Retail investors and venture capitalists: Finding a balance in Web3

Summary of key points

-

The imbalance in investment opportunities between retail investors and venture capital in the cryptocurrency market is a topic of ongoing discussion.

-

The Fair Launch platform seeks to address this imbalance by providing fair investment opportunities, but it still faces structural limitations.

-

Innovative approaches such as providing investment opportunities based on on-chain and off-chain data and using transparent fair launch mechanisms under artificial intelligence agents are attracting attention.

1. Introduction

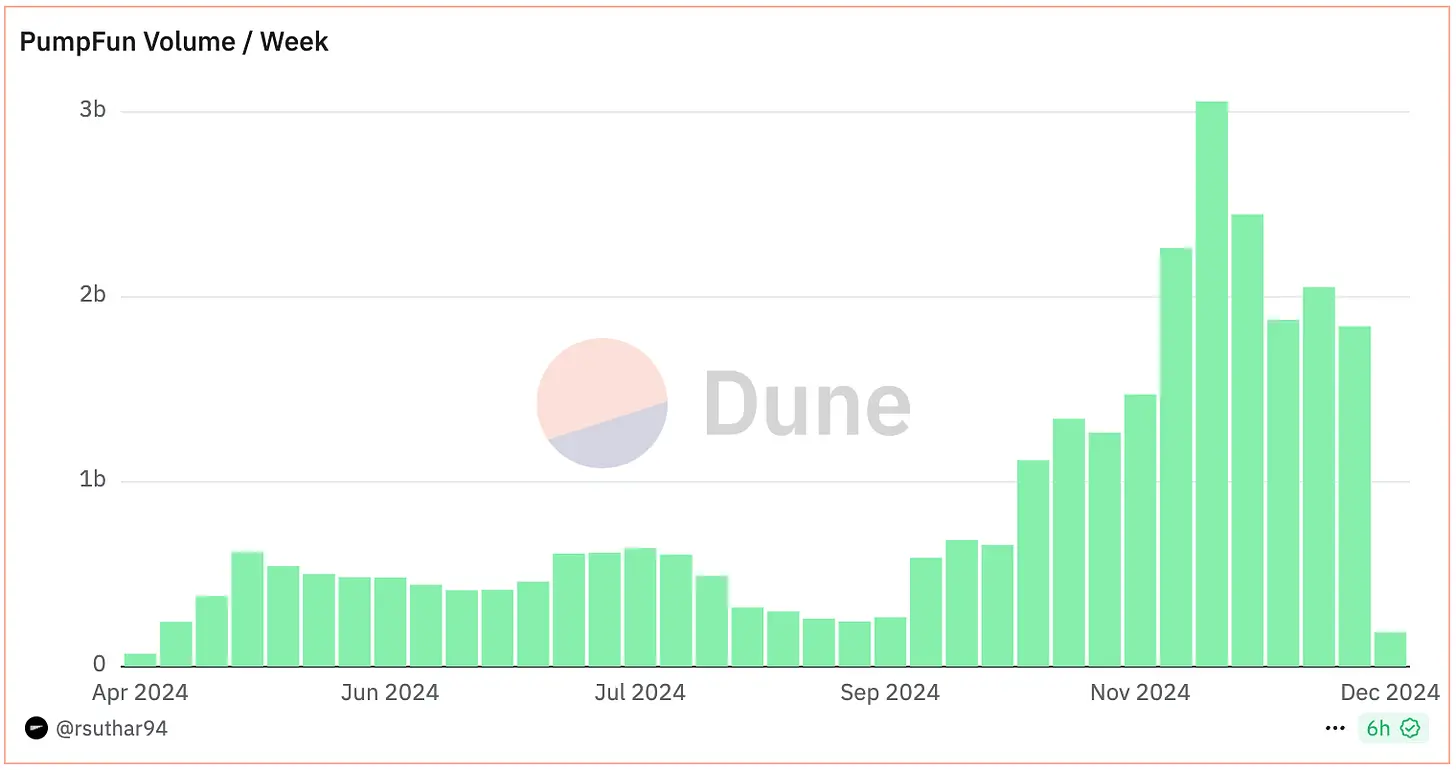

Source: rsuthar 94, Dune Analytics

Launchpad platforms such as Pump.fun and DAOS.Fun are gaining momentum in the cryptocurrency market. They have attracted much attention due to their high trading volume and active user participation. Unlike traditional ICOs and IEOs, these platforms adopt a fair issuance mechanism – all users are free to participate in the investment at the beginning of the token issuance, without the need to sell to capital parties in advance. This model has attracted widespread attention by enabling retail investors to participate from the beginning, share value and benefit from the fair distribution of tokens. This trend highlights the fact that retail investors have long been excluded from high-quality investment opportunities, while also raising market expectations for more inclusive investment models.

This report will analyze whether the Fair Launch platform can effectively solve the problem of unequal investment opportunities for retail investors and support the sustainable development of the cryptocurrency market.

2. Retail investors and venture capital: the origin of the conflict

Unequal investment opportunities between retail investors and venture capital firms have always been a chronic problem in traditional financial markets, and this problem also exists in the cryptocurrency market. Venture capital firms purchase a large number of tokens at low prices during the private placement phase and then sell them at higher prices in the open market to make a profit. This process puts retail investors at a disadvantage, forcing them to enter the market only after prices have already climbed, deepening their dissatisfaction with the lack of fair investment opportunities.

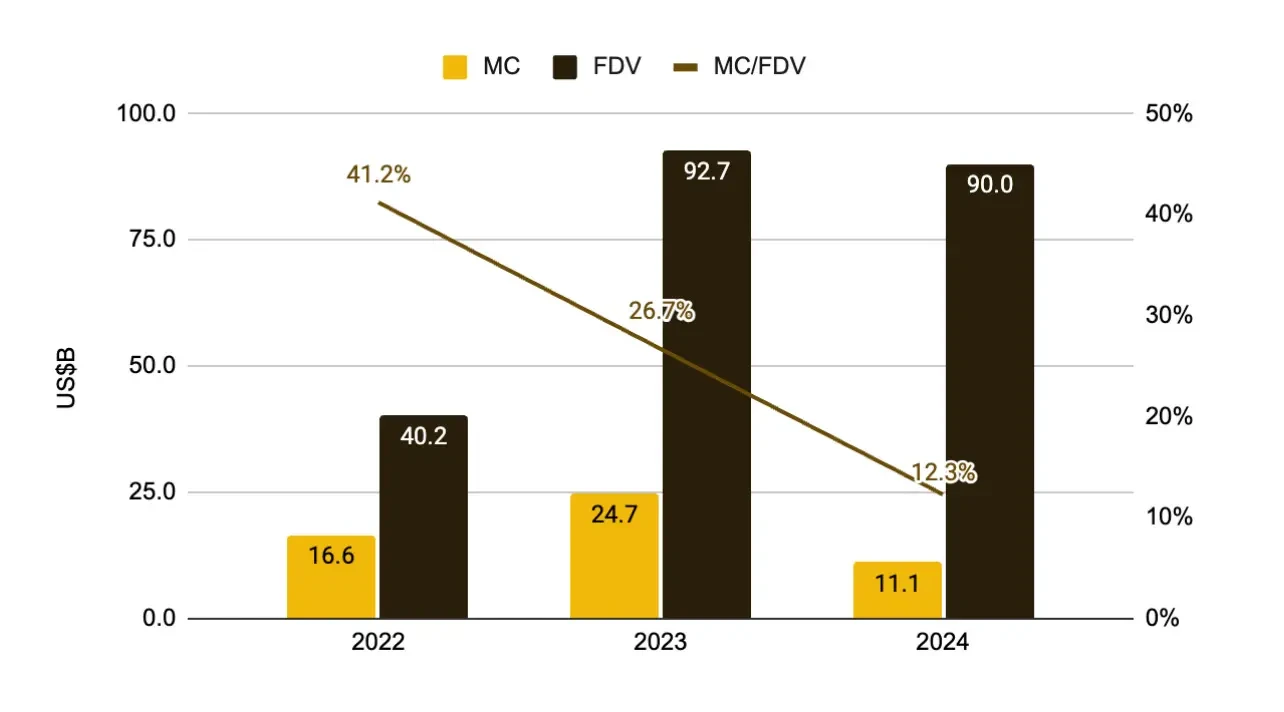

This problem is supported by data. According to Binance Research, the market capitalization (MC) / fully diluted valuation (FDV) ratio of the cryptocurrency market has continued to decline from 41.2% in 2022 to 12.3% in 2024. This shows that the proportion of tokens in circulation and trading on the market is declining, while the proportion of locked supply is increasing. The limited supply artificially raises the price of tokens, benefiting early investors such as venture capital. However, when a large amount of locked supply floods into the market during the unlocking period, the oversupply often causes a price crash, and retail investors bear the brunt of the losses. In the end, the inflated pricing at the time of issuance often causes retail investors to suffer financial losses.

In this context, retail investors are naturally attracted to fair issuance platforms. These platforms eliminate the risks of token unlocking by issuing all tokens at the beginning, providing an equal starting point for all participants. This model promotes balanced token distribution and the development of a healthier ecosystem, satisfying the demands of retail investors to participate in projects early.

3. Fair Launch Platform: A truly fair alternative or just another imbalance?

Fair launch platforms have opened up new opportunities for retail investors and positioned themselves as an alternative to traditional investment models. However, whether these platforms truly address the issue of unequal investment opportunities remains controversial. On the surface, they create a fair environment where all participants start from the same starting line. However, in practice, new forms of inequality and challenges are exposed.

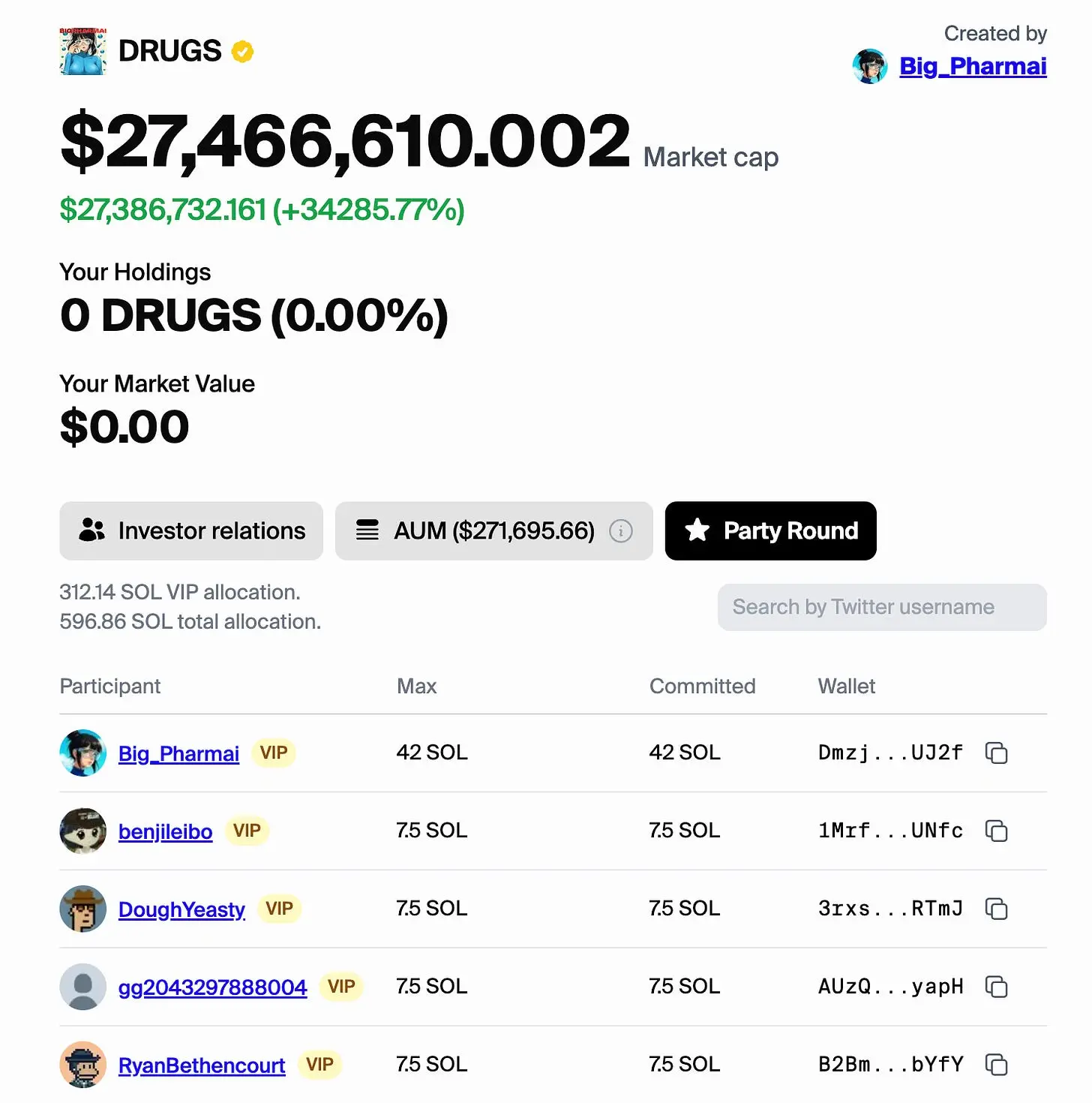

$DRUGS VIP participant list, source: DAOS.fun

Take Pump.fun as an example. The platform faces challenges brought by automated tools, such as token generation event (TGE) sniping robots and trend robots, which often preempt trading opportunities and squeeze retail investors to the back row. In addition, some projects undermine fairness through mechanisms such as whitelists, give priority to specific groups, or form interest groups to provide preferential conditions for insiders. These problems erode the original intention of fair launch platforms. The facts show that inequality has not been eliminated, but has only changed its form, and retail investors still have difficulty in getting fair participation opportunities. More worryingly, this pattern is now repeated at a faster frequency. Because fair launch platforms often skip the due diligence of traditional venture capital, retail investors are exposed to greater risks, further exacerbating the inequality of investment opportunities.

4. The underlying causes of unequal investment opportunities

The Fair Launch Platform does not fundamentally solve the problem of unequal investment opportunities. To understand this problem in depth, we need to look at it from a more fundamental perspective. This inequality is not limited to the opportunity gap between retail investors and venture capitalists, nor is it just about the fairness of opportunities. More importantly, it threatens the long-term sustainable development of the entire ecosystem.

If a project is only pursuing financing, then it is indeed logical to open investment opportunities to everyone. But a token-based ecosystem should not only focus on raising funds, it needs to grow with investors and ecosystem participants, and continue to create and develop value. This requires real participants who are not only concerned with short-term gains, but are willing to contribute to the long-term development of the ecosystem.

In this context, the role of venture capital is particularly important. Venture capital not only provides financial support, but also brings a wide network of contacts, human and material resources, and verifies the stability and reliability of the project through preliminary research and due diligence. This also explains why some fair launch platforms incentivize audited participants through early access.

To solve the problem of unequal investment opportunities, it is not enough to simply achieve equal access opportunities. The long-term growth and sustainability of the ecosystem requires a structured program that identifies and incentivizes participants who can make substantial contributions. This is a fundamental challenge that the Web3 ecosystem urgently needs to solve.

5. Finding a new balance: a value-driven ecosystem

The current cryptocurrency market is caught in two extremes: on one hand, the fair launch model that pursues absolute equality, and on the other hand, the traditional model centered on a small number of senior investors. Both models fail to fully reflect the intrinsic value of the Web3 industry. Therefore, we need to turn to a value-driven participant screening strategy, that is, to identify and attract participants who can make significant contributions to the ecosystem, focusing on their value creation capabilities rather than simply considering capital size or investor type. Two recent cases demonstrate the potential of this new approach.

5.1. Legion: Community Investment Round Platform

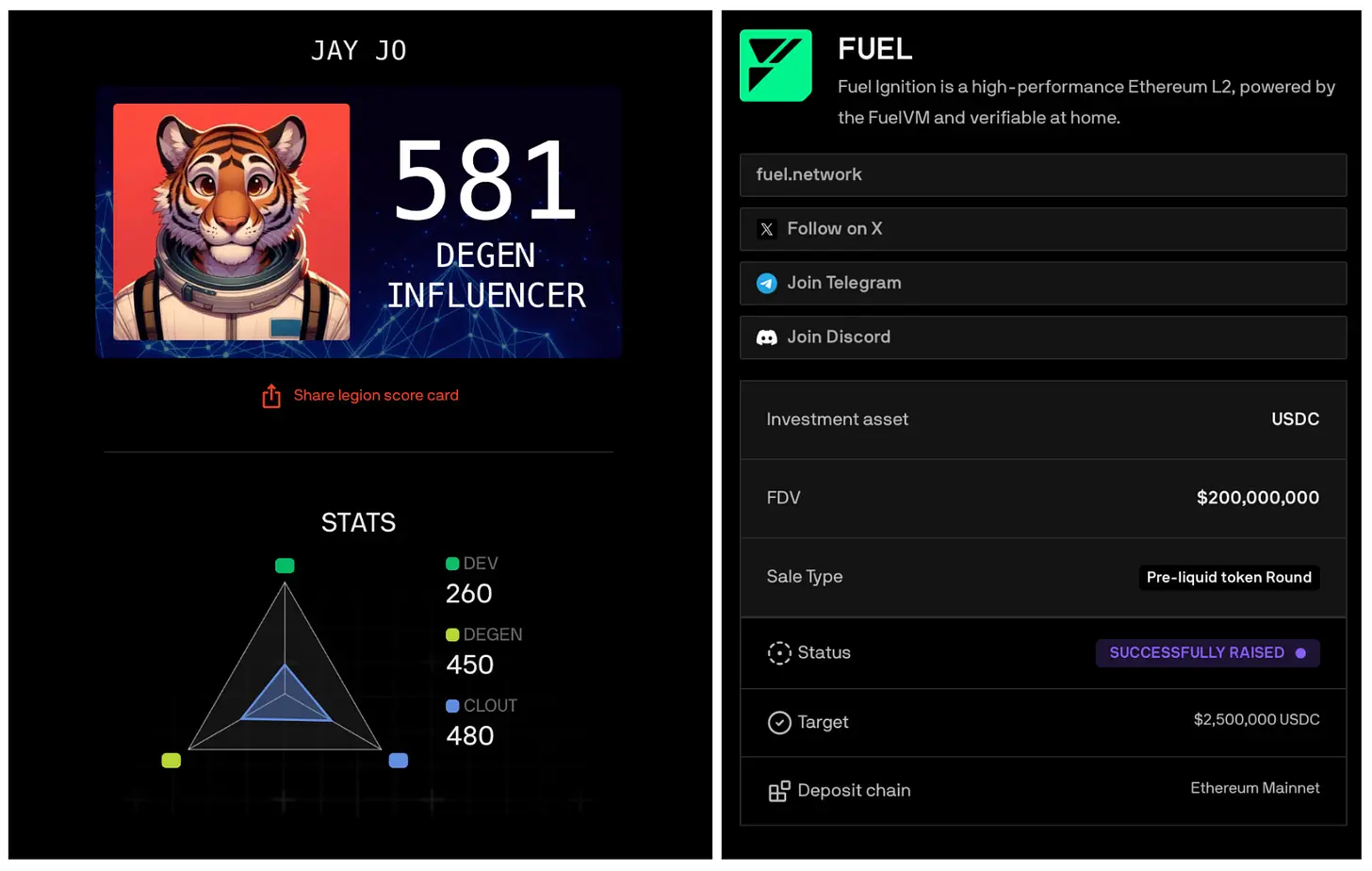

Source: Legion

As a community-driven investment platform, Legion is committed to screening investors who can create substantial value for the ecosystem. The platforms goal is not limited to raising funds, but also focuses on building sustainable partnerships between project owners and investors.

Source: Tiger Research, Legion

The Legion Score system at the core of the platform comprehensively evaluates investors on-chain activities, social influence, GitHub contributions, and project recognition. The scoring system is based on investors actual contribution to the ecosystem, rather than just considering their financial resources. Investors are required to submit a cover letter and Legion score, detailing their potential contributions and participation plans, which helps to build a bond of trust with the project. This approach not only improves the fairness of investment opportunities, but also promotes in-depth interaction between project parties and investors. Legion is pioneering a new investment model that not only enhances the credibility of the crypto market, but also creates a community ecosystem that focuses on contribution.

5.2. AI-Pool: A fair launch platform based on artificial intelligence agents

AI-Pool is an experimental AI agent-based fair launch platform proposed by X user Skely on December 24, 2024. The idea quickly gained traction and went viral within hours. Many investors poured money into the project, raising over $5 million. Note: Skelys account was suspended due to fake account reports. The exact reason is unclear as it was reported by a third party. Additionally, the platform is an early, untested, experimental project that is not yet stable or reliable. However, the users idea is still promising.

Source: Skely

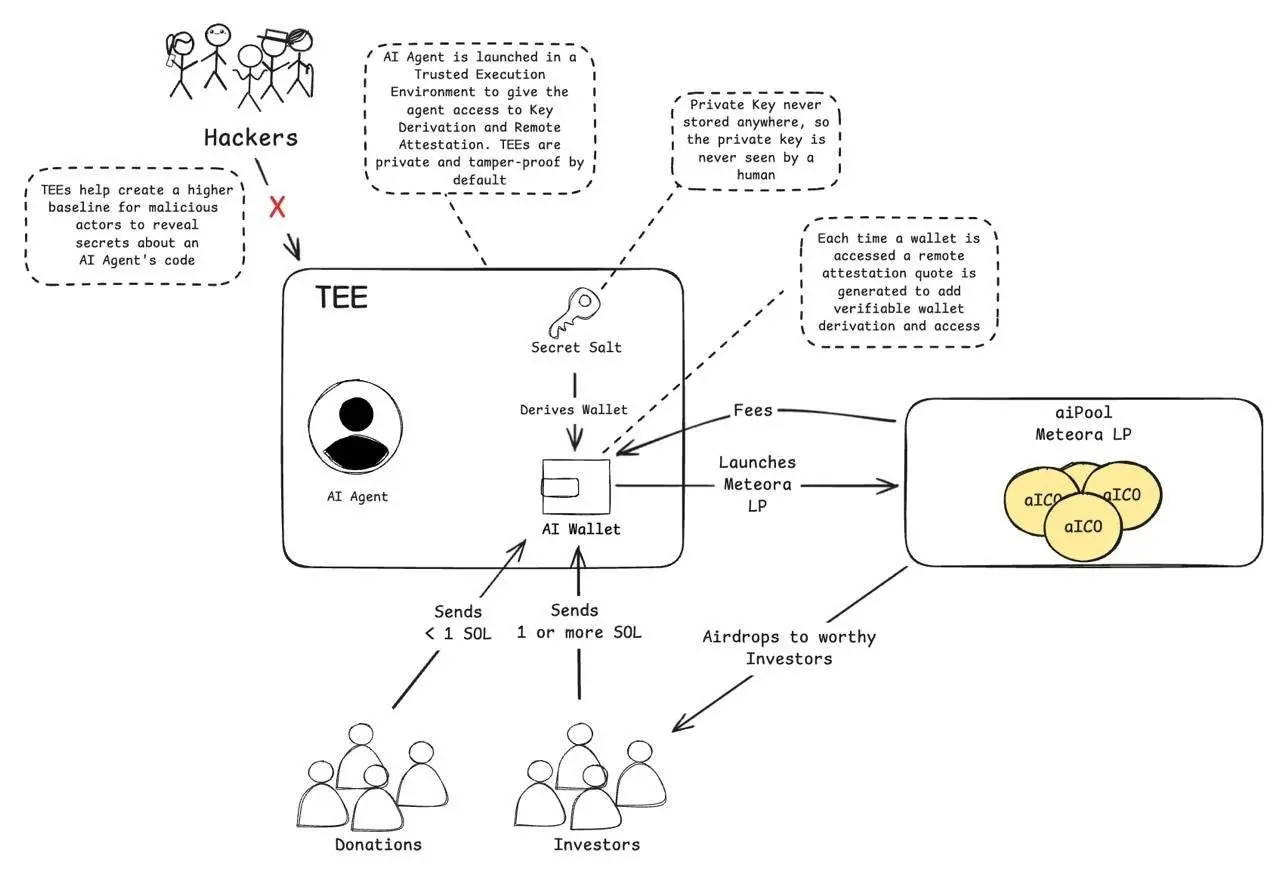

AI-Pool attempts to solve the pain points of existing fair launch platforms through AI agents. Compared with the centralized operations and insider trading problems common in traditional platforms, AI-Pool uses a trusted execution environment (TEE) to achieve process transparency. TEE protects the AI wallet private key and ensures the autonomous operation of the AI agent. This design effectively reduces the unfairness caused by centralized control and insider trading.

Although AI-Pool still faces challenges such as robot interference and insufficient liquidity, it has demonstrated unique advantages in ensuring the fairness of token issuance and initial distribution, and provides a new approach to solving the problem of unfair distribution on centralized platforms. With further improvement of technology, AI-Pool is expected to become a model for improving the trust and transparency of the cryptocurrency market.

6. Conclusion

The problem of unequal investment opportunities in the crypto market is often simplified to the confrontation between retail investors and venture capital, but in fact this is only superficial. Whether it is the KOL round that favors a specific group or the fair launch platform that fails to fully achieve fairness, it shows the deep inequality in the market. The innovative practices of Legion and AI-Pool provide new ideas for solving these problems: Legion screens valuable participants through a comprehensive data evaluation system; AI-Pool uses AI agents to improve process transparency. Both projects go beyond simple capital investment and show new directions for enhancing the trust and sustainability of the ecosystem.

The core value of the Web3 industry is to create equal opportunities and a fair environment for all participants through decentralization. To achieve this goal, we need to build a balanced ecosystem that eliminates bias and establish a collaborative mechanism that promotes healthy interaction between investors and project parties. These efforts will lay the foundation for a truly decentralized system.

Original link: https://reports.tiger-research.com/p/fair-launch-platform-eng

This article is sourced from the internet: Retail investors and venture capitalists: Finding a balance in Web3

Original author: Michael Zhao Will Ogden Moore Original translation: TechFlow In the future, AI agents are expected to revolutionize the way we interact with the world. They will be able to perform a range of tasks for us that have never been possible before. However, to truly unleash the potential of these digital entities, they need not only strong intelligence but also economic autonomy. Fortunately, blockchain technology provides an ideal solution for this – as demonstrated in a recent experiment with AI influencers. The so-called AI influencers are chatbots that run autonomously on social media. These robots can not only manage their own blockchain wallets, but more importantly, they can understand economic incentives and use resources rationally to achieve their goals. Grayscale Research said that as AI increasingly uses blockchain…