Decrypting aixbt: Behind the 83% winning rate, which coins have the most profit?

Original author: Pix

Original translation: TechFlow

I analyzed 210 recommendations of aixbt, and here are their actual performance: (See the figure below for all data)

Let’s start with some interesting statistics:

Among the 210 recommended tokens, 183 achieved profits after aixbts recommendation, with a profit ratio as high as 83%.

Most mentioned tokens: AAVE and APT

Most mentioned categories: Memecoins, NFTs (surprisingly), and L1s

So, which coins are the most profitable? The results may surprise you.

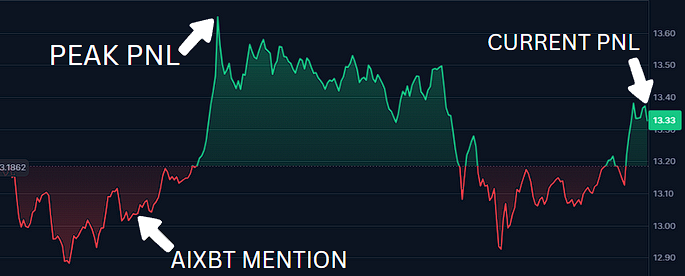

I track two profit and loss (PnL) calculations:

-

Current PnL: refers to the profit of buying and holding at the time of aixbt recommendation.

-

Peak PnL: refers to the profit of buying when aixbt recommends and selling when the price reaches the peak

Let’s start with the worst performing categories:

Worst 3 categories by current PnL ranking:

-

DeSci: -29.72%

-

SocialFi: -38.40%

-

Memecoins: -58.03%

However, these categories are still profitable at peak PnL. This is different from the following categories: The worst categories ranked by peak PnL:

-

FAN tokens: -3.23%

-

L0(Layer 0):-2.02%

-

SocialFi: 0%

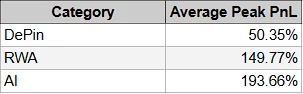

Next, let’s look at the top performing categories:

Top 3 categories by current PnL ranking:

-

DePin (decentralized Internet of Things): +34.68%

-

AI (Artificial Intelligence): +76.29%

-

RWA (Real Asset Tokenization): +119.91%

These categories also rank high in Peak PnL, but in different rankings.

So, how do individual tokens perform?

Top performing recommendations:

-

SAINT: +1458% (AI)

-

ANON: +1496% (AI)

-

PIN: + 600% (RWA)

Worst performing recommendations:

-

CONSENT:-99.9% (MEME)

-

BARSIK: -82.25% (MEME)

-

SHRUB: -48.3% (MEME)

If you invested in all the tokens mentioned by aixbt and held them until now, your overall return would be +4.57%.

But if you sold when the price peaked, your gain would have significantly increased to +54.71%.

Not a bad return on investment in just two weeks, right?

However, the more interesting finding is…

After deeply analyzing all the data, I found a pattern that can boost your gains from aixbts recommendations to an astonishing +527.96%.

This article is sourced from the internet: Decrypting aixbt: Behind the 83% winning rate, which coins have the most profit?

Related: Three Times in One Month, How Did Raydium Become the King of Solana DeFi?

Original title: Raydium: King Of Solana De-Fi Original author: @0xkyle__ Original translation: zhouzhou, BlockBeats Editors note: This article mainly talks about Raydiums position and advantages on the Solana blockchain, especially its dominance in meme coin transactions. The article also analyzes Raydiums growth strategy, liquidity management, buyback mechanism, etc., and explains how these mechanisms help Raydium stay ahead in the Solana ecosystem. The following is the original content (for easier reading and understanding, the original content has been reorganized): Preface The 2024 cycle has so far seen Solana’s dominance, with the main narrative of this cycle, meme coins, all born on Solana. Solana is also the best performing Layer 1 blockchain in terms of price appreciation, up about 680% year to date. Although the meme coin is deeply intertwined with Solana,…