Key indicators: (December 30, 4pm -> January 6, 4pm Hong Kong time)

-

BTC/USD rose 6.2% (93.5k USD -> 99.3k USD), ETH/USD rose 7.4% (3.4 -> 3.65k USD)

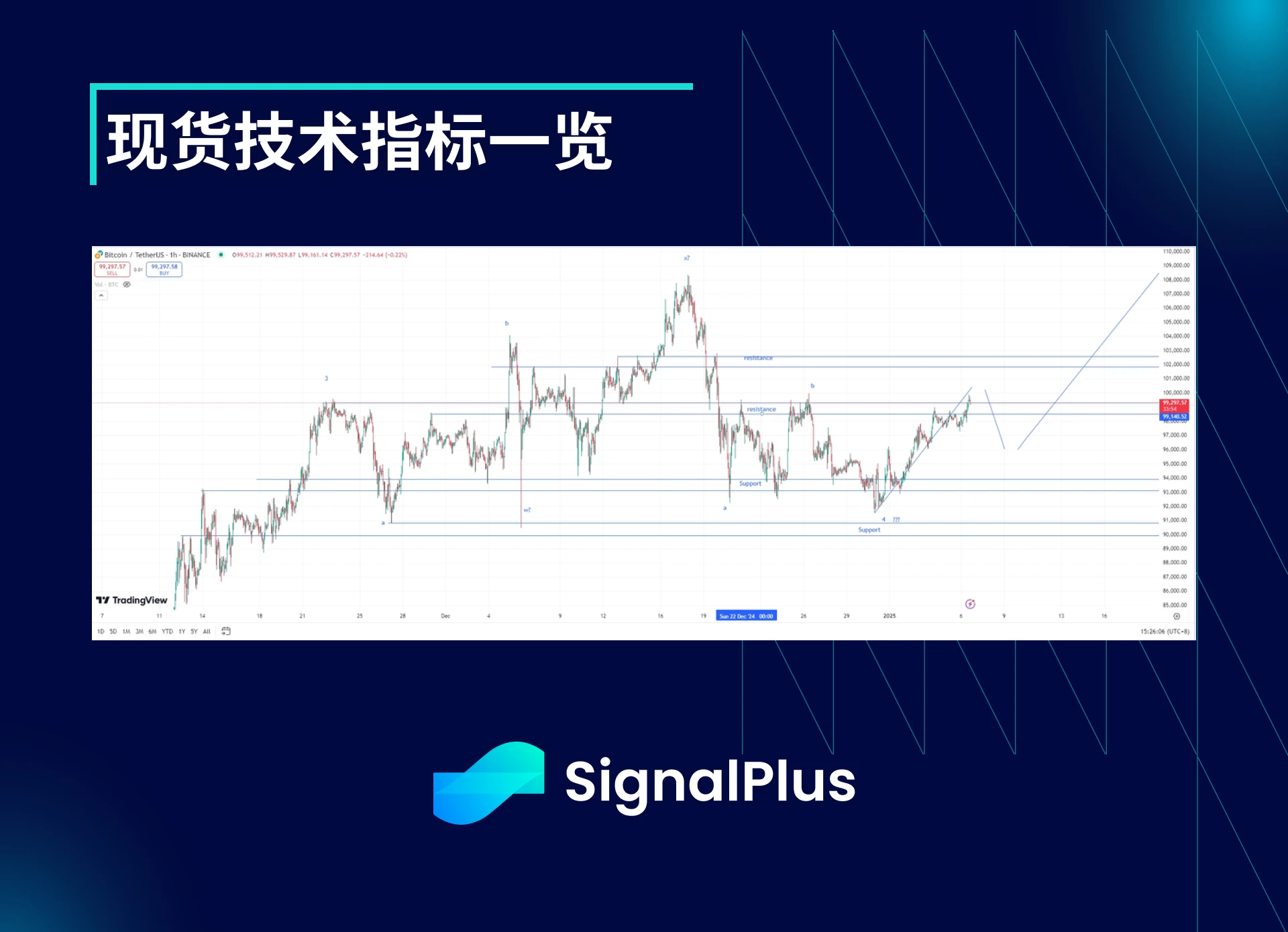

Spot technical indicators

-

At the end of 24 years, the price of the coin maintained the support point of $92,000. At the beginning of the new year, we saw that the market began to show a willingness to buy, and the price of the coin rose slightly to test the resistance level of $100,000. This strongly suggests that the market is accumulating strength for the next rise and accumulating long positions during the pullback. We believe that in the long run, the price of the coin will be in the range of $115-120,000.

-

We believe that the short-term top of the coin price will be at or slightly above $100k, and expect sellers to appear around this point. If there is a lack of more follow-up buying, it may trigger a drop back to the $95-96k range. However, if the price completely breaks through $100k, the next top will appear at $102-103k, followed by $104-105k and finally reach the previous high of $108.5k. On the downside, the initial support point is at $95-96k, and continued decline will reach below $92k.

Market Theme

-

It was another turbulent holiday week. The cryptocurrency market once again fell within a certain range, with BTC/USD falling below $93,000 and ETH/USD falling below $3,300. However, the arrival of the New Year brought momentum to the market. The market seems to be adjusting its positions in advance of Trumps inauguration this month.

-

Elsewhere, the “Trump trade” has also regained momentum. The dollar has gained ground against the G10/Asia trade, while the SP 500 (SPX) has started to recover after a drop at the start of the year.

-

On the macro front, this week is relatively light on data until Fridays non-farm payrolls. The market is looking forward to this data, especially after the Fed caught the market off guard with a relatively hawkish stance in December. If there are any downside surprises, the market may quickly re-price for faster rate cuts.

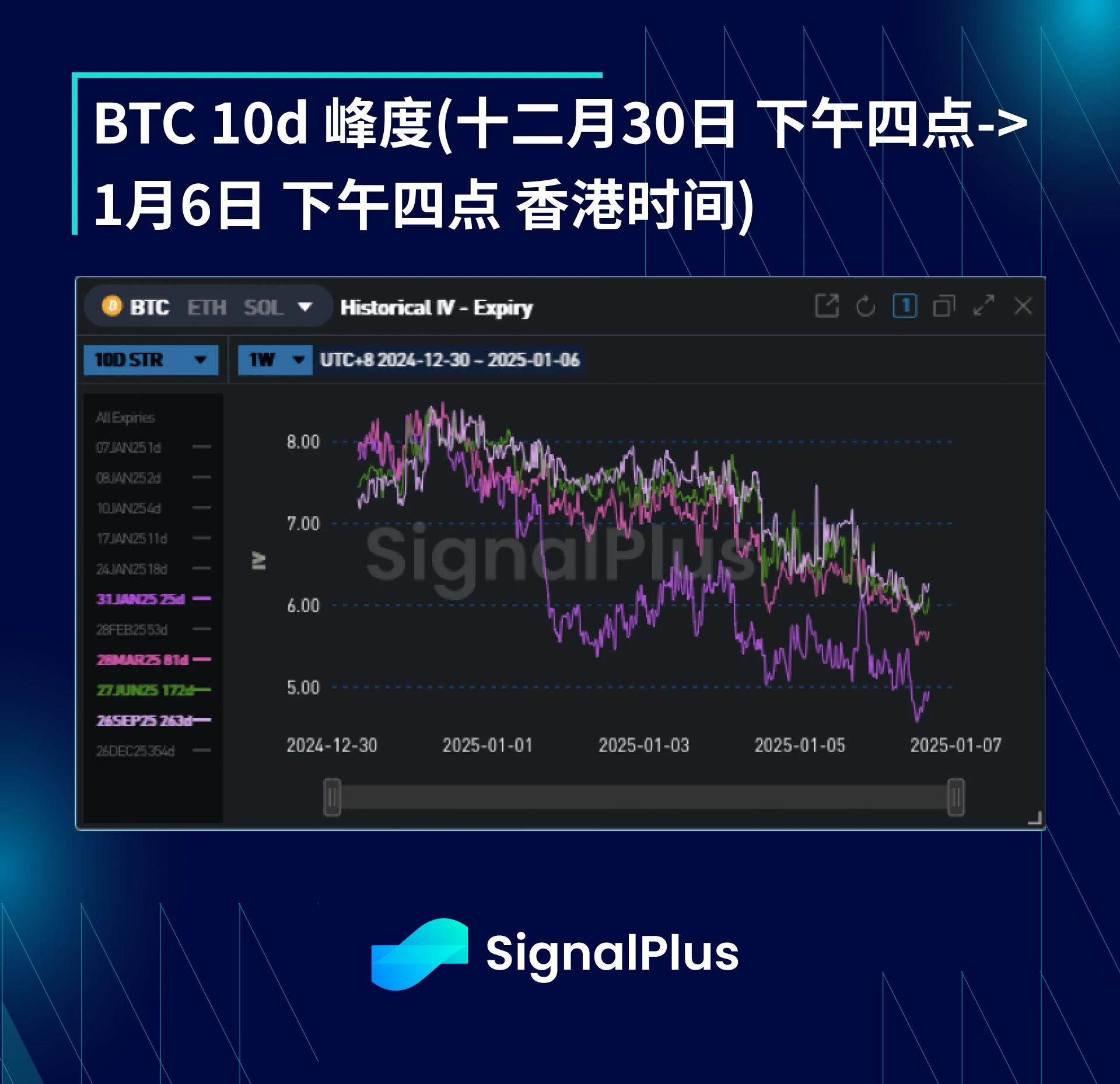

BTC Implied Volatility

-

Although the price of the currency fluctuates greatly in some areas, the overall actual volatility continues to decline and further leads to a continuous decline in implied volatility, especially for the expiration date in January. The implied volatility for January expiration is currently lower than the same period last week, despite the inauguration of Trump in January and the rebalancing of ETFs at the beginning of the new year.

-

At the far end of the curve, implied volatility is still showing strong bids as the market continues to digest the strong demand that occurred in December, especially in the February and March expiration dates. Given the downward correction that has occurred in the January expiration date, we expect to see implied volatility at the far end gradually return to normal.

BTC Skewness/Kurtosis

-

Skewness is trending down this week as liquidity is fully restored in the market and the market returns to lower realized volatility from the year-end lows. If the market continues to rise slowly before the inauguration, we expect realized volatility to underperform as the market is relatively evenly distributed on the upside. However, if we see another sharp pullback in price, market players may actively participate in betting on the upside.

-

Kurtosis remains low for the same reasons as above. The demand for the flanks is starting to decrease as the spot market moves away from the $90k level where the potential for slippage is high. At the same time, the demand for single buy-alls above is also decreasing, or it is converted into a call spread and puts selling pressure on Kurtosis. The low correlation between spot and skewness also drags down the price of Kurtosis.

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility Weekly Review – (December 30 – January 6)

In recent years, Bitcoin has gradually transformed from a niche investment product to a mainstream asset that attracts global attention. Especially with the participation of corporate investors, its value proposition and application scenarios have been further deepened. Among many institutions, MicroStrategy is undoubtedly one of the most determined Bitcoin believers. Since 2020, MicroStrategy has embarked on its unprecedented journey of strategic Bitcoin reserves. Through continuous purchases and holdings, Bitcoin has become a core component of its balance sheet. So why has MicroStrategys Bitcoin strategy attracted so much attention from the market? In the future, can it push Bitcoin to $100,000 or even higher through this layout? This article will conduct an in-depth analysis from multiple dimensions such as strategic motivations, market impact, potential risks, and future prospects. Part 1: MicroStrategys…