How to outperform the market in the money-making time? Grayscale Fund and Coin50 Index are worth paying attention to

When almost everyone was FUDing that there would be no altcoin season, the market finally came out of the garbage time of nearly half a year, and the altcoin season finally arrived as scheduled. According to statistics, among the 388 crypto assets tradable on Binance, 299 have increased by more than 50% in the past 30 days, 98 have increased by more than 100%, and only 10 targets have no increase at all.

However, in the general rise mode under the money-making time, how to choose the tokens with the highest increase has become a science from maximizing the use of funds. Which altcoins should you buy to outperform the market average? Instead of following the KOLs, it is better to let Grayscale and Coinbase work for you.

Grayscale Fund leads the market

In the last bull market, the concept of Grayscale was everywhere. In this bull market, it is still the same, and the concept of Grayscale still dominates the cryptocurrency circle.

Mainstream currency funds

Grayscale has launched a series of funds around the top 20 currencies by market value, such as BTC, ETH, SOL, XRP, AVAX, SUI, BCH, LINK, XLM, LTC, etc. Some leading currencies have also been shortlisted, such as STX, BAT, ZEC, MKR, and ZEN.

In addition to single-currency trust funds, the basket of currency combination funds launched by Grayscale still have strong reference value.

Grayscale Decentralized AI Fund

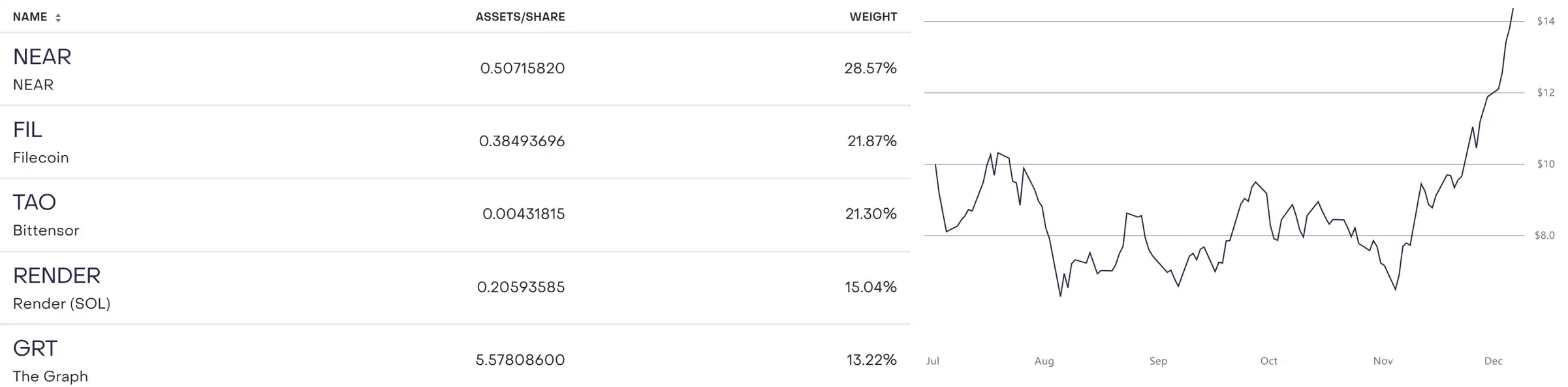

This package of decentralized AI funds includes AI targets such as Near, Filecoin, Bittensor, Render, and Graph. These targets have performed well this month, with NAV per share (net asset value per share) soaring from US$6 to US$14. The current asset management scale is US$2.2 million.

Left: Decentralized AI Fund Holdings; Right: NAV per Share

It is worth noting that Near, FIL, Bittensor and Livepeer, which are on the same track, all have independent Grayscale funds.

Grayscale DeFi Fund

Grayscale Decentralized Finance (DeFi) Fund is one of the first securities to invest in a basket of decentralized financial applications and gain value from them, including UNI AAVE LDO MKR SNX and other targets. It has performed well in the past month, with NAV per share soaring from $13 to $35. The current asset management scale is $8 million.

Left: Decentralized AI Fund Holdings; Right: NAV per Share

It is worth noting that Grayscale also has an independent AAVE fund.

In addition to the above funds, Grayscale plans to add new fund currencies in various tracks:

There are a total of 7 currencies in the DeFi track, namely: Jupiter (JUP), Ondo Finance (ONDO), Ethena (ENA), Core (CORE), THORChain (RUNE), Aerodrome (AERO), Pendle (PENDLE);

There are a total of 6 currencies in the underlying infrastructure track, namely: Celestia (TIA), Pyth Network (PYTH), Cosmos (ATOM), Akash (AKT), UMA Project (UMA), Neon (NEON);

There are 9 currencies in the Layer 1 track, namely: Toncoin (TON), TRON (TRX), Aptos (APT), Aptos (APT), Injective Protocol (INJ), Internet Computer (ICP), Kaspa (KAS), VeChain (VET), Mantra (OM), Celo (CELO);

There are a total of 8 currencies in the Layer 2 track, namely: Optimism (OP), Arbitrum (ARB), Sei (SEI), Starknet (STRK), Polygon (POL, formerly MATIC), Mantle (MNT), Immutable (IMX), Metis (METIS);

There are 2 currencies in the DePIN track, namely: Arweave (AR) and Helium (HNT);

There are 2 currencies in the AI + track, namely: Fetch.ai (FET) and Worldcoin (WLD);

There is 1 currency in the Meme track: Dogecoin (DOGE)

Among the Grayscale concept coins listed above, almost all of them have outperformed the average increase in the bull market. In addition to the Grayscale Selection, which is essential for the bull market, the Coin 50 Index established by Coinbase is also a good reference standard.

Coin 50: The Nasdaq of Crypto

What is Coin 50 Index?

As the saying goes, first-rate companies set standards, second-rate companies set brands, and third-rate companies make products. Benchmarking the SP and Nasdaq, Coinbase uses its top 50 high-quality cryptocurrencies by market value to form COIN 50, establishing the worlds leading digital asset benchmark index. COIN 50 aims to provide investors with a transparent and reliable tool to better understand and evaluate the performance of the cryptocurrency market.

How is Coin 50 performing?

From the perspective of weight composition, BTC ETH SOL is still the most important asset in encryption, among which BTC accounts for 50%, ETH accounts for 28.8%, and SOL accounts for 6.4%.

Also in the top five are XRP and DOGE, accounting for 2.9% and 1.4% respectively, while the remaining crypto assets within the indicator account for 10.4% of the weight.

The COIN 50 index has achieved a return rate of 68.30% in the past 30 days and 99.64% in the past 90 days. This amazing return rate can still be achieved when the weight of BTC and ETH accounts for 70%. It can be seen how exaggerated the return rate of other crypto assets within this index is, except for large-cap currencies such as BTC and ETH.

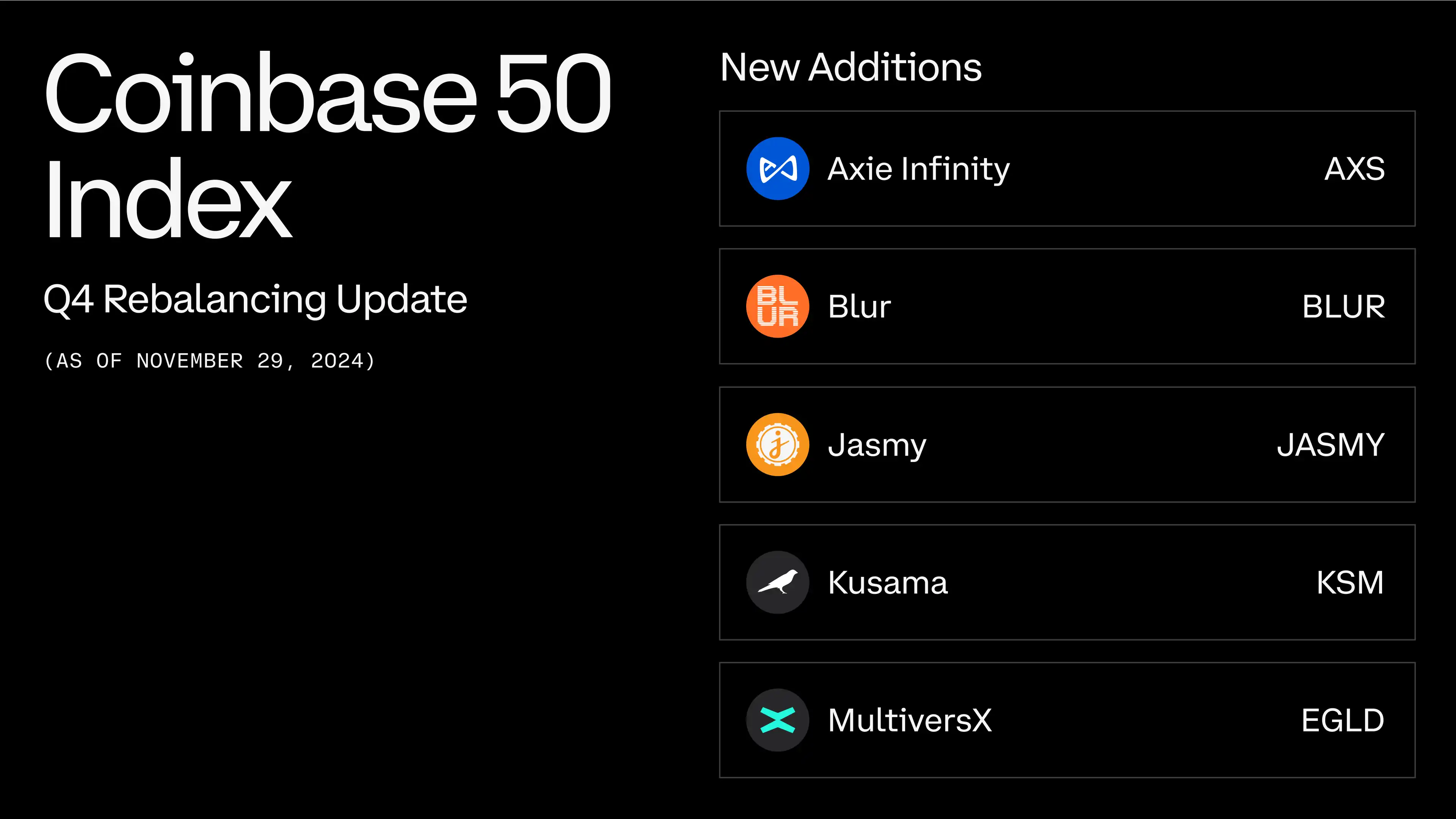

It is worth noting that the COIN 50 index is not constant, and tokens are added and deleted every quarter based on their fundamentals. Recently, tokens AXS BLUR, JASMY, KSM, and EGLD have all been included in the COIN 50 index.

Where are the opportunities?

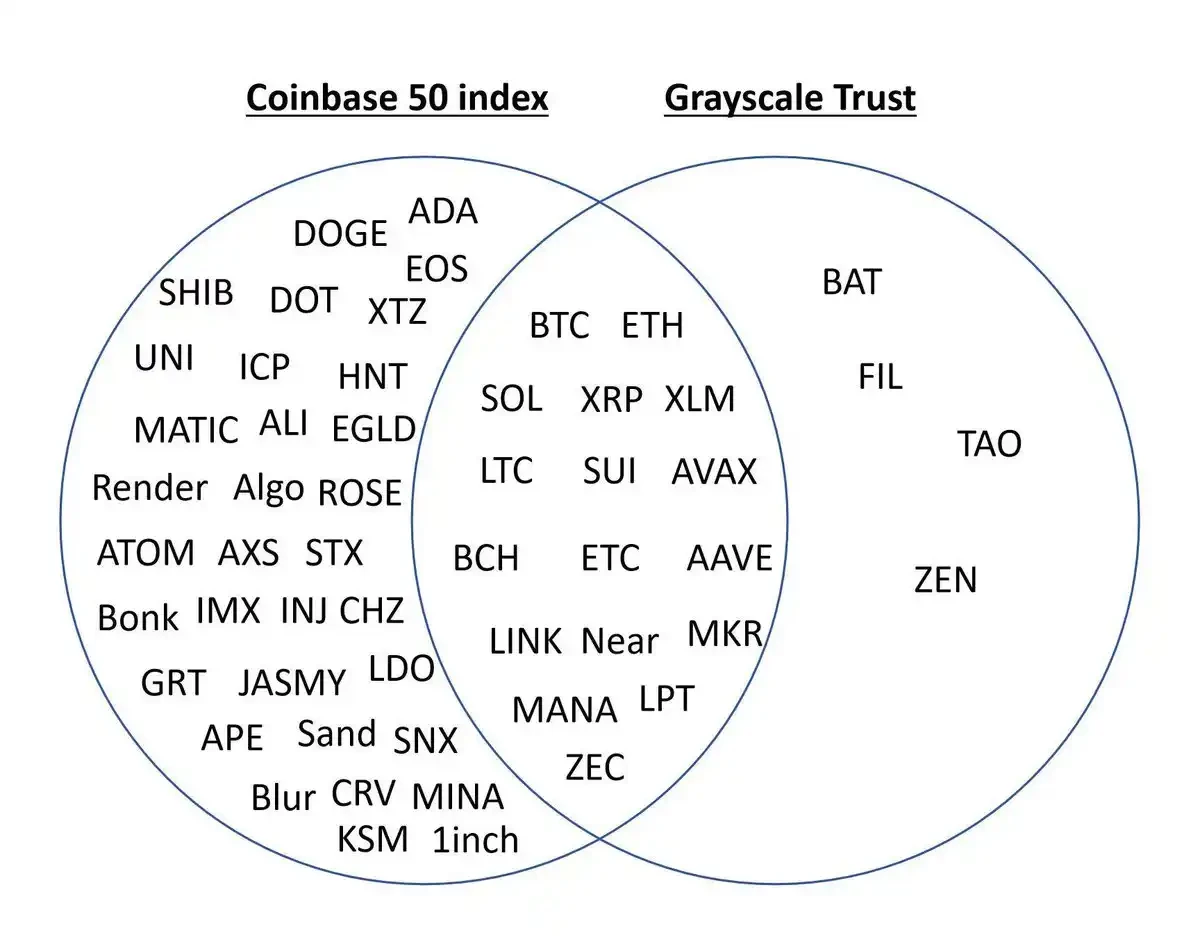

By summarizing the crypto assets of COIN 50 and Grayscale Trust Fund, we can get some highly overlapping assets. In addition to BTC, ETH, SOL, etc., XRP, XLM, SUI, AVAX, AAVE, LINK, LPT, etc. have all experienced exponential growth in the past 60 days. And the main funds for the growth of these assets come from American institutions, which can undertake large funds.

At the same time, many people think this is hindsight. What you said has already risen, where is the opportunity?

However, the bull market allows those who are well prepared to make big money, those who are slightly prepared to make money, and those who are unprepared to experience making money.

After understanding the power of Coin 50 and Grayscale’s holdings, there are still many “wealth codes” surrounding this main line that can allow people who are “slightly prepared” to make money.

for example:

(1) You can explore projects that are waiting to rise. Not all the currencies in the above list soared at the same time, but there was a certain sector rotation. After SOL SUI was shut down, it was XRP XLM. After XRP XLM rested, it was blue chip Defi, followed by hot track projects such as LPT. You can ambush projects waiting to rise, such as APE BLUR ZEC, etc.

(2) In the traditional financial market, we take the US stock market as an example. In 1993, the first US ETF, the Standard Poors Depositary Receipt (SPDR SP 500 ETF), was listed on the New York Stock Exchange. From 2000 to 2009, the US ETF market expanded rapidly, forming a diversified asset class including broad-based, industry-themed, Smart Beta, fixed income and commodity ETFs. The crypto market is still in its infancy compared to the mature traditional financial market.

Currently, ETFs such as BTC, ETH, and SOL have been approved, and there is a high probability that XRP ETF will be approved. After these leading ETFs are completed, there will definitely be a package of ETFs based on various sub-sectors in the future, such as DeFi ETF, AI ETF, Meme ETF, and so on.

The compound growth rate of US ETFs from 2010 to 2021 was 19.7%. It is foreseeable that there will still be many growth opportunities for crypto asset ETFs in the future.

This article is sourced from the internet: How to outperform the market in the money-making time? Grayscale Fund and Coin50 Index are worth paying attention to

Original | Odaily Planet Daily ( @OdailyChina ) Author: Azuma ( @azuma_eth ) As U.S. President-elect Trumps second term approaches, some key positions in his cabinet have surfaced in the past few days, but the battle for the position of Treasury Secretary has become increasingly fierce. According to current market expectations, the nomination for the new Treasury Secretary may be announced as early as this week, but the Trump team has not yet decided on the final candidate. This morning, Fox Business reporter Charles Gasparino revealed that the Trump team has sought advice from BlackRock CEO Larry Fink and at least one BlackRock executive; in addition, Trump will meet with Coinbase CEO Brian Armstrong to discuss personnel issues for the next administration. The prediction market Polymarket has opened a guessing…