Bitcoin never gives up: $100,000 per coin, from zero to $2 trillion in 16 years

On December 5, 2024, a single Bitcoin was worth $100,000, a record high, with a market value of $2.1 trillion. It has officially entered the six-digit range. The $100,000 that was once out of reach and even seemed unrealistic is now history.

Any asset that has grown from zero to a trillion-dollar market value must have a magnificent story behind it, and Bitcoin is no exception. For those of us who are in the game, we feel that the journey of Bitcoin over the past decade can only be described as magical. The Bitcoin network was officially launched on January 3, 2009, and the initial trading price of Bitcoin was $0.0008.

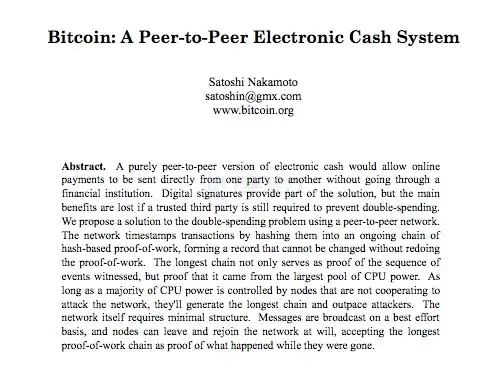

At a price of 100,000, Bitcoin has increased by more than 125 million times. Let us return to the starting point of the birth of encryption and commemorate the release of the Bitcoin white paper.

The 2008 financial crisis, where it all started

Compared to the glory of Bitcoin today, its birth is insignificant.

In November 2008, a paper signed by Satoshi Nakamoto was published on the Internet, titled Bitcoin: A Peer-to-Peer Electronic Cash System. The paper describes in detail how to use a peer-to-peer network to create an electronic transaction system that does not rely on trust.

The birth of Bitcoin directly reflects Satoshi Nakamotos deep disappointment with the financial system at the time. In September 2008, the financial crisis triggered by the collapse of Lehman Brothers broke out in the United States and quickly spread to the world. In order to save the economy on the verge of collapse, the US government took unprecedented intervention measures: huge public funds to rescue the market and excessive money issuance caused by quantitative easing policies. Although these measures alleviated the crisis in the short term, they also brought a series of sequelae such as inflation, market turmoil and exchange rate fluctuations.

Therefore, Satoshi Nakamoto came up with a bold idea: to create a monetary system independent of the government and financial institutions. In the traditional system, currency is issued by the central bank, and transactions are recorded and confirmed by banks. Bitcoin breaks this model and makes peer-to-peer transactions possible through decentralized blockchain technology without the need for third-party intervention.

The core design of Bitcoin also reflects its philosophy: its total amount is limited to 21 million, avoiding the risk of depreciation of traditional currencies due to unlimited issuance. This design ensures the scarcity of Bitcoin, allowing it to serve as digital gold in an inflationary environment. This feature has attracted widespread attention from cryptography enthusiasts and economists.

However, there is controversy in the economics community over the quantitative design of Bitcoin. Scholars of the Keynesian school believe that a fixed total amount deprives monetary policy of flexibility, and the deflationary effect may drag down economic development. Supporters of the Austrian school believe that a fixed total amount of money helps reduce human intervention, and deflation may instead encourage market efficiency.

Two months after the publication of Satoshi Nakamotos paper, on January 3, 2009, on a small server in Helsinki, Finland, Satoshi Nakamoto personally mined the Genesis Block of Bitcoin. As a reward, he received the first batch of 50 Bitcoins, and the first Bitcoin was born.

Silk Road, Black Demand

For a long time after Bitcoin was invented, no one was interested in it. People wondered: What practical use does this invention have? Even Satoshi Nakamoto, the founder who is regarded as a genius, has never given a clear answer. In December 2010, he left his last message online and then disappeared mysteriously.

In the early years of Bitcoin, its value always hovered around $0.1 per coin. The most famous transaction during that time was when someone used 10,000 Bitcoins to buy a pizza. Although Bitcoin was designed to be perfect, it was like a play that no one performed and was considered to have no practical significance – until it met another genius.

Ross Ulbricht, born in 1984, has been involved in drug trafficking since college. Due to the governments strict control over drugs, his business has never been able to scale up. The turning point came in 2010, when he heard about the existence of Bitcoin from his customers.

Ross Ulbricht

The key to the governments crackdown on illegal activities lies in the regulation of capital flows, which relies on the traditional banking system. However, as a decentralized and difficult-to-trace payment tool, Bitcoin is naturally suitable for circumventing regulation. Ross was keenly aware that this was exactly the tool he needed. In January 2011, 26-year-old Ross created a deep network platform, which is often referred to as the dark web. He named the platform Silk Road, symbolizing a free trading market.

However, the Silk Road traded not tea, silk or porcelain, but illegal goods such as drugs, human beings, child pornography, hired killers, arms and fake documents. This platform quickly became the worlds most notorious dark web market, attracting a large number of illegal traders.

With the rise of the Silk Road, Bitcoin finally found its first large-scale application scenario: a payment tool for criminal transactions. According to statistics, more than 9.5 million Bitcoins were circulated on the Silk Road, accounting for 80% of the total Bitcoin circulation at the time. This undoubtedly pushed Bitcoin to the forefront of public opinion.

Rosss criminal behavior eventually backfired. Not only did he use Silk Road to trade drugs, he also tried to resolve business disputes by hiring hitmen. In August 2013, he was arrested at a public library in San Francisco. In 2015, Ross was sentenced to life in prison without parole.

Screenshot of the Silk Road website

Just like the consensus of fools is also a consensus, the demand of black is also a demand.

Driven by criminal transactions, Bitcoin experienced its first surge, reaching $31 in June 2011. Two months after Ross was arrested, Bitcoin rose to $1,100 per coin. In conclusion, Ross is an important figure in the history of Bitcoin development. When Bitcoin was about to be ignored by the world, he ended the history of Bitcoin as a toy and gave it real-world significance – serving crime.

Criminals are the most likely to embrace new technologies, said Xu Zhihong, a partner at Biyou. Law enforcement agencies have gradually mastered the technology to trace Bitcoin transactions, weakening its appeal in the illegal market. More and more criminal transactions have begun to turn to cryptocurrencies that are more difficult to track, such as Monero, so Bitcoin has started a long bear market that has lasted for several years.

Block size wars and forks in the road

Fast forward to 2015, the Bitcoin community ushered in the most intense controversy in history – the block size war. This block size war not only caused the community to split, but also led to the largest hard fork in Bitcoin history.

Since Satoshi Nakamoto designed Bitcoin in 2009, the block size has been limited to 1 megabyte. The original intention of this design was to prevent meaningless transactions and network data expansion. However, as the number of users increased, this limit gradually became inadequate: transaction congestion, soaring fees, and delayed confirmation time. In 2013, core developer Jeff Garzik proposed to increase the block size to 2 megabytes, which first triggered a heated discussion in the community about expansion.

By 2015, the rapid growth of transaction volume made the expansion issue urgent. The Bitcoin developer camp split into two factions: those who supported large blocks advocated direct expansion to solve the congestion problem; opponents believed that decentralization was more important and advocated improving transaction efficiency through technical optimization.

Gavin Andresen and Mike Hearn, developers who support the expansion, believe that the goal of Bitcoin is to be an efficient electronic cash system rather than just a value storage tool. To this end, they proposed the BIP-101 proposal, suggesting that the block size be increased to 8 megabytes. They believe that Bitcoin transfers are becoming slower and slower, and the transaction fees required for transfers are getting higher and higher. If this continues, Bitcoin will become as mediocre as bank card transfers.

Opponents include core developers such as Greg Maxell, Luke-Jr and Pieter Wuille, who warn that large blocks may increase the hardware cost of running nodes, reduce the number of full nodes, and weaken the decentralization of the Bitcoin network. They prefer to adopt second-layer solutions such as Segregated Witness and Lightning Network to optimize transactions without changing the block size. Related reading: History Today|Eight Years of Block Size War, the Philosophical Revelation of Blockchains Checks and Balances

This dispute also directly led to the birth of Ethereum. Ethereum founder Vitalik Buterin is a staunch supporter of Bitcoins large blocks. When he realized that Bitcoin might find it difficult to move towards large blocks, he took a different approach and transferred the scalability problem to a new chain. With larger blocks and flexible smart contract design to reduce transaction fees, Ethereum will be able to do more.

On February 20, 2016, the two parties reached an agreement in Hong Kong called the Hong Kong Consensus. The agreement included the implementation of the Segregated Witness technology and subsequent expansion plans, and was once seen as a major breakthrough in calming the controversy. However, the agreement was quickly denied because the core developers of Bitcoin Core did not participate in the signing and did not fully express their views. The breakdown of the Hong Kong Consensus has intensified community conflicts, and the trust between miners and developers has almost disappeared.

With the failure of the Hong Kong consensus, the dispute escalated into a philosophical confrontation about the future direction of Bitcoin. One side emphasized transaction efficiency, while the other insisted on decentralization. This disagreement eventually led to a hard fork in 2017. Bitmain founder Jihan Wu became the representative of the big block faction, advocating the creation of a new chain through a fork to support the 8-megabyte big block plan.

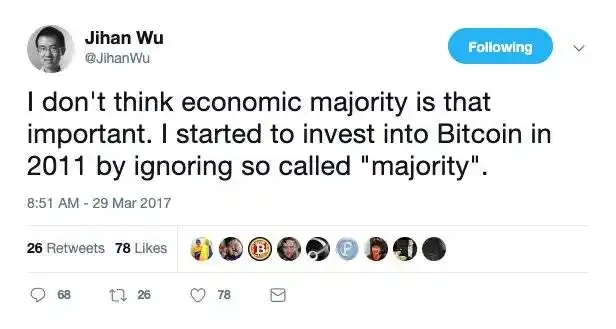

One day in March 2017, Wu Jihan wrote on Twitter, I dont think the economic majority is important. I ignored the so-called majority when I started investing in Bitcoin in 2011. He decided to start a new business and stop playing with Bitcoin Core.

At that time, Wu Jihan, as one of the founders of Bitmain, the worlds largest cryptocurrency mining machine manufacturer, was ranked among the top 50 self-made people born in the 1980s in Huruns Wealth List of Post-80s with assets of RMB 16.5 billion. Bitmain controlled more than 60% of the computing power of the Bitcoin network, and Wu Jihan was also considered the only person who had the opportunity to destroy and control Bitcoin at the time. Therefore, Wu Jihans fork plan was supported by miners and some developers.

On August 1, 2017, the fork officially occurred and Bitcoin Cash (BCH) was born. BCH is designed to support large blocks, is incompatible with Segregated Witness technology, and can handle more transactions. At the same time, the Bitcoin Core camp insists on the 1-megabyte small block plan and optimizes transaction efficiency through Segregated Witness and Lightning Network.

After the fork, Bitcoin and Bitcoin Cash developed along different paths. Wu Jihan sought market recognition for BCH by raising the price of BCH and weakening the computing power of BTC. In the short term, the price of BCH soared from $200 to nearly $900, triggering a wave of miners to switch. However, Bitcoins brand effect and huge ecosystem have always made it dominant. Over time, the price and market value of BCH have gradually shrunk, and its computing power share has continued to decline.

However, with the advent of the bear market in 2018, the price of BCH plummeted, and Bitmain, which had a heavy position in BCH, suffered heavy losses. Since then, BCH has maintained a ratio of 1:20 with Bitcoin in terms of price and computing power. It was also because of the heavy position of BCH that Bitmain was questioned for relying on the sale of BCH in exchange for income when it went public in Hong Kong in 2018.

Looking back two years after the Bitcoin fork, the BTC fork has long been settled, and BCH has also taken another parallel route. But this fork has had a profound impact on the entire Bitcoin ecosystem. Related reading: The History of Bitcoin Forks .

Miners Story

If I told you today that Bitcoin had a chance to be controlled by the Chinese ten years ago, would you believe it?

One night in May 2010, a hungry programmer exchanged 10,000 bitcoins for two pizzas worth $30, and bitcoin had its first price – $0.003. This invisible and intangible protocol has since had real value, and what followed was a bull market full of myths about wealth creation and the rise of crypto mining.

In the early days, Bitcoin had no value, and few people participated in the network. Mining only required a computer CPU. Hal Finney was one of the earliest miners at the time. He mined thousands of Bitcoins with his computer in a week or two. Later, he turned off the mining software because the CPU was overheating and the computer fan noise was annoying.

But this transaction of $0.003 changed everything. Seeing that Bitcoin mining was profitable, more and more people participated in the network, and soon, geeks from all walks of life began to write their own GPU graphics card mining programs and build targeted mining machines, which are now known as mining machines.

Soon, this technological craze spread to domestic geek forums, sparking heated discussions among a small group of people. In 2011, Wu Jihan funded Changxia and established Babbitt, the earliest Bitcoin forum in China, and began to discuss how to mine on the forum. Zhang Nangeng, who studied integrated circuit design at Beihang University, became famous for making FPGA mining machines and was called Pumpkin Zhang by netizens. In addition, there is Xigua Li, a software engineer from Guilin, who developed the popular Watermelon Miner.

When GPUs were becoming popular, a small American company called Butterfly Labs began to announce that it would develop a machine specifically for Bitcoin mining – ASIC. This machine abandoned all other computer functions and was specifically designed for Bitcoins SHA-256 algorithm, with a speed far exceeding that of GPU mining machines.

Butterfly mining machine, picture from the Internet

After the concept of ASIC mining machines spread to China, some people took action soon. In addition to the previously mentioned Pumpkin Zhang Zhang Nangeng, there is another legendary figure in the mining circle, Fried Cat Jiang Xinyu. Fried Cat entered the University of Science and Technology of China at the age of 15, and later went to Yale to pursue a doctorate in computer science. When he first heard about Bitcoin, he was attracted by its concept. Before he finished his studies, he ran back to China to work as a miner, becoming the second person in China to develop an ASIC mining machine after Zhang Nangeng.

In August 2012, BBQ established a company in Shenzhen and conducted an IPO on the Internet, issuing 160,000 shares at a price of 0.1 bitcoin per share, with the code ASICMINER. Afterwards, he used the crowdfunding funds to open a mining farm in Shenzhen and used his own mining machines to mine bitcoins. It is rumored that he made 200 million yuan in 3 months.

One of the few public photos of FriedCat (left), the picture comes from the Internet

17 days after the release of the ASIC prototype of Baked Cat, Zhang Nangeng also formed his own Avalon team and completed the delivery of the first mining machine Avalon 1. While Baked Cat and Zhang Nangeng were developing rapidly, another competitor also rushed into the market. In the first half of 2013, Wu Jihan founded Bitmain and launched 3 computing chips in just 13 months, forming a three-legged tripod with Baked Cat and Zhang Nangeng. After the winter, Bitmains Antminer S 1 swept a large number of competitors, allowing its mining machine agents to make a lot of money.

For Kaomao and Zhang Nangeng, it is also difficult to get a machine and their business is booming. The era of Bitcoin ASIC mining machines is coming.

The huge wealth effect attracted countless entrepreneurs to join the market and produce a variety of Bitcoin mining machines, including Chrysanthemum Miners, Xiaoqiang Miners, and Silverfish Miners. Manufacturers competed with each other, and the iteration of mining machines became faster and faster, so that there was a crazy phenomenon that early bookings of futures mining machines became outdated after they were received. Later, manufacturers found that their own mining machines were still on the production line, and the customers of their competitors had already received mining machines with better performance. Companies like Bitmain, which entered the market early, have begun to deploy larger-scale computing power in units of P. From then on, more than 70% of Bitcoins computing power has been firmly rooted in China.

On the other hand, led by geek miners, a large number of gold diggers have flooded into Chinas Bitcoin market. Driven by Chinese aunties, the price of Bitcoin has skyrocketed. After breaking through the 4,000 yuan mark, it has approached 7,000 yuan in a few days. At the beginning of the year, Bitcoin was less than 80 yuan. In just a few months, about 10 billion yuan of capital has been invested in the market, and China has become the worlds most enthusiastic market for mining and trading Bitcoin.

In the past 13 years, Bitcoin has created one wealth myth after another, and Li Xiaolai is the most typical one. This former New Oriental English teacher bought 100,000 Bitcoins in 2011 and has now become Chinas richest Bitcoiner. He not only founded the Bit Fund, but also established Yunbi.com. Lao Mao is another example. In 2010, Lao Mao was on a business trip with his boss and saw a report about Bitcoin in a newspaper at a newsstand, which changed his life trajectory.

Related reading: The end of Ethereum’s 8-year mining era: Vitalik Buterin, China’s mining industry, and Nvidia

The Great Migration

Time quickly came to 2021, and the dark moment for miners arrived.

At midnight on June 20, all Bitcoin mines in Sichuan were forced to cut off power under the document’s instructions. Previously, domestic Bitcoin miners had been constantly moving their machines from Inner Mongolia, Qinghai, Xinjiang, and Yunnan under the pressure of policy documents, with Sichuan becoming the last gathering place. However, the issuance of the Sichuan shutdown document completely dashed the miners’ hopes, and also meant that theoretically there would be no more mines in China, and China’s computing power, which once accounted for 75% of the entire Bitcoin network, would completely disappear from the map.

After that unforgettable night, what Chengdu, the capital of Chinas crypto mining industry, lacked the least was depressed and confused miners.

On June 22, in a jazz bar on the top floor of a five-star hotel in Chengdu, solemn-looking young men sat together in twos and threes, smoking and talking. Their T-shirts were printed with slogans from the cryptocurrency circle such as Bitcoin and To Da Moon. Their conversations were filled with keywords such as mining machines, going overseas and overseas resource docking. There were always a few people scattered in the corridor at the entrance of the bar, making phone calls to sell mining machines while pacing back and forth, smoking one cigarette after another.

On the same day, the Global Mining Resources Matchmaking Conference was held in a low-key manner at the venue of another five-star hotel in Chengdu. Miners who had lost power in various parts of Sichuan came here to systematically understand the overseas process from the introductions of various overseas companies, attempting to salvage the Noahs Ark to the other side of the ocean through mutual support and the wisdom of the masses.

It is not difficult to see from the state of the miners that the suspended Chinese Bitcoin mining industry has fallen into confusion and panic.

At Dujiangyan, 50 kilometers away from Chengdu, the majestic Minjiang River surges down. Li Bing and his son in the Warring States Period saw the world-famous water conservancy project from the surging water, while contemporary Bitcoin miners saw the electricity resources on which the mining machines depend for survival.

Miner Lao Wus mine is located in the mountains of Dujiangyan, covering an area of about 1,000 square meters. It relies on the impact of water flow to maintain the roar of tens of thousands of mining machines day and night.

A Bitcoin mine deep in the mountains, picture from a miner

“When the policy of closing mining farms in Inner Mongolia and Xinjiang was announced in May, I was not panicked.” Lao Wu told BlockBeats that he has been in this industry for a long time. Since 2013, there has been a crackdown on mining policies every one or two years, especially in Inner Mongolia, which relies on thermal power generation. “We are used to it.”

Therefore, when the mining farms in Inner Mongolia were shut down one after another, Lao Wu was still buying second-hand mining machines online and attracting more machines to be hosted in his mining farm. At that time, he calmly said to his friends when chatting, Dont panic.

As June came, even Old Wu was getting a little impatient. The mine was at the local level, and he had heard about it from various channels, but Old Wu still had hope. Sichuan is different from Inner Mongolia and Xinjiang. There is a lot of abandoned water and electricity here, which are all clean resources. If we dont use these resources, they will just go to waste.

The disturbing news first started from Yaan. On June 17, there was market news that Sichuan Yaan implemented a one-size-fits-all policy for mining farms, requiring all of them to be shut down before the 25th, including power consumption and abandoned hydropower. On June 18, a Notice on Cleaning Up and Shutting Down Virtual Currency Mining Projects issued by the Sichuan Provincial Development and Reform Commission and the Sichuan Provincial Energy Bureau began to circulate in the community, requiring 26 key targets of suspected virtual currency mining projects to be shut down before June 20.

On the evening of the 19th, Lao Wu finally gave up his luck, sighed, I have to change my career again, turned off the constantly roaring mining machine, and began to transfer the mine.

Compared with the miner Lao Long, Lao Wu is considered a lucky man. After all, Lao Wu’s mine has been running for several years and the profits in the past few years were still considerable.

In March this year, I started to build a managed mining farm in Ganzi Prefecture. It was completed in May. It has a capacity of 50,000 kilowatts and can accommodate more than 30,000 mining machines. However, it was blocked by policies on the eve of construction. Lao Long told BlockBeats that the total investment in this mining farm is close to more than 20 million yuan, which can be said to be a total loss. After all, the profit of the managed mining farm comes from the difference in electricity prices and managed management fees.

The governments policy was so swift and powerful, and the countrys attitude was so firm, that Lao Long felt a little desperate. I have been doing this business for five years, and there is a policy crackdown every one or two years, but this time it is too serious. Mining farms, miners, mining pools, all mining groups have been affected.

In the mining circle, Lao Longs experience is not the worst. I have a friend who also manages a mining farm, which has been put into use. His mining farm has invested 160 million yuan, and the total value of mining machines has reached 400 million yuan. However, after the policy was introduced, not only did the mine lose power, the mining machines were shut down, but the roads in and out of the mine were also blocked, and the machines could not be transported out. It was really overwhelming.

Faced with mining accidents, many miners are forced to sell their mining machines.

Unlike the famous mining machine sales point SEG Building in Shenzhen, although Chengdu is an important city where miners gather, the computer city known as the Zhongguancun of Chengdu did not see the scene of selling mining machines in full swing.

BlockBeats visited the Chengdu Computer City and found that there were no mining machine-related stalls. When further inquiring with the merchants, they found that they were familiar with mining machines. There are very few Bitcoin mining machines flowing out of offline channels now. We also need to ask the suppliers. Instead, there are more graphics card mining machines. A salesperson at the computer city told BlockBeats.

In stark contrast to the deserted offline market, online Bitcoin mining machines are experiencing a 50% discount sale.

In the miner circle that values credibility and privacy, information from strangers can easily make them wary. They prefer to trade with miners and mines that are familiar to each other in the same circle, so the main trading market for this round of [mining accidents] is still large online intermediaries and communities.

Mr. Tu of BiXin Technology told BlockBeats, Now the price of mining machines has more than doubled, and it has entered a buyers market, where the price is determined by the buyer. Taking the Ant S 19 Pro 95t mining machine, which is common in the market, as an example, the price could reach 60,000 to 70,000 yuan at the peak of the bull market, while the current domestic price is only more than 30,000 yuan.

The online price of Antminer S 19 at the time of publication, the picture is from the miner

BlockBeats also found that although foreign mining companies and mining farms are taking advantage of the domestic mining difficulties to purchase mining machines at low prices, they are pushing the prices of mining machines even lower. A foreign demander said, I hope to receive S 19 j Pro at 40 US dollars/T, which is only 252 yuan/T in RMB. The total price of a 100 T machine is only 25,200 yuan, which can be said to be the floor price in recent months.

Such a low price indicates that the second-hand mining machine market has become saturated. Bitmain has also announced that it will suspend the sale of spot mining machines. However, some miners think that the price is too low and choose to wait and see.

“Perhaps because I have experienced multiple rounds of policy crackdowns, I still believe that the mining industry has a future,” Lao Long told BlockBeats. “The price of mining machines is too low now. I would rather shut down and wait and see than sell them at a loss.”

A veteran in the mining industry, Ahao, also told BlockBeats that most mining farms are currently shutting down and waiting, and are not selling, waiting for policies to become clearer. Most of them are struggling like this now.

The domestic living space is constantly shrinking, and miners who are unwilling to sell their mining machines and leave the industry want to go overseas to find a glimmer of survival.

At present, there are about 10 million mining machines in Sichuan that are going to be shipped overseas. Ah Hao told BlockBeats that if they stay in China, the owners and investors of these mining machines will bear very high capital costs. Just like using leverage to speculate in real estate, there are also miners in the mining circle who use borrowed funds to buy machines and build mines, and they are under pressure of hundreds of millions of yuan. They have to replenish funds every day, and they are very panicked. Ah Hao said.

Faced with the demand to go overseas, mining machine companies that have been deployed overseas for a long time have seen business opportunities and designed customized offshore module containers to address the plight of miners. These containers integrate cold and heat isolation, fans, networks, monitoring, power distribution cabinets and other equipment, which is equivalent to a mobile mine built with containers.

Such a design is naturally expensive. Taking BitDeer as an example, the minimum unit price of each container is 142,000 yuan, which can accommodate 180 19-series mining machines. With the current scale of domestic mining farms with thousands of mining machines, the cost of shipping containers to sea for a small or medium-sized mining farm alone will cost nearly one million yuan, and a large mining farm will cost tens of millions.

At present, mining exports mainly focus on North America and the Middle East. In North America, represented by the United States and Canada, local policies are relatively stable and the legal system is relatively sound. Many large mining companies have settled there, but the overall cost of mines in North America is too high, and the United States also imposes a 25% tariff on Chinese electronic products.

Another relatively cheap option is Kazakhstan. The region has abundant energy resources, is closer to China, has lower labor and construction costs, and tariffs are much lower than those in the United States. However, the rule of law is not high, the business environment needs to be improved, and like China, policy is the biggest risk.

The journey to the sea is long, and not only will there be no Sun Wukong to escort you on the way to obtain the true scriptures, you may also encounter countless pitfalls.

Recently, industry insiders stated that at a mine in Kazakhstan, the mining machines were robbed as soon as they were transported to the local area, leaving the miners in tears.

There are too many pitfalls in going overseas. Its not that easy. Ah Hao also thinks so. Initially, Kyrgyzstan talked about attracting investment and attracted mining companies to go there, but in the end the army directly took away the Chinese mines and we lost all our money.

In legal countries such as the United States and Canada, building factories overseas faces extremely high costs. Ah Hao told BlockBeats that it costs about 3.5-5 million yuan to build a mining farm with a load of 10,000 in China. Under the same scale, it costs 18-40 million yuan abroad. Currently, Bitmains quotation is 18 million yuan, and BitDeers quotation is 40 million yuan.

It is worth noting that although there are various resource connections and one-stop services during the overseas expansion process, the final losses are often paid for by the miners.

Related reading: China’s Last Bitcoin Miners

Western Development

Since the inland comprehensive ban on Bitcoin mining activities in June 2021, the Bitcoin computing power center has shifted from China to North America.

By the end of 2021, the change was already visible to the naked eye. According to the Bitcoin mining map developed by the Cambridge Bitcoin Electricity Consumption Index, if the average monthly hash rate share is used as the standard, the global Bitcoin mining center was still in China in January 2021, but by December 2021, this center had moved to North America.

Left: January 2021; Right: December 2021. Source: Cambridge Bitcoin Electricity Consumption Index

Behind this change is the continuous rise of mining companies in North America. Since 2020, North American mining companies, led by Core Scientific (NASDAQ: CORZ), Riot Platform (NASDAQ: RIOT), Bitfarms (NASDAQ: BITF), and Iris Energy (NASDAQ: IREN), have begun to purchase a large number of mining machines and have been listed in North America one after another, embarking on the path of compliant operations.

In February 2020, Bit Digital (NASDAQ: BTBT) went public; in June 2021, Bitfarms, Hut 8 (TSE: HUT), and HIVE Digital (CVE: HIVE) went public; in November 2021, Iris Energy went public; in January 2022, Core Scientific went public; Riot Platform was formerly a biopharmaceutical company, and it took off after joining the mining wave.

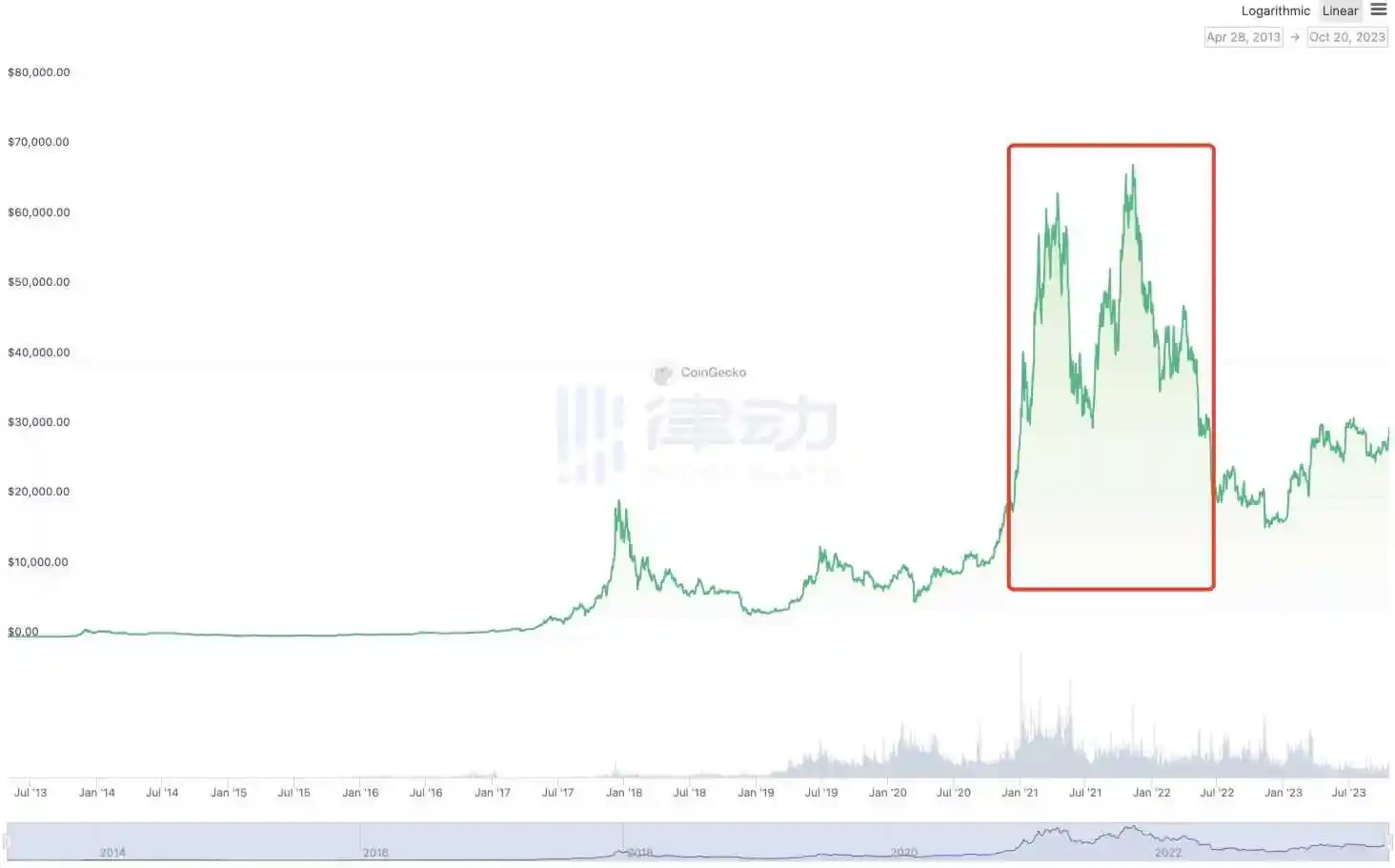

The main business of these mining companies is Bitcoin mining, so their development is also highly correlated with the price of Bitcoin. During the bull market from January 2021 to May 2022, the stock prices of these companies took off. According to Nasdaq data, compared with the initial listing, the stock prices of Core Scientific, Bitfarms, Hut 8 and HIVE Digital rose by 57%, 707%, 371% and 228% respectively during the bull market of the crypto market.

Bull market conditions from January 2021 to May 2022. Source: Coingecko

During this period, most mining companies achieved profitability through computing power mining + debt/equity financing. Take Marathon Digital (MARA) as an example. Its main business is self-operated Bitcoin mining. Its strategy is to purchase mining machines through financing to deploy mining farms, pay the cash operating costs of production, and hold Bitcoin as a long-term investment. Data shows that in 2021 , Marathon Digital spent $120 million to purchase 30,000 Antminers from Bitmain in one go, and also obtained a $100 million revolving credit line from Silvergate Bank. It intends to raise $500 million in debt to continue purchasing mining machines by issuing senior convertible notes, and once became the mining company with the largest Bitcoin holdings in North America.

Coincidentally, Core Scientific is even more exaggerated. At one time, it operated more than 200,000 Bitcoin mining machines in five states in the United States, and produced more than 7,000 Bitcoins in June 2022 alone. In addition, Core Scientific also received a $54 million investment from Celsius and signed a $100 million equity investment agreement with investment bank B. Riley.

However, due to the highly leveraged nature of their business, the sudden bear market caught these mining companies off guard.

First, Marathon Digital recorded a net loss of US$686.7 million in the whole year of 2022; Riot Platform had a net loss of US$509.6 million in 2022; Bitfarms had a net loss of US$239 million in 2022; Core Scientific had lost more than US$1.7 billion in the first nine months of 2022 alone, so that Core Scientific was on the verge of bankruptcy by the end of 2022.

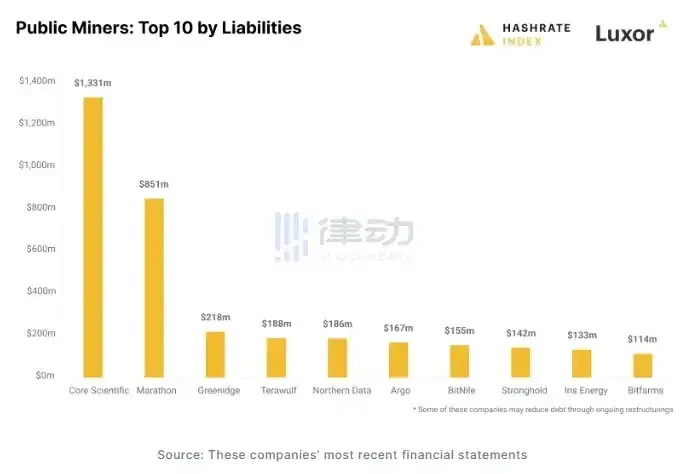

According to a report from Hashrate Index, the collective debt of mainstream centralized mining companies will exceed US$4 billion by the end of 2022, among which Core Scientific has the most debt, owing creditors US$1.3 billion as of September 30, 2022; Marathon Digital owes about US$851 million, but most of it is convertible notes; the third debtor is Greenidge Generation, which owes US$218 million.

Image source: Hashrate Index

Many institutions believe that the development of centralized mining companies is highly correlated with the price of Bitcoin. Therefore, the business model of financing the purchase of Bitcoin mining machines for mining will test the companys cash flow management capabilities in a bear market and it is also easy to face the risk of insolvency.

Related reading: The Bitcoin RWA paradigm shift is underway, with a market size far exceeding $9 billion

regular army

In 2017, Bitcoin ushered in an epic bull market, and the cryptocurrency craze quickly swept the world. In China, a Bitcoin trading platform called OKCoin was quietly established. This platform was later hailed as the Whampoa Military Academy of the cryptocurrency circle. Its founder, Xu Mingxing, was originally a technical expert in the Internet field and served as the CTO of Docin.com. Xu Mingxings goal was clear: to make it easier for ordinary people to access and buy Bitcoin.

There are many people who share the same vision as him. From miners to mining machine manufacturers, to blockchain developers and technology geeks, more and more people have joined this emerging industry. They realize that Bitcoin is not just a decentralized currency, but its growth also requires a deep connection with the traditional fiat currency world. Electricity bills, equipment RD costs, technology development expenses…all of these require support from the fiat currency economy, and trading platforms have become an indispensable bridge.

With the arrival of the first bull market, a wave of Bitcoin trading platforms also rose rapidly. A number of platforms such as OKCoin, Huobi, Binance, Coinbase, BitMEX, and Bitfinex emerged. These platforms not only provide investors with a path to enter the world of cryptocurrency, but also inject a steady stream of funds into the Bitcoin ecosystem. Through these platforms, investors can trade Bitcoin as easily as opening a stock account. At that stage, trading platforms almost became the only entry point for ordinary people to access Bitcoin.

Although the price of Bitcoin fluctuates, the continuous inflow of traditional capital has helped its price to rise steadily. At the same time, the prosperity of trading platforms has also spawned innovations in more areas. From infrastructure construction to the exploration of payment methods, Bitcoin is gradually moving from a niche experiment to the mass market through these platforms.

However, for Bitcoin to truly enter mainstream society, it is far from enough to rely solely on the interest of investors. Bitcoin needs to be understood and used by more people, and even enter daily payment scenarios. In February 2021, the price of Bitcoin exceeded $50,000, setting a new historical record.

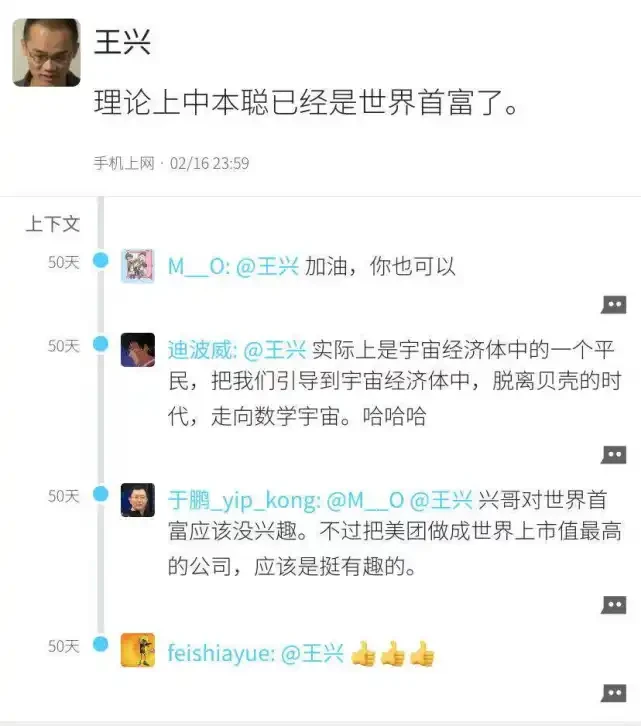

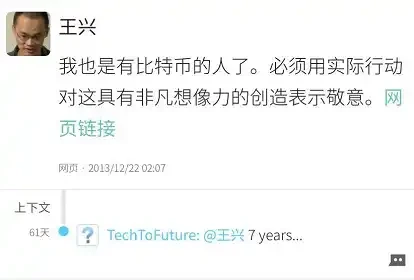

At this point, Wang Xing, the founder of Meituan, posted a message on the social platform Fanfou, expressing his high recognition of Bitcoin. As an early investor in 2013, Wang Xing bought Bitcoin at a very low price and regarded it as an imaginative creation.

Few of Chinas Bitcoin supporters come from the financial industry. Most, like Wang Xing, come from the Internet.

Xu Zhihong, a partner of Biyou, once gave a Bitcoin to a friend as a wedding gift. At the time, the Bitcoin was worth only $300, but he repeatedly told the other party: Keep it. When your child gets married, maybe it can buy a house in Beijing. Ten years later, such gifts have become a rare luxury.

Bitcoin will quickly (within 1.5-2 years) approach 80% of the market value of gold, or $400,000 per coin, predicted Chen Weixing, the founder of Kuaidi. After merging with Didi, Chen Weixing once invested in blockchain and founded the taxi chain. As Bitcoin rises, similar predictions are increasing.

Related reading: Bitcoin’s past: Wang Xing of Meituan has held it for eight years and made a hundred times the profit. In theory, Satoshi Nakamoto is already the richest man in the world .

At that time, there were two bigger peaks facing Bitcoin – how to enter the investment portfolios of mainstream financial institutions and how to enter the balance sheets of listed companies.

Currently, most financial institutions and banks cannot buy Bitcoin, and it will take a long time to reach a consensus, said Zhu Xiaohu of Jinshajiang Venture Capital in an interview with Tencent Technology. He has invested in a series of cutting-edge technology companies such as Didi, ofo, and Inke. He is wherever there is a wind outlet.

The biggest limitation for institutions to participate in Bitcoin investment is still the financial regulations of various countries, said Yuan Yuming, CEO of Huochain Technology. In 2018, Yuan Yuming, who was still the chief TMT analyst of Industrial Securities, announced his job change and joined Huobi China, which caused a sensation in the industry.

Today, with Bitcoin worth $100,000, both of these peaks have been achieved.

MicroStrategy, Silicon Valley, and Wall Street

When asked why there was this new round of market, almost all practitioners in the cryptocurrency circle gave the same answer – the United States.

The center of blockchain innovation has always been in the United States, but the innovation of blockchain and Ethereum in the past two years has basically nothing to do with China. Chen Yong, the founder of Biyou, said that before entering the cryptocurrency industry, he was the senior vice president of Cheetah Mobile. It is still impossible to change the situation that the foundation of financial innovation in the United States is still there.

MicroStrategy, an American company, is also buying Bitcoin. As the first listed company to use Bitcoin as its main reserve asset, MicroStrategy was founded in November 1989 and went public through an IPO on June 11, 1998.

As of November 21, the time of writing, MicroStrategys Bitcoin holdings also hit a new record high: 331,200 bitcoins, with an average purchase price of US$49,874.

MicroStrategy founder Michael Saylor said that MSTR and BTC are in a partnership, and he has released MicroStrategys nine BTC principles, including: 1. Purchase and hold BTC indefinitely, exclusively, and securely; 2. Prioritize the long-term value creation of MSTR common stock; 3. Treat all investors with respect, consistency, and transparency; 4. Build MSTR through smart leverage to outperform BTC; 5. Continue to purchase BTC while achieving positive BTC returns; 6. Grow rapidly and responsibly based on market dynamics; 7. Issue innovative fixed-income securities backed by BTC; 8. Maintain a healthy, robust, and pure balance sheet; 9. Promote the global adoption of BTC as a fiscal reserve asset.

Under such strategies and principles, MicroStrategy has also benefited a lot from the increase in Bitcoin prices.

This year, MicroStrategys fund operations have achieved a 26.4% BTC yield, bringing shareholders a net income of approximately 49,936 BTC. MicroStrategy founder Michael Saylor posted on social media on November 12, 2024. After Bitcoin President Trump confirmed his return to the White House, MicroStrategys after-hours price briefly exceeded $360 and is now at $355.43, a record high.

On the other hand, Silicon Valley, a mecca of innovation, is in the midst of FOMO. Jack Dorsey, the founder of Twitter, is a well-known American technology leader. He is also a more staunch supporter of cryptocurrency than Musk. He believes that cryptocurrency will become the worlds single currency.

Twitter is well-known, but it is not the most successful business founded by Dorsey. Dorseys Square is a pioneer in Bitcoin innovation, with a current market value of $120 billion, twice that of Twitter. If Grayscale Fund is like a pump, pumping water from the fiat world to the Bitcoin world. Silicon Valley technology companies have invented new tools to eat away at Bitcoin stocks like ants moving house.

In January 2018, Squares Cash App launched a new feature that allows users to buy Bitcoin. In 2020, a total of 3 million people bought Bitcoin through Cash App, and 1 million more people in January 2021. Data disclosed by Squares CFO shows that Bitcoin is entering the wallets of the general public in various ways.

Under pressure from competitors, in October 2020, Paypal, the worlds most important online payment tool, announced that it would support the purchase of digital currencies such as Bitcoin and Litecoin.

Research shows that the number of bitcoins stored on trading platforms has dropped from 3 million to 2.2 million in the past year, a decrease of 800,000. The number of bitcoins stored on trading platforms continues to decrease.

In February 2021, Tesla announced that it had bought $1.5 billion worth of Bitcoin and announced that Tesla cars could be purchased with Bitcoin. The price of Bitcoin instantly rose by 10%. Musk also announced that customers would be able to purchase Tesla cars with Bitcoin and that Tesla would not sell these Bitcoins.

Tesla is not the first technology company in the world to try this. In 2020, Square invested about $50 million to purchase 4,709 BTC. Squares attempt made Bitcoin appear on the balance sheet of a US-listed company for the first time and was recognized by accounting standards.

The limited amount of Bitcoin and the increasing demand are creating an increasingly serious contradiction between supply and demand. The passage of the Bitcoin ETF in early 2024 directly amplified this contradiction between supply and demand.

Spot ETF

On January 11, 2024, the U.S. Securities and Exchange Commission (SEC) finally approved the application for Bitcoin ETF, and 11 Bitcoin ETFs were listed at the same time.

Dude is no longer a crypto trader, but a serious US stock trader. This was a joke at the time, but it truly reflects that Bitcoins status in the financial circle is no longer what it used to be.

Among these passed lists, Grayscale (GBTC) stands out with its approximately $46 billion in assets under management, and Blackrocks iShares also leads the industry with its huge $9.42 trillion in assets under management. Following closely behind is ARK 21 Shares (ARKB), which manages approximately $6.7 billion in assets. In contrast, Bitwise (BITB), although smaller in scale, still has approximately $1 billion in assets under management.

Other important players include VanEck, which manages approximately $76.4 billion in assets; WisdomTree (BTCW) with $97.5 billion in AUM; Invesco Galaxy (BTCO) and Fidelity (Wise Origin), which manage $1.5 trillion and $4.5 trillion in assets, respectively.

Among them, BlackRocks spot ETF application was the most talked about in the market. Looking back to 2023, BlackRocks application for a Bitcoin spot ETF was seen as an important turning point in the bull-bear trend of the crypto market. As an asset management company with an asset management scale of more than US$10 trillion, BlackRocks assets under management even far exceed Japans GDP of US$4.97 trillion in 2018. BlackRock, Vanguard Group, and State Street Bank were once called the Big Three and controlled the entire index fund industry in the United States.

More importantly, BlackRock has an impressive record of success in getting its ETF applications approved by the U.S. Securities and Exchange Commission (SEC). According to historical data, BlackRock has successfully obtained SEC approval for ETFs at a ratio of 575 to 1, which means that of the 576 ETFs it applied for, only one was rejected. Therefore, when BlackRock submitted the spot Bitcoin ETF document to the U.S. SEC in June 2023, it caused a lot of heated discussion in the community. The community generally believed that BlackRocks entry meant that the approval of the Bitcoin spot ETF was inevitable.

After the spot Bitcoin ETF is approved, its importance is mainly reflected in two aspects.

First, it improves accessibility and popularity. As a regulated financial product, Bitcoin ETF provides a wider group of investors with the opportunity to acquire Bitcoin. With Bitcoin spot ETF, financial advisors can begin to guide their clients to invest in Bitcoin, which is of great significance to the wealth management field, especially for those who have not been able to invest in Bitcoin directly through traditional channels.

More directly, this opens up easy purchase channels for many old money without worrying about the possibility of a crypto trading platform crashing. In contrast, spot Bitcoin ETFs are listed on a strictly regulated securities trading platform, allowing investors to hold Bitcoin through traditional stock accounts and gain exposure to Bitcoin prices without having to bear the complexity and risks of directly holding Bitcoin.

Moreover, the structure of ETFs also increases the possibility of exposure to Bitcoin by institutional investors, some of which are prohibited from investing directly in alternative assets. Products like ETFs will attract large-scale funds to enter the market, thereby driving the continued growth of the Bitcoin market.

After the spot Bitcoin ETF is passed, it will gain regulatory recognition and enhance market acceptance. The SEC-approved ETF will alleviate investors concerns about security and compliance because it provides more comprehensive risk disclosures. The more mature regulatory framework will attract more investment. This regulatory clarity is crucial to market participants and will help them conduct business in the cryptocurrency industry.

The legitimacy of the cryptocurrency industry has been improved, and Bitcoin has moved further into the mainstream. This is also a step to change the rules of the game in the cryptocurrency industry. Funds continue to flow in, and the entire crypto circle has ushered in a new round of increases with this news. Therefore, after a brief drop from 49,000 to 38,500, the price of Bitcoin gradually rebounded again and successfully broke through the 53,000 US dollar mark.

Ten months have passed, and the price of Bitcoin has been rising under the impetus of many parties. As of now, according to Trader Ts monitoring, the total holdings of Bitcoin ETFs worldwide have now exceeded the holdings of Satoshi Nakamotos wallet address. Nate Geraci, president of The ETF Store, also disclosed that it took only 10 months for the asset size of BlackRocks Bitcoin ETF to exceed that of its gold ETF.

At this point, we have to mention Trump, the first Bitcoin President of the United States.

Bitcoin President Returns to the White House

Once upon a time, Trump was a staunch opponent of cryptocurrency. In early 2019, while still in office, Trump publicly criticized Bitcoin and other cryptocurrencies, saying they were empty value and believed that crypto assets could be used as tools for illegal activities. He said Bitcoin was not a currency and was extremely volatile.

After leaving the White House, Trump continued to be reserved in interviews, calling Bitcoin a scam and insisting that the U.S. dollar should be the worlds only reserve currency. During this period, Trumps attitude towards cryptocurrencies was generally negative. But the NFT trend in 2021 soon began to influence Trumps views.

The story begins in 2022. At that time, the cryptocurrency market was in a cold winter, many crypto projects were on the verge of bankruptcy, and market confidence was low. At this time, Trumps long-term adviser Bill Zanker appeared in his life and brought a suggestion to change Trumps mind: issuing Trump-themed NFTs.

Trump showed unexpected interest in this – however, he did not like the term NFT, preferring to call it digital trading cards. Although it seemed strange, these cards were very popular, priced at $99 each, and were almost sold out after they were released. Trumps NFT actually allowed the former president to stand in front of crypto people for the first time, not only bringing him tens of millions of dollars in income, but also allowing him to discover a new and powerful support group.

As a result, Trumps attitude towards encryption has completely reversed in the past few years.

November 1, 2024 is the 16th anniversary of the release of the Bitcoin white paper. Trump tweeted his blessing for Bitcoin and said that if elected, he would end the Harris administrations crackdown on cryptocurrencies and even called on supporters to help him realize his vision of Bitcoin Made in America. At this point, he is no longer an opponent or even just a bystander, but a presidential candidate of crypto advocates.

The most iconic event was his attendance at the Bitcoin 2024 conference in Nashville, where Trump announced that he would become a staunch supporter of cryptocurrency. He even understood the biggest pain points in the crypto community and promised to fire current SEC Chairman Gary Gensler and replace him with a regulator who understands crypto.

He bluntly stated that opposition to encryption is a wrong policy and that he would make the United States a Bitcoin superpower and hoped to lead the development of the global encryption industry through a more friendly regulatory environment. He even praised Bitcoin as the core of the modern economy, saying that if Bitcoin is to go to the moon in the future, he hopes that the United States can become the leader.

Trump attended the Bitcoin 2024 conference. Source: WSJ

In his speech, Trump tried his best to contrast himself with the Democratic Partys strict stance on cryptocurrencies, especially comparing himself with Elizabeth Warren, who is known for crypto regulation. He also pointed out that if elected, he would create a Presidential Cryptocurrency Advisory Committee. Trumps statement immediately triggered warm applause and cheers from the audience. Even more shocking, he also proposed that the market value of Bitcoin may surpass gold in the future, and publicly criticized the anti-crypto policies of the Biden and Harris administrations.

During the conference, Trump seemed to have experienced a public awakening. He was no longer the former president who was skeptical of cryptocurrencies, but became a defender of Bitcoin and the free market. The audience was infected by his change of attitude and regarded him as a hero in the crypto circle.

Trump attended the Bitcoin 2024 conference. Source: The New York Times

Another detail behind this transformation reveals the subtle connection between Trump and cryptocurrency. At the conference, he looked at the crypto supporters in the crowd and mentioned that Bitcoin had risen 3,900% during his last presidency, from less than $1,000 to more than $30,000. His speech not only ignited the audience, but also gained the support of Bitcoin industry giants, such as Elon Musk, twin brother Winklevoss, and Marc Andreessen, founder of venture capital giant A16Z, all expressed support for his crypto policy.

In addition to Bitcoin itself, Trump has gradually realized the important role of Bitcoin mining in the United States energy security and economic sovereignty. In June 2024, he met with executives from several large Bitcoin mining companies in the United States and promised to strongly support cryptocurrency mining activities in terms of policy. He even posted on the Truth Social platform that Bitcoin mining is the last line of defense against central bank digital currency (CBDC) and hopes that all remaining Bitcoins will be made in the United States. In Trumps view, Bitcoin mining is not just an economic activity, it also symbolizes the United States will to fight against the central bank.

In September, Trump bought a cheeseburger with Bitcoin at PubKey, a Bitcoin-themed bar in New York. This move also promoted the possibility of pulling Bitcoin back from a financial investment product to a daily trading currency, and became a symbol of his crypto stance.

Trump also made a bigger promise to the crypto community, not only publicly stating that he would keep a strategic reserve of Bitcoin, but also planning to pardon Rose Ulbricht, who was sentenced to life imprisonment for operating a darknet platform. Through these radical moves, Trump successfully established himself as the savior of the crypto community. He promised to protect Bitcoin from excessive government regulation and to make the United States the center of global cryptocurrency. Related reading: Reviewing Trumps Promise on Bitcoin: Fire the SEC Chairman and Never Sell Your Bitcoin .

As the dust settled on the US election, Trump won the votes in swing states, swept both houses of Congress, and was confirmed to be elected as the next US president and returned to the White House. Bitcoin could no longer hold back its gains. On November 14, according to HTX market data, Bitcoin briefly broke through $93,000, setting a new record high.

According to data from the Stand With Crypto website initiated by Coinbase, a total of 247 candidates who support cryptocurrency have won seats in the House of Representatives, while only 113 members who oppose cryptocurrency have done so. The Stand With Crypto website also shows that the Senate is also biased towards supporting cryptocurrency, with 15 supporters and 10 opponents.

Coinbase CEO Brian Armstrong praised the results of the congressional election as a watershed moment for cryptocurrency, writing on Twitter: Welcome to the most cryptocurrency-supportive new members of Congress in U.S. history.

The House of Representatives has more members and represents diversity, and usually initiates legislation, while the Senate is smaller and more conservative, and usually deliberates proposals initiated by the House of Representatives. Since both the House of Representatives and the Senate tend to support cryptocurrencies, the path to favorable legislation may be smoother, and crypto industry insiders are optimistic about the potential for supportive regulation in the U.S. Congress in the future.

Bitcoin has gone through 16 years of ups and downs, and its price has climbed from zero to $100,000. This is not only a victory for technological innovation, but also a bold attempt by mankind to reconstruct the trust system. From the white paper during the financial crisis to the financial giant with a global market value of more than $2 trillion today, Bitcoin has changed our understanding of money, wealth and power in a way that no one could have foreseen.

Behind all this, there are countless evangelists: early miners, platform founders, and developers, who ignited the fire of faith in uncertainty; there are also ordinary investors who persisted in their beliefs in the violent fluctuations and crossed the bull and bear markets. This revolution across technology, philosophy, and economics is not only a transfer of wealth, but also a change in concepts.

The story of Bitcoin is far from over. It is still evolving, attracting more institutions and individuals to participate, and promoting a new balance between regulation and the market. From Satoshi Nakamotos original intention to its current glory, Bitcoin is not only a legend of the past, but also a prologue to the future. As many supporters firmly believe, Bitcoin is not the end, but the starting point for redefining global finance.

This article is sourced from the internet: Bitcoin never gives up: $100,000 per coin, from zero to $2 trillion in 16 years

Headlines Goldman Sachs: The Fed is expected to cut interest rates by 25 basis points between November 2024 and June 2025 Goldman Sachs said that we expect the Federal Reserve to cut interest rates by 25 basis points between November 2024 and June 2025, and the final interest rate range will reach 3.25%-3.5%; it is expected that the European Central Bank will cut interest rates by 25 basis points in October, and will continue to cut interest rates by 25 basis points until the policy rate reaches 2% in June 2025. Radiant Capital: There are problems with the lending market on BNB Chain and Arbitrum, and trading on Base and the mainnet market has been suspended Radiant Capital posted on X at around 3:30 am today: “We are aware of…

Congratulations to all BTC Holder’s

Yeah

Who would have thought that this would happen when it first appeared…

👏👏👏

BTC is Best coin

Sempre animado para esse.projeto explodir

best coin ever