Market FOMO sentiment is high, these indicators are worth paying attention to

Original author: BitpushNews

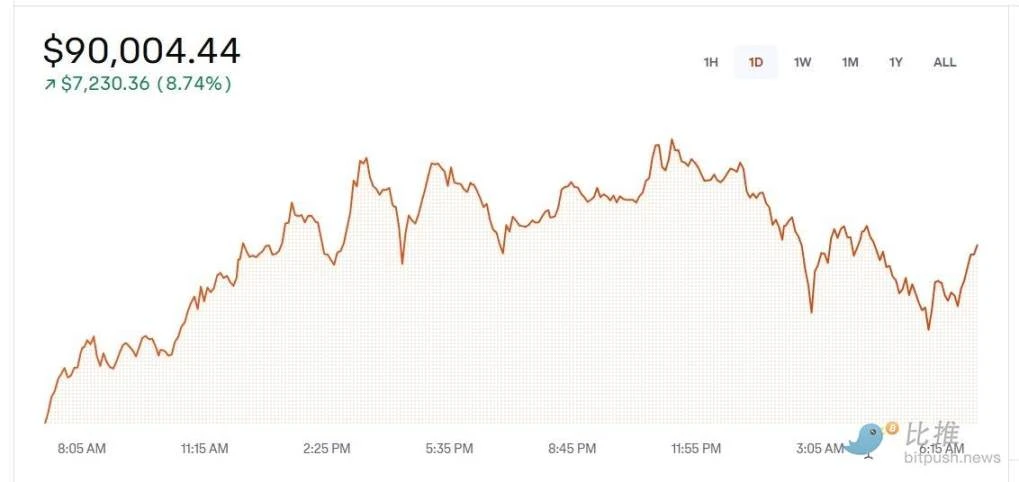

Bitcoin broke through $90,000 on November 12, setting a new all-time high.

According to TradingView data, at 12:56 PST on November 12, Bitcoin rose above $90,000 on Coinbase, up 11% over the past day and just one step away from entering the 10s.

It is worth noting that on the Coinbase platform, the transaction price of Bitcoin is often slightly higher than other platforms, which is called premium trading. This means that even when the price of Bitcoin in the overall market is already high, there are still a large number of buyers willing to buy it at a higher price on Coinbase, which further illustrates that the market demand for Bitcoin is very strong.

At press time, Bitcoin is trading back down to $88,223, up 0.4% over the past 24 hours.

Altcoins were mixed, with Bonk (BONK) seeing the biggest gains among the top 200 altcoins, up 27.7%, AIOZ Network (AIOZ) up 23.2%, and Akash Network up 18.8%. EigenLayer (EIGEN) led the decline, down 12.8%, followed by DOGS (DOGS) and Artificial Super Alliance (FET), down 11.6% and 11.5%, respectively.

The current overall market value of cryptocurrencies is 2.98 trillion US dollars, and Bitcoins market share is 59.5%.

CoinGlass data shows that in the past 24 hours, violent price fluctuations caused the entire crypto network to have a liquidation amount of nearly US$940 million, the largest single-day liquidation amount since August 5.

As for U.S. stocks, as of the close, the SP 500, Dow Jones and Nasdaq all closed lower, down 0.29%, 0.86% and 0.09% respectively.

Analysts: Some indicators are worth paying attention to

Analysts generally believe that cryptocurrencies will continue to be bullish in the short term as market FOMO sentiment is high in anticipation of a looser regulatory environment brought about by Republican control of Congress.

However, Shubh Varma, co-founder and CEO of Hyblock Capital, pointed out: One notable indicator is the True Retail Long percentage, which is abnormally low at just 40%, which is at the 20th percentile over the past 90 days. In addition, open interest (OI) is at the 99th percentile. This dynamic echoes the situation on November 7, when the True Retail Long percentage was even lower at the 12th percentile and OI was also high. Historically, when OI is high, low retail long positions tend to squeeze out short positions, leading to large rallies.

Additionally, leverage data in derivatives markets shows that top traders continue to favor long positions, with the leverage spread between average longs and shorts once again exceeding +10, a strongly bullish indicator.

Analysts explained that usually, this leverage pattern appears after a price drop, but this time, it appeared after a sharp price increase, and if long leverage continues to increase after BTC鈥檚 recent surge, this deviation may indicate continued bullish momentum.

Varma suggested using pullbacks as buying opportunities, and said that buying on dips could provide a favorable entry point given the strength of this rebound. However, he warned traders to pay close attention to indicators such as retail long positions and leverage imbalances, which can help investors judge the risks and potential turning points of the market to a certain extent. In addition, other factors such as fundamentals and policies need to be considered comprehensively.

This article is sourced from the internet: Market FOMO sentiment is high, these indicators are worth paying attention to

Related: Die Zukunft des Geldes: Wie Kryptowährungen die Welt verändern

Kryptowährung ist ein Schlagwort, das Sie wahrscheinlich schon gehört haben, aber was genau ist es? Und warum spricht jeder darüber? Lassen Sie uns in diese aufregende neue Art des Umgangs mit Geld eintauchen. Was ist Kryptowährung? Kryptowährung ist eine digitale Form des Geldes. Im Gegensatz zu normalem Geld, wie Dollar oder Euro, existiert sie nicht physisch. Sie können sie nicht in den Händen halten oder in Ihrer Brieftasche aufbewahren. Stattdessen existiert es nur online. Menschen verwenden Kryptowährungen, um Dinge zu kaufen, wie sie es mit normalem Geld tun würden. Zu den beliebtesten Kryptowährungen gehören Bitcoin, Ethereum und Litecoin. Wer mehr über diese Münzen erfahren möchte, findet bei einem Coin-Ratgeber hilfreiche Informationen über ihre Funktionsweise. Was ist der Unterschied zwischen Kryptowährungen? Der große Unterschied zwischen Kryptowährungen und normalem Geld ist, dass sie…