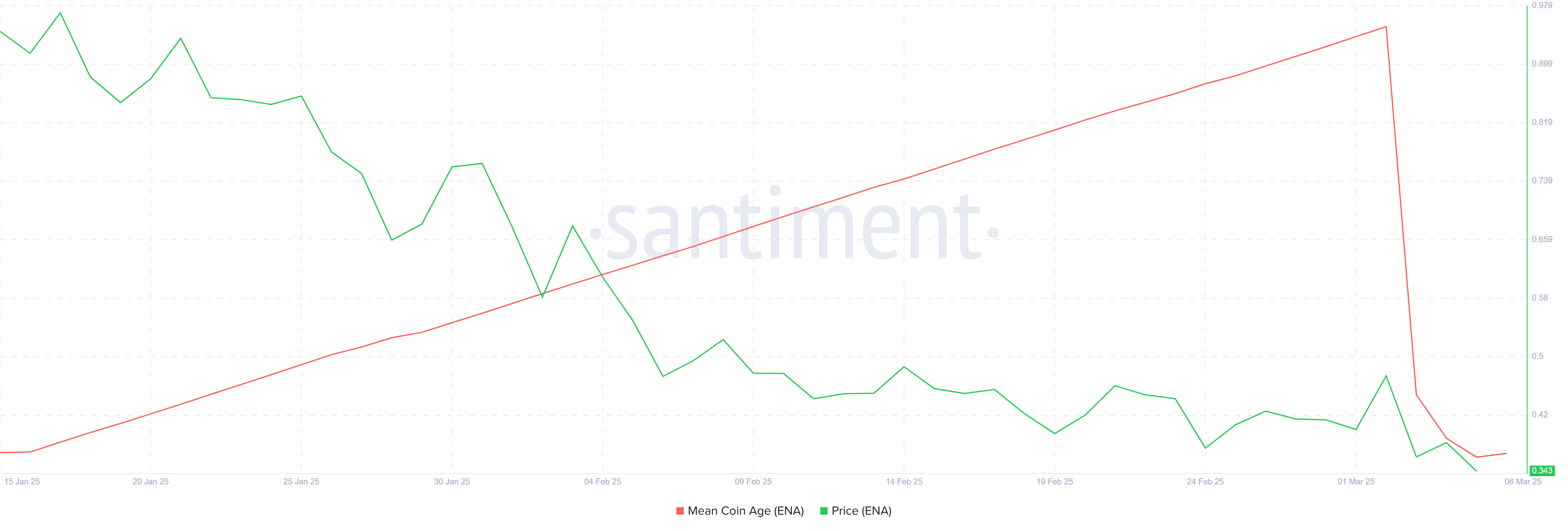

Ethena’s overall momentum has also been negatively affected by the actions of long-term holders (LTHs). The Mean Coin Age (MCA) indicator has shown a significant downtick. This signals that LTHs began liquidating their positions even before the broader market reacted.

LTHs are considered the backbone of any cryptocurrency. Thus, their selling behavior is often a sign of weak sentiment toward the asset.

The decrease in the MCA reflects the loss of confidence among these long-term holders, adding further pressure to Ethena’s price. When LTHs exit their positions, it often signals a broader market reluctance to hold, which can keep the price in a downtrend for an extended period.

ENA Price May Face Some Challenges

At the time of writing, Ethena’s price stands at $0.404, just under the resistance level of $0.434. Despite a 17% rise, this move was not enough to reverse the broader downtrend. For ENA to break free of the current market conditions, it needs to breach the $0.434 barrier and sustain higher levels decisively.

If the bearish sentiment persists and the aforementioned factors worsen, Ethena could see a decline toward the $0.326 support level. Should this support fail, further downside risk remains, with the price potentially slipping as low as $0.259, confirming the bearish outlook.

However, if investor sentiment shifts and there is a concerted effort to accumulate ENA at these lower prices, a breakout could be on the horizon. A successful breach of $0.434, followed by a flip into support, would set ENA on a trajectory toward $0.602. This scenario would invalidate the bearish thesis and provide a path for long-term recovery.

This article is sourced from the internet: Ethena Price Gains 17%, But Selling Surges After $833 Million ENA Unlock

Related: Trumps policy fog + Powells problem, the market is hesitant

Original author: BitpushNews Mary Liu In the early morning of March 20th, Beijing time, the Federal Reserve will announce its latest interest rate decision, followed by Chairman Powell holding a press conference. The global market is waiting with bated breath. Financial markets are facing many uncertainties. The special thing about this meeting is that it will comprehensively assess the impact of a series of new policies of the Trump administration on the US economy. Fed policymakers will discuss the progress of inflation control and decide whether to adjust monetary policy. The market has been under pressure in advance, and Bitcoin has consolidated and fallen The optimism lasted only a few days, as risk markets retreated again ahead of the Federal Reserve鈥檚 interest rate meeting. As of press time, Bitcoin is…