Ethereum Sees $20 Million Spot Inflows After 10-Day Outflow Streak – What Next for ETH?

Ethereum has recorded spot inflows for the first time in 10 days. This signals a resurgence in investor confidence ahead of the highly anticipated White House Crypto Summit scheduled for March 7.

At press time, ETH trades at $2,290, noting a 4% price hike in the past 24 hours. With growing bullish pressure in the broader market ahead of the meeting, the altcoin might extend its gains in the short term.

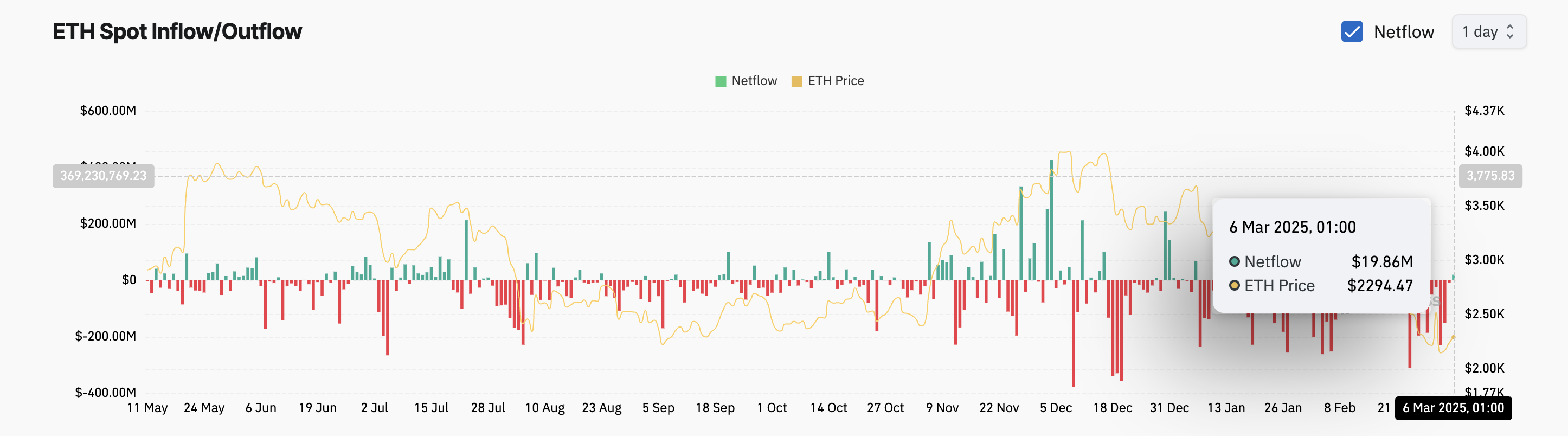

ETH Sees $20 Million Spot Inflows After 10-Day Outflow Streak

According to Coinglass, ETH’s spot inflows totaled $20 million on Thursday. This comes after the leading altcoin witnessed 10 consecutive days of fund outflows from its spot markets, exceeding $600 million.

When an asset that previously recorded significant outflows begins to record inflows, it indicates a shift in investor sentiment. It means that renewed buying interest is replacing prior selling pressure. ETH’s spot inflows indicate a rise in demand for the asset, as buyers are willing to acquire it at the current market price, positioning it for further upside.

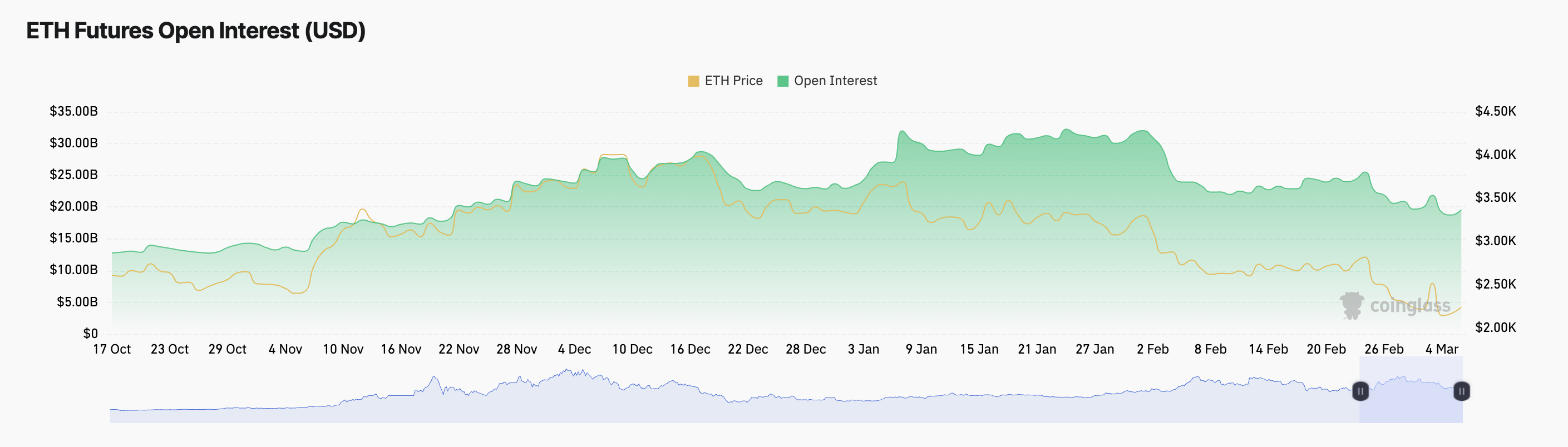

In addition, Ethereum’s open interest is also climbing, indicating a surge in trading activity. At press time, this is at $20 billion, increasing by 4% over the past 24 hours.

An asset’s open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled. ETH’s rising open interest reflects increased market participation and capital inflows into its futures market, reinforcing the current bullish trend.

Ethereum Eyes $2,361 as Indicator Confirms Growing Buying Pressure

On the daily chart, readings from ETH’s Moving Average Convergence Divergence (MACD) reflect the growing demand for the coin ahead of Friday’s Crypto Summit. As of this writing, the coin’s MACD line (blue) is poised to climb above the signal line (orange).

When this momentum indicator is set up this way, it suggests a potential bullish crossover as upward momentum strengthens. This is seen as a buy signal, increasing the possibility of further price rallies. If ETH’s demand grows, its price could reach $2,361.

On the other hand, if it suffers a correction, ETH’s price could drop below $2,000 to trade at $1,990.

This article is sourced from the internet: Ethereum Sees $20 Million Spot Inflows After 10-Day Outflow Streak – What Next for ETH?

Original锝淥daily Planet Daily Author: jk In 2025, the wave of legislation on Bitcoin strategic reserves swept across the United States, becoming the latest battlefield for the collision between the crypto industry and the traditional financial system. According to statistics, more than 20 of the 50 states in the United States have proposed or are considering legislation related to Bitcoin reserves, covering public fund allocation, tax incentives and regulatory frameworks. Analysts pointed out that the approval of Bitcoin ETFs and the increase in institutional adoption are driving states to accelerate the layout of strategic reserves of crypto assets in order to gain an advantage in future digital economic competition. Odaily Planet Daily has compiled the latest progress updates on strategic reserves in each state for readers. What are the steps for…