Dismantling the SVM arms race: Insight into the competition among Solayer, SOON, and Sonic SVM

What would the Crypto world look like if Ethereum reached 10,000 TPS or more in another parallel universe?

As the most anticipated seed player in the new round of Solana ecosystem narrative in 2025, the Solana Virtual Machine (SVM) seems to be gradually turning this hypothesis into reality through three game changers – Sonic, SOON, and Solayer.

Especially in the context of Solanas new narrative urgently needing to take over in 2025, the three leading players in the SVM ecosystem are trying to answer the industrys ultimate proposition of high concurrency, low latency, and cross-chain compatibility with differentiated technical paths. This article will also dismantle the deep logic of this SVM arms race from three dimensions: underlying architecture, ecological strategy, and market positioning.

Why is SVM important in 2025?

I am the Ethereum killer, send me money. With the era of easy land grabbing, financing, and hype for new public chains from 2018 to 2020 gone forever, few people have mentioned the Ethereum killer narrative in recent years.

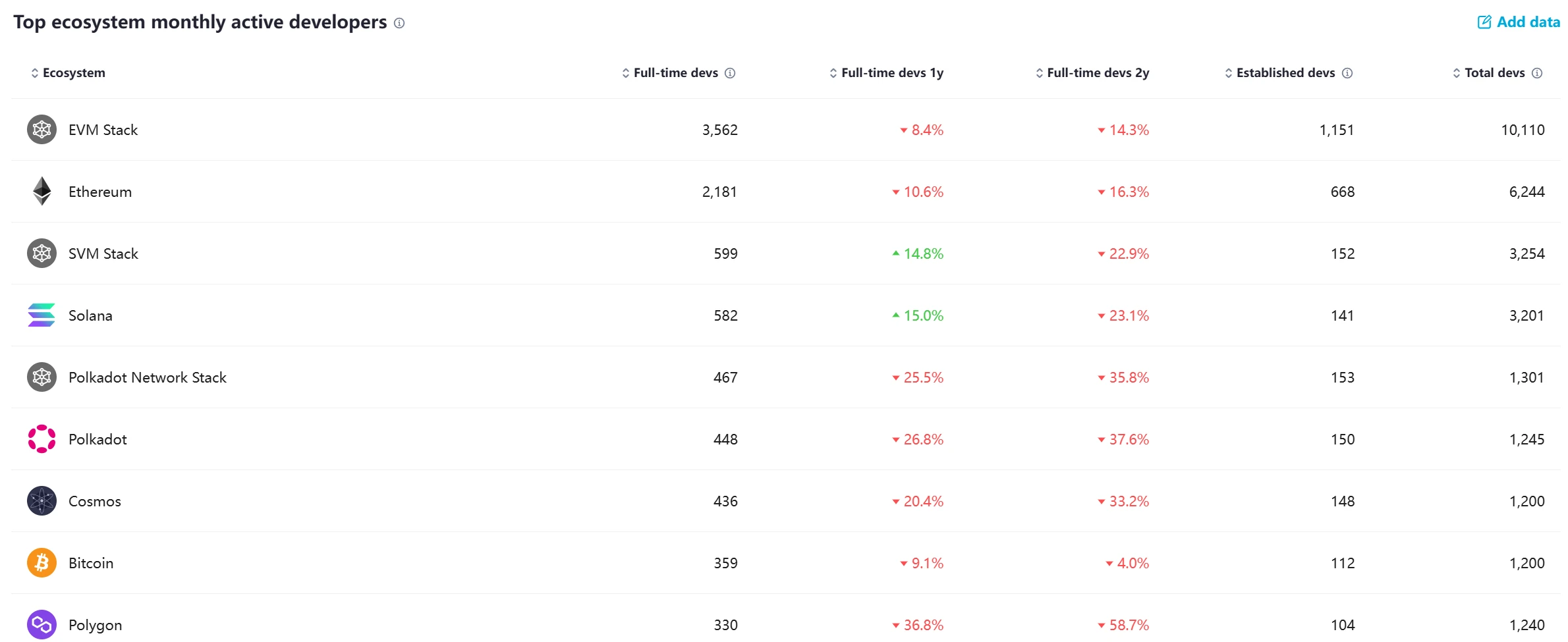

To put it bluntly, games that simply copy the EVM architecture + TPS numbers can no longer meet the evolutionary needs of Web3 . According to the Electric Capital developer report, among the cryptocurrency ecosystems with the fastest new developers in 2024, EigenLayer, Aptos, and Solana ranked in the top three, with growth rates of 167%, 96%, and 83%, respectively.

In terms of developer share, Ethereum is still the largest ecosystem on every continent, but Solana, ranked second, is the preferred ecosystem for new developers. This is also the first ecosystem to attract more new developers than Ethereum since 2016.

This shift reflects a profound change in industry perception: the blockchain war has shifted from a narrative battle to an execution environment revolution. Especially after Solana Virtual Machine (SVM) completed its architecture upgrade and attracted new developers, its essence is not to replace a public chain, but to reconstruct the technical paradigm of the entire smart contract execution layer.

So what exactly is SVM? Its full name is Solana Virtual Machine, which is the execution environment for processing transactions, smart contracts, and programs on the Solana network. It is designed to solve specific expansion and user experience problems.

As we all know, the traditional EVM (Ethereum Virtual Machine) performs well in terms of compatibility, but in high-frequency application scenarios such as games, DeFi, social networks, etc., its performance often cannot keep up. SVM is based on Solanas core performance and provides extremely fast transaction speeds and lower gas fees.

The most critical thing is that SVM supports parallel processing of transactions, unlike EVM which has to queue up one by one to process (just like there is only one cashier during peak shopping hours). The advantage is that multiple transactions can run at the same time, and it is still fast during high demand periods, and the transaction fees are low.

As the Solana ecosystem gave birth to SVM and Sui and Aptos built MoveVM, the technological evolution of the Crypto ecosystem presented a clear strategic roadmap: the core battlefield of the next generation of blockchain wars is shifting from the consensus layer to execution environment innovation.

SVM itself is an extension of Solana’s influence — the better SVM does, the greater Solana’s influence.

The technical paths and ecological ambitions of the three SVM masters

SOON: Movement of SVM

In an objective comparison, SOONs positioning is more like Movement in SVM, that is, it gives priority to being close to the community in construction. At the same time, a relatively different point is that it completes financing through co-builder rounds and the community fair launch model.

So if Movement brought Move to Ethereum, then SOON goes a step further and can bring SVM to all L1s: and it is quite different from the imagined Solana L2. It does not rely on the Solana mainnet, but provides flexible expansion capabilities through the SOON Stack, so that SVM can be deployed on other mainstream Layer 1s.

This design allows any L2 in the public chain ecosystem to enjoy the advantages of SVM, including faster transaction speeds and lower Gas fees. Therefore, SOON and other SVMs face completely different execution environments, which requires higher-performance Rollups and technology stacks to assist.

After all, the multi-chain prosperity of the pan-EVM ecosystem forces developers to reinvent the wheel (deploy one project on multiple chains), resulting in reduced product quality and user fatigue. SOON, on the other hand, concentrates resources in a unified environment, which actually greatly optimizes the developer experience.

Speaking of fees, Ethereums global charging model is really not considerate – a popular NFT auction can drive up the cost of your ordinary transactions. In comparison, SOONs localized fee market is great: spend as much as you should, without interfering with each other.

At the same time, SOONs private placement round also attracted co-founders of a number of well-known projects (Solana, Celestia, etc.), and allocated 51% of the tokens to NFT buyers. It also responded to the communitys opinions at the first time, which coincides with Movements idea – attach importance to the community and be willing to listen to the communitys voice, and ultimately jointly promote the success of the project and enjoy the positive effects it brings.

From the actual project progress, SOON development progress is also the fastest among the three SVMs. To some extent, SOON is not only the volume king, its design is actually solving the old problems of EVM and Solana. If you are a market operator, you might as well learn some tricks from its community and resource concentration methods – a win-win situation of user experience and efficiency is not a dream~

Solayer: I have TVL and efficiency

In the past year, Solayers narrative switching has been textbook-level: from re-pledge agreement to RWA stablecoin to hardware-accelerated SVM, each time it accurately hits the market hotspot.

I have always said that the teams cognition and execution, plus luck, ultimately determine the ceiling of the project. Founders Rachel (former core developer of Sushiswap) and Jason (founder of MPCVault) have both product and technical acumen. This can be seen from the acquisition of Fuzzland to strengthen chain security – fast narrative switching, strong financing, and full execution.

I first heard about Solayer more than a year ago, when EigenLayer was very popular. Solayer came out of nowhere, focusing on the staking direction on Solana, and aimed to become the Solana version of EigenLayer.

For this reason, Solayer started in the SOL staking ecosystem, especially based on Solanas staking data and infrastructure to lay a solid initial foundation. However, recent developments show that Solayer is no longer limited to staking, but has begun to get involved in the SVM technology track.

For a project that started with pledge, what is its core competitiveness after entering the SVM technology field?

In fact, there is a key node that cannot be ignored, that is, Solayer acquired the technology company FuzzLand and created Solayer InfiniSVM together. It was with this opportunity and handle that Solayer started a new narrative layout, and aimed at the first public chain to implement hardware acceleration expansion solutions, and finally truly realize high-speed public chains:

Solayers 2025 roadmap proposes Infiniband RDMA technology, with a target of one million TPS + 100 Gbps. Its hardware acceleration claims that it can achieve 1 millisecond transaction confirmation by offloading key operations of the blockchain to dedicated hardware components, which are responsible for various operations from transaction sorting, scheduling to storage. If the technical solution can be implemented, it is indeed expected to achieve a large multiple of Monad.

To put it simply, in Solayer Chain, each transaction follows a set of workflows. The transaction first enters a scalable entry cluster consisting of hundreds of thousands to millions of nodes, which clean and pre-execute the transaction based on probabilistic predictions of future states.

All execution snapshots are then sent to a sequencer built with Intel Tofino switches and additional FPGAs. It is worth noting that most transactions have been confirmed as valid during the pre-execution phase and therefore do not need to be executed again on the sequencer.

Don’t understand? Don’t worry, here is a simple example to help you understand:

-

Imagine you are waiting in line at an airport for security check. Everyones luggage will be scanned by a machine (corresponding to the cleaning and pre-execution stage of the transaction). Most of the luggage is generally fine and can be released directly;

-

However, if the machine finds a suspected problem with a bag (conflicting transactions), it will be sent to a more advanced inspection station for detailed inspection (sequencer and re-execution). This inspection station is equipped with top-level detection equipment and professionals (Intel Tofino switches and FPGAs) to ensure that the baggage inspection is efficient and fair;

-

At this airport, simple baggage checks can process 16 billion pieces per second (TPS for simple transactions); even problematic baggage can process 890,000 pieces per second (TPS for conflicting transactions);

-

In other words, the airport (solayers SVM) can handle both routine baggage checks for billions of passengers and complex checks for millions of problematic bags within one second, ensuring both efficiency and taking care of special circumstances;

Like SOON mentioned above, Solayer has also been recognized by Solana and large institutions. The two rounds of financing not only included investment from Solana co-founder Toly, but also attracted support from top institutions including Binance Labs (now YZi Labs) and Polychain.

Sonic SVM: The Breaking Engine of Blockchain Game Infrastructure

Sonic SVM is the earliest TGE project in the SVM track, and has been launched on most mainstream exchanges except Binance.

Different from the SVM project mentioned above, Sonic SVM focuses on games – the innovative design is mainly aimed at the high concurrency and instantaneous transaction requirements in game scenarios.

The entire Sonic SVM technology is built on the HyperGrid framework, which is also Solana’s first concurrent expansion framework. The original design intention is to achieve high customization and scalability while maintaining native composability with Solana.

Because HyperGrid supports developers to write applications in the EVM environment, but ultimately executes them on Solana, and the settlement layer is still Solana, it is more convenient for developers to write projects using existing familiar programming languages, reducing the time to get started and understand the new public chain.

It is worth mentioning that Sonic SVM is the first Grid instance in the HyperGrid framework – is it very similar to the relationship between Virtuals and Luna?

In addition, Sonics Guardian Nodes system focuses on the verification of on-chain user behavior. Through this mechanism, it effectively prevents robot attacks and malicious behavior, providing gamers with a safer interactive environment. The operation of the nodes also provides a guarantee for the stability of network performance.

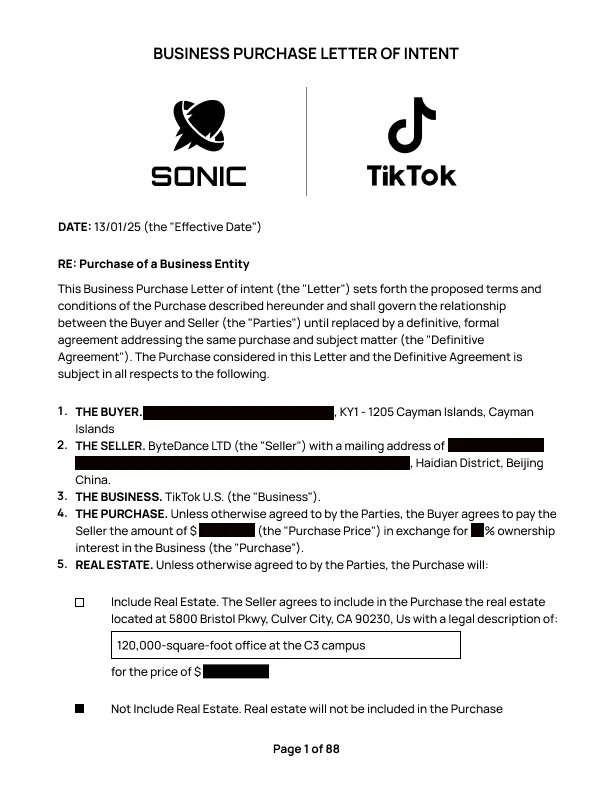

Another key highlight of Sonic is its TikTok Mini App – SonicX. With the help of TikToks huge user base, SonicX generates a wallet for users that is bound to their TikTok account through a simple login method, thus achieving seamless account abstraction.

This design greatly lowers the entry threshold of Web3, allowing ordinary users to participate in various blockchain activities without having to understand private keys and on-chain operations (as a side note, TikTok is currently facing policy risks in Europe and the United States, and its traffic prospects are always overshadowed, so whether this new user acquisition channel can work for a long time is a challenge).

In general, the three major projects in the SVM track have their own characteristics:

-

Sonic SVM: Focuses on blockchain gaming experience through TikTok traffic diversion and seamless on-chain interaction mode;

-

Solayer: Focus on improving efficiency with higher performance, combining the original re-staking and liquidity optimization to expand the ecosystem;

-

SOON: It focuses on starting from the community and learning the idea of Movement to expand SVM to the entire blockchain world;

Conclusion

A strong storm starts with a small ripple. Behind every successful coin issuance, there is often an important clue: the infrastructure needed by the market is being redefined!

From DeFi to blockchain games, and then to social applications, users demand for fast, low-cost, and high-quality experience is becoming stronger and stronger. In this process, the bottleneck of traditional EVM gradually emerges. It is precisely because of these limitations that the innovation of SVM is particularly important.

This article is sourced from the internet: Dismantling the SVM arms race: Insight into the competition among Solayer, SOON, and Sonic SVM

Related: First experience with Line Mini Program: Will it be the next Telegram Mini-App?

Original锝淥daily Planet Daily Author: jk On January 22, LINE NEXT, a subsidiary of LINE, a global first-tier social messaging app focused on Web3 ecosystem development, announced the launch of Mini Dapps with Kaia Blockchain to bring a more convenient Web3 service experience to global users. This new feature is very similar to WeChat Mini-App and Telegram Mini-App. It can be directly accessed through the Dapp Portal official account on LINE without the need for users to download additional applications, covering multiple categories such as games, social media and content. At the same time, the mini-app function has a built-in wallet function, which natively realizes the transaction and reward acquisition of virtual assets and NFTs. Will this be a new wave of TG applets? Before that, let鈥檚 first understand the background.…