Mankiw Web3 Research: Which well-known crypto projects have settled in Singapore, a popular overseas destination?

Written by: Xu Yuewen and Iris, Mankiw LLP

Since 2019, a series of forward-looking policy measures have been introduced, which have strongly promoted the progress of Web3 technology. For example, the Digital Economy Alliance was established in 2019 to fully promote the growth of the digital economy ecosystem; the Digital Payment Alliance was established in 2020 to actively promote the development and innovation of the digital payment field; and the Digital Currency Laboratory was launched to explore the potential and application of digital currency.

These policies have spawned a large number of Web3 projects to take root and flourish in Singapore. Today, Singapore has achieved remarkable results in the field of Web3, and many well-known projects have been born. Attorney Mankiw has compiled some representative Web3 projects in Singapore for your reference.

* The following rankings are in no particular order and are sorted only by the year of establishment

Merlin Chain

#Infrastructure#Layer 2

-

Founded: 2023

-

Ecosystem: Bitcoin

-

Funding: $800 million

-

Project Introduction: MerlinChain is a Bitcoin Layer 2 powered by Bitmap. It makes Bitcoin interesting again based on the native assets, protocols and products of Bitcoin Layer 1. MerlinChain aims to amplify the asset potential of the Bitcoin ecosystem as a whole by enabling Layer 1 assets, protocols and user ecosystems on the second layer, such as building a metaverse that users can easily access based on Bitmap and building DeFi protocols based on BRC-420 to maximize the duality of graph and currency. It is a new BTCLayer 2 solution supported by OKX. The reason why it has attracted much attention is that it directly solves the core problem of the Bitcoin network – scalability.

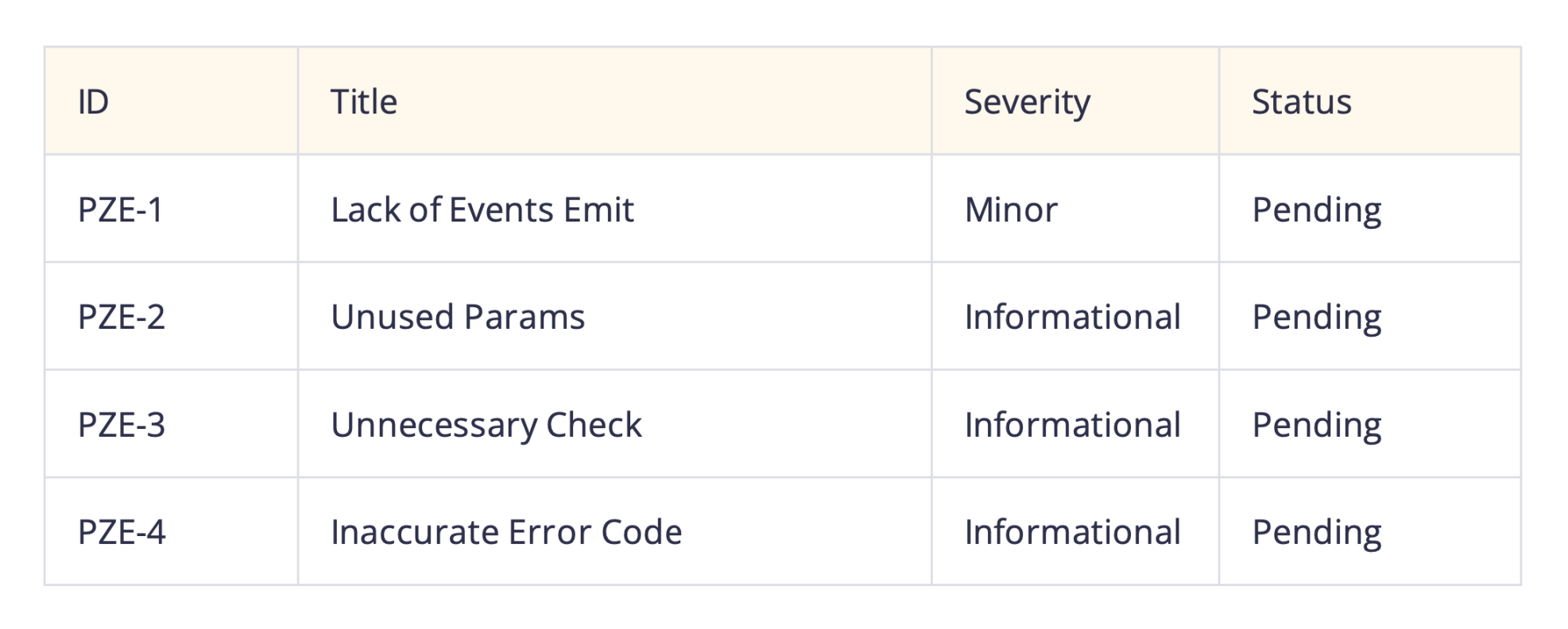

Bitmap Tech, the development team of Merlin Chain, has registered a limited liability company in Texas, USA in 2021, with its headquarters in Dallas. According to Github data, Merlin Chian has commissioned ScaleBit to do a smart contract audit report, including manual code review and static analysis to identify potential vulnerabilities and security issues. During the audit, ScaleBit identified 4 problems of varying degrees: lack of event occurrence, unused parameters, unnecessary checks, and inaccurate error codes.

AltLayer

#Infrastructure#Modularity#Re-staking

-

Founded: 2022

-

Ecosystem: Ethereum

-

Financing: US$21.6 million, US$7.2 million seed round completed in July 2022, and US$14.4 million strategic financing completed in February 2024.

-

Project Introduction: AltLayer is an open and decentralized Rollups protocol that brings together the novel concept of Restaked rollup. It adopts existing rollups (derived from any rollup stack, such as OP Stack, Arbitrum Orbit, ZKStack, Polygon CDK, etc.) and provides them with enhanced security, decentralization, interoperability, and rapid finality of the crypto economy.

AltLayers airdrop document clarifies some specific legal terms, such as strictly requiring users to complete KYC (Know Your Customer) certification, especially in its cooperation with Binance Launchpool, all participants need to complete identity verification when staking BNB or FDUSD to obtain ALT token rewards; at the same time, no airdrops will be given to sanctioned regions or countries, and users are prohibited from participating in ALT new coin mining, including Canada, Cuba, Crimea, Iran, Japan, New Zealand, the Netherlands, North Korea, Syria, the United States of America and its territories, and any non-government controlled areas of Ukraine; in addition, the document also points out the regulatory and tax issues that ALT may involve, and clarifies that the agreement is governed by the laws of the British Virgin Islands; and the airdrop document also mentions the relevant requirements for complying with data protection and privacy regulations, such as complying with data privacy regulations such as GDPR.

DWF Labs

#CeFi#OTC#Market Maker

-

Founded: 2022

-

Project Introduction: DWFLabs is a Web3 venture capital and market maker. DWFLabs provides market making, secondary market investment, early investment and over-the-counter (OTC) services, as well as token listing and consulting services for Web3 companies. DWFLabs is part of DigitalWaveFinance (DWF), one of the worlds top cryptocurrency traders, trading spot and derivatives on more than 40 top exchanges. DWF is headquartered in Switzerland and its Asian headquarters is in Singapore. It also has offices in Dubai, mainland China and Hong Kong, China.

DWF Labs is headquartered in Switzerland but has an office in Singapore. According to the privacy policy document officially disclosed by DWF Labs, DWF Labs collects and shares data based on laws and regulations and retains the data rights of users. In particular, for users living in the European Economic Area, DWF Labs complies with the General Data Protection Regulation (GDPR). Users have the right to access, correct, delete and limit the processing of personal data. The company relies on legal processing bases when processing user data, including contract performance, legal compliance and user consent.

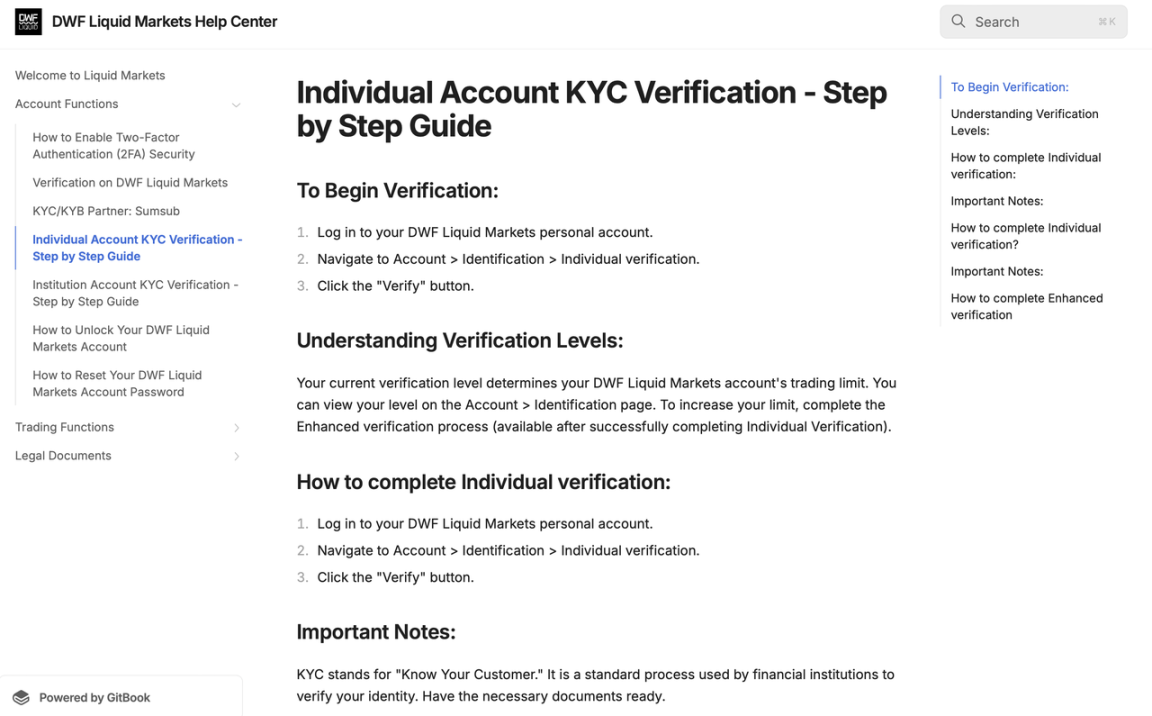

DWF Labs requires users to complete KYC (Know Your Customer) certification on the Liquid Markets platform, including collecting and verifying the users identity information, proof of address, and biometric verification (such as facial recognition). These processes are designed to prevent illegal activities such as identity theft and money laundering. The KYC process has two versions: basic and enhanced. The enhanced version is suitable for users with higher transaction amounts, such as accounts with daily withdrawals of more than $1 million.

In addition, DWF Labs cooperates with Sumsub for KYC and KYB certification. Sumsub provides technical support including global multiple identity document verification, address verification and database checking. It also integrates multi-level security and compliance measures on its platform, including anti-money laundering (AML) requirements and compliance with the Travel Rule to ensure that its global business complies with local regulatory standards.

Aethir

#Infrastructure #DePIN #Cloud Computing #AI

-

Founded: 2022

-

Ecosystem: Ethereum, Arbitrum

-

Financing: $9 million, Pre-A round to be completed in July 2023

-

Project Introduction: Aethir is a decentralized real-time rendering network that unlocks content accessibility in the metaverse. Aethir builds a scalable, decentralized cloud infrastructure (DCI), and its network helps gaming and AI companies (both large and small) deliver their products directly to consumers, no matter where they are located or what hardware they have.

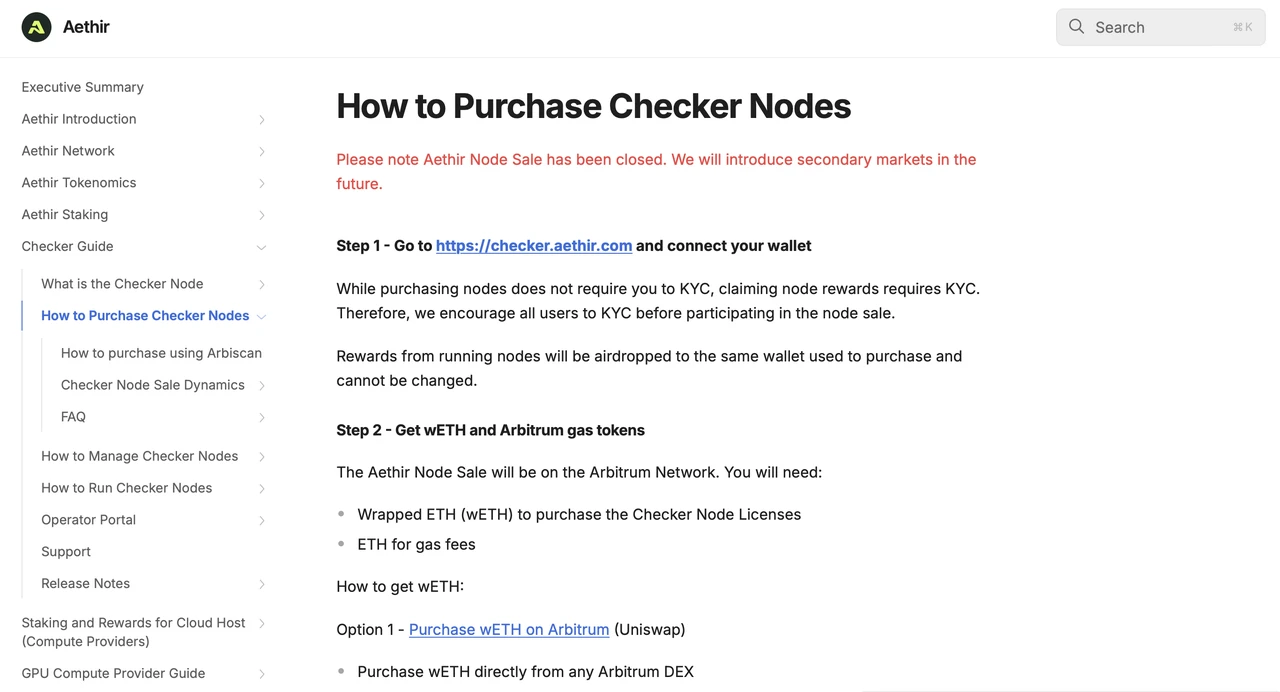

Aethir has registered a foundation in Singapore, Aethir Foundation, whose main purpose is to support the expansion of decentralized computing and the Web3 ecosystem. To ensure project compliance, Aethir Foundation has taken necessary measures to ensure that its operations comply with international and Singaporean legal requirements. For example, Aethir requires users to complete KYC identity verification in its Checker Node rewards and withdrawals to comply with anti-money laundering (AML) compliance requirements; node operators also need to complete KYC during node sales and operations. At the same time, Aethirs terms clearly restrict user behavior to comply with applicable laws and regulations, such as not using unauthorized software or engaging in illegal content publishing. The terms also cover ownership of intellectual property and feedback, ensuring the legal operation of the platform. In addition, in some regions, the Aethir platform restricts the participation of certain users, such as users from the United States and sovereign sanctioned countries. These measures comply with local laws and international sanctions requirements to ensure compliance with laws and regulations around the world when conducting business.

Cointime

#Encrypted Media

-

Founded: 2022

-

Project Introduction: Cointime is a crypto news aggregation platform operated by QUANTBASE PTE. LTD. Cointime mainly provides readers with the latest crypto news, events, data and indexes. Whether it is cryptocurrency trend news, real-time price trends, in-depth industry analysis, or cutting-edge technology, readers can find it on Cointime.

zkLink

#Infrastructure#Layer 2

-

Founded: 2021

-

Ecology: Ethereum, Polygon, BNBChain, Avalanche, Arbitrum, Optimism, Base, StarkNet, ZkSync, Linea, PolygonzkEVM, Manta, opBNB

-

Financing: Completed US$8.5 million seed round in October 2021, US$10 million strategic financing in May 2023, US$4.68 million public offering round in January 2024, and completed strategic financing in July 2024.

-

Project Introduction: zkLink is a transaction-centric multi-chain L2 network with unified liquidity protected by ZK-Rollups. dApps built on the zkLink L2 network leverage seamless multi-chain liquidity to provide rapid deployment solutions for decentralized and non-custodial order books, AMMs, derivatives, and NFT exchanges. zkLink operates as a trustless, permissionless, and non-custodial interoperability protocol designed to connect different blockchains, eliminate differences between different tokens, and solve the liquidity island problem formed on isolated chains.

According to public information, during the sale and registration of $ZKL tokens of zkLink, the company implemented a series of compliance measures, such as requiring participants to complete KYC (Know Your Customer) identity verification, and residents of the United States, Canada, China, South Korea and some restricted areas were excluded to comply with the regulations of relevant countries. At the same time, the zkLink platform restricts access to users in certain regions subject to economic sanctions to ensure that the use of services complies with local and international regulations, such as the economic sanctions lists of Europe and the United States. This measure ensures zkLinks compliance in the global market and avoids legal risks.

zkLink provides a detailed privacy policy document to ensure compliance with data protection regulations such as GDPR. This policy stipulates the collection and processing of users IP addresses, access data, and log information, mainly used to ensure the stability of the service and improve the user experience. In addition, zkLink will conduct anonymous user behavior tracking to collect non-personally identifiable data for product improvement. In addition, in the policy document, zkLink clearly emphasizes user responsibilities, including ensuring the security of wallet keys and recovery phrases.

ZkLink commissioned ABDK Consulting to conduct a comprehensive review of its smart contracts and protocols. The scope of the review was the differences between the zkLinkProtocol and the Era contract, including specific .sol files and synchronization cost optimization related files and interfaces. The audit found some medium-level problems, mainly focusing on suboptimal design of the code, such as parameter passing, encoding call efficiency, storage address calculation, etc., as well as some overflow and defect issues that have been fixed, and corresponding suggestions were also made for these problems.

SkyArk Chronicles

#GameFi

-

Founded: 2021

-

Ecosystem: BNB Chain

-

Funding: $15 million

-

Project Introduction: SkyArk Chronicles is a Triple A fantasy JRPG game with interoperable NFTs. SkyArk Chronicles is a trilogy of 2 GameFi (House of Heroes and Legends Arise) and 1 SocialFi Metaverse (Mirrorverse).

SkyArk Studio, the developer of SkyArk Chronicles, is a Singapore-based blockchain gaming company that aims to emulate the success of Hong Kong unicorn Animoca by building an ecosystem to incubate crypto projects and leveraging SkyArk Studio鈥檚 proprietary resources.

SkyArk Chronicles token system includes two tokens, $SAR and $REO, which will be used in multiple scenarios in the game and the metaverse, providing players with a way to participate in the game economy, purchase game items, and obtain rewards. Currently, SkyArk has not officially launched the token sale.

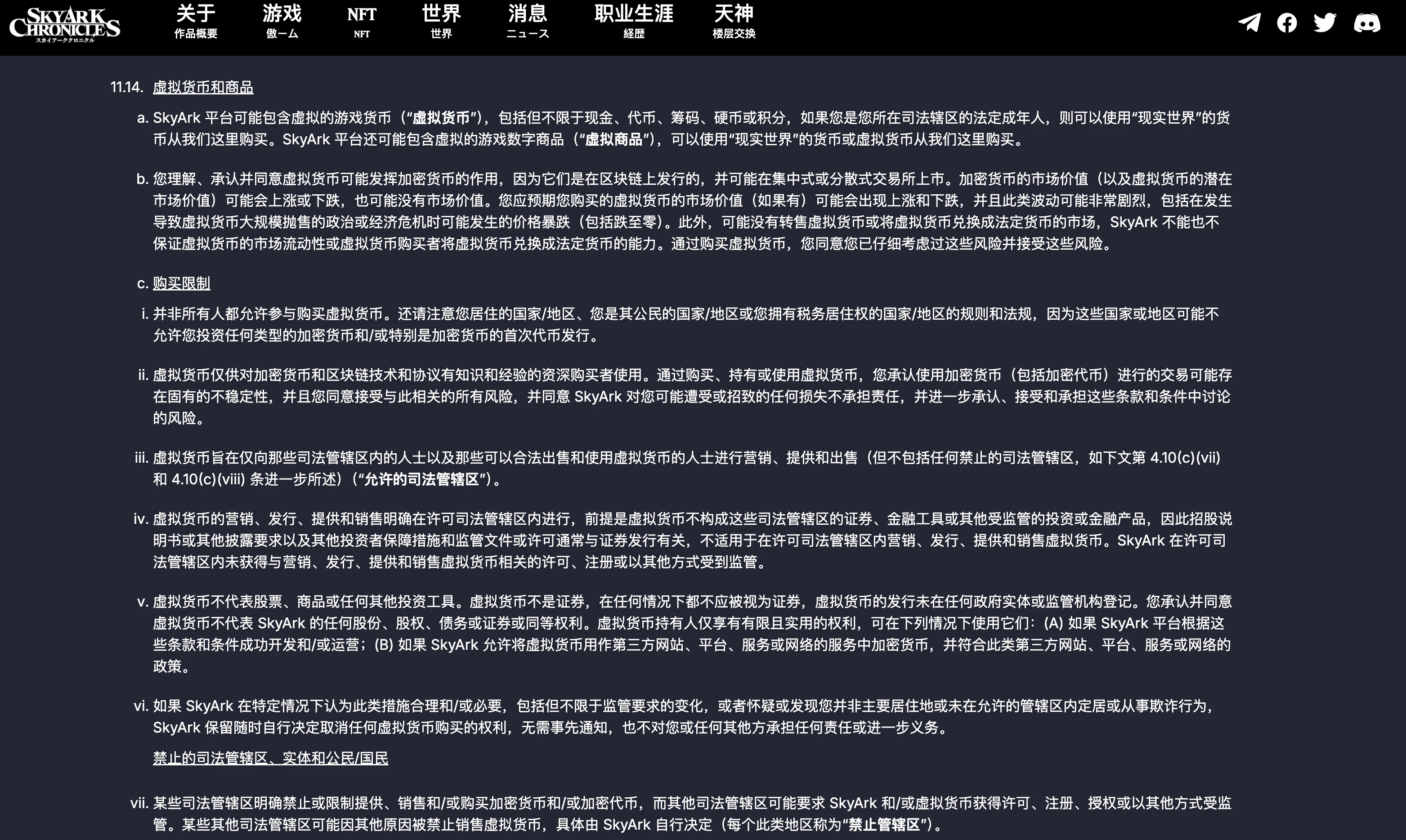

SkyArk Chronicles explains compliance matters related to virtual currency in its official website terms.

First, it clearly defines virtual currencies and commodities, pointing out that virtual currencies may function as cryptocurrencies but do not represent investment vehicles such as securities, are not registered with government entities or regulators, and holders enjoy only limited practical rights.

Secondly, strict purchase restrictions are set. Not everyone can participate in the purchase. Attention should be paid to the regulations of the country/region where they live. It is only open to experienced and sophisticated buyers with experience in cryptocurrencies and blockchain technology. It is clearly only marketed, provided and sold to persons who can legally sell and use it in specific jurisdictions. It does not constitute a regulated investment or financial product when conducted in a permitted jurisdiction.

Finally, regulations are made for prohibited jurisdictions. Some regions explicitly prohibit or restrict cryptocurrency-related transactions, while other regions may require licensing and other supervision. SkyArk may decide at its sole discretion which regions to prohibit the sale of virtual currency to ensure that the game operates within a compliant framework.

Nansen

#Tools#DataAnalysis#On-chain data

-

Founded: 2019

-

Financing: US$88.2 million, including a US$1.2 million seed round in October 2020, a US$12 million Series A round in 2021, and a US$75 million Series B round in 2021.

-

Project Introduction: Nansen is a blockchain analytics platform that enriches on-chain data with millions of wallet tags. Crypto investors use Nansen to discover opportunities, conduct due diligence, and protect their portfolios through its real-time dashboards and alerts.

As an analysis platform, Nansen does not directly conduct cryptocurrency transactions for end users, but focuses more on analysis and data mining. In addition, the cooperation with Kaiko uses Kaikos market data and Nansens blockchain data to provide regulatory compliance reference prices for digital assets on central exchanges (CEX) and decentralized exchanges (DEX).

Nansen is not completely free to use. The platform offers limited free features, but advanced analytics and data access services usually require a subscription. Users can choose different paid plans to unlock more advanced tools and deeper on-chain data analysis. Accordingly, the Nansen on-chain data platform uses a standard agreement (MSA) made by customers who purchase products and/or services in the form of orders for compliance. The MSA clarifies the responsibility boundaries of both parties to the transaction, such as the time, method, quality standards of product delivery, etc., to ensure that customers can obtain products and services that meet their expectations. At the same time, there are also corresponding clauses for customers payment methods, payment deadlines, and possible refunds, exchanges, etc. These regulations help to ensure the fairness and transparency of transactions, avoid the situation where there is no law to rely on when disputes arise during the transaction process, thereby safeguarding the legitimate rights and interests of both the platform and customers, and making them comply with relevant laws, regulations and industry norms in their business operations.

Mask Network

#SocialFi

-

Founded: 2018

-

Ecology: Ethereum, Polygon, BNB Chain, Solana, Avalanche, Arbitrum, Optimism, Fantom, Gnosis Chain, Scroll, Harmony, Aurora, Conflux, Flow, Astar

-

Funding: Nearly $200 million

-

Project Introduction: Mask Network is a Web3 portal designed to connect Web2 users to Web3. By introducing a decentralized application ecosystem to traditional social networks, Mask Network provides a decentralized option for features familiar to Web 2.0 users. Users can enjoy secure, decentralized social messaging, payment networks, file storage, and file sharing without leaving mainstream social media networks. The 2.0 version released by Mask Network includes a multi-chain Mask wallet, a MaskID login system that aggregates user social media accounts and Web 3.0 addresses, and a dApp market called D.Market.

The Mask Network team has an office in Singapore and conducts some management and operational activities locally. Its legal entity Mask Network Pte. Ltd. has been deregistered. Therefore, Mask Network mainly operates through its affiliates and partners: Mask Network has established a fund with partners such as Bonfire Union, headquartered in Singapore, to promote the development of Web3 and decentralized social networks. In addition to commercial activities, Mask Network has also established a non-profit organization, Mask Academy, to support Web3 research and education through cooperation with universities and research institutions around the world.

Mask Networks privacy compliance measures are based on its user privacy policy, covering data management, user autonomy, and third-party DApp integration. The platform stated in its privacy policy that it is only responsible for DApps developed by it, and the DApp services provided by third parties are not within its direct control, so users need to bear certain risks in using these services.

In addition, Mask Network has clarified its data encryption and privacy protection principles to ensure that users social information and data are properly protected when using Web3 decentralized applications. At the same time, the platform adopts a self-sovereign control mechanism, and users have control over their wallets, private keys and other information, and the platform will not store these sensitive data.

Regarding data usage rights, Mask Network also requires users to cooperate with necessary identity verification to ensure the security of transactions.

Bitget

#CeFi #CEX

-

Founded: 2018

-

Funding: $30 million

-

Project Introduction: Bitget was founded in 2018 and is a cryptocurrency exchange and Web3 company. As of early 2024, Bitget provides services to more than 100 countries and regions around the world, helping more than 25 million users to achieve smart trading through leading copy trading and other trading solutions.

Bitget has registered as a Virtual Asset Service Provider (VASP), specifically in countries such as Poland and Lithuania. These registrations enable Bitget to legally provide cryptocurrency trading and related services in these regions, ensuring that it complies with local and international financial regulatory requirements.

Regarding KYC, Bitget has implemented mandatory KYC verification since September 1, 2023. All new users must complete KYC verification to use the platforms services, such as spot trading, futures trading, and other functions. Users who have not completed KYC will only be able to perform limited operations such as withdrawals and order cancellations after October 1, and will not be able to create new transactions. This move is intended to improve the security of the platform and ensure compliance with global and regional anti-money laundering (AML) and counter-terrorism financing (CFT) requirements.

At the audit level, Bitget publishes monthly proof of reserve (PoR) reports to show the health of its asset reserves to ensure the safety of user funds. In 2023, these reports showed that its reserve ratio remained at about 200%, far higher than the industry standard of 100%.

In addition, Bitget launched a $300 million auditable protection fund in 2023 to strengthen compliance and transparency. The platforms protection fund is mainly composed of BTC and a small amount of ETH and USDT. These funds are used to protect assets stored on the platform from hacking, theft and other threats. Bitget promises not to use these funds for at least three years and maintain publicly accessible wallet addresses. The fund was recently supported and currently totals $300 million and is stored in seven public wallet addresses for transparency.

Cryptocurrency group BGX has made a strategic investment in Hong Kong-listed BC Technology Group (HKG: 0863), the parent company of OSL, a licensed virtual asset exchange in Hong Kong, and subscribed for new shares worth HK$710 million.

Paradigm

#CeFi

-

Founded: 2018

-

Financing: Completed US$35 million Series A financing in December 2021.

-

Project Introduction: Paradigm is a liquidity network for crypto derivatives traders across CeFi and DeFi. The platform provides traders with unified access to multi-asset, multi-protocol liquidity on demand without compromising price, scale, cost, and immediacy. The companys mission is to create a platform where traders can trade anything with anyone and settle anywhere. Paradigm has the largest network of crypto institutional counterparties, with more than 1,000 institutional clients trading over $10 billion per month, including hedge funds, OTC desks, lenders, structured product issuers, market makers, and well-known family offices.

In Singapore, the entity behind Paradigm is Paradigm Pte. Ltd., which focuses on liquidity provision and innovation in the digital asset market. Paradigm has also just incubated a decentralized perpetual derivatives application chain called Paradex to integrate its liquidity and provide a more transparent trading environment.

The relevant terms and agreements on its official website have made many efforts in compliance: clearly restricting the provision of services to restricted persons (including persons of specific nationalities and those subject to sanctions); having strict regulations on the use licenses of systems and software, including authorized user management; emphasizing that users must use the software in compliance and must not operate in violation of regulations; involving fees, terms and termination clauses; having detailed provisions on confidentiality, intellectual property rights, etc.; clarifying the responsibilities of all parties, including the users liability for compensation and Paradigms exemption from liability; and stipulating the application of Singapore law and dispute resolution methods such as arbitration to ensure compliance with business operations.

KuCoin

#CeFi #CEX

-

Founded: 2017

-

Financing: US$180 million, completed US$20 million Series A financing in November 2018, completed US$150 million financing in 2022, and completed US$10 million strategic financing in 2022.

-

Project Introduction: KuCoin was founded in September 2017 and is a global cryptocurrency exchange that provides spot trading, margin trading, P2P fiat currency trading, futures trading, staking and lending services.

KuCoin has implemented mandatory KYC verification since July 15, 2023. All new users must complete KYC certification to fully access the platforms services, including spot trading, futures trading, leveraged trading and other financial products. For users who registered before this date but did not complete KYC, their account functions will be restricted and they can only perform limited operations, such as selling spot orders and withdrawing funds, but they cannot make new deposits.

While introducing KYC, KuCoin has also strengthened the security management of user data. The platform promises to protect users personal information using encryption and secure storage methods to ensure the security of users data when submitting identity verification information. In addition, KuCoin continues to provide withdrawal functions, allowing users to withdraw funds from their accounts at any time even if they have not passed KYC.

Paxos

#CeFi #Custody #StablecoinIssuer

-

Founded: 2013

-

Financing: Approximately US$535 million, US$3.25 million completed in 2013, US$25 million in Series A financing in 2015, US$65 million in Series B financing in 2018, US$142 million in Series C financing in 2020, and US$300 million in Series D financing in 2021.

Paxos is a US-based fintech company focused on blockchain and digital assets. It has issued the Pax Dollar (USDP), a stablecoin pegged 1:1 to the US dollar, and provides secure digital asset custody services to help institutional clients manage cryptocurrency assets. In addition, Paxos has developed blockchain infrastructure to support the operation of its financial products, and is committed to promoting the integration of traditional finance and digital assets, building enterprise blockchain solutions for institutions such as PayPal, Interactive Brokers, Mastercard, Bank of America, Credit Suisse, and Societe Generale.

Paxos provides a variety of digital asset services including stablecoins (such as Pax Dollar, USDP and PayPal USD, PYUSD, launched in cooperation with PayPal) and gold tokens (PAXG) through a trust company license approved by the New York State Department of Financial Services (NYDFS). With a trust company license, Paxos is able to provide regulated financial services including custody, trading, clearing, etc., with a higher level of supervision than general cryptocurrency exchanges or payment institutions.

Paxos announced on July 1, 2024 that its Singapore entity, Paxos Digital Singapore Pte. Ltd., has obtained formal approval from the Monetary Authority of Singapore (MAS) and obtained a VASP license, becoming a major payment institution, allowing it to issue stablecoins in Singapore. Companies holding VASP licenses must comply with specific laws and regulations to ensure compliance: companies follow compliance measures such as anti-money laundering (AML) and know your customer (KYC) to reduce the risk of financial crime; they need to submit reports and accept audits regularly; and they are supervised by financial regulators.

In addition, as a digital asset custody service provider, Paxos disclosed on its official website that it has achieved bankruptcy isolation. If Paxos Trust goes bankrupt (which is unlikely to happen), customer assets will be protected. It also stated that its operating method is different from that of a bank, especially that it does not hold partial reserves. Paxos holds all customer assets at a 1:1 ratio to ensure that customer funds are always available for redemption and will never lend customer assets.

Attorney Mankiws Summary

Judging from the above projects, although the Singapore authorities have begun to promote crypto regulation and set up crypto VA licenses, in practice, it is still in a relatively open and vague regulatory state. However, this also brings convenience to the crypto industry and projects to settle in Singapore – Singapore ranks high among the worlds popular startup locations.

However, for Web3 projects, compliance is bound to be the future trend. So, in addition to development, entrepreneurs should also cooperate to complete compliance implementation, such as obtaining relevant licenses for financial projects, ensuring compliance with data, privacy and other compliance for dApp projects, and paying more attention to changes in Singapores regulatory rules to avoid being affected by regulation during the hot development stage.

This article is sourced from the internet: Mankiw Web3 Research: Which well-known crypto projects have settled in Singapore, a popular overseas destination?

Headlines Binance responds to rumors of rat trading: welcome to report any form of corruption, the reward will be up to 5 million US dollars Odaily Planet Daily News Binance Chinese posted on the X platform that recently, a screenshot of a certain V community circulated in the Chinese community triggered a discussion about Binances rat warehouse. Although the content of these screenshots was eventually confirmed to be a misunderstanding, Binance attaches great importance to such issues. Any behavior involving leakage or corruption will be dealt with seriously once verified. According to the exchanges compliance requirements, all Binance employees need to complete relevant mandatory compliance training. At the same time, Binance also has an independent audit team that specializes in investigating such violations. If it is verified that there is…