Lazy man’s financial management guide: Ethena and Perena start a new season, and the stablecoin track has another dark h

Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

Previous records

U-based financial management strategy for lazy people (February 24) ;

U-based financial management strategy more suitable for lazy people (March 3) ;

U-based financial management strategy for lazy people (March 10) ;

This column aims to cover the relatively low-risk return strategies based on stablecoins (and their derivative tokens) in the current market (Odaily Note: systemic risks can never be ruled out) to help users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

Base rate

-

Odaily Note: The base interest rate is tentatively set to cover the single-currency financial solutions of mainstream CEX, as well as mainstream DeFi lending, DEX LP, RWA and other deposit and market-making solutions.

I would like to mention two main points regarding the base interest rate this week.

One is Binanca LaunchPad/LaunchPool (including Binance Wallet IPO) on the CeFi side. Binance has recently shown obvious signs of strength. Last week, Nillion (NIL) was listed on LaunchPool, and Bedrock (BR) was also listed on Wallet. Considering the current recovery of market sentiment, the estimated annualized yield of the USDC pool (FDUSD pool is higher) of this LaunchPool can exceed 15% (based on 1 billion FDV, because NIL has not yet been launched, the specific data may fluctuate); the Wallet IPO order number income also exceeded 100 U. These are all must-eat mosquito meat, just go for it.

The other is Meteora. Last week, the Meteora team officially announced two governance drafts regarding the MET token.

-

The first governance draft is to increase the token reward share of liquidity providers (LPs) from 10% of the total supply to 15% ; in addition, an additional 3% of the total supply of tokens will be provided to Launch Pools and Launch Pads participants.

-

The second governance draft is: it is proposed to allocate 20% of the total supply of tokens to the team, which will be locked for 6 years ; in addition, 2% of the teams share will be allocated to M3M3 stakeholders.

The lost community trust can only be repaired with a structure, and I tend to believe it again. In terms of specific strategies, you can consider the FDUSD-USDC pool (7.32% APY, and Meteora points are earned simultaneously) that currently has FDUSD incentives.

Pendle Zone

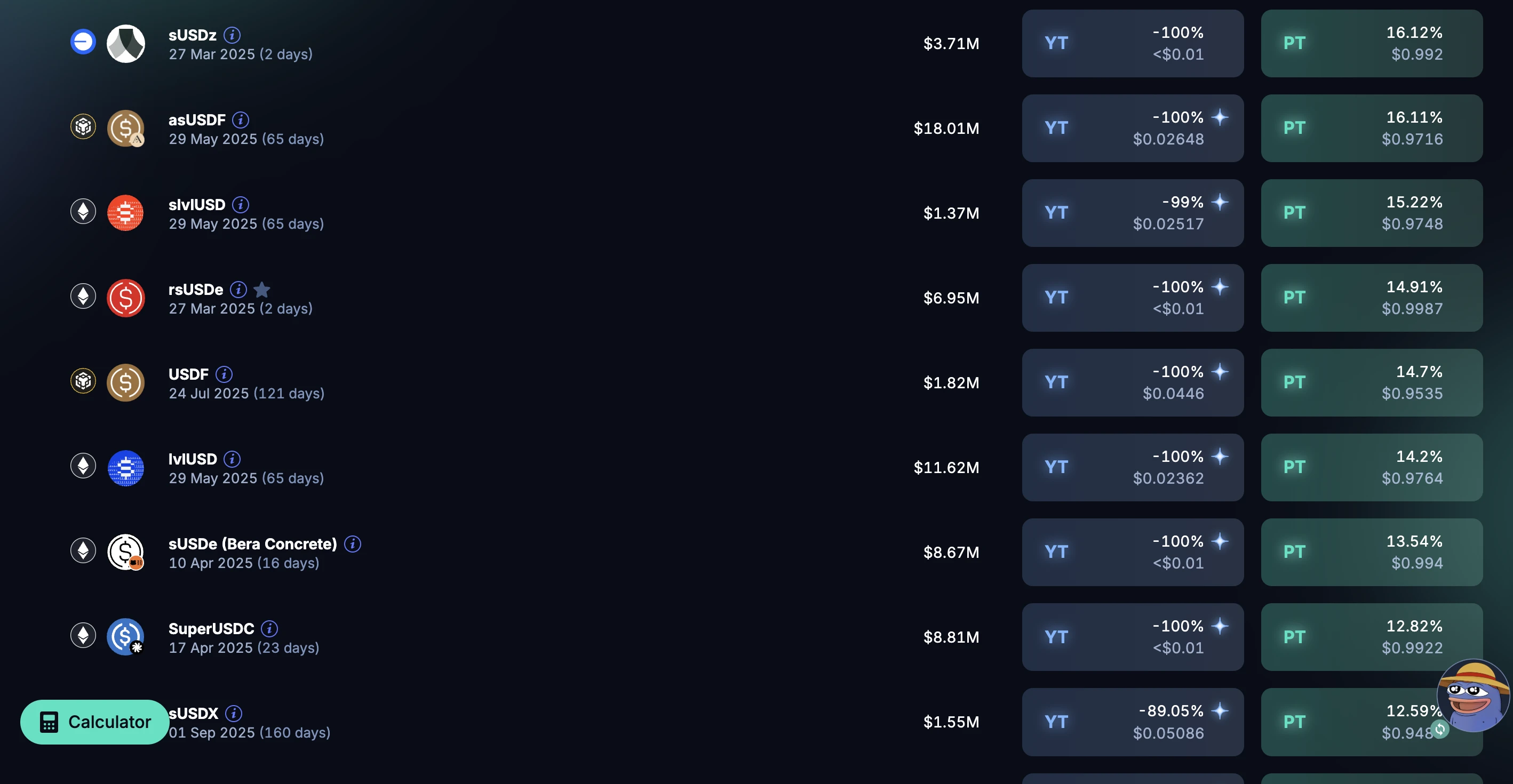

Let鈥檚 talk about fixed income first. The real-time ranking of PT yields of major stablecoin pools in Pendle in the mainstream ecosystem (Ethereum mainnet, Base, Arbitrum, BNB Chain) is as follows.

As for LP, the most important thing this week is that the Ethena Season 3 event has ended (airdrop inquiries will be open in the first week of April), but Ethena has officially launched a 6-month Season 4 event, and the current pools that can receive point incentives will remain unchanged. From the perspective of pure point efficiency, you can consider the USDe pool that expires on July 31 (up to 10.83% APY, 60 times Ethena point increase) and the eUSDe pool that expires on May 29 (up to 7.59% APY, 50 times Ethena point increase and 1.6 times Ethreal point increase) .

In addition, other LP pools can consider the Level lvlUSD pool that has just completed a new round of financing (described in detail below) and the Astherus USDF (up to 16.82% APY, 35 times the points increase) and asUSDF pool (up to 13.19% APY, 25 times the points increase) that CZ interacted with on X over the weekend.

Always remember that the meaning of depositing Pendle LP is to get returns and get free points. The value of the points depends on the potential of the project itself, so you should look for projects with a stronger narrative angle.

Other Opportunities

Continuing with Level mentioned above, the project just completed a $2.6 million financing last week, led by Dragonfly and participated by Polychain and others.

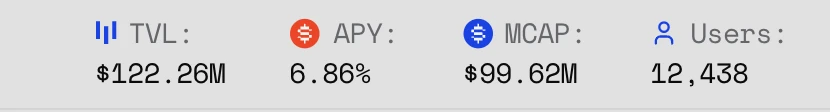

Currently, Level has launched a points program. Points can be accumulated by holding positions, staking (6.86%), and making markets on platforms such as Pendle (lvlUSD pool has a maximum APY of 13.79%, a 40-fold points increase). As of the time of posting, the total number of users is only 12,452 – the capital side is excellent, the competition is relatively small, and there is initial potential for big profits.

Another project that needs attention is Perena , a project founded by Anna Yuan, the former head of stablecoins at the Solana Foundation (invitation code available: GRLJKL). The project opened a new season (Pre-Season) points event last week . Currently, there are three main ways to accumulate points (Petals):

-

Transactions (limited to 5 transactions per day): It is not recommended to deliberately swipe, just use it for daily use;

-

The LP in the agreement will have different increases depending on the deposit duration (up to 3 times, 60 days required), and the LP yield is low;

-

The LP groups within RateX and Exponent can be understood as the Solana version of Pendle. The LP yield is relatively higher, and the increase is currently unknown.

Personally, I would recommend the third path. After all, RateX and Exponent also have certain airdrop expectations.

Finally, Backpack also launched a points program last week . If you have a daily stablecoin exchange need, you can also use this channel in addition to Perena. Those who are willing to try hedging strategies can also consider using SOL to participate in Meteoras JITOSOL-SOL pool (9.64%) or Fragmetric staking (8.05%), and at the same time shorting SOL in Backpack in equal amounts , while maintaining a certain rate of return and simultaneously brushing points on multiple platforms.

This article is sourced from the internet: Lazy man’s financial management guide: Ethena and Perena start a new season, and the stablecoin track has another dark horse (3.24)

Related: Shiba Inu (SHIB) Stuck in Downtrend: Awaiting Bitcoin’s Cue for Potential Rebound

In Brief Shiba Inu is stuck in a downtrend, with more transactions in loss than profit, reflecting weak investor sentiment. SHIB shares a 0.94 correlation with Bitcoin, meaning its recovery depends on Bitcoin’s performance, especially if BTC breaks $100,000. Holding $0.00001462 support is crucial for stability; breaking $0.00001676 resistance could push SHIB to $0.00002000. promo var rnd = window.rnd || Math.floor(Math.random()*10e6); var pid588602 = window.pid588602 || rnd; var plc588602 = window.plc588602 || 0; var abkw = window.abkw || ”; var absrc = ‘https://servedbyadbutler.com/adserve/;ID=177750;size=0x0;setID=588602;type=js;sw=’+screen.width+’;sh=’+screen.height+’;spr=’+window.devicePixelRatio+’;kw=’+abkw+’;pid=’+pid588602+’;place=’+(plc588602++)+’;rnd=’+rnd+’;click=CLICK_MACRO_PLACEHOLDER’; document.write(”+’ipt>’); Shiba Inu has been stuck in a persistent downtrend, with recovery attempts consistently failing. The meme coin has struggled to break through key resistance levels, and investor sentiment remains lackluster due to ongoing losses. With limited support from investors, SHIB now finds itself reliant on the…