The Web3 industry is entering a new era of compliance. Are we pursuing the wrong Mass Adoption?

Original author: Spinach Spinach (X: @bocaibocai_ )

Recently, the industry has been discussing the issue of Ethereum Fud. Some time ago, Brother Jian @jason_chen998 , Teacher Haotian @tmel0211 and Teacher NingNing @ningning initiated a three-hour Space discussion on What happened to Ethereum?. We participated in the whole discussion and heard many very exciting viewpoints. From the game relationship between Ethereum and Layer 2 to ideology, organizational structure, and historical lessons, we fully learned about the current difficulties faced by Ethereum and the industry, and felt everyones deep love and sharp criticism for Ethereum.

During the Space, I actually had some ideas in my mind, but I was very hesitant because I knew that my views were obviously different from those of most people on Web3 Native and I was afraid of being criticized, so I did not make any comments throughout the whole process. However, I decided to stand up and express my views afterwards, trying to provide everyone with a new perspective on the challenges facing Ethereum and the entire industry from the application level that everyone has talked about. Although this view may not be mainstream enough, I believe that only through rational and frank discussions can the industry be pushed in a healthier direction.

Please do not criticize: This article is not to FUD Ethereum and the industry, and I do not want to provoke any confrontation. It is just to provide a different perspective for everyone to criticize and think about. If you do not agree with my point of view, just smile, do not criticize, do not criticize, do not criticize, thank you! I also speculate in cryptocurrencies, and I also want to make money, but I do not want the industry to be limited to speculating in cryptocurrencies!

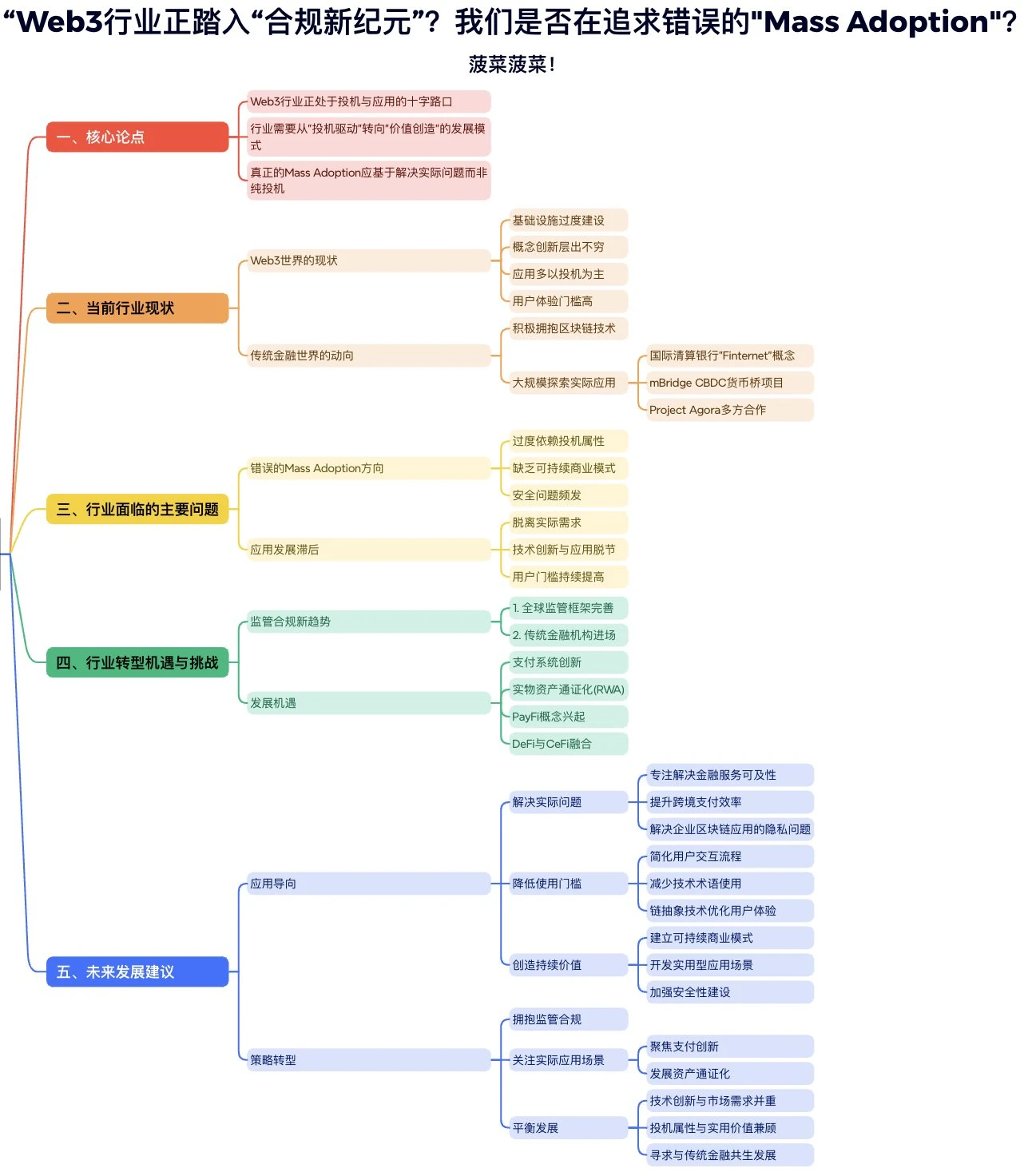

The article is quite long, so I compiled an AI summary for those who don鈥檛 want to read long articles:

background

Before talking about my views, let me first introduce my current work background. Many friends who follow me should have noticed that my output frequency has decreased a lot over a long period of time, and I have rarely expressed my views on the industry.

This is because in the past year, as a founding member of Ample FinTech, a Singaporean FinTech startup, I have been deeply involved in project cooperation with the central banks of three countries on tokenization and cross-border payments. This experience has also made my thinking mode and attention no longer limited to the pure Web3 circle, but turned my attention to the strategic trends of global central banks and traditional financial institutions.

During this period, I began to spend a lot of time studying research reports and papers related to blockchain and tokenization published by traditional forces to understand the projects they are working on. At the same time, I also kept following industry trends on Twitter and communicated with friends to understand the development trends of the Web3 industry. By paying attention to the application development of both the Web3 circle and the traditional financial system, I was able to establish a more comprehensive cognitive framework between the two dimensions, which also gave me a different perspective on the future of the industry.

A split parallel world

It is this dual perspective of being in two different worlds at the same time that makes me more and more aware of the separation of the atmosphere and development paths of the two fields. In the Web3 world, everyone is complaining about the current situation: more and more technical infrastructure is emerging, more and more new concepts and new terms are emerging, deliberately creating complexity and raising the threshold of understanding. The ultimate goal is mostly to start businesses for Vitalik and exchanges. After TGE, it has almost become a ghost town. As for whether it has real use value, who really cares?

Recently, the focus of discussion has also shifted to questioning Vitalik and the Ethereum Foundation. More and more people are complaining that Vitalik and the Foundation seem to be too obsessed with technical discussions and ideal pursuits, investing a lot of energy in studying technical details, but seem to have little interest in users actual needs and commercial exploration. This tendency has caused widespread concern in the industry.

In this Space, Mr. Meng Yan @myanTokenGeek drew on the historical experience of Internet development and pointed out that this development path of decoupling from C and alienating from the market is unsustainable. If Ethereum continues to maintain this technology first development orientation, then everyones concerns are not unreasonable.

However, when we look beyond the Crypto circle, we find a completely different picture: the attitudes of traditional financial forces and governments towards Web3 technology are changing significantly. They not only regard blockchain and tokenization as important opportunities to upgrade the existing payment and financial systems, but also actively explore the path of transformation. This change is certainly due to the recognition of new technologies, but the deeper motivation may be the impact and threat that Web3 technology brings to the existing structure.

In 2024, a milestone turning point occurred. The Bank for International Settlements (BIS), known as the central bank of central banks, formally proposed the concept of Finternet.

This move is of far-reaching significance – it positions tokenization and blockchain technology as the next-generation paradigm of human financial and monetary system, instantly causing uproar in the traditional financial world and becoming one of the most talked-about topics.

This is not just a new concept, but also an important endorsement of blockchain and tokenization technology by the traditional financial sector. Its influence spreads rapidly: major financial institutions and central banks around the world have accelerated their pace and launched unprecedented active explorations in tokenization infrastructure construction, asset digitization, and payment application implementation.

Behind this series of major initiatives, it is by no means a hasty decision made by the Bank for International Settlements on a whim, but a strategic choice based on years of in-depth research. Spinach spent a lot of time tracing and studying the decision-making trajectory of the Bank for International Settlements and found a gradual development context: as early as 2018, the institution began to systematically study Web3 technology and published dozens of highly professional and in-depth research papers.

In 2019, the Bank for International Settlements took a crucial step by establishing the Bank for International Settlements Innovation Center to systematically carry out experimental projects related to blockchain and tokenization. This series of in-depth research and practice finally made them realize an important fact: blockchain technology and tokenization innovation have great potential to reshape the global financial landscape.

Among the many experimental projects of the Bank for International Settlements, the most iconic one is mBridge, a CBDC cross-border payment bridge jointly launched by the Bank for International Settlements Hong Kong Innovation Center, the Peoples Bank of China, the Hong Kong Monetary Authority, the Bank of Thailand and the Central Bank of the United Arab Emirates in 2019. From the perspective of technical architecture, mBridge is essentially an EVM-based public permissioned chain, operated by the central banks of participating countries as nodes, and supports cross-border settlement of central bank digital currencies (CBDC) of various countries directly on the chain.

However, history is always full of dramatic twists and turns. In the current complex geopolitical landscape, especially after the outbreak of the Russia-Ukraine conflict, this project, which was originally intended to improve the efficiency of cross-border payments, unexpectedly became an important tool for BRICS countries to circumvent SWIFT international sanctions.

This situation forced the Bank for International Settlements to withdraw from the mBridge project at this stage. Recently, Russia has officially launched the BRICS Pay international payment and settlement system based on blockchain technology, pushing blockchain technology to the forefront of geopolitical games.

Another major move by the Bank for International Settlements is the launch of Project Agora, the largest public-private partnership in the history of blockchain. This project brings together an unprecedented lineup of participants: seven major central banks (the Federal Reserve, the Bank of France representing the European Union, the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, and the Bank of England), as well as more than 40 global financial giants including SWIFT, VISA, MasterCard, and HSBC.

The goal of such a large-scale cross-border collaboration is surprisingly clear: to use blockchain technology and smart contracts to build a global unified ledger system while maintaining the existing financial order, thereby optimizing the existing financial and monetary system. This move itself is a strong signal: the development momentum of blockchain technology is unstoppable, and traditional financial forces have shifted from watching to fully embracing it and actively promoting its application in practical scenarios.

On the other hand, the Web3 industry, although shouting the slogan of Mass Adoption every day, is actually keen on hyping meme coins and indulging in the short-term attention economy. This sharp contrast makes people think deeply: when traditional financial institutions are taking practical actions to promote the large-scale application of blockchain technology, should the Web3 industry also rethink its own development direction?

Mass Adoption: Casino or Application?

In this fragmented development trend, we have to think about a fundamental question: What is the true meaning of Mass Adoption? Although this term frequently appears in discussions in the Web3 industry, it seems that everyone has a significant difference in their understanding of it.

Looking back at the so-called explosive projects in the Web3 field in the past few years, an intriguing pattern emerges: those projects that claim to achieve Mass Adoption are essentially speculative games in the guise of innovation. Whether it is the endless MEME coins, or the P2E model under the banner of GameFi (such as the popular running shoe project), or SocialFi that boasts of social innovation (such as http://Friend.tech ), in essence, they are nothing more than carefully packaged digital casinos. Although these projects have attracted a large influx of users in the short term, they are not truly solving the actual needs and pain points of users.

If allowing more and more people to participate in speculation and drive up the price of the currency is Mass Adoption, then this kind of Adoption is merely a zero-sum game that concentrates wealth in the hands of a few people, and its unsustainability is obvious.

I have witnessed many cases where friends outside the cryptocurrency industry have lost all their money after entering the cryptocurrency industry, and only a few have actually made a profit. This phenomenon has also been confirmed by recent data: a recent study by an on-chain data analyst showed that on the http://pump.fun platform, only 3% of users made a profit of more than $1,000. Behind these cold numbers, it is reflected that cryptocurrency speculation is a game for a very small number of people.

What is even more worrying is that the entire industry has become a hotbed for hackers, phishing and fraud. From time to time, you can see information on Twitter about a whale being phished by Permit and suffering heavy losses. Not to mention ordinary retail investors, according to the latest FBI report, in 2023 alone, the American people suffered more than $5.6 billion in fraud losses in the field of cryptocurrency, and victims over the age of 60 actually accounted for 50% of the total number. The interests of many ordinary investors cannot be protected in this dark forest.

Speculation and increasingly serious hacking have made the industry environment worse, which makes us think deeply: Are we chasing the wrong Mass Adoption direction? In the frenzy of speculation, have we ignored the real sustainable value creation?

It should be made clear that I am not completely denying the speculative nature of Web3. After all, the original intention of most participants to enter this field is to obtain a return on investment. This profit-seeking motive itself is understandable, and the speculative nature will continue to exist. However, Web3 should not and cannot just stop at being a global casino. It needs to develop application scenarios that are truly sustainable and of practical value.

Among them, payment and finance are undoubtedly the application areas with the greatest potential for Web3 technology. This has been recognized by traditional financial forces, national governments and the market: we see that traditional financial forces are exploring various innovative applications on a large scale, including payment system innovation, real-world asset tokenization (RWA), the integration of DeFi and traditional finance, and the emerging concept of PayFi. These active explorations and practices clearly point to the most urgent needs of the current market.

In my humble opinion, the core issue for Ethereum or the industry may not be whether the technical direction is correct, but whether we truly understand what are valuable applications. When we pay too much attention to technological innovation but ignore market demand; when we are keen on creating concepts but stay away from real scenarios, is this development direction really correct?

This kind of thinking has triggered a deeper worry: if we continue to develop in this way, will the traditional financial system or SWIFT network that we once aspired to subvert become the main force in promoting the real large-scale adoption of blockchain? Furthermore, will there be a situation where the public permissioned blockchain system led by traditional financial forces and governments dominates the vast majority of actual application scenarios, while the public chain may be marginalized as a niche speculation paradise?

While the Web3 industry is still focusing on Solana and other Ethereum challengers, no one seems to have noticed that traditional financial forces have also sounded the clarion call for entry. In the face of this huge change, for Ethereum or the entire industry, should we think not only about the current development strategy, but also about how to find our own positioning and value proposition in the future wave of gradual compliance in the industry? This may be the real test facing the industry.

After observing these trends, I have the following thoughts on the path to a truly healthy and sustainable mass adoption for the industry:

The first thing is to solve practical problems:

Whether it is infrastructure or applications, we should base ourselves on real needs and focus on solving real pain points. For example, many ordinary people and small and medium-sized enterprises around the world still have difficulty accessing financial services; for example, privacy issues when companies use blockchain, etc. The value of technological innovation must ultimately be reflected by solving practical problems.

The second is to lower the threshold for use:

The ultimate goal of technology is to serve users, not to create obstacles. The endless terminology and complex concepts in the current Web3 world have, to some extent, hindered real popularization. We need to make technology more approachable, such as using (Based Chain Abstraction) chain abstraction technology to solve problems at the user experience level.

The third is to create sustainable value:

The healthy development of the industry must be based on a sustainable business model, and cannot be overly dependent on speculation. Only projects that truly create value can survive the test of the market for a long time, such as Web3 payment, PayFi and RWA. The importance of technological innovation is unquestionable, but we must also realize that application is the primary productive force. Without practical applications as a foundation, no matter how much infrastructure or how advanced the technology is, it will ultimately be just castles in the air.

Web3 Application Mass Adoption Turning Point Has Come

Throughout history, attempts to combine blockchain with the real world have never stopped, but they have often failed to take off due to multiple factors such as timing, regulatory restrictions or technical bottlenecks. However, the current situation presents an unprecedented turnaround: the technical infrastructure is becoming more mature, traditional financial forces are beginning to actively embrace innovation and explore practical applications, and at the same time, the regulatory frameworks of countries around the world are gradually improving. These signs all indicate that the next few years are likely to be a key turning point for Web3 applications to move towards large-scale adoption.

At this critical juncture, regulatory compliance is both the biggest challenge and the most promising opportunity. More and more signals indicate that the Web3 industry is gradually moving from the initial barbaric era to a new era of compliance. This transformation not only means a more standardized market environment, but also heralds the beginning of truly sustainable development.

The signs of this shift are reflected on multiple levels:

1. The regulatory framework is becoming more complete

– Hong Kong launches comprehensive regulatory regime for virtual asset service providers (VASPs)

– EU MiCA Act formally implemented- US FIT21 Act passed by the House of Representatives in 2024

– Japan amends the Funding Resolution Law to provide a clear definition of crypto assets

2. Standardized participation of traditional financial institutions

– BlackRock and other large asset management institutions launched Bitcoin and Ethereum ETFs

– Traditional banks begin to provide custody services to crypto companies and launch tokenized bank deposits

– Mainstream payment companies launch compliant stablecoins

– Investment banks set up digital asset trading departments

3. Compliance upgrade of infrastructure

– More exchanges actively apply for compliance licenses

– Widespread adoption of KYC/AML solutions

– The rise of compliant stablecoins

– Application of privacy computing technology in compliance scenarios

– The launch of central bank-level blockchains (CBDC currency bridge mBridge, Singapore Global Layer 1, Bank for International Settlements Project Agora, etc.)

4. Regulatory pressure on Web3 and project compliance transformation

– MakerDAO, the largest decentralized stablecoin project, transforms to Sky and embraces compliance

– FBI sting enforcement MeMe project market maker

– DeFi projects have begun to introduce KYC/AML mechanisms

In this trend, we are seeing:

– More traditional financial institutions enter the Web3 space through acquisitions or partnerships

– Traditional financial forces continue to control the price of Bitcoin through BTC ETF

– A new generation of compliant Web3 applications is rapidly emerging

– The entire industry is gradually establishing order under regulatory pressure, and the chances of getting rich overnight will continue to decrease

– The application scenarios of stablecoins have shifted from speculation to substantive uses such as international trade

There is no doubt that the future main battlefield of blockchain technology will focus on several key areas: payment system innovation, physical asset tokenization (RWA), the emerging concept of PayFi, and the deep integration of DeFi and traditional finance (CeFi). This reality brings an unavoidable proposition: if the industry wants to achieve breakthrough development at the level of real applications, it must face the interaction with regulators and traditional financial institutions. This is not a multiple-choice question, but a necessary path for development.

The reality is that regulation is always at the top of the industry ecosystem. This is not only an objective fact, but also an iron law that has been repeatedly verified in the development of the crypto industry over the past decade. Every major industry turning point is almost closely related to regulatory policies.

Therefore, we need to seriously consider several fundamental issues: Should we embrace regulation and seek a symbiotic path with the existing financial system, or stick to the concept of decentralization and continue to wander in the gray area of regulation? Should we pursue a purely casino-style Mass Adoption and repeat the old path of speculation-driven growth over the past decade, or should we commit to creating real and sustainable value and truly realize the innovative potential of blockchain technology?

At present, the Ethereum ecosystem faces a significant structural imbalance: on the one hand, there is a continuous accumulation of infrastructure and endless technological innovations, while on the other hand, the application ecosystem is relatively lagging behind. Under this contrast, Ethereum is facing a dual challenge: it must not only cope with the strong offensive from new public chains such as Solana in terms of performance and user experience, but also be wary of the erosion of the actual application market by the compliant public permissioned chains that traditional financial forces are deploying.

What鈥檚 even more tricky is that Ethereum has to deal with competitive pressure from two directions at the same time: on the one hand, public chains such as Solana are grabbing more and more market share and user attention in the meme market with their performance advantages; on the other hand, public permission chains dominated by traditional financial institutions are relying on their natural compliance advantages and huge user base to gradually deploy in practical application scenarios such as payment and asset tokenization, and are likely to occupy first-mover advantages in these key areas in the future.

How to find a breakthrough under this double pressure and maintain technological innovation while not losing market competitiveness are the key challenges that Ethereum must face in its quest for a breakthrough.

The above views only represent my personal perspectives, and I hope they can inspire more constructive thinking and discussion in the industry. As industry participants, we should all contribute to promoting the development of Web3 in a healthier and more valuable direction.

Due to my personal cognitive limitations, I welcome everyone to engage in friendly discussions and jointly explore the future development direction of the industry. In addition, I also trade in cryptocurrencies and want to make money. Please dont criticize me, you local players and believers in decentralization. My point of view is that the industry should not only be about speculation, but also have some positive things.

This article is sourced from the internet: The Web3 industry is entering a new era of compliance. Are we pursuing the wrong Mass Adoption?

Related: Countdown to the US election: Crypto stances and policy orientations of both parties

Original author: Chandler, Foresight News The countdown to the 2024 US presidential election has begun. According to data from NBC News, as of 2:00 a.m. local time on October 30, more than 50 million voters across the United States have cast early votes for the 2024 presidential election. As the election campaign heats up, voters are increasingly focusing on the future direction of the U.S. economy and differences in policy choices. Morgan Stanley analysts Monica Guerra and Daniel Kohen analyzed the potential impact of the 2024 U.S. presidential election on the market in a recent report, pointing out that economic signals are mixed and investor uncertainty is increasing. Fluctuating consumer sentiment and persistently high prices are influencing voter opinion, while traditional market indicators are unable to provide a clear prediction…