FTT Price Rallies 44% Following Sam Bankman-Fried’s Tweets

FTX’s native token, FTT, has been experiencing a rollercoaster of price action, particularly following recent corrections. Despite FTX beginning payouts to its creditors, the altcoin struggled to regain its footing in the market over the past week.

However, today marked a significant shift as the price of FTT soared by 44%, driven primarily by tweets from FTX founder Sam Bankman-Fried (SBF).

Sam Bankman Fried Shows Empathy

The rally in FTT’s price was largely driven by speculative buying, with Sam Bankman-Fried’s supporters rallying around the news. Sam Bankman-Fried discussed the challenges of firing employees, emphasizing that layoffs often stem from company mismatches, poor management, or unsuitable environments rather than individual deficiencies. He acknowledged the necessity of firing unproductive employees but stressed it’s often a leadership failure.

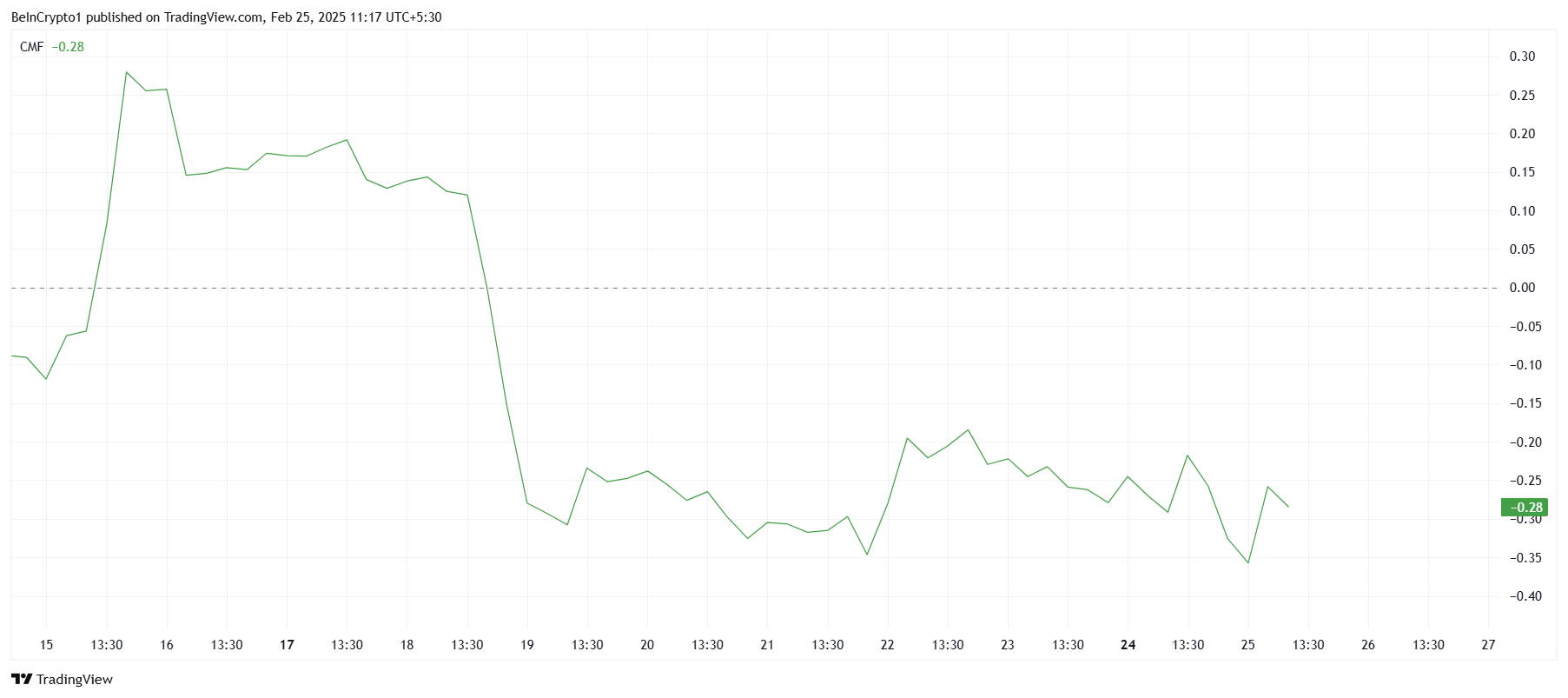

While the price did rally, the Chaikin Money Flow (CMF) indicator revealed that this uptick wasn’t backed by substantial capital inflows. Instead, it was fueled by sentiment surrounding SBF and the FTX situation. The CMF failed to show a corresponding uptick in buying volume, indicating that the price rise was speculative and not sustainable.

Furthermore, while the price of FTT surged, it became evident that investors were hesitant to fully commit to the token. The CMF’s neutral reading points to weak inflows, reinforcing the view that the price rally is likely to fizzle out. Without substantial support from actual inflows, the price may struggle to hold above current levels, and further speculative rallies may become less frequent.

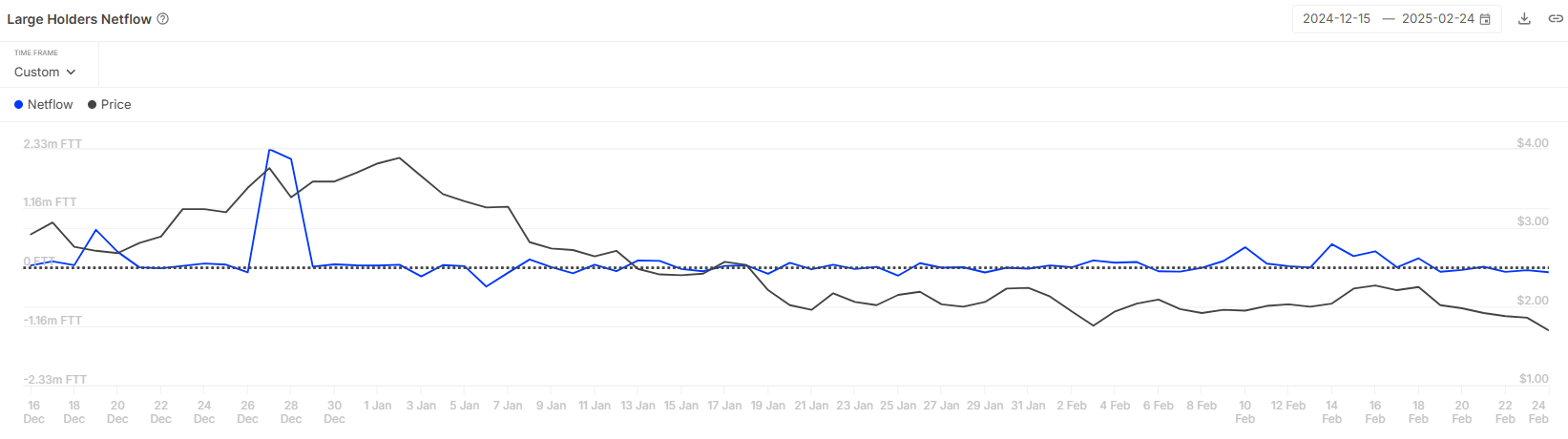

On a broader scale, the market momentum of FTT has been lackluster. Whale addresses, typically seen as strong indicators of price trends, have exhibited minimal activity over the last two months. The net flows of large wallet holders have remained neutral. This is an indication that even the most influential players in the market have shown little interest in the token.

This lack of engagement from major investors further supports the view that the recent rally is not driven by fundamental interest in FTT.

FTT Price May Not Sustain The Rise

FTT’s sharp rise by 44% brought the price to a high of $2.31 before it retraced to $1.75. Despite this, it has managed to somewhat recover from a 32% decline seen earlier in the week. However, the token is still struggling to break above the resistance of $1.83.

Given the current market conditions, FTT is likely to face further challenges in pushing above the $2.00 mark. The price may consolidate around $1.55 in the short term, as the previous resistance proves difficult to breach. However, with the current sentiment and lack of strong investor backing, a sustained rally beyond $2.00 remains uncertain.

If FTT can garner enough investor interest and secure $1.98 as a support level, it could push beyond $2.31. If that happens, the bearish outlook could be invalidated, leading to further gains and a more promising recovery for FTT.

This article is sourced from the internet: FTT Price Rallies 44% Following Sam Bankman-Fried’s Tweets

Part 1: DeFAI Industry Overview 1.1 DeFAI Industry Background and Industry Evolution Since the rise of DeFi in 2020, the decentralized financial market has gradually developed from the initial liquidity mining and decentralized exchanges (DEX) stage to diversified directions such as DAO governance, NFT financialization, and GameFi. However, with the maturity of the market and the intensification of competition, DeFi has gradually faced core problems such as stagnant user growth, insufficient risk management, and inefficient capital. At the same time, in recent years, artificial intelligence technology has made breakthrough progress in generative AI, natural language processing (NLP), automated decision-making and other fields. Especially since 2024, the combination of AI and Web3 technology has been considered to be the key direction of a new round of narratives. The combination of DeFi…