If Trump loses the election, what are the arbitrage opportunities on Polymarket?

Original title: Polymarket | What will happen if Trump loses the election?

Original author: zaddycoin, founder of Shoal Research

Original translation: zhouzhou, BlockBeats

Editors note: This article explores the complications and arbitrage opportunities that the Polymarket platform may face if Trump loses the election. The article assumes that the market may enter a double dispute period after AP, Foxnews, and NBCNews announce Trumps defeat. The author believes that arbitrage opportunities will arise during the dispute period and points out that if Foxnews does not announce the election results, it may make the situation more chaotic. The article reminds that this is a hypothetical discussion and looks forward to insights from industry insiders.

The following is the original content (for easier reading and understanding, the original content has been reorganized):

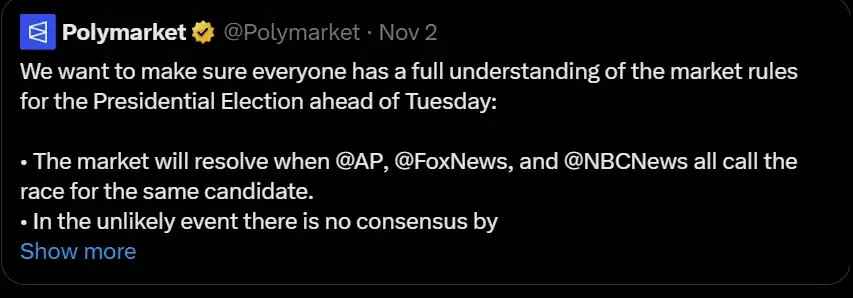

If Trump loses the election according to market rules, it means there will be reports from AP, Foxnews and NBCNews confirming that he lost the election. I am betting that the US presidential election market on Polymarket will experience a full double dispute, and retail investors may get hurt in the process of chasing 100x bets because they expect the market results to reverse.

In other words, if the US presidential election market ends with Trump losing, the market will experience two disputes, and retail traders will try to make risky bets in the hope that the market may overturn the dispute. You are not Tom Brady…

If Trump loses the election, TRUMPYES holders will certainly not concede easily, especially compared to HARRISYES holders. However, rules are rules, and @Polymarket reminds you of the consequences if this happens.

Market rules:

Dispute Mechanism

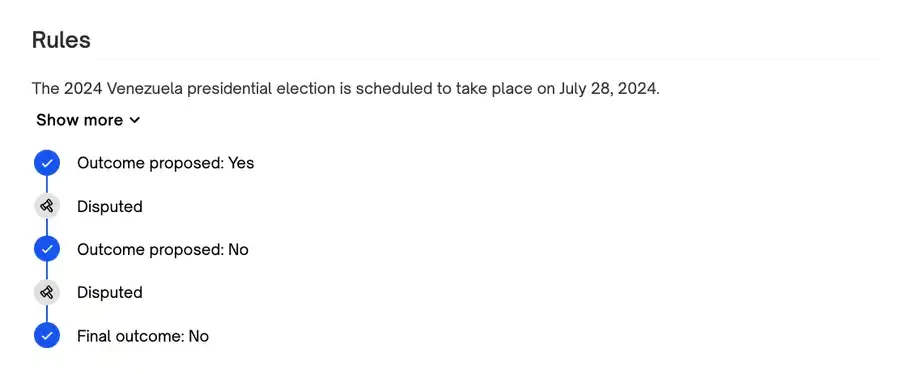

Anyone can dispute the outcome within about a day after the market is settled, by staking only $750 on the UMA protocol. This is a drop in the bucket for the liquidity on the platform, and traders can dispute up to two times before the market is finally settled.

Here’s an example of a “double dispute” being overturned (these examples only show what a disputed market looks like).

Rules description and arbitrage opportunity analysis

According to the rules: All news organizations must confirm the election results. Based on Polymarket’s past dispute precedent (i.e., the results of previous disputed markets), I predict that the market will enter a “double dispute” phase, and the large holders of UMA tokens (UMA voters) will eventually determine the result as “Trump lost the election.”

False arbitrage opportunities

During the controversy, I expect some arbitrage opportunities to emerge as some holders try to take advantage of the possibility of a reversal in market outcomes and pursue 100x returns (betting TRUMPYES at 1% odds would result in a 100x return if the outcomes reverse).

During a dispute, the market may start pricing in TRUMPYES – 1%, TRUMPNO – 99%, and as activist deposits are injected, the price gap may widen further (creating arbitrage opportunities).

These prediction markets are gambling machines… People will say there is a 100x chance, why not invest a little, while some people are more confident to invest a lot of money. The result may make people hurt… I will not bet on a 100x game, but prefer to bet on 99% odds, because after the controversial period, it should end with Trump loses the election.

Note: There may also be situations where arbitrage opportunities remain narrow because 100x bettors are unable to drive market prices alone.

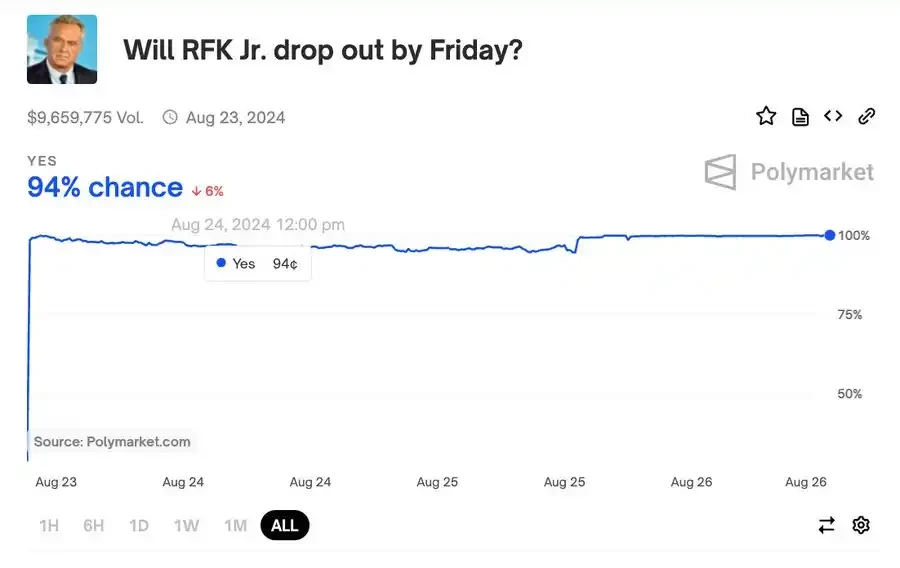

In a recent RFK will exit on Friday market, YES fell to 96% during the post-resolution dispute period. Senior players (OGs) familiar with the Polymarket dispute mechanism took advantage of this to gain a 6% arbitrage opportunity, which is one of the market rules.

Timing and forecasting premise

My prediction can come true only if AP, Foxnews and NBCNews all declare Trump the loser.

If that happens, it will be extremely interesting. If Fox News chooses not to announce the election results in favor of Trump, it will be quite complicated, and Im not sure if there is any precedent for this. But if it happens, it will be really exciting.

Sympathy and Hypothesis Analysis for Polymarket

I sympathize with Polymarket because if any of these hypothetical scenarios were to play out, things could get very (cannot be stressed enough) messy and a lot of money would be at stake. Again, this is just hypothetical thinking based on multiple variables and is intended to provoke thought, so take it in that light.

Let the games begin

This article is sourced from the internet: If Trump loses the election, what are the arbitrage opportunities on Polymarket?

After looking at hundreds of fund teams over the past five years, he found that success in trading can be achieved by doing four things well. The following text is a summary of my conversation with @ma_s_on_, who is an FOF investor with many years of family office experience. This is the 21st episode of #Dialogue100Traders, which will be updated continuously, so please follow us. ? Masons career began in the golden age of mobile Internet. For the past five or six years, he has been doing asset allocation in a family office with a technology background. Masons interest in the crypto space originated from the bull market craze in 2020. That year, they invested a small amount of money in several VCs related to Digital Asset, which performed very…