Ethereum (ETH) Drops Another 10% as Whales Stop Accumulating

Ethereum (ETH) is down almost 10% on February 25. This drop has pushed its market cap below $300 billion, marking the first time it has fallen to this level since early November 2024.

Multiple indicators, including RSI and moving averages, show bearish momentum. As ETH navigates this downturn, market watchers are looking for signs of either a continued decline or a potential reversal.

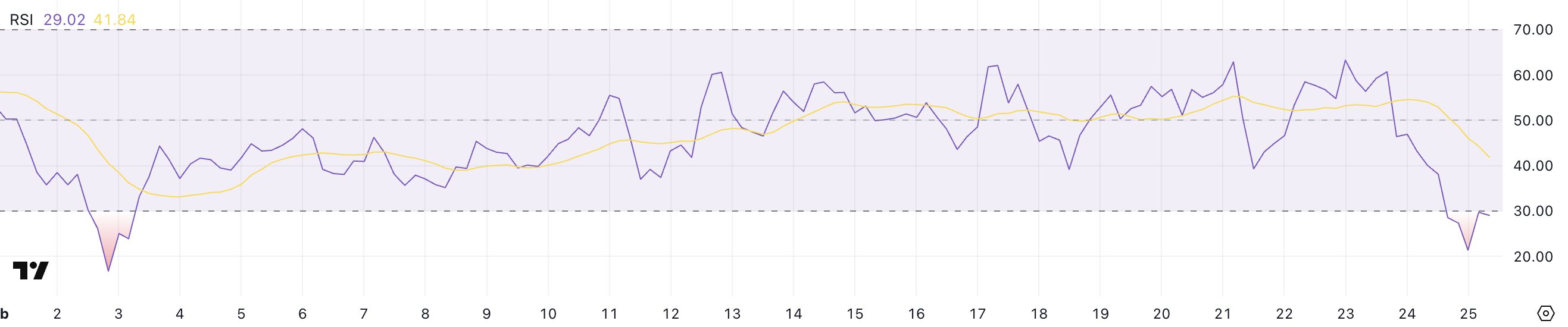

RSI Shows an Oversold State for Ethereum

ETH’s RSI is currently at 29 after dropping to 21.3 a few hours ago. This marks the first time since February 3 that ETH has entered oversold territory, indicating intense selling pressure.

RSI measures the speed and change of price movements, helping traders identify overbought or oversold conditions. An RSI below 30 typically signals that an asset is oversold, while above 70 suggests it is overbought.

With ETH’s RSI at 29, it indicates that selling momentum may be exhausted, potentially setting the stage for a short-term rebound. However, oversold conditions do not always guarantee an immediate price recovery.

If bearish sentiment persists, ETH could continue to face downward pressure before any significant reversal occurs. Conversely, if buyers step in at these oversold levels, a relief rally could follow.

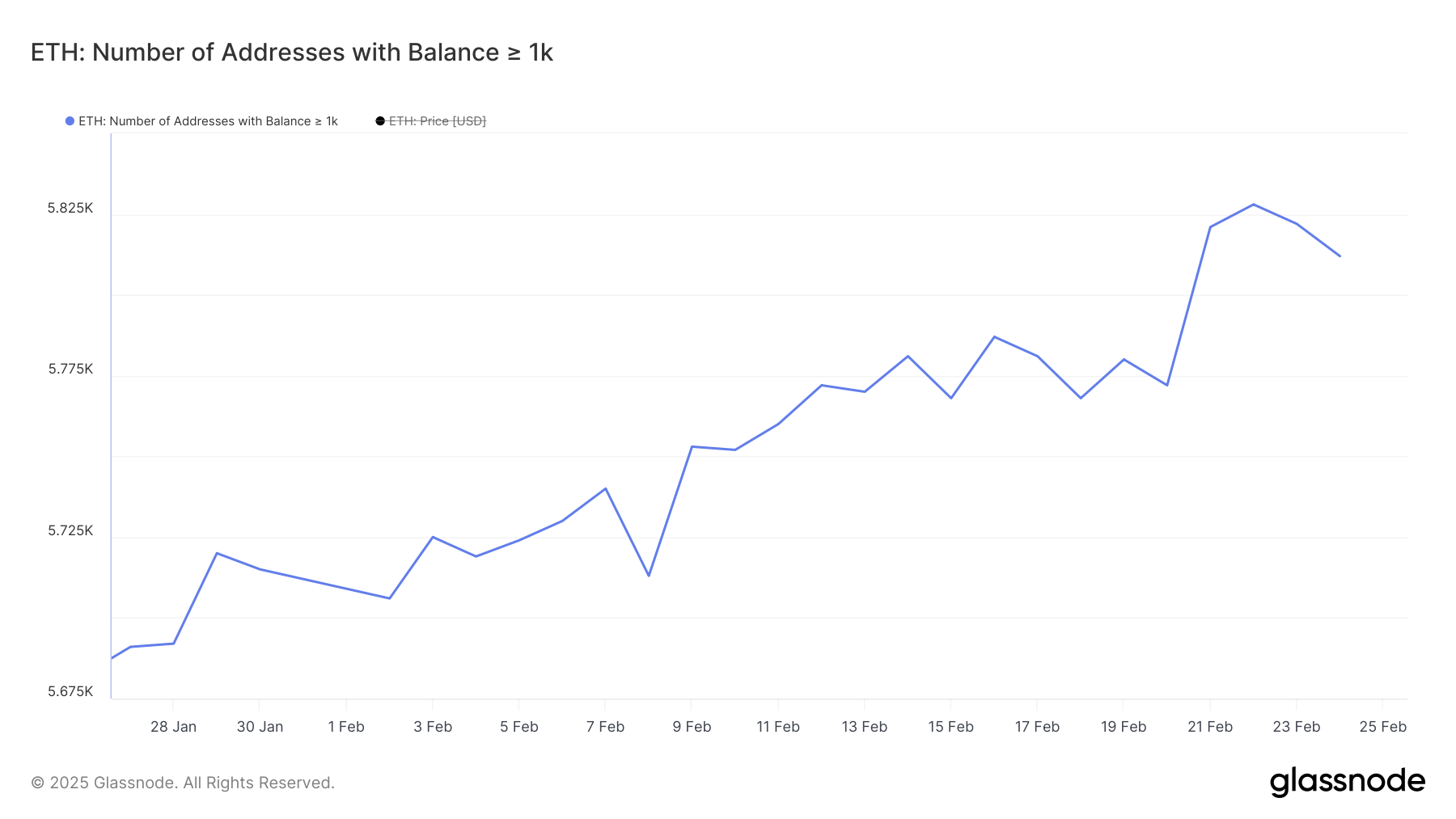

ETH Whales Dropped After Reaching Its Highest Levels In One Year

The number of ETH whales – addresses holding at least 1,000 ETH – steadily increased throughout the last month, peaking at 5,828 on February 22, the highest level since February 2024. However, this upward trend has recently reversed, with the number now slightly declining to 5,812.

This shift suggests that some large holders have started to reduce their positions, potentially contributing to the recent selling pressure on ETH.

Tracking ETH whales is crucial because they control a significant portion of the total supply, influencing price movements with their buying and selling activities. When the number of whales increases, it often indicates accumulation, which can support price stability or even drive a rally. Conversely, a decrease suggests distribution, potentially leading to increased selling pressure.

The recent decline in ETH whale numbers could indicate cautious sentiment, possibly signaling short-term weakness.

However, the overall number remains relatively high, suggesting that while some whales are offloading, a substantial number still hold their positions, which could help cushion any sharp declines.

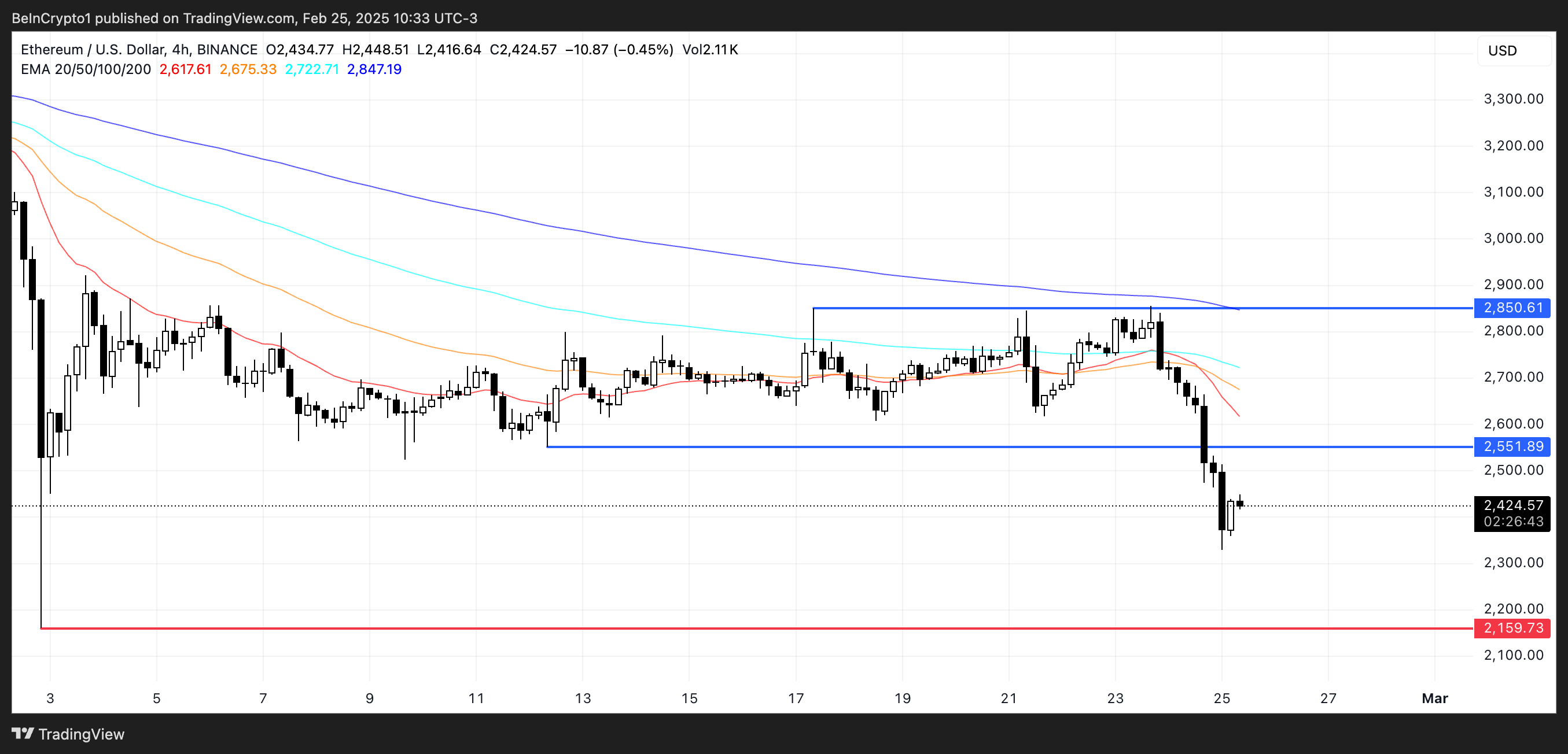

Ethereum Could Drop Below $2,200 Soon

Ethereum price recently formed a death cross, where the short-term moving average crossed below the long-term moving average, signaling a bearish trend.

Following this pattern, Ethereum’s price dropped below $2,500, reflecting increased selling pressure. If this downtrend continues, ETH could decline further to $2,159, falling below $2,200 for the first time since December 2023. This death cross indicates that bearish momentum is dominating, and caution is warranted as downward pressure could persist.

However, if Ethereum manages to reverse this trend, it could attempt to break through the resistance at $2,551. Successfully overcoming this level could pave the way for a rally toward $2,850.

For this reversal to occur, buying pressure would need to increase, pushing the short-term moving average back above the long-term one. Until that happens, the death cross suggests that the bearish sentiment remains strong.

This article is sourced from the internet: Ethereum (ETH) Drops Another 10% as Whales Stop Accumulating

In this article, we explore how on-chain liquidity is gradually changing the competitive landscape between decentralized exchanges (DEX) and centralized exchanges (CEX) through technological innovation. From AMM to vAMM, Peer-to-Pool, and then to the evolution of Order Book, these mechanisms provide users with a better trading experience while solving core problems such as slippage, impermanent loss, and price discovery. We particularly emphasize that deep liquidity is the main factor for CEX to succeed in its competition with DEX. The success of $Trump once again proves that on-chain liquidity is becoming increasingly abundant, and behind it is the increasingly diverse group of liquidity providers. We analyzed the development trend of LP Vault modularization and specialization, and this innovation is providing deeper liquidity support for long-tail assets and mainstream assets on the…