What is VVV (Venice), which was first listed on Coinbase and has a market value of US$2 billion?

Original | Odaily Planet Daily ( @OdailyChina )

Author锝淣an Zhi ( @Assassin_Malvo )

This morning, Coinbase announced that it will launch the Base chain AI concept token Venice Token (VVV). The token鈥檚 market value hit a record of $2.3 billion at the time of the announcement, and its market value is still $1.6 billion at the time of writing.

Venice has no public financing background, and compared with mainstream AI applications, the number of users is not large. Why was it able to be directly launched on Coinbase? Odaily Planet Daily will explain Venices business, airdrop rules and token economics in this article.

What is Venice (VVV)?

Venice is a permissionless, private, and censorship-resistant AI platform whose mission is to provide users with private, unmonitored AI reasoning services . Venice said that based on OpenAIs various AI products, OpenAI always stores every conversation so that it can be read, cracked, or sent to the NSA or CCP. Venice was born to solve this problem. Venice also supports functions such as conversation, image generation, and code creation, but does not view, store, or restrict any user data (including prompts, conversations, and generated content) .

(Note: NSA refers to the U.S. National Security Agency.)

Since its launch in May 2024, it has accumulated 400,000 registered users, 50,000 daily active users, and processes 15,000 inference requests per hour. (Note: In comparison, ChatGPT has about 300 million weekly active users and Doubao has 50 million monthly active users.) Today, January 28, Venice opened its API to the public for use by AI Agents, developers, and third-party applications. At the same time, it launched VVV tokens and airdropped them to 250,000 addresses. The detailed rules of the airdrop are detailed in the next section.

Venice Airdrop Rules

This airdrop will distribute 50 million VVV to two types of users, accounting for 50% of the initial supply:

-

Venice users must have at least 25 points by December 31, 2024, and have been active on October 1, 2024.

-

Specific token holders , including VIRTUALS, AERO, DEGEN, AIXBT, GAME, LUNA, VADER, CLANKER, MOR, and 200 Coinbase Agentkit developers.

The deadline for claiming the airdrop is March 13, 2025, and you can claim it directly through the official website .

Venice Hashrate Rules

Generally speaking, AI applications such as OpenAIs ChatGPT and Anthropics Claude are divided into two modes: free terminal version and paid API. The latter charges according to the number of tokens used. (Note: token can be simply understood as the number of characters input and output)

Venice provides a new model, which is to pledge tokens to obtain computing power, and then obtain the right to use AI through computing power .

Venice has set a standardized unit VCU to measure the computing power required for AI reasoning. The proportion of VVV tokens staked by users to the total staked amount determines the amount of VCU available daily (for example, if you hold 1% of the staked amount, you will get 1% of the total VCU capacity). As Venices infrastructure expands and the total VCU capacity increases, the daily reasoning power of users will also increase even if they do not add additional stakes.

Venice Token Economics

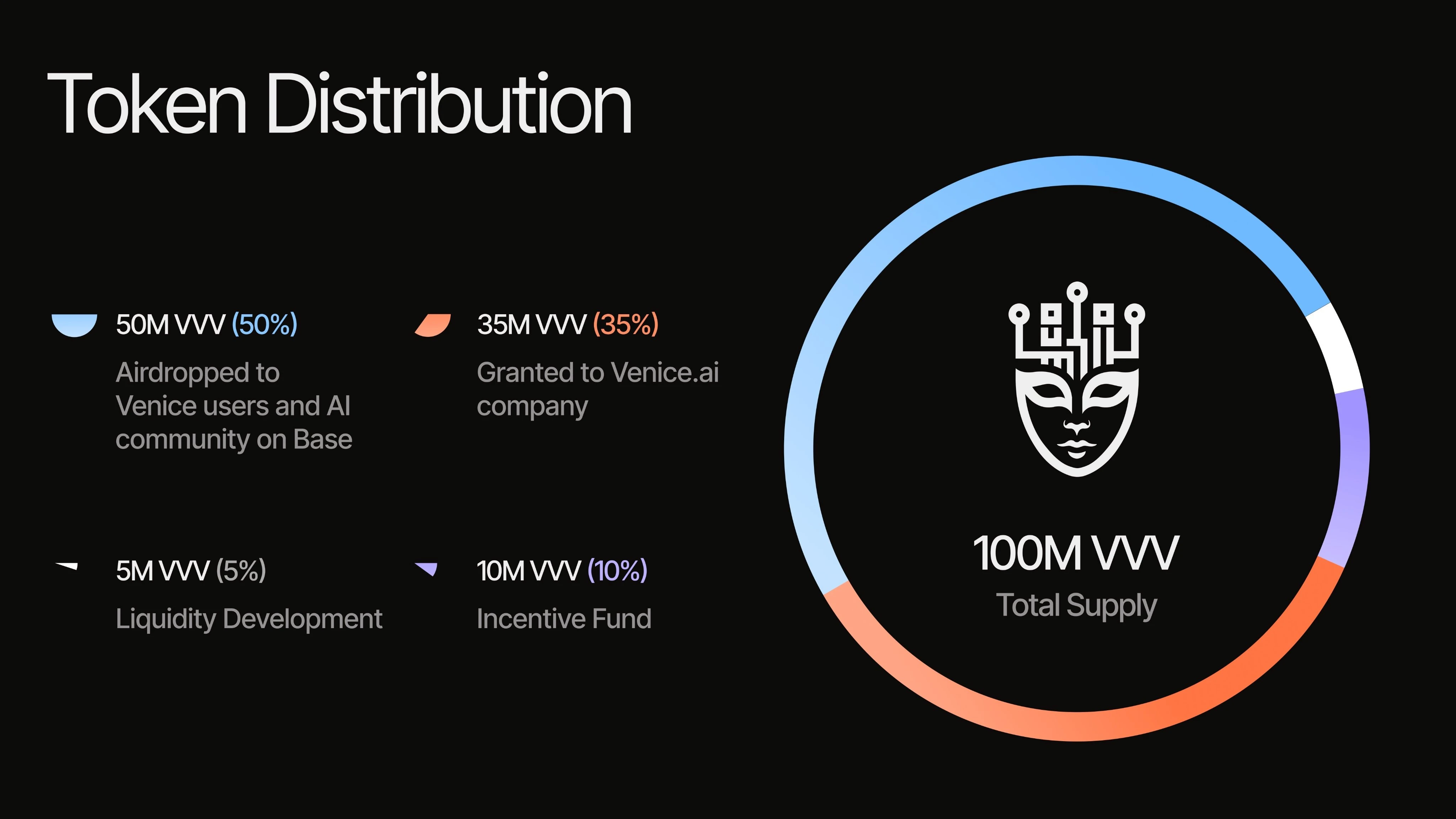

The initial supply is 100 million VVVs, distributed as follows:

-

50% airdrop to users and the community

-

10% allocated to incentive fund

-

5% for providing liquidity

VVV has an inflation mechanism, and 14 million VVV will be issued each year (the initial inflation rate is 14%, decreasing year by year) to incentivize staking and network expansion. Venice stated in the document that this model enables VVV stakers to use the API for free, while covering costs through staking rewards to achieve negative cost use. The premise for this statement is that the token price does not fall further or fluctuates very little, but in fact, Venices real users, token demand, and development prospects other than brush users are currently unknown. According to official documents, it takes 7 days to release the pledge, during which there is no income and tokens cannot be withdrawn. Users who participate in token staking should consider it carefully .

This article is sourced from the internet: What is VVV (Venice), which was first listed on Coinbase and has a market value of US$2 billion?

Related: Arthur Hayes updates forecast: Market will peak in late March

Original author | Arthur Hayes (BitMEX co-founder) Compiled by Odaily Planet Daily ( @OdailyChine ) Translator| Azuma ( @azuma_eth ) Editors note: This article is a new article Sasa published by BitMEX co-founder Arthur Hayes this morning. In the article, Arthur analyzes the possible subsequent actions of the Federal Reserve and the Treasury Department, and the impact of related actions on the overall dollar liquidity situation in the market. Arthur is generally optimistic about the first quarter market, and believes that the markets disappointment with the effect of the Trump teams policy shift can be masked by the extremely positive dollar liquidity environment, but at the same time Arthur also predicts that the market will peak at the end of the first quarter and will not improve until the second…

If you have lost money fraudulently to any company, broker or account manager and want to retrieve it, then contact www. BsbForensic. com and get back your money !they helped me out .