In FTX repayments, which currencies need to bear huge selling pressure?

Original|Odaily Planet Daily

Author: jk

After the collapse of FTX in 2022, the story of this exchange turned from glory to complicated repayment and liquidation. Two years later, FTXs compensation plan has gradually become clear, but it has brought huge selling pressure to some currencies.

In this article, Odaily Planet Daily will take readers to review FTX’s progress in repaying debts, tokens that are under selling pressure, and how featured products that once attracted market attention will affect the future of the crypto industry.

FTX’s repayment plan and timeline

In May 2024, the Associated Press reported that FTX had put forward clear compensation figures in the court documents filed at the time. According to the court documents, FTX owed creditors about $11.2 billion, and the exchange estimated that the funds that could be distributed to creditors were between $14.5 billion and $16.3 billion.

The plan also provides for additional interest payments to creditors as long as funds remain after claims are paid in full, the filing said. Most creditors will be paid 9 percent.

However, all of these compensations will be settled in U.S. dollars based on the price of cryptocurrencies at the time of FTX’s collapse. Specifically, when FTX filed for bankruptcy protection in November 2022, the price of Bitcoin was $16,080. This is both a good thing and a bad thing—

The bad thing is that the investor owned digital currency at the time, and now the compensation is in US dollars. If the investor held 1 Bitcoin at the time, then the gains of about 6 times today are not included in the compensation at all, and the investor can only get compensation of US$16,080 + two years interest.

The good thing is that if it weren’t for the crypto bull market in the past two years, FTX might not have had enough money in its vault to compensate all its customers – being able to get the money back is a very comforting thing.

According to the plan filed in the U.S. bankruptcy court in Delaware, customers and creditors with claims of $50,000 or less will receive about 118% of the payout. This group accounts for 98% of FTX’s customers.

In August 24, there was a small update to this incident: Odaily previously reported that FTX and the U.S. Commodity Futures Trading Commission (CFTC) had agreed to a $12.7 billion settlement. The CFTC agreed that as long as FTX complied with the restructuring plan, the CFTC would not collect any compensation. As a result, FTX will pay up to $12.7 billion in compensation to creditors, depending on available funds. This is equivalent to stamping the governments seal on the compensation agreement, ensuring that the governments lawsuit against FTX will not reduce the funds available to customers. According to the estimated amount of funds at the time, FTX can still complete the full compensation and even have a surplus.

Odaily previously reported that the judge approved FTX to sell its shares in AI startup Anthropic worth $1 billion, and planned to pay $200 million in priority taxes and $685 million in secondary tax claims to the IRS. FTX argued that the amount it owed was much lower than the $24 billion claimed by the IRS. These are all part of FTXs compensation path.

So, how is FTXs compensation going now? FTX needs to sell coins for compensation. What is the selling pressure caused by this part? Will some tokens face huge selling pressure? Lets take a look.

What is currently in FTX’s wallet?

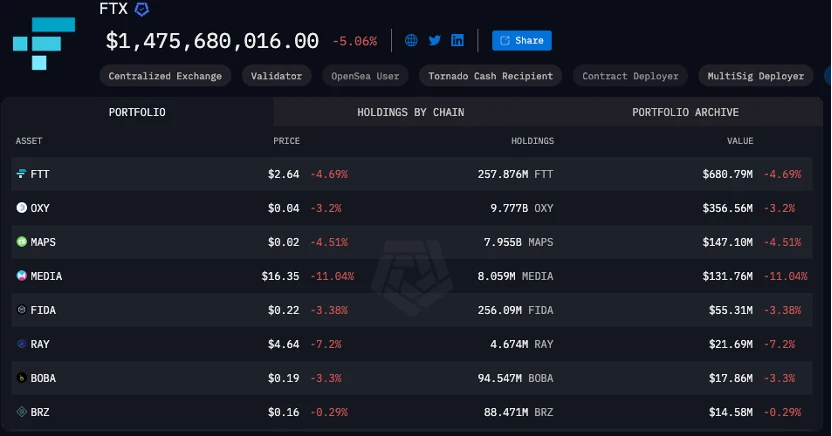

FTX’s current wallets and holdings are publicly available on Arkham. As of the time of writing, FTX’s on-chain addresses still have a total of $1.475 billion in assets, with the largest holding being FTT, valued at approximately $680 million.

Including FTT, there are 20 other currencies with holdings of more than one million US dollars:

-

FTT: $ 680.79 M

-

OXY: $ 356.56 M

-

MAPS: $ 147.10 M

-

MEDIA: $ 131.76 M

-

FIDA: $55.31 M

-

RAY: $21.69M

-

BOBA: $17.86M

-

BRZ: $14.58M

-

DRIFT: $10.15M

-

JUP: $ 6.66 M

-

JTO: $6.25M

-

USDC: $ 3.31 M

-

SOL: $ 3.14 M

-

RENDER: $ 2.77 M

-

ASD: $2.76M

-

SRM: $2.72M

-

KMNO: $2.67M

-

MPLX: $2.65M

-

AMPL: $1.67M

-

STG: $1.18M

So, which coins need extra attention for selling pressure? Based on Coingecko data, Odaily has compiled the following tokens for you:

-

FTT: The fully diluted valuation FDV is only $870 million, the 24-hour circulation is $18 million, and FTXs holdings have reached $680 million. Even if there is pressure from market makers, it is difficult for buying orders to support the current price.

-

OXY: Currently, the 24-hour trading volume is only $3,000, while FDV is around $365 million. FTX’s holdings reached $356 million, which shows that the token has no trading volume due to the prospect of selling pressure. However, in addition to DEX, the token is only listed on Kraken, so it has nothing to do with most traders.

-

MAPS: Currently, FDV is $185 million, FTX’s holdings have reached $147 million, and the 24-hour trading volume is also bleak, at only $130,000.

-

MEDIA: The current FDV on Coingecko is 14.23 million US dollars, and FTX’s holdings have reached 131 million US dollars.

-

FIDA: FDV is currently $216 million, and FTXs holdings are $55.31 million. If operated properly, shorts may have room to play. The current 24-hour trading volume is 15.51 million.

-

BOBA: FDV is currently 94.67 million, with a market value of 81.05 million, while FTXs holdings have reached 17.86 million US dollars. The 24-hour trading volume is 1.62 million US dollars.

-

SRM: The current market value is $11.37 million, the 24-hour trading volume is $490,000, and FTX holdings are $2.72 million.

-

MPLX: The current market value is $185 million, the 24-hour trading volume is $1.36 million, and FTX holdings are $2.65 million.

-

AMPL: The market value is currently $150 million, the 24-hour trading volume is $830,000, and FTX holdings are $1.67 million.

Less affected currencies:

-

RAY: Raydium currently has a market value of $1.3 billion, a 24-hour trading volume of $94.83 million, and FTX holds 21.69 million. If market makers aim to sell steadily and operate properly, a large drop is not expected.

-

DRIFT: The current market value is 310 million US dollars, the 24-hour trading volume is 29.01 million, and FTX holds 10.15 million US dollars, which is fully capable of taking over.

-

ASD: Current market value is $32.02 million, 24-hour trading volume is $1.24 million, and FTX holdings are $2.76 million.

-

KMNO: Current market value is $146 million, 24-hour trading volume is 19.92 million, and FTX holdings are $2.67 million.

For other currencies, such as Solana, which has a high circulation volume (24-hour trading volume reaches 4 billion US dollars, and FTX currently holds only 3.14 million US dollars), Jupiter, Jito, Render, Stargate, and fully supported stablecoins such as USDC and BRZ, there is no need to worry at all.

FTX holdings. Source: Arkham

As of this writing, FTX is still selling tokens. On Arkham, it can be seen that the FTX liquidation address is transferring the tokens it holds to Binance and Gate at a frequency of several transactions per day, and the amount transferred each time is not large, ranging from $50,000 to $5 million each time, depending on whether the currency is held in large amounts. It is not clear whether there is a shadow of market makers behind the sale of tokens, but this time, FTX did not sell all the tokens it holds at once like the German government did, causing the price to plummet.

FTX’s Featured Products

As the preferred exchange for traders and institutions, FTX naturally supported high-frequency trading. This also produced a considerable degree of technological spillover effects, and FTX also developed many special trading products for retail investors. After FTX collapsed, some of these products were absorbed by other exchanges, while some have not been followed up to date.

For example, the leveraged tokens that were popular on FTX at the time were extremely friendly to retail investors:

Leveraged tokens can provide investors with double leveraged assets without complicated operations or directly bearing the liquidation risk of leveraged trading. Most investors are familiar with contract trading/leveraged trading, which requires investors to pledge assets in the form of margin and monitor market fluctuations to avoid forced liquidation. The leveraged tokens launched by FTX, such as 3x long Bitcoin and 3x short Ethereum, greatly simplify this process. Users can buy and sell leveraged tokens like trading ordinary spot tokens, without having to open a separate leverage account or pay margin. In addition, leveraged tokens lock the risk of market fluctuations within the daily range through a daily rebalancing mechanism, helping users avoid the risk of liquidation that may be caused by large market fluctuations.

For retail investors, the emergence of leveraged tokens lowers the threshold for participating in leveraged trading. They can obtain multiple market returns with a smaller capital cost, which was quite popular in the FTX market at the time. Now, this product has been absorbed by exchanges such as KuCoin and has been applied to popular tokens such as Bitcoin.

Triple short Bitcoin product on KuCoin. Source: KuCoin

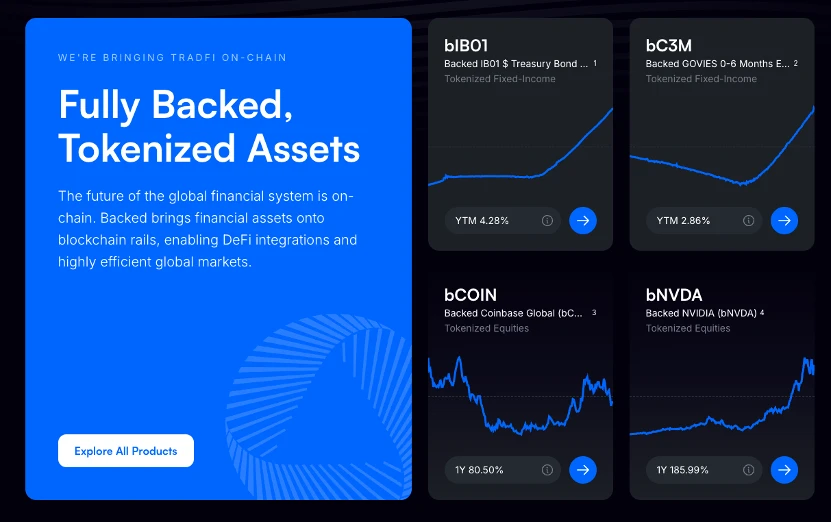

As for FTXs other product, the tokenized U.S. stock product, there is no large-scale product that can provide similar services so far. FTX provided tokenized products of multiple U.S. stock companies including Alibaba and Coinbase at the time; the launch of these tokenized U.S. stock products allowed global investors to easily participate in the U.S. stock market investment without opening a U.S. securities account . FTX circulates these stock assets on the blockchain in the form of tokens by working with regulated partners and custodians. These tokens are linked to the underlying stocks 1:1, and investors can directly trade tokenized U.S. stocks through the FTX platform.

This product solves many pain points of the traditional stock market. For example, investors are no longer restricted by region or regulation and do not need to open cumbersome securities accounts. At the same time, tokenized products support 24/7 trading , unlike the traditional stock market with fixed opening and closing times.

So far, protocols like Backed have been able to provide tokenized U.S. stock products to non-U.S. users , including stocks such as Nvidia, which was very popular some time ago. However, U.S. users still do not have a platform to buy tokenized U.S. stocks.

Tokenized US stocks provided by Backed. Source: Backed official website

Odaily previously reported that Base developer Jesse Pollak said in a post on the X platform that Coinbase is considering offering tokenized shares of its stock to US users of its Ethereum Layer 2 network Base. Pollak said that non-US users can already get tokenized COIN shares through protocols such as Backed (a tokenized RWA platform), and implementing COIN on Base is something we will study in the new year, adding that eventually every asset in the world will be implemented on Base. Jesse Pollak added that Coinbase has no specific plans at the moment.

This article is sourced from the internet: In FTX repayments, which currencies need to bear huge selling pressure?

Original | Odaily Planet Daily ( @OdailyChina ) Author | Fu Howe ( @vincent 31515173 ) In 2024, the investment and financing enthusiasm in the crypto field will be decoupled from the overall market trend, and VC coins will no longer dominate market performance. At the macro level, the crypto market ushered in many historical moments in 2024. With the launch of the Bitcoin spot ETF, the launch of the Ethereum spot ETF, the clarification of regulatory policies in various countries, the Federal Reserve’s announcement of a rate cut, and Trump’s upcoming return to the White House, and other positive macro-level influences, Bitcoin successfully broke through the important mark of $100,000. From the perspective of the crypto market, meme has become the focus of market attention, and different meme types…