SignalPlus Macro Analysis Special Edition: Final Election Preview

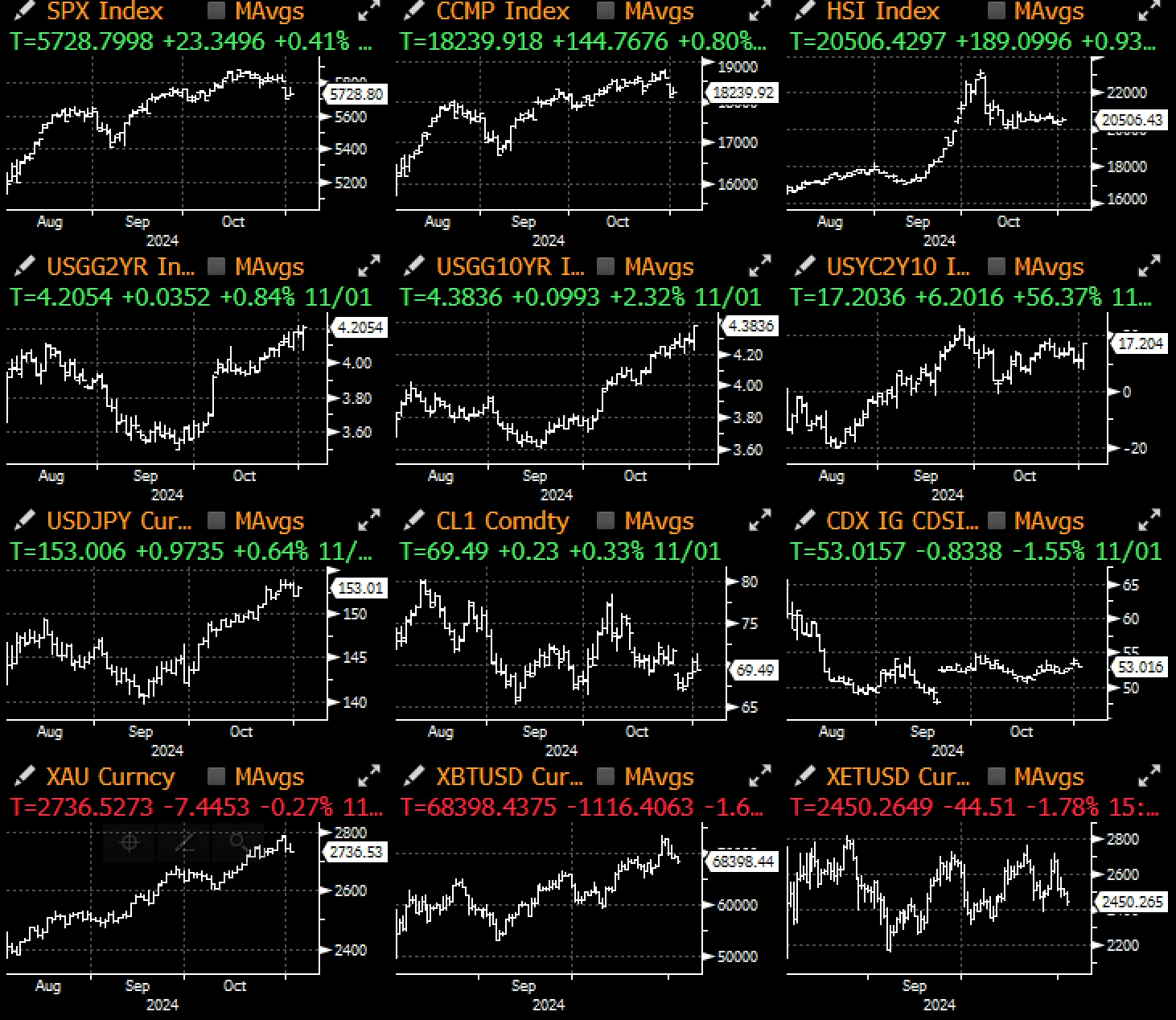

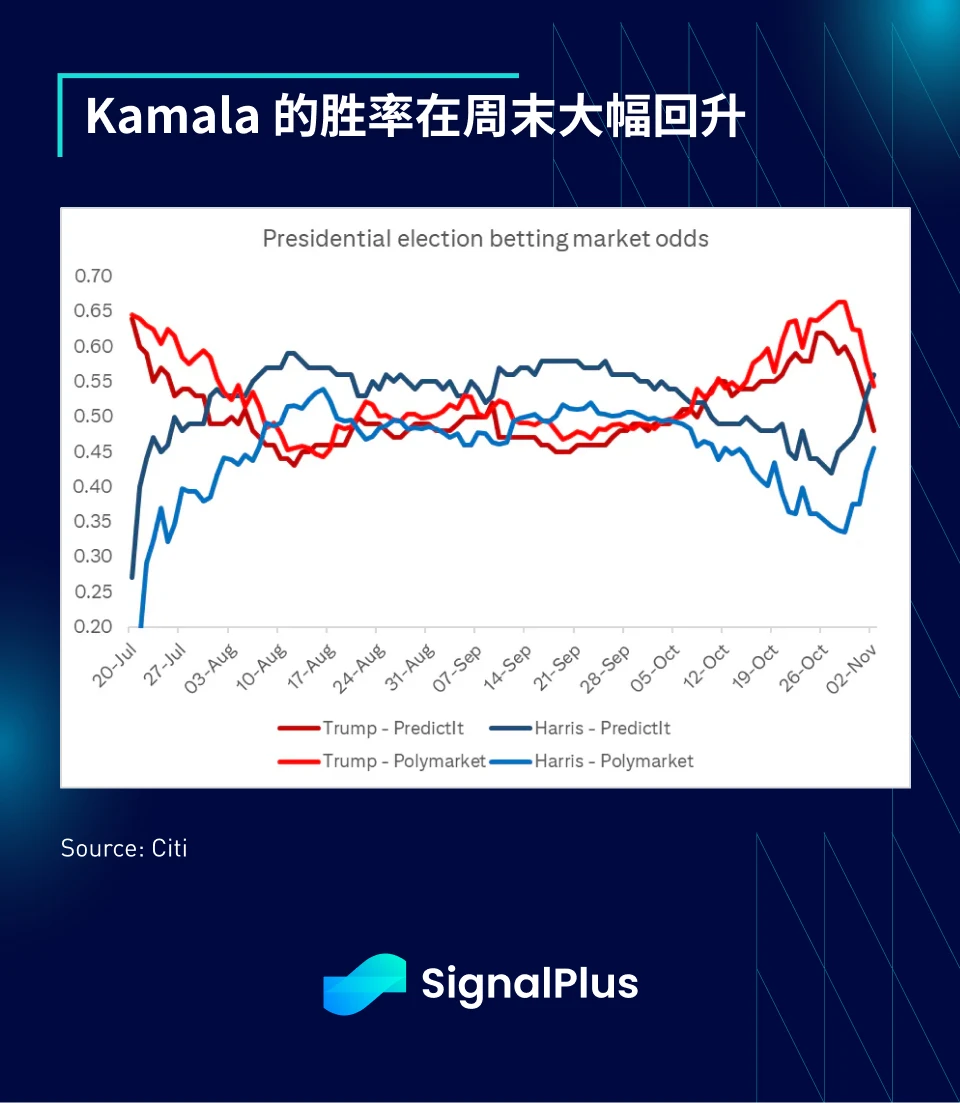

After an intense and turbulent campaign, the long-awaited election has finally arrived, and all kinds of macro assets are paying close attention (perhaps too much attention) to the final poll fluctuations. Among them, Polymarkets Trumps chance of winning has dropped sharply from 67% to 55%, which is consistent with other mainstream polls and is currently in a 50-50 stalemate.

The focus on the election slightly distracted the market from the non-farm payrolls data last Friday, which was significantly lower than market expectations, with only 12,000 new jobs, far lower than the expected 100,000. Although recent strikes and hurricanes have partially affected this result, economists believe that the job market will continue to slow down, the number of unemployed people will rise to a recent high, and the number of people who have been unemployed for more than 15 weeks will also increase significantly. In addition, private sector employment decreased by 28,000, with manufacturing (-46,000) and professional and business services (-47,000) falling sharply. In addition, the new employment data for the previous two months was also significantly lowered, and the final data for August was only +37,000.

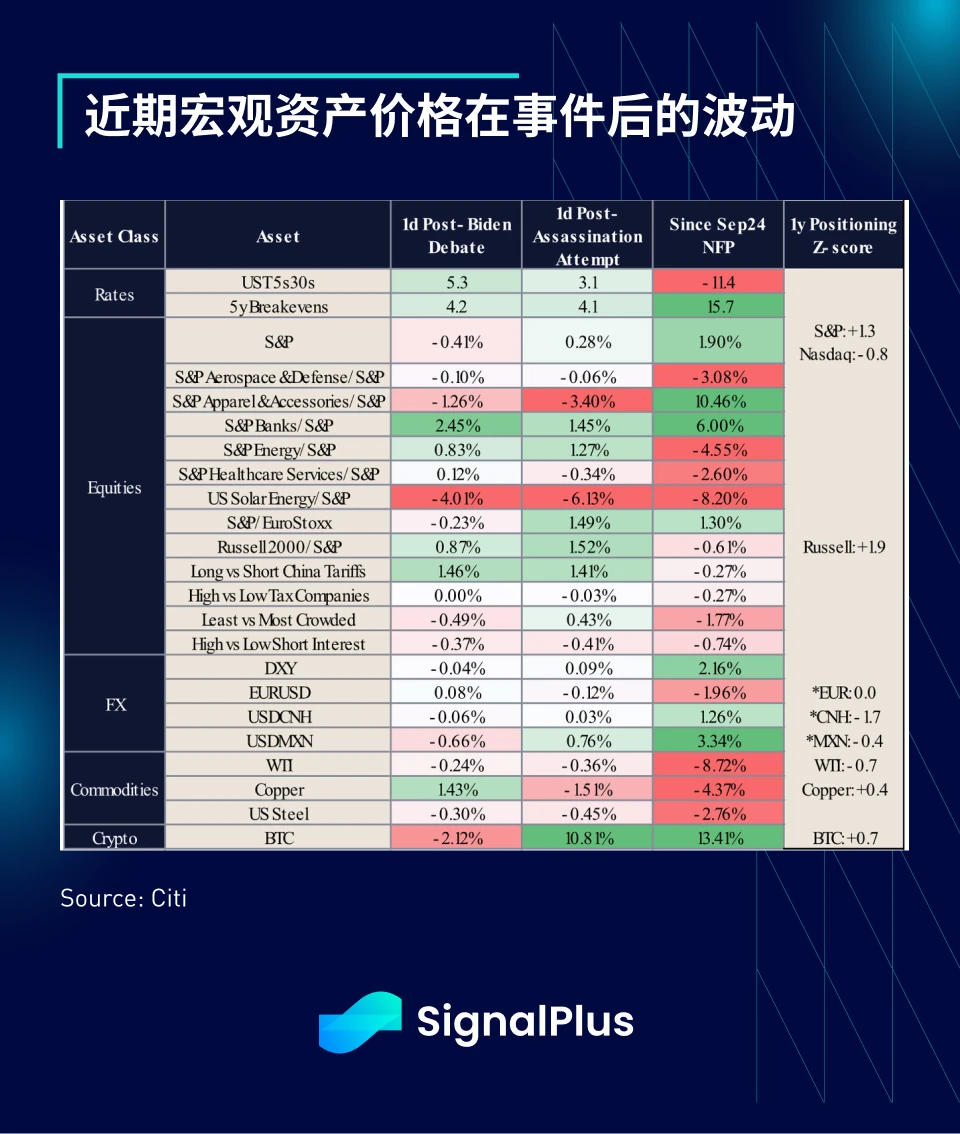

Although the data was significantly below expectations, the market was not affected before the US election. Although US Treasury yields reacted subconsciously after the release of non-farm payrolls, they eventually reversed and rose, with the yield curve closing up 4-10 basis points, with the 10-year yield close to 4.40%, and bond traders are still hedging the possibility of Trumps victory. In the stock market, although momentum stocks, small-cap stocks and high-beta stocks performed poorly on the day, stocks still rose slightly, while the US dollar strengthened significantly against the British pound (UK budget issues) and the Japanese yen (carry trade).

As for interest rate expectations, despite the weak employment data, the market still expects only a 25 basis point rate cut this week, followed by another 25 basis point rate cut thereafter, but the specific trend may depend on the final election results.

Back to the election, with Kamalas last-minute gains, the polls have almost returned to a tie, but actual market positioning may still be tilted towards a Trump victory. Compared to most recent election results, the market reaction this time may be two extremes, with a Trump victory likely to drive higher yields, a stronger dollar, and higher cryptocurrencies, while a Kamala victory will lead to the opposite result. However, no matter who wins, we also think that the market may overestimate the short-term impact of the victory, and once the dust settles, the market will do a lot of recalibration and turn to focus on more fundamental themes.

The US Electoral College (EC) system concentrates the decision-making power of the entire US election in seven swing states, especially Pennsylvania (19), which has the most electoral votes. According to the latest situation from RealClearPolitics, Trump is currently leading in five swing states, including a slight lead in Pennsylvania.

Exit polls will begin to appear at 5 p.m. on Election Day (Wednesday morning Asia time), and voting will end by 10 p.m. EST. In the 2016 election, states made official announcements within 1 to 8 hours after the end, but the 2023 election was delayed for days (or even weeks) due to controversy, leading to the Capitol Hill incident. If the results are delayed, the market may react with risk aversion, especially considering the current allegations of election fraud and the extreme polarization of the electorate.

Regardless, we expect presidential election results to be announced earlier than House results due to potential delays in New York and California, which would provide a significant boost to risk markets if a Republican sweep is achieved, but we may have to wait until the end of the week to get a clear picture.

The coming week will undoubtedly be busy with trading activity, with previous elections seeing trading volumes increase by 50-100%+ on Election Day and the week following, and given that this election is more closely watched and more dramatic than previous ones, we expect to see a surge in trading activity in the short term, similar to the surprise Trump win in 2016.

Finally, in terms of cryptocurrencies, BTC was only one step away from its all-time high, but as Trumps chances of winning fell, the price of BTC also fell below $70,000. According to Coinglass data, BTC failed to break through its all-time high, and more than $500 million in futures long positions were liquidated. The high point is within reach, but it is out of reach.

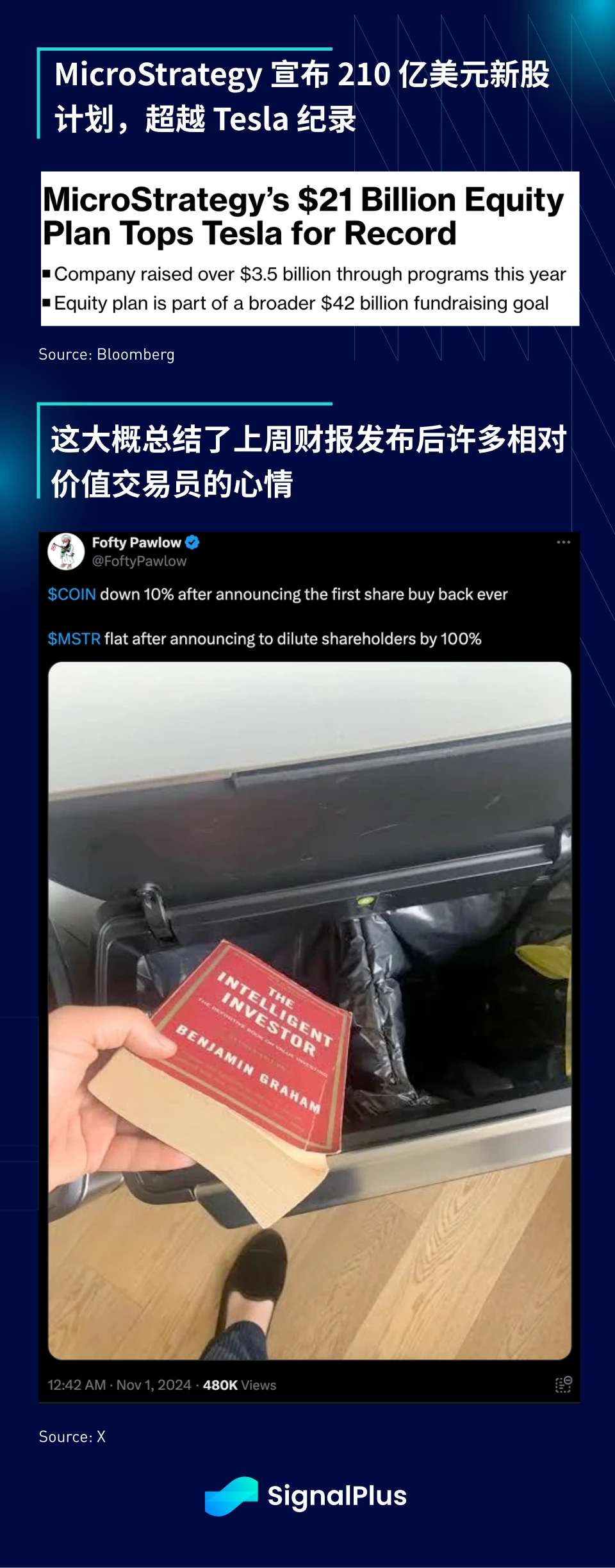

Open interest in BTC futures and options has been climbing steadily over the past month, especially on the Chicago Mercantile Exchange (CME). While mainstream interest in cryptocurrencies has also helped, some of the reason may be hedge funds basis trades on Microstrategy, where hedge funds may have made basis trades between long BTC futures and short MSTR stock, which is up more than 250% this year, while BTC is up 65% and Coinbase is up only 5%. As for why TradFi investors chose this target instead of spot ETFs or other mining companies, we dont have a clear answer at this time.

To make matters worse, Michael Saylor recently announced a $21 billion new share offering to fund the purchase of more BTC, with plans to continue purchasing up to $42 billion in BTC over the next three years. Despite the significant dilution of equity, Microstrategys share price remained stable, while other cryptocurrency targets performed relatively weakly, with Coinbase falling 10% after the earnings report. Perhaps its easier to speculate on macro and political outcomes than on a single stock!

Get some rest and good luck this week!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Final Election Preview

Related: Lumoz: Leading ZK-PoW algorithm, ZK computing efficiency increased by 50%

The modular computing layer RaaS platform Lumoz has achieved phased results in the just-concluded third round of incentive testnet. On the market level, the testnet activities have received attention and support from over 1 million users and more than 30 leading ecological project parties, and the market popularity, discussion, and community scale have reached new highs; on the technical level, the Lumoz team has also made deeper optimizations to the ZK-POW algorithm, and has also made effective breakthroughs. Currently, it can effectively improve the proof efficiency of ZKP by about 50%. As the leading ZK AI modular computing layer, Lumoz can use the PoW mining mechanism to effectively provide computing power for Rollup, ZK-ML and ZKP verification, and its core technical team has been working tirelessly for this. This technical…