The trend of positioning itself as a meme has still spread to every corner of the cryptocurrency circle

Original|Odaily Planet Daily

Author: jk

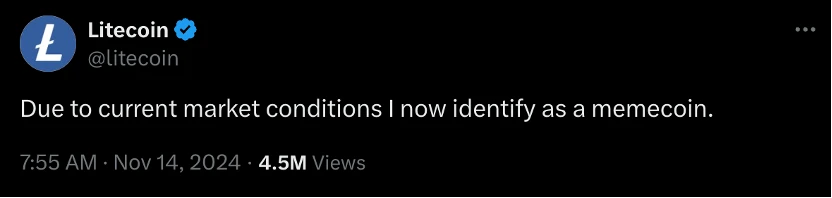

On the morning of November 14th, Beijing time, Litecoin, which had faded out of the market for a long time, suddenly released an official tweet:

Source: X

“Given the current market environment, I now consider myself a meme coin.”

As soon as the tweet came out, it immediately triggered a craze in the crypto market. The recent trend of Meme coins can be described as hot, and the narrative of anti-VC and exchange collusion project (aka the project that used to have business support) is also very solid, and the old PoW Litecoin now has a meme-like tweet that has further detonated market sentiment. Litecoin rose by 10% in a short period of time, from around US$72 to US$82. At this time when memes such as Pnut, Pepe and Bome have begun to follow the rise of Bitcoin and started to exert their strength, the markets fomo sentiment for Meme coins has also been accumulating, and the outbreak of Litecoin has undoubtedly proved this.

Litecoin trend, source: Coingecko

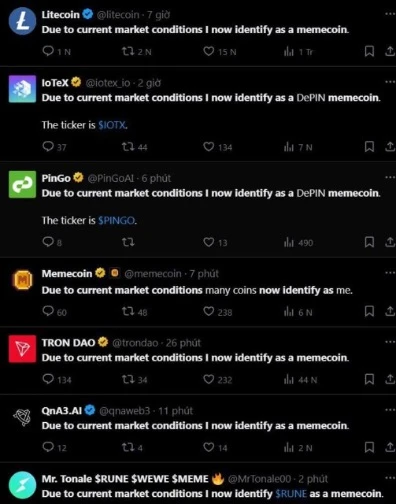

Project parties that followed suit, source: X

Except for Litecoin, all of the projects in the above picture claim to have become Memecoin; the screenshots are far from covering the trend on X platform, including well-known projects such as Manta Network, AVA Foundation, Aleph Zero, and even Gate Exchange have all joined this trend, just like a remake of a popular video on Douyin (or a popular challenge on Tik Tok), which filled the push of X platform yesterday.

So how are these “new meme coins” performing?

In general, the coins that were just riding on the wave of popularity did not see any increase – IoTeX did not see a significant increase, with a 24-hour drop of 7.5%; Mantas 24-hour drop reached 11.9%. This part of the decline has little to do with whether or not to post a tweet, and is mainly due to the callback led by Bitcoin.

At the same time, the old meme coins on the market have seen a rise + pullback trend due to this meme craze: PEPE and WIF both began to surge at some point yesterday, and although there was a pullback within 24 hours, the 7-day increase remained at around 90% and 50%. Needless to say, PNUT, which led this trend, has reached a price of $1.6 as of press time.

Meme trends, source: Coingecko

What’s even more outrageous is that this trend has apparently spread beyond the circle: this morning, Royal Dutch Airlines KLM also posted an identical tweet on its official Twitter account with 2.2 million followers:

Source: X

You know, KLM Royal Dutch Airlines is an account that has nothing to do with the crypto market, so it was naturally suspected that the account was hacked. Litecoin replied below: It looks a bit bumpy, but ok! Someone else commented below: Is Litecoins intern who manages Twitter accounts working two jobs at the same time?

Of course, KLMs stock price has not changed at all, and even fell a little. It seems that the marketing in the crypto circle is just shouting slogans, and no one really buys it (but, buying is not for the stock market).

Whats more, the token Meme coin of this event has been released on Pump.fun: INIAAM (I now identify as a memecoin). As of press time, the market value has reached about 32K.

INIAAM, source: Pump.fun

Back to the original context, of course everyone is playing with memes: I now identify as xx is actually mostly used in the context of gender in the original English context. Someone may now identify himself as another gender, and then it is repeatedly grafted with other meanings in the tug-of-war between supporters and opponents, such as the famous I now identify myself as a Wal-Mart shopping bag and so on. This part just corresponds to the core of Meme culture, that is, to deconstruct an existing system, whether it is gender or a classical crypto project that was once serious, and then completely trample on the original meaning, so that this sense of contrast can bring more traffic to the project.

This is the market strategy and the core of Meme. Of course, we have to mention the most important catalyst: crypto investors may have been suffering from high FDV and low circulation tokens for a long time and are unwilling to be the receivers of VCs and project parties. Meme is at least a fairer market – there is no other reason, only quick hands and ears.

This article is sourced from the internet: The trend of positioning itself as a meme has still spread to every corner of the cryptocurrency circle

Related: Why was SBF’s ex-girlfriend Caroline Ellison only sentenced to two years in prison?

Compiled by: Felix, PANews On September 25, U.S. Judge Lewis Kaplan sentenced Caroline Ellison (former co-CEO of Alameda Research and SBF’s ex-girlfriend), the main witness in the case against former FTX CEO SBF (Sam Bankman-Fried), to two years in prison. Ellison will also forfeit approximately $11 billion and may serve her sentence in a “minimum security prison.” Ellison, 29, pleaded guilty nearly two years ago (December 2022) to seven charges, including two counts of conspiracy to commit wire fraud, two counts of actual wire fraud, one count of conspiracy to commit commodities fraud, one count of conspiracy to commit securities fraud and one count of conspiracy to commit money laundering, and faced a maximum sentence of 110 years in prison. He testified against SBF for nearly three days at the…